Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

One of the key factors driving the growth of the global antiscalants market is the rising demand for clean water across the world. With rapid industrialization and urbanization, water scarcity has become a pressing issue in many regions, leading to increased investments in water treatment infrastructure. Antiscalants play a crucial role in water treatment processes by preventing scale formation in reverse osmosis (RO) membranes and other filtration systems, thereby improving the efficiency of water purification. The expansion of the oil and gas industry, particularly in regions such as North America and the Middle East, has contributed to the growing demand for antiscalants. In oil production operations, antiscalants are used to prevent the deposition of scale in pipelines and drilling equipment, which can lead to costly downtime and maintenance issues. As the global demand for energy continues to rise, the need for effective antiscalants solutions in the oil and gas sector is expected to increase significantly.

In addition to water treatment and oil and gas industries, the mining sector is another key market for antiscalants. Mining operations often involve the use of large quantities of water for various processes such as ore processing and dust suppression. Antiscalants help to maintain the efficiency of mining equipment and reduce the risk of scale buildup in pipelines and processing facilities, thereby enhancing productivity, and reducing operating costs. The global antiscalants market is poised for continued growth in the coming years, driven by increasing demand from key end-use industries such as water treatment, oil and gas, mining, and power generation. With rising concerns about water scarcity, energy efficiency, and environmental sustainability, the importance of antiscalants in maintaining the integrity and performance of industrial equipment is expected to further drive market expansion. However, manufacturers will need to focus on innovation and product development to meet the evolving needs of customers and gain a competitive edge in the market.

Key Market Drivers

Expansion of the Oil and Gas Industry is Expected to Drive the Demand for Global Antiscalants Market

The anticipated expansion of the oil and gas industry is poised to become a significant driving force behind the escalating demand for antiscalants on a global scale. As the world's dependence on fossil fuels persists, particularly in sectors like transportation, manufacturing, and energy production, the need for efficient extraction and processing of oil and gas resources becomes paramount. However, the extraction process often encounters challenges posed by scaling, a phenomenon where inorganic deposits such as calcium carbonate, barium sulfate, and silica accumulate on equipment surfaces, impeding operational efficiency and potentially causing costly downtime. In response to these challenges, the deployment of antiscalants has emerged as a crucial solution, offering effective prevention and mitigation of scaling issues in various stages of oil and gas production, including drilling, well stimulation, and water treatment processes.The expansion of unconventional oil and gas exploration, including shale gas and tight oil, has been a key driver behind the increasing demand for antiscalants. With technological advancements enabling the extraction of hydrocarbons from previously inaccessible reserves, such as shale formations, the need to combat scaling issues has become more pronounced. Hydraulic fracturing, or fracking, which involves injecting water, sand, and chemicals into underground formations to release trapped hydrocarbons, often faces challenges associated with scaling due to the high mineral content of the injected water and the geologic composition of the reservoirs. Antiscalants play a vital role in preventing scale formation in fracking equipment and pipelines, thereby ensuring the uninterrupted flow of oil and gas and maximizing production efficiency.

As offshore drilling activities continue to expand into deeper waters and harsher environments, the demand for antiscalants is expected to witness a considerable upsurge. Offshore oil and gas production operations encounter unique scaling challenges due to the corrosive nature of seawater and the presence of high concentrations of sulfate ions, which can lead to the formation of stubborn scales such as barium sulfate and calcium sulfate. Antiscalants formulated specifically for offshore applications offer effective protection against scale deposition, thereby safeguarding critical infrastructure such as subsea pipelines, production platforms, and drilling equipment from costly damage and corrosion-induced failures.

The global push towards enhanced oil recovery (EOR) techniques, aimed at maximizing the extraction of hydrocarbons from mature reservoirs, is anticipated to fuel the demand for antiscalants in the coming years. EOR methods, including water flooding, steam injection, and chemical injection, often involve the injection of large volumes of water or specialized fluids into reservoirs to displace oil and improve its mobility. However, these operations are prone to scaling issues, particularly in formations with high salinity or temperature gradients. By incorporating antiscalants into EOR processes, operators can mitigate scale formation in reservoirs and production wells, thereby prolonging equipment lifespan, optimizing production rates, and ultimately enhancing the overall economics of oil recovery operations.

