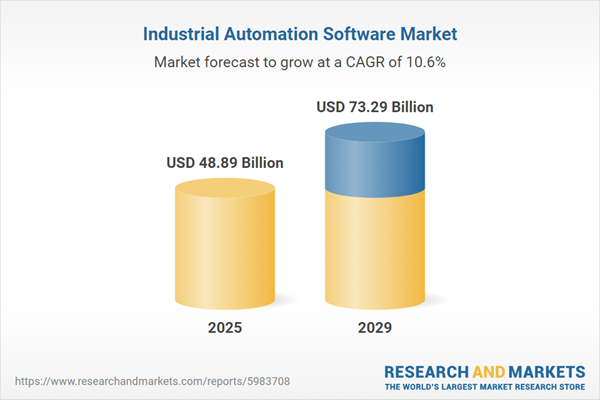

The industrial automation software market size has grown rapidly in recent years. It will grow from $44.11 billion in 2024 to $48.89 billion in 2025 at a compound annual growth rate (CAGR) of 10.8%. The growth in the historic period can be attributed to the growth in need for mass production with reduced operation costs, need for industrial automation software, and rise in demand for augmented reality (AR) technology.

The industrial automation software market size is expected to see rapid growth in the next few years. It will grow to $73.29 billion in 2029 at a compound annual growth rate (CAGR) of 10.6%. The growth in the forecast period can be attributed to the rising adoption of Industrial IoT, government initiatives to promote industrial automation, and rise in investment to develop industrial operations. Major trends in the forecast period include automation solutions offering dual benefits of innovation, new technology approaches, adoption of Industry 4 principles for manufacturing, and adoption of new digital industrial technologies.

The industrial automation software market is expected to experience significant growth due to the increasing adoption of IoT devices. These devices are physical objects equipped with sensors, software, and connectivity features, enabling them to gather, exchange, and act on data. This facilitates automation, optimization, and enhanced functionality across various sectors. The demand for IoT is on the rise because of its potential to transform industrial operations by enabling real-time monitoring, predictive maintenance, and data-driven decision-making. This, in turn, leads to improved efficiency, productivity, cost savings, and competitive advantage. IoT technologies enhance the capabilities of industrial automation software by providing real-time data insights, remote monitoring and control, predictive maintenance, asset tracking, energy management, and scalability. Consequently, this contributes to increased efficiency, productivity, and competitiveness in industrial settings. For example, a report from the GSM Association projected that there will be over 23 billion IoT connections by 2025, compared to 15.1 billion in 2021. Thus, the growing adoption of IoT devices is a key driver fueling the growth of the industrial automation software market.

Key players in the industrial automation software market are embracing digital industrial technologies such as next-generation automation architecture to stay competitive. This architecture offers a flexible, scalable platform delivering secure and optimized solutions for industrial clients. For instance, in February 2024, Emerson Electric Co., a US-based manufacturing company, launched the Boundless Automation software, a next-generation automation architecture aimed at revolutionizing industrial manufacturing by breaking down data silos, liberating data, and harnessing the power of software. This innovative software is designed to address challenges in the industry and assist customers in achieving operational improvements.

In December 2023, Foodmate BV, a Netherlands-based poultry processing equipment company, acquired Barth Industrial Automation. This acquisition bolsters Foodmate's product portfolio, complementing its existing technologies such as weighing, grading, cutting, and deboning. It also enhances Foodmate's research and development efforts, fostering innovation in the industrial automation software segment. Barth Industrial Automation, based in the Netherlands, specializes in software solutions for industrial automation.

Major companies operating in the industrial automation software market are Amazon Web Services (AWS), Accenture plc, International Business Machines Corporation, Cisco Systems Inc., Oracle Corporation, NetSuite Inc., SAP SE, Salesforce Inc., Workday Inc., Infor Inc., OpenText Corporation, Citrix Systems Inc., SAS Institute Inc., HubSpot Inc., Epicor Software Corporation, Progress Software Corporation, Deltek Inc., ActiveCampaign LLC, Canonical Ltd., Acoustic L.P., GetResponse Sp. z o.o., Puppet Inc., Act-On Software Inc., Qualisystems Ltd., ActiveTrail Ltd., Push Engage LLC.

North America was the largest region in the industrial automation software market in 2024. Asia-Pacific is expected to be the fastest-growing region in the market. The regions covered in the industrial automation software market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the industrial automation software market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Industrial automation software comprises computer programs engineered to oversee and regulate industrial processes, machinery, and equipment. These software systems play a vital role in modern industrial automation solutions, facilitating the efficient and dependable operation of manufacturing plants, assembly lines, and other industrial facilities.

The primary products within the realm of industrial automation software include supervisory control and data acquisition (SCADA) systems, distributed control systems (DCS), manufacturing execution systems (MES), human-machine interfaces (HMI), programmable logic controllers (PLC), integration solutions for information technology (IT) and software environments, production process testing systems, automated material handling systems, coordinated data management systems, among others. SCADA systems enable the monitoring and control of industrial processes, enabling operators to remotely oversee and gather real-time data from diverse sensors and equipment. They find application across various sectors including oil and gas, chemicals and materials, paper and pulp, pharmaceuticals and biotechnology, mining and metals, food and beverage, power generation, consumer goods, automotive, and others.

The industrial automation software research report is one of a series of new reports that provides industrial automation software market statistics, including the industrial automation software industry's global market size, regional shares, competitors with an industrial automation software market share, detailed automation software market segments, market trends and opportunities, and any further data you may need to thrive in the plastic paint industry. This automation software market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The industrial automation software market includes revenues earned by entities by providing services such as software licenses, consulting, training, and support services. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Industrial Automation Software Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on industrial automation software market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for industrial automation software ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The industrial automation software market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Supervisory Control and Data Acquisition (SCADA); Distributed Control System (DCS); Manufacturing Execution Systems (MES); Human Machine Interface (HMI); Programmable Logic Controller (PLC); Information Technology (IT) And Software Environment Integration Solutions; Production Process Test Systems; Automated Material Handling Systems; Coordinated Data Management Systems; Other Products2) By Deployment Type: on-Premise; Cloud-Based

3) By End User: Oil and Gas; Chemicals and Materials; Paper and Pulp; Pharmaceuticals and Biotech; Mining and Metals; Food and Beverage; Power; Consumer Goods; Automotive; Other End Users

Subsegments:

1) By Supervisory Control and Data Acquisition (Scada): Scada Software for Monitoring and Control; Remote Terminal Unit (Rtu) Scada Solutions; Distributed Scada Systems; Web-Based Scada Solutions; Real-Time Scada Data Visualization Tools; Scada Systems for Energy Management; Integrated Scada for Industrial Iot (Iiot)2) By Distributed Control System (Dcs): Dcs Software for Process Automation; Hybrid Dcs and Scada Solutions; Dcs for Power Generation and Distribution; Advanced Dcs for Oil and Gas Industry; Real-Time Process Control in Dcs; Dcs With Safety Instrumented Systems (Sis)

3) By Manufacturing Execution Systems (Mes): Mes for Production Tracking and Monitoring; Mes for Quality Management; Mes With Integration To Erp Systems; Real-Time Manufacturing Data Analytics; Batch Manufacturing Execution Software; Mes for Automotive Manufacturing; Cloud-Based Mes Solutions

4) By Human Machine Interface (Hmi): Hmi Software for Industrial Control Systems; Touchscreen Hmi Solutions; Hmi With Scada Integration; Mobile and Remote Hmi Applications; Customizable Hmi for Manufacturing Plants; Visual Data Display and Control Panels

5) By Programmable Logic Controller (Plc): Plc Programming Software; Plc Simulation and Testing Software; Plc With Motion Control; Plc-Hmi Integrated Systems; Modular and Compact Plc Software Solutions; Plc Communication and Networking Software

6) By Information Technology (It) And Software Environment Integration Solutions: Enterprise Resource Planning (Erp) Integration for Automation; It Infrastructure Integration With Automation Systems; Industrial Iot (Iiot) Integration Software; Cloud-Based Industrial Automation Solutions; Big Data Analytics Integration for Automation Systems; Cybersecurity Solutions for Industrial Automation

7) By Production Process Test Systems: Automated Testing Software for Production Lines; Test Systems for Quality Control; Real-Time Testing for Manufacturing Processes; End-of-Line Testing Systems; Process Simulation and Validation Tools

8) By Automated Material Handling Systems: Automated Conveyor Systems; Automated Storage and Retrieval Systems (Asrs); Automated Guided Vehicles (Agvs); Robotic Picking and Sorting Software; Material Handling Automation in Warehouses

9) By Coordinated Data Management Systems: Data Integration for Manufacturing Systems; Centralized Data Management for Industrial Operations; Data Synchronization for Multi-Site Manufacturing; Industrial Data Collection and Analysis Systems; Data Sharing and Cloud-Based Data Management

10) By Other Products: Robotics and Automation Control Software; Industrial Automation Software for Asset Management; Predictive Maintenance Software; Digital Twin Software for Manufacturing; Energy Management Automation Software; Building Automation Systems (Bas); Fleet Management Automation Software.

Key Companies Mentioned: Amazon Web Services (AWS); Accenture plc; International Business Machines Corporation; Cisco Systems Inc.; Oracle Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Industrial Automation Software market report include:- Amazon Web Services (AWS)

- Accenture plc

- International Business Machines Corporation

- Cisco Systems Inc.

- Oracle Corporation

- NetSuite Inc.

- SAP SE

- Salesforce Inc.

- Workday Inc.

- Infor Inc.

- OpenText Corporation

- Citrix Systems Inc.

- SAS Institute Inc.

- HubSpot Inc.

- Epicor Software Corporation

- Progress Software Corporation

- Deltek Inc.

- ActiveCampaign LLC

- Canonical Ltd.

- Acoustic L.P.

- GetResponse Sp. z o.o.

- Puppet Inc.

- Act-On Software Inc.

- Qualisystems Ltd.

- ActiveTrail Ltd.

- Push Engage LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 48.89 Billion |

| Forecasted Market Value ( USD | $ 73.29 Billion |

| Compound Annual Growth Rate | 10.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |