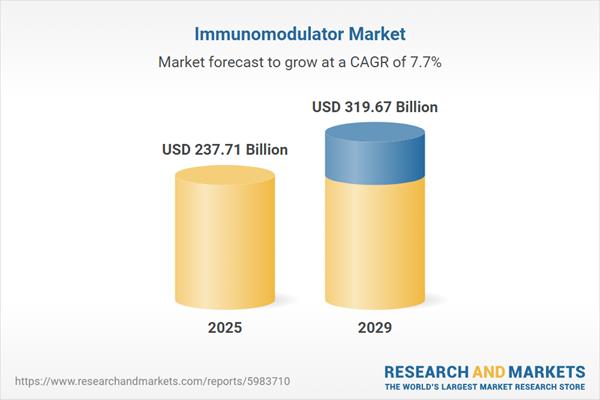

The immunomodulator market size has grown strongly in recent years. It will grow from $219.94 billion in 2024 to $237.71 billion in 2025 at a compound annual growth rate (CAGR) of 8.1%. The growth in the historic period can be attributed to healthcare infrastructure development, increased awareness among patients, the aging population, increasing incidence of autoimmune diseases, and the introduction of biologic drugs.

The immunomodulator market size is expected to see strong growth in the next few years. It will grow to $319.67 billion in 2029 at a compound annual growth rate (CAGR) of 7.7%. The growth in the forecast period can be attributed to growing patient preference for non-invasive, regulatory approvals and guidelines, the extent of health insurance coverage for immunomodulatory treatments, the number and progress of immunomodulatory drugs, and government healthcare expenditure. Major trends in the forecast period include advancements in biotechnology and immunotherapy, the number and progress of immunomodulatory drugs in the research and development pipeline, advances in technology, the trend towards personalized medicine, and advancements in immuno-oncology.

The increasing prevalence of chronic diseases is anticipated to significantly drive the growth of the immunomodulator market in the coming years. Chronic diseases are long-term medical conditions that develop gradually and persist for extended periods, often for a lifetime. The rise in chronic diseases is fueled by factors such as an aging population, lifestyle choices, genetic predispositions, and the availability and infrastructure of healthcare systems. Immunomodulators play a crucial role in managing chronic diseases by modulating immune responses, reducing inflammation, preventing organ rejection, enhancing immune surveillance, and improving symptom control. For instance, in September 2023, the World Health Organization (WHO) reported that 41 million deaths, accounting for 74% of all global deaths, were attributed to non-communicable diseases (NCDs) or chronic diseases. These included 17.9 million deaths from cardiovascular diseases, 9.3 million from cancer, 4.1 million from chronic respiratory diseases, and 2 million from diabetes. Consequently, the growing burden of chronic diseases is driving the demand for immunomodulators.

Companies in the immunomodulator market are increasingly focusing on developing non-immunosuppressive products to meet the rising demand for treatments that modulate immune responses without compromising overall immune function. Non-immunosuppressive treatments do not suppress or weaken the immune system. For example, in February 2024, Nuvig Therapeutics, Inc., a US-based biotechnology company, commenced early-stage clinical trials for NVG-2089, a next-generation immune modulator. NVG-2089 is designed to treat patients with inflammatory myopathies and severe dermatologic autoimmune diseases. The FDA has granted fast-track designation for NVG-2089's development in treating bullous pemphigoid. This innovative, recombinant, non-immunosuppressive immunomodulator targets type II Fc receptors to activate an endogenous regulatory mechanism that mitigates autoimmune dysregulation. The primary objective of the study is to evaluate the safety and tolerability of NVG-2089, with secondary objectives focusing on its pharmacokinetics