Therefore, the anticipated expansion of the oil and gas industry, driven by increasing global energy demand and advancements in extraction technologies, is expected to catalyze the growth of the global antiscalants market. As operators strive to maximize production efficiency, minimize operational costs, and ensure the integrity of critical infrastructure, the demand for innovative antiscalant solutions capable of addressing scaling challenges across various stages of oil and gas production will continue to rise, presenting lucrative opportunities for manufacturers and suppliers in the evolving landscape of the energy industry.

Rising Demand for Clean Water is Expected to Propel the Demand for Global Antiscalants Market Growth

The escalating demand for clean water worldwide is poised to become a primary catalyst propelling the growth of the global antiscalants market. With rapid population growth, urbanization, and industrialization exerting increasing pressure on freshwater resources, the importance of efficient water treatment and desalination processes has never been more pronounced. However, these essential water treatment operations are often plagued by scaling issues, wherein mineral deposits such as calcium carbonate, magnesium sulfate, and silica accumulate on equipment surfaces, hindering performance and efficiency. In response to these challenges, the adoption of antiscalants has emerged as a crucial solution, offering effective prevention and mitigation of scaling problems across various water treatment applications, including reverse osmosis (RO) desalination, cooling towers, boilers, and membrane filtration systems.The rising global demand for clean water, driven by population growth, industrial expansion, and environmental concerns, is expected to drive significant growth in the antiscalants market. As municipalities and industries seek to meet stringent regulatory standards for water quality and safety, the deployment of advanced water treatment technologies, such as RO desalination, has become increasingly prevalent. However, RO membranes are highly susceptible to fouling and scaling due to the presence of dissolved minerals in feedwater streams, leading to decreased efficiency and increased operational costs. Antiscalants play a crucial role in preventing scale formation on RO membranes by inhibiting the nucleation and growth of scale crystals, thereby ensuring the long-term performance and reliability of desalination plants and facilitating the production of clean, potable water.

The growing demand for antiscalants in industrial water treatment applications, particularly in sectors such as power generation, chemical manufacturing, and food and beverage production, is expected to drive market growth. Cooling towers and boilers, integral components of industrial processes, are particularly vulnerable to scaling due to the high temperatures and concentrations of dissolved solids in recirculating water systems. Scaling can lead to reduced heat transfer efficiency, increased energy consumption, and equipment failures, resulting in costly downtime and maintenance. By incorporating antiscalants into water treatment programs, industrial facilities can effectively control scale formation, extend equipment lifespan, and optimize operational performance, thereby enhancing overall productivity and cost-effectiveness.

As countries increasingly turn to desalination as a sustainable solution to address water scarcity challenges, the demand for antiscalants in seawater and brackish water desalination plants is expected to witness significant growth. Coastal regions with limited freshwater resources are investing in desalination infrastructure to meet growing water demand for municipal, agricultural, and industrial purposes. However, scaling remains a major operational challenge in desalination plants, particularly in areas with high concentrations of dissolved minerals in seawater. Antiscalants offer a cost-effective and environmentally friendly solution to prevent scale formation on membrane surfaces, improve water recovery rates, and minimize chemical usage, thereby enhancing the overall efficiency and sustainability of desalination processes.

To sum up, the rising demand for clean water, driven by population growth, urbanization, and industrialization, is expected to fuel significant growth in the global antiscalants market. As municipalities, industries, and governments prioritize water quality and sustainability, the adoption of antiscalant solutions will continue to expand across various water treatment applications, driving innovation and investment in the evolving landscape of the water treatment industry.

Rising Power consumptions Propels the Global Antiscalants Market Growth

The surge in power consumption worldwide is emerging as a pivotal driver propelling the growth trajectory of the global antiscalants market. With increasing industrialization, urbanization, and technological advancements, the demand for electricity continues to escalate across various sectors, including manufacturing, transportation, residential, and commercial. However, the efficient generation and distribution of power face significant challenges due to scaling issues in critical infrastructure such as boilers, cooling systems, and heat exchangers. Scaling, caused by the precipitation of mineral deposits such as calcium carbonate, magnesium sulfate, and silica, leads to reduced heat transfer efficiency, increased energy consumption, and equipment failures, ultimately resulting in downtime and maintenance costs. In response to these challenges, the adoption of antiscalants has emerged as a crucial strategy to mitigate scaling problems and optimize operational performance in power generation and distribution systems.The burgeoning demand for electricity, driven by population growth, economic development, and technological advancements, is expected to drive substantial growth in the global antiscalants market. Power plants, both thermal and nuclear, rely on efficient heat exchange processes to generate electricity, wherein scaling can severely impede heat transfer efficiency and overall plant performance. Antiscalants play a vital role in preventing scale formation on heat transfer surfaces, including boilers, condensers, and evaporators, by inhibiting the nucleation and growth of scale crystals. By incorporating antiscalants into water treatment programs, power plants can enhance heat transfer efficiency, reduce energy consumption, and extend equipment lifespan, thereby optimizing plant operations and maximizing electricity generation capacity.

The increasing adoption of renewable energy sources such as solar and wind power is expected to further drive the demand for antiscalants in the power generation sector. While renewable energy technologies offer sustainable alternatives to conventional fossil fuels, they also require efficient water treatment processes to maintain operational efficiency and reliability. Solar thermal power plants, for instance, utilize concentrated solar power (CSP) systems to generate electricity, wherein scaling can occur in the heat transfer fluid circuits and steam generation equipment. Antiscalants play a crucial role in preventing scale formation in CSP systems, thereby ensuring uninterrupted operation, and maximizing energy production from solar resources.

The growing emphasis on energy efficiency and sustainability is driving investment in advanced power generation technologies such as combined-cycle gas turbines (CCGT) and cogeneration systems, which are inherently susceptible to scaling issues. CCGT plants, which integrate gas turbines and steam turbines to maximize energy conversion efficiency, rely on efficient heat exchange processes for power generation. Scaling the heat recovery steam generators (HRSG) and condensers can significantly impact plant performance and profitability. By incorporating antiscalants into water treatment programs, CCGT plants can mitigate scale formation, reduce maintenance costs, and improve overall efficiency, thereby enhancing competitiveness in the evolving energy market landscape.

Briefly, the rising power consumption worldwide is fueling significant growth in the global antiscalants market, driven by the need to optimize operational performance and efficiency in power generation and distribution systems. As industries, governments, and utilities strive to meet growing electricity demand while reducing environmental impact, the adoption of antiscalant solutions will continue to expand across various power generation technologies, driving innovation and investment in the dynamic energy industry.

Key Market Challenges

Competition from Other Water Treatment Technologies

Competition from other water treatment technologies presents a formidable obstacle to the growth of the global antiscalants market. As industries and municipalities seek efficient solutions for water treatment, alternatives such as membrane filtration, ion exchange, and ultraviolet disinfection vie for attention and investment. These competing technologies offer distinct advantages, including higher efficiency, lower operational costs, or specific applications that may better suit certain industries or environmental conditions. Consequently, the antiscalants market faces the challenge of demonstrating its unique value proposition amidst this diverse landscape. The ongoing advancements and innovations in alternative technologies further intensify the competitive pressure. To maintain and expand market share, antiscalant manufacturers must focus on enhancing their product efficacy, optimizing cost-effectiveness, and diversifying applications to address evolving industry needs. Collaborative efforts with research institutions and strategic partnerships could also foster innovation and differentiation, enabling the antiscalants market to overcome the barriers posed by rival water treatment solutions.High Cost of Antiscalants

The high cost of antiscalants poses a significant barrier to the growth of the global antiscalants market. While antiscalants offer effective solutions for preventing scale formation in various industrial processes, their relatively expensive price tags limit widespread adoption across different sectors. Industries, especially in emerging economies, often prioritize cost-effectiveness in their operational expenditures, making it challenging to justify the investment in antiscalant products. The perception of antiscalants as a high-cost component within water treatment systems may deter potential customers from integrating them into their processes, opting instead for cheaper alternatives or delaying maintenance activities altogether. To mitigate this obstacle and stimulate market growth, manufacturers need to explore strategies for reducing production costs, optimizing supply chains, and offering competitive pricing models without compromising product quality or performance. Educating end-users about the long-term benefits and cost-saving potential of antiscalants could help alleviate concerns about upfront expenses and drive greater market penetration.Key Market Trends

Development of New and Improved Antiscalants

The development of new and improved antiscalants stands as a pivotal trend propelling the growth trajectory of the global antiscalants market. With industries across sectors such as water treatment, oil and gas, power generation, and mining increasingly reliant on efficient scale inhibition solutions, the demand for advanced antiscalants has surged. This trend is primarily fueled by the pressing need to combat the detrimental effects of scaling, which include reduced operational efficiency, equipment damage, and elevated maintenance costs. In response, manufacturers are intensifying their research and development efforts to formulate antiscalant products that offer superior performance, enhanced efficacy, and environmental sustainability. Key innovations in this domain encompass the utilization of novel chemical formulations, advanced nanotechnology, and eco-friendly ingredients to achieve optimal scale inhibition while minimizing adverse environmental impacts.The integration of cutting-edge technologies such as artificial intelligence and machine learning is revolutionizing the process of antiscalant development, enabling the creation of customized solutions tailored to specific industrial applications. This concerted focus on innovation is not only driving product differentiation but also fostering partnerships between industry stakeholders to leverage collective expertise and resources for accelerated market penetration. Stringent regulatory standards pertaining to water quality and environmental protection are prompting end-users to seek antiscalant solutions that comply with stringent regulatory requirements, thereby bolstering market growth. The growing emphasis on sustainable practices and the adoption of green chemistry principles are influencing manufacturers to adopt eco-friendly production processes and incorporate renewable raw materials into their formulations, further amplifying market expansion. As a result, the development of new and improved antiscalants is poised to remain a key trend shaping the trajectory of the global antiscalants market, offering lucrative opportunities for industry players to capitalize on evolving market dynamics and meet the escalating demand for effective scale inhibition solutions across diverse industrial sectors.

Growing Demand for Bio-Based Antiscalants

The burgeoning demand for bio-based antiscalants emerges as a pivotal trend driving the growth of the global antiscalants market. In an era marked by increasing environmental consciousness and regulatory scrutiny over chemical usage, there's a discernible shift towards sustainable and eco-friendly solutions across various industries. Bio-based antiscalants, derived from renewable sources such as plants, microbes, and marine organisms, are gaining traction due to their inherent biodegradability, low toxicity, and reduced environmental footprint compared to conventional chemical counterparts. This growing preference for bio-based alternatives is fueled by concerns surrounding the environmental impact of traditional antiscalants, including their persistence in water bodies and potential adverse effects on aquatic ecosystems. The rising awareness of health hazards associated with exposure to synthetic chemicals underscores the importance of adopting safer and more environmentally benign alternatives. Manufacturers are thus investing in research and development to harness the potential of bio-based ingredients and biotechnological processes in formulating effective antiscalant solutions.Leveraging advancements in biotechnology, enzymatic catalysis, and fermentation techniques, these companies can produce bio-based antiscalants that exhibit comparable or even superior performance to their chemical counterparts while offering the added benefits of sustainability and biocompatibility. Stringent regulations mandating the reduction of hazardous chemical usage in industrial processes are driving the uptake of bio-based antiscalants among end-users seeking to ensure compliance with environmental standards and safeguard public health. As a result, the growing demand for bio-based antiscalants is poised to significantly influence the trajectory of the global antiscalants market, presenting lucrative opportunities for industry players to capitalize on the shifting preferences towards sustainable and environmentally friendly solutions across diverse industrial sectors.

Segmental Insights

End User Industry Insights

Based on the end user industry, the water & waste treatment segment has established its dominance in the global market for Antiscalants. This segment stands as a pivotal force, driving the demand and adoption of antiscalant solutions across diverse applications within the water and waste treatment industry. With escalating concerns regarding water scarcity, quality, and environmental sustainability, the need for effective antiscalants has become increasingly paramount. The water and waste treatment sector relies heavily on antiscalants to mitigate scaling issues, ensuring the efficient operation and longevity of critical infrastructure such as pipelines, desalination plants, and sewage treatment facilities.The dominance of the water and waste treatment segment reflects the indispensable role of antiscalants in safeguarding water resources, optimizing operational efficiency, and adhering to regulatory standards. As industries and municipalities worldwide confront escalating challenges related to water management and pollution control, the demand for advanced antiscalant solutions continues to soar within this segment. Manufacturers and suppliers are continually innovating to develop tailored antiscalant formulations capable of addressing the evolving needs and complexities of water and waste treatment processes. The expansion of the global antiscalants market hinges significantly on the growth trajectory of the water and waste treatment industry. As investments pour into infrastructure development, water reuse initiatives, and environmental conservation efforts, the demand for antiscalants is poised to witness sustained growth. The dominance of the water and waste treatment segment underscores its pivotal role as a primary driver shaping the landscape of the global antiscalants market, with profound implications for sustainable water management practices and the preservation of vital natural resources.

Regional Insights

Based on the region, the Asia Pacific region has emerged as a hotspot for Antiscalants market growth. The burgeoning demand for antiscalants across major sectors such as mining, oil & gas, and water & wastewater treatment, specifically for boilers, filters, and pipes, is exerting a significant influence on market growth in the Asia-Pacific region. This surge in demand is attributed to various factors, including increased crude oil production in Japan due to high oil demand, substantial growth in mining and water & wastewater treatment activities in India and China, and significant investments in wastewater treatment infrastructure in China.Such remarkable growth trajectories across these sectors underscore the escalating demand for antiscalants/scale inhibitors in the Asia-Pacific region. These chemicals play a vital role in preventing scale formation and ensuring the efficient operation of critical infrastructure components like boilers, filters, and pipes. As industrial activities continue to expand and environmental regulations become increasingly stringent, the need for effective antiscalant solutions becomes even more pronounced.

Consequently, the Asia-Pacific antiscalants industry is experiencing growth momentum, driven by the surging demand from key sectors and supported by infrastructure developments and regulatory initiatives aimed at enhancing water and environmental sustainability. This trend highlights the region's pivotal role in shaping the trajectory of the global antiscalants market, with significant implications for industry stakeholders and sustainable development efforts.

Key Market Players

- Dow Chemical Company

- Clariant AG

- Kemira Oyj

- General Electric Company

- Lenntech B.V.

- Ashland Inc.

- Kurita Water Industries Ltd.

- Solenix Deutschland GmbH

- Solvay SA

- Acuro Organics Limited

Report Scope:

In this report, the Global Antiscalants Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Antiscalants Market, By Type:

- Phosphonates

- Carboxylates

- Sulfonates

Antiscalants Market, By End User Industry:

- Power & Construction

- Mining

- Water & Waste Treatment

- Oil & Gas

Antiscalants Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Qatar

- Turkey

- Egypt

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Antiscalants Market.Available Customizations:

Global Antiscalants market report with the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Dow Chemical Company

- Clariant AG

- Kemira Oyj

- General Electric Company

- Lenntech B.V.

- Ashland Inc.

- Kurita Water Industries Ltd.

- Solenix Deutschland GmbH

- Solvay SA

- Acuro Organics Limited

Table Information

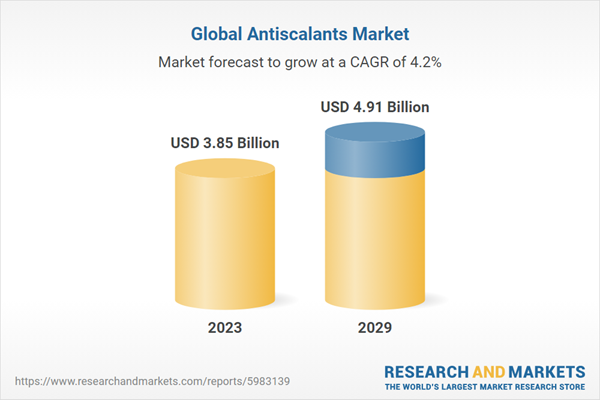

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | July 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 3.85 Billion |

| Forecasted Market Value ( USD | $ 4.91 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |