Flourishment of Automotive Industry Bolsters Middle East & Africa Iron Powder Market

The automotive industry heavily relies on iron powder as it is a fundamental raw material in the field of powder metallurgy. This manufacturing process involves shaping and sintering metal powders to create intricate parts. Automotive manufacturers increasingly turn to powder metallurgy for the production of components such as gears, bearings, and bushings, as it offers cost-effective, precise, and resource-efficient manufacturing solutions. In addition, in recent years, the automotive sector has heavily invested in reducing the weight of vehicles to enhance fuel efficiency and reduce emissions. Iron powder, when integrated into metal matrix composites and other advanced materials, can contribute to the development of lightweight components that maintain structural integrity. These components are integral to achieving the industry's lightweight objectives, resulting in more fuel-efficient vehicles and a reduced carbon footprint.As the automotive industry experiences a transformative shift toward electric vehicles (EVs), iron powder's role becomes even more crucial. Electric motors used in EVs often rely on iron powder for the production of soft magnetic cores, which are essential for the motors' efficiency and performance. According to the International Energy Agency's annual Global Electric Vehicle Outlook, over 10 million electric cars were sold worldwide in 2022, and sales are projected to grow by another 35% in 2023 to reach 14 million.

As the automotive parts sector continues to evolve and innovate, iron powder is poised to remain a fundamental material for the production of high-quality, efficient, and environmentally responsible automotive components.

Middle East & Africa Iron Powder Market Overview

The Middle East & Africa iron powder market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. The Middle East & Africa iron powder market in the Middle East & Africa is experiencing rapid development due to the increased adoption of the iron powder by the region's end-use industries. Better marketing strategies and new investments have led to the capture of market share in the Middle East & Africa. The Middle East & Africa iron powder market is highly driven by economic development, along with the growing end-use industries such as electronics and automotive. As per the Department of Trade and Industry, South Africa has a diverse electronics industry that ranges from household appliances, electrical machinery, and telecommunications equipment to consumer electronics. According to Statistics South Africa, the nation produces over US$ 4.7 billion worth of electrotechnical equipment annually. South Africa is committed to building a competitive environment for the electronics sector. Besides, government assistance is focused on programs that promote domestic manufacturing, research and development, and the development of safety standards to assist the electrical & electronics manufacturing industry. The iron powders are widely used in the automotive sector. The applications include exhaust system components, muffler flange, valve seats and guides, mirror mounts, and fittings. The iron powders for automotive are produced to strike the maximum balance of cost and performance. These factors are anticipated to boost the demand for iron powder in the Middle East & Africa.Middle East & Africa Iron Powder Market Segmentation

The Middle East & Africa iron powder market is categorized into type, grade, manufacturing process, end-use industry, and country.Based on type, the Middle East & Africa iron powder market is segmented into reduced, atomized, and electrolytic. The atomized segment held the largest market share in 2022.

In terms of grade, the Middle East & Africa iron powder market is bifurcated into ≤ 99.0% and ≥ 99.1%. The ≤ 99.0% segment held a larger market share in 2022.

By manufacturing process, the Middle East & Africa iron powder market is categorized into physical, chemical, and mechanical. The physical segment held the largest market share in 2022. Furthermore, the physical segment is further subsegmented into atomization and electro deposition. Additionally, the chemical segment is further subsegmented into reduction and decomposition.

Based on end-use industry, the Middle East & Africa iron powder market is segmented into paints and coatings, additive manufacturing, medical, soft magnetic products, metallurgy, and others. The metallurgy segment held the largest market share in 2022. Furthermore, the metallurgy segment is further subsegmented into compound brazing, compound sintering, compound welding, and others.

By country, the Middle East & Africa iron powder market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East and Africa. Saudi Arabia dominated the Middle East & Africa iron powder market share in 2022.

Rio Tinto Metal Powders, American Elements Inc, Industrial Metal Powders (India) Pvt Ltd, CNPC Powder North America Inc, Ashland Inc, BASF SE, JFE Steel Corp, Hoganas AB, Reade International Corp, and Kobe Steel Ltd are among the leading companies operating in the Middle East & Africa iron powder market.

Table of Contents

Companies Mentioned

- American Elements Inc

- Ashland Inc

- BASF SE

- CNPC Powder North America Inc

- Industrial Metal Powders (India) Pvt Ltd

- JFE Steel Corp

- Hoganas AB

- Kobe Steel Ltd

- Reade International Corp

- Rio Tinto Metal Powders

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 116 |

| Published | May 2024 |

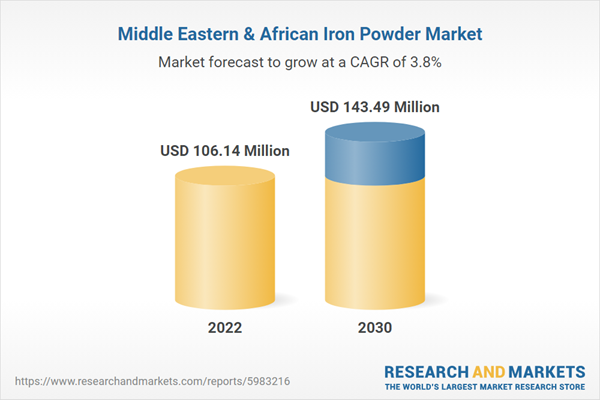

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 106.14 Million |

| Forecasted Market Value ( USD | $ 143.49 Million |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Africa, Middle East |

| No. of Companies Mentioned | 10 |