Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Increasing Prevalence of Chronic Diseases Expected to Drive the Demand for Global Medical Coatings for Implants Market

The increasing prevalence of chronic diseases is anticipated to be a significant driving force propelling the demand for medical coatings for implants, driving substantial growth in the global market. Medical coatings play a crucial role in enhancing the performance, biocompatibility, and longevity of implants used in the treatment of various chronic conditions, including cardiovascular diseases, orthopedic disorders, neurological disorders, and cancer. With the rising incidence of chronic diseases worldwide, coupled with an aging population and changing lifestyles, the demand for implantable medical devices for disease management and treatment is on the rise.In the field of cardiovascular medicine, medical coatings are utilized in implantable devices such as stents, pacemakers, and implantable cardioverter-defibrillators (ICDs) to improve their biocompatibility, reduce thrombogenicity, and enhance tissue integration. Medical coatings such as biodegradable polymers, hydrogels, and drug-eluting coatings are applied to cardiovascular implants to prevent restenosis, thrombosis, and infection, thereby improving patient outcomes and reducing the need for repeat interventions. With the growing burden of cardiovascular diseases, including coronary artery disease, heart failure, and arrhythmias, the demand for cardiovascular implants with advanced coatings is expected to surge, driving market growth in the cardiovascular segment.

In orthopedic medicine, medical coatings play a vital role in improving the performance and longevity of orthopedic implants such as joint replacements, bone plates, and spinal implants. Medical coatings such as hydroxyapatite, titanium nitride, and ceramic coatings are applied to orthopedic implants to enhance osseointegration, reduce wear and corrosion, and minimize the risk of implant-related complications such as implant loosening and infection. With the increasing prevalence of musculoskeletal disorders, including osteoarthritis, osteoporosis, and spinal disorders, the demand for orthopedic implants with advanced coatings is expected to increase, driving market growth in the orthopedic segment.

In neurological medicine, medical coatings are utilized in implantable devices such as neurostimulators, deep brain stimulators, and neuromodulation devices to improve biocompatibility, reduce inflammation, and enhance electrical conductivity. Medical coatings such as biocompatible polymers, silicones, and conductive coatings are applied to neurological implants to promote tissue integration, minimize immune response, and improve therapeutic efficacy. With the growing prevalence of neurological disorders, including Parkinson's disease, epilepsy, and chronic pain syndromes, the demand for neurological implants with advanced coatings is expected to rise, driving market growth in the neurological segment.

In oncology medicine, medical coatings are employed in implantable devices such as brachytherapy seeds, drug-eluting implants, and tissue scaffolds for cancer treatment and tissue regeneration. Medical coatings such as biodegradable polymers, hydrogels, and drug-eluting coatings are applied to cancer implants to control drug release, target tumor sites, and enhance therapeutic efficacy while minimizing systemic toxicity. With the increasing incidence of cancer worldwide, coupled with advances in cancer diagnosis and treatment modalities, the demand for implantable devices with advanced coatings for oncology applications is expected to grow, driving market expansion in the oncology segment.

The increasing prevalence of chronic diseases is expected to drive significant growth in the global medical coatings for implants market across various therapeutic segments, including cardiovascular, orthopedic, neurological, and oncological medicine. As the demand for implantable medical devices for disease management and treatment continues to rise, the need for advanced coatings to improve biocompatibility, enhance performance, and minimize complications is expected to increase. Market players are poised to capitalize on this growing demand by offering innovative medical coatings, expanding their product portfolios, and providing tailored solutions to meet the evolving needs of healthcare providers and patients worldwide.

Advancements in Coating Technology is Expected to Propel the Demand for Global Medical Coatings for Implants Market Growth

Advancements in coating technology are anticipated to be a driving force propelling the demand for medical coatings for implants, fueling substantial growth in the global market. Medical coatings play a pivotal role in enhancing the performance, biocompatibility, and durability of implants used in various medical applications, ranging from cardiovascular and orthopedic implants to neurological and oncological devices. With continuous innovation and research in coating materials, processes, and application techniques, significant strides have been made in improving the functionality and efficacy of medical coatings, driving their adoption across diverse therapeutic areas.In recent years, there have been significant advancements in the development of biocompatible and bioactive coatings that promote tissue integration, reduce inflammation, and enhance the healing process following implantation. These coatings, often based on biodegradable polymers, hydrogels, ceramics, and bioactive molecules, are designed to mimic the natural environment of tissues and cells, facilitating seamless integration with the surrounding biological structures. Advancements in surface modification techniques, such as plasma spraying, physical vapor deposition (PVD), and chemical vapor deposition (CVD), have enabled precise control over coating thickness, composition, and morphology, resulting in improved implant performance and patient outcomes.

The emergence of nanotechnology has revolutionized the field of medical coatings by enabling the development of nanostructured coatings with unique properties and functionalities. Nano coatings, composed of nano-sized particles or thin films, offer enhanced surface properties such as increased surface area, improved mechanical strength, and tailored surface chemistry, making them ideal for a wide range of medical applications. Nano coatings have been utilized in implants to impart antimicrobial properties, enhance drug delivery, and improve biocompatibility, thereby addressing key challenges in implantology and advancing the field of regenerative medicine.

Advancements in drug-eluting coatings have revolutionized the treatment of various medical conditions by enabling controlled and localized drug delivery directly to the target site. Drug-eluting coatings, composed of biocompatible polymers loaded with therapeutic agents, such as antibiotics, anti-inflammatory drugs, and growth factors, can be applied to implants to prevent infection, reduce inflammation, promote tissue regeneration, and enhance implant integration. These coatings have been widely used in orthopedic, cardiovascular, and oncological implants to improve patient outcomes and reduce the need for additional interventions, driving their adoption and market growth.

Advancements in coating technology have led to the development of multifunctional coatings that offer a combination of therapeutic properties, such as antimicrobial, anti-inflammatory, and anti-thrombotic effects, in a single coating layer. These coatings, often referred to as smart coatings or responsive coatings, can respond to environmental stimuli, such as pH, temperature, and mechanical forces, to release therapeutic agents or alter surface properties in a controlled manner. Smart coatings have the potential to revolutionize implantology by enabling personalized medicine approaches, enhancing implant performance, and reducing the risk of complications, thereby driving market growth and adoption in the medical field.

In brief, advancements in coating technology are expected to propel significant growth in the global medical coatings for implants market by enabling the development of innovative coatings with enhanced functionality, biocompatibility, and therapeutic efficacy. As research and development efforts continue to focus on improving coating materials, processes, and functionalities, the demand for medical coatings for implants is projected to rise across diverse therapeutic areas, driving market expansion and adoption. Market players are poised to capitalize on this growing demand by investing in research and development, expanding their product portfolios, and providing tailored solutions to meet the evolving needs of healthcare providers and patients worldwide.

Growing preference for minimally invasive surgeries Propels the Global Medical Coatings for Implants Market Growth

The growing preference for minimally invasive surgeries (MIS) is emerging as a significant driver propelling the demand for medical coatings for implants, thereby fueling substantial growth in the global market. Minimally invasive surgeries offer several advantages over traditional open surgical procedures, including smaller incisions, reduced trauma to surrounding tissues, faster recovery times, and lower risk of complications. As a result, there has been a significant increase in the adoption of minimally invasive techniques across various medical specialties, including orthopedics, cardiovascular surgery, neurosurgery, and cosmetic surgery, driving the demand for implants with specialized coatings optimized for minimally invasive procedures.In orthopedic surgery, for example, minimally invasive techniques such as arthroscopy and laparoscopy are commonly used for joint replacement surgeries, spine surgeries, and sports medicine procedures. These techniques require specialized implants with coatings that facilitate insertion through small incisions, minimize tissue damage, and promote rapid healing and integration with surrounding tissues. Medical coatings for orthopedic implants play a crucial role in reducing friction, wear, and corrosion, thereby improving implant longevity and patient outcomes. With the growing aging population and increasing prevalence of musculoskeletal disorders, the demand for orthopedic implants suitable for minimally invasive techniques is expected to rise, driving market growth in the orthopedic segment.

In cardiovascular surgery, minimally invasive techniques such as transcatheter interventions and endovascular procedures have revolutionized the treatment of cardiovascular diseases, including coronary artery disease, valvular heart disease, and peripheral artery disease. These techniques rely on specialized implants such as stents, grafts, and heart valves with coatings optimized for delivery through catheters and minimally invasive access routes. Medical coatings for cardiovascular implants play a crucial role in reducing thrombogenicity, preventing restenosis, and enhancing biocompatibility, thereby improving implant performance and patient outcomes. With the increasing prevalence of cardiovascular diseases and the growing demand for minimally invasive treatment options, the demand for cardiovascular implants with advanced coatings is expected to increase, driving market growth in the cardiovascular segment.

In neurosurgery, minimally invasive techniques such as endoscopic surgery and neurostimulation procedures are increasingly used for the treatment of neurological disorders, including brain tumors, epilepsy, and movement disorders. These techniques require specialized implants such as deep brain stimulators, neurostimulation leads, and brain electrodes with coatings optimized for compatibility with neural tissues and minimally invasive insertion. Medical coatings for neurological implants play a crucial role in reducing inflammation, enhancing electrical conductivity, and promoting tissue integration, thereby improving implant performance and patient outcomes. With the growing prevalence of neurological disorders and the increasing adoption of minimally invasive neurosurgical techniques, the demand for neurological implants with advanced coatings is expected to rise, driving market growth in the neurological segment.

In cosmetic surgery and aesthetic medicine, minimally invasive techniques such as injectable fillers, dermal implants, and tissue scaffolds are increasingly used for facial rejuvenation, body contouring, and tissue augmentation procedures. These techniques require specialized implants with coatings optimized for biocompatibility, tissue integration, and long-term durability. Medical coatings for cosmetic implants play a crucial role in enhancing tissue compatibility, minimizing inflammation, and promoting natural-looking results, thereby improving patient satisfaction and outcomes. With the growing demand for cosmetic procedures and the increasing popularity of minimally invasive techniques, the demand for cosmetic implants with advanced coatings is expected to rise, driving market growth in the cosmetic surgery segment. The growing preference for minimally invasive surgeries is expected to propel significant growth in the global medical coatings for implants market by driving demand for specialized coatings optimized for minimally invasive procedures across various medical specialties. As healthcare providers and patients increasingly opt for minimally invasive treatment options, the need for implants with advanced coatings that enhance performance, biocompatibility, and patient outcomes is projected to rise, driving market expansion and adoption. Market players are poised to capitalize on this growing demand by offering innovative medical coatings, expanding their product portfolios, and providing tailored solutions to meet the evolving needs of healthcare providers and patients worldwide.

Key Market Challenges

Long-term Durability Concerns

Long-term durability concerns present a substantial barrier to the growth of the global medical coatings for implants market. Medical coatings play a crucial role in enhancing the performance and longevity of implantable medical devices, such as orthopedic implants and cardiovascular stents. However, issues related to the durability of these coatings over extended periods pose significant challenges. Factors such as wear and tear, degradation, and potential delamination of coatings over time raise concerns about the reliability and safety of implanted devices, leading to hesitancy among healthcare providers and patients. Stringent regulatory requirements necessitate thorough testing and documentation of the long-term performance and biocompatibility of medical coatings, further complicating the market landscape.To address these challenges and stimulate market growth, manufacturers must prioritize research and development efforts aimed at improving the durability and stability of medical coatings, as well as establishing comprehensive post-market surveillance mechanisms to monitor device performance over extended periods. Collaboration with regulatory authorities and healthcare professionals to develop standardized testing protocols and guidelines can help instill confidence in the long-term reliability of coated implants, driving greater market acceptance and adoption.

High Cost of Development and Manufacturing

The high cost of development and manufacturing poses a significant obstacle to the growth of the global medical coatings for implants market. Developing and manufacturing medical coatings requires substantial investment in research, testing, and regulatory compliance to ensure product safety and efficacy. The complex nature of coating technologies, specialized equipment, and stringent quality control measures further contribute to elevated production expenses. These high costs are passed on to healthcare providers and ultimately to patients, making coated implants prohibitively expensive for some individuals and healthcare systems. The lengthy and rigorous regulatory approval processes increase time-to-market and add additional financial burdens to manufacturers.To overcome this barrier and foster market growth, stakeholders must explore strategies for streamlining development and manufacturing processes, optimizing resource allocation, and leveraging economies of scale to reduce production costs. Collaboration with research institutions and regulatory agencies can also facilitate innovation and regulatory compliance, ultimately driving greater affordability and accessibility of medical coatings for implants.

Key Market Trends

Growing Focus on Use of Nanoparticles in Coatings

A growing focus on the utilization of nanoparticles in coatings emerges as a key trend propelling the growth trajectory of the global medical coatings for implants market. Nanoparticles offer unique properties such as high surface area-to-volume ratio, tunable surface chemistry, and enhanced mechanical strength, making them highly desirable for biomedical applications including implant coatings. Manufacturers are increasingly leveraging the potential of nanoparticles to develop advanced coatings that exhibit superior biocompatibility, antimicrobial activity, and drug delivery capabilities. Key advancements in this domain involve the incorporation of nanomaterials such as titanium dioxide, silver, and hydroxyapatite into coating formulations, which impart desirable functionalities such as enhanced osseointegration, reduced bacterial adhesion, and controlled release of therapeutic agents. The nanoscale dimensions of these particles enable precise control over coating properties such as porosity, roughness, and drug release kinetics, thereby optimizing implant performance and biocompatibility. The development of novel nanoparticle synthesis techniques such as sol-gel processing, electrospinning, and layer-by-layer assembly facilitates the fabrication of thin, uniform coatings with tailored nanoparticle distributions, further enhancing their efficacy and versatility.The advent of nanotechnology-enabled surface modification methods such as plasma treatment, ion implantation, and chemical vapor deposition allows for the functionalization of implant surfaces with nanoparticles to impart specific properties such as enhanced lubricity, hemocompatibility, and tissue integration. As healthcare providers and patients increasingly recognize the potential benefits of nanoparticle-based coatings in improving implant outcomes and patient care, the demand for medical coatings for implants is expected to witness significant growth. Manufacturers and suppliers are thus presented with lucrative opportunities to capitalize on this trend and drive innovation in the global medical coatings for implants market, catering to the evolving needs of the healthcare industry and driving the continued expansion of the market.

Increased Focus on Bioactive Coatings

An increased focus on bioactive coatings emerges as a key trend propelling the growth trajectory of the global medical coatings for implants market. With the rising demand for implantable medical devices across various healthcare applications, there is a growing emphasis on enhancing the biocompatibility, performance, and longevity of these implants. Bioactive coatings play a pivotal role in addressing these requirements by promoting osseointegration, minimizing inflammation, and reducing the risk of implant-related complications such as infection and implant rejection. Manufacturers are responding to this trend by developing innovative bioactive coatings that offer enhanced bio integration properties and therapeutic functionalities. Key advancements in this domain include the integration of bioactive agents such as hydroxyapatite, titanium dioxide, and bio glass into coating formulations, which mimic the composition and structure of natural bone tissue, thereby facilitating the regeneration and remodeling of bone around the implant site. The incorporation of antimicrobial agents and drug-eluting functionalities in bioactive coatings enhances their ability to prevent infections and promote tissue healing, further driving market growth.The development of advanced surface modification techniques such as plasma spraying, ion implantation, and electrochemical deposition enables precise control over coating properties such as thickness, porosity, and roughness, thereby optimizing biocompatibility and performance. The growing adoption of additive manufacturing technologies allows for the fabrication of customized implants with tailored bioactive coatings, offering personalized solutions for patients with specific medical needs. As healthcare providers and patients increasingly recognize the benefits of bioactive coatings in improving implant outcomes and patient satisfaction, the demand for medical coatings for implants is expected to witness significant growth. Manufacturers and suppliers are thus presented with lucrative opportunities to capitalize on this trend and cater to the evolving needs of the global medical community, driving the continued expansion of the medical coatings for implants market.

Segmental Insights

Type Insights

Based on the type, the Hydroxyapatite (HA) type has emerged as the dominant segment in global Medical Coatings for Implants market. This dominance can be attributed to several factors that underscore the unique properties and benefits of hydroxyapatite coatings in medical implant applications. Hydroxyapatite, a biocompatible ceramic material, has garnered significant attention in the medical field due to its excellent osseointegration properties, biocompatibility, and ability to promote bone growth. As a result, hydroxyapatite coatings are widely used in orthopedic and dental implants to enhance implant stability, longevity, and biocompatibility.Hydroxyapatite coatings facilitate the bonding of implants with surrounding bone tissue, leading to improved implant fixation and reduced risk of implant loosening or failure. This is particularly crucial in orthopedic procedures such as joint replacements and spinal surgeries, where implant stability and integration are critical for long-term success. Hydroxyapatite coatings exhibit excellent corrosion resistance and bioactivity, making them ideal for use in challenging physiological environments within the human body. These coatings can withstand the harsh conditions of the body while promoting bone ingrowth and minimizing adverse reactions or complications.

The growing prevalence of orthopedic and dental disorders, coupled with an aging population and increasing demand for minimally invasive surgical procedures, has driven the adoption of hydroxyapatite-coated implants worldwide. Healthcare providers and patients alike recognize the benefits of hydroxyapatite coatings in improving implant outcomes and patient satisfaction. The dominance of the Hydroxyapatite (HA) type in the global market for medical coatings for implants underscores its superiority and effectiveness in enhancing implant performance and biocompatibility. With ongoing advancements in materials science and medical technology, hydroxyapatite coatings are expected to maintain their leading position in the medical coatings market, offering promising solutions for improving patient outcomes and quality of life.

Application Insights

Based on the application, in the global medical coatings for implants market, medical implants emerge as the dominant segment, owing to several key factors that underscore their significance and widespread adoption across various medical applications. Medical implants, including orthopedic implants, dental implants, cardiovascular implants, and neurological implants, are essential medical devices designed to replace, support, or enhance the function of damaged or missing body parts. These implants play a crucial role in various medical procedures, ranging from joint replacement surgeries to dental restorations, vascular interventions, and neurological interventions.One of the primary drivers propelling the dominance of medical implants in the medical coatings market is the increasing prevalence of chronic diseases, musculoskeletal disorders, and age-related conditions that necessitate the use of implantable medical devices for treatment and management. With the aging population worldwide and the growing incidence of conditions such as osteoarthritis, cardiovascular diseases, and dental disorders, the demand for medical implants continues to rise, driving market growth for medical coatings specifically formulated for implantable devices. Advancements in materials science, surface engineering, and coating technologies have revolutionized the design and performance of medical implants, enhancing their biocompatibility, durability, and functionality. Medical coatings play a crucial role in improving the performance and longevity of implantable devices by enhancing their surface properties, preventing corrosion, reducing friction, promoting osseointegration, and minimizing the risk of adverse reactions or infections. As a result, medical coatings have become integral components of modern medical implants, driving market demand for advanced coating solutions tailored to specific implant materials and applications.

Regional Insights

Based on the region, the North America region has emerged as a hotspot for Medical Coatings for Implants Market growth. North America boasts a robust healthcare infrastructure and a thriving medical device industry, which constantly seeks to enhance the safety and performance of implants through advanced coating technologies. With a strong emphasis on innovation and quality, healthcare providers in the region prioritize the use of coated implants to improve patient outcomes and reduce the risk of complications. North America is home to a vast network of research institutions, academic centers, and industry players dedicated to advancing medical coating technologies. Collaborative efforts between academia, government agencies, and private companies drive research and development initiatives aimed at creating novel coatings with enhanced functionalities, including antimicrobial properties, biocompatibility, and durability. Stringent regulatory standards and guidelines in North America ensure the safety and efficacy of medical coatings for implants, fostering trust among healthcare professionals and patients. Compliance with regulations set forth by organizations such as the U.S. Food and Drug Administration (FDA) and Health Canada is essential for market access, driving manufacturers to adhere to high-quality standards and undergo rigorous testing and evaluation processes.North America's aging population and rising prevalence of chronic diseases contribute to the growing demand for implants and related medical devices. As the population ages, there is an increased need for joint replacements, cardiovascular implants, and dental implants, among others, driving the demand for advanced coatings that improve implant longevity and performance. Strategic partnerships and collaborations between industry stakeholders further propel market growth in North America. Companies often collaborate with healthcare providers, research institutions, and material suppliers to develop and commercialize innovative coatings tailored to specific clinical needs and applications.

Key Market Players

- Freudenberg Medical

- Hydromer Inc.

- DOT GmbH

- Lincotek Rubbiano S.P.A

- Medicoat AG

- CAM Bioceramics B.V.

- APS Materials, Inc.

- Accentus Medical Ltd.

- Bio-Gate AG

- SurModics, Inc.

Report Scope:

In this report, the Global Medical Coatings for Implants Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Medical Coatings for Implants Market, By Type:

- Hydroxyapatite (HA)

- Titanium Plasma Spray

- Nanoparticle

- Others

Medical Coatings for Implants Market, By Material Type:

- Polymers

- Metals

Medical Coatings for Implants Market, By Application:

- Medical Devices

- Medical Implants

- Medical Equipment & Tools

- Protective Clothing

Medical Coatings for Implants Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Qatar

- Turkey

- Egypt

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Medical Coatings for Implants Market.Available Customizations:

Global Medical Coatings for Implants Market report with the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Freudenberg Medical

- Hydromer Inc.

- DOT GmbH

- Lincotek Rubbiano S.P.A

- Medicoat AG

- CAM Bioceramics B.V.

- APS Materials, Inc.

- Accentus Medical Ltd.

- Bio-Gate AG

- SurModics, Inc.

Table Information

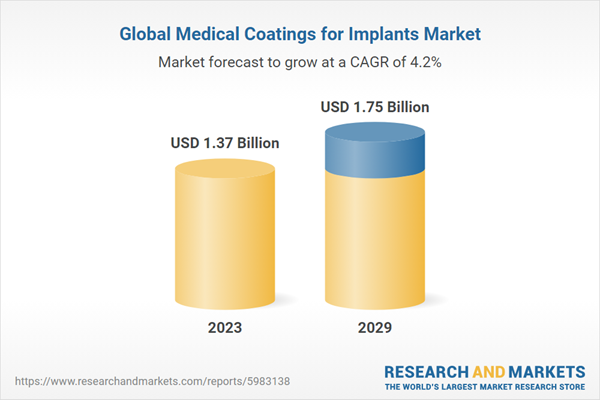

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | July 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 1.37 Billion |

| Forecasted Market Value ( USD | $ 1.75 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |