Growing Adoption of Sustainable Aviation Fuel Boosts South & Central America Aviation Fuel Card Market

The need for sustainable aviation fuel is growing significantly to reduce carbon emissions in the aviation industry. Sustainable aviation fuel (SAF) is an alternative jet fuel derived from renewable and waste feedstocks that can reduce greenhouse gas emissions during its entire lifecycle. Thirty-eight of the world's largest airlines have pledged to reach net-zero emissions targets by 2050 or before, Alaska Airlines, American Airlines, Delta, JetBlue, Southwest, and United Airlines are some of them.Aviation fuel card suppliers can expand their business by offering attractive offers and discounts on the purchase of sustainable aviation fuel. This will ultimately lead to higher adoption and usage of aviation fuel cards. Further, by partnership with fixed-based operators, fuel card service providers can expand the network to supply sustainable aviation fuel. Thus, the rise in sustainable aviation fuel transactions is anticipated to have ample opportunities for the aviation fuel card market growth during forecast period.

South & Central America Aviation Fuel Card Market Overview

The South America aviation fuel card market is still in the developing stage. The overall aviation industry in South America is growing at a notable growth rate. In Brazil, the average daily consumption of jet fuel in 2016 was 116,000 barrels, which reached 123,000 barrels in 2018. Higher fuel consumption of Brazilian airlines led to the adoption of aviation fuel cards for operational capital optimization in the aviation industry. The overall aviation and aviation-related industries in Argentina are smaller and are in the developing stage compared to Brazil. Argentina had ~35,000 passengers per day on average across 23 airports in late 2022. According to the most recent Aerocivil figures, Colombia had 22.6 million passengers in 2022, up from 19.5 million in the same period in 2019. Many aviation fuel and related companies are focusing on business expansion strategies in South American countries.South & Central America Aviation Fuel Card Market Segmentation

The South & Central America aviation fuel card market is categorized into type, application, and country.Based on type, the South & Central America aviation fuel card market is bifurcated into merchant and branded. The merchant segment held a larger South & Central America aviation fuel card market share in 2022.

In terms of application, the South & Central America aviation fuel card market is bifurcated into commercial and private. The commercial segment held a larger South & Central America aviation fuel card market share in 2022.

By country, the South & Central America aviation fuel card market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America aviation fuel card market share in 2022.

Shell Plc, BP Plc, Associated Energy Group LLC, TITAN Aviation Fuels Inc, and TotalEnergies SE are among the leading companies operating in the South & Central America aviation fuel card market.

Table of Contents

Companies Mentioned

- Shell Plc

- BP Plc

- Associated Energy Group LLC

- TITAN Aviation Fuels Inc

- TotalEnergies SE

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 58 |

| Published | May 2024 |

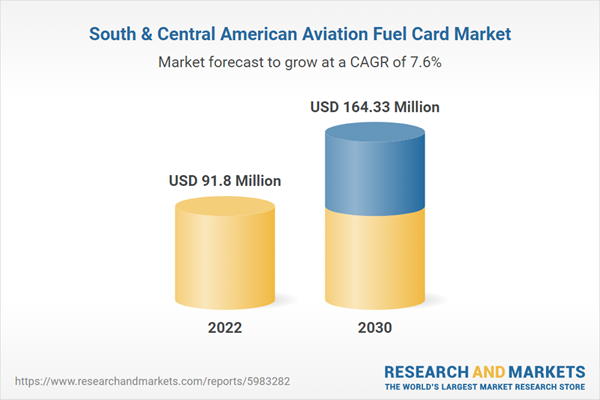

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 91.8 Million |

| Forecasted Market Value ( USD | $ 164.33 Million |

| Compound Annual Growth Rate | 7.6% |

| No. of Companies Mentioned | 5 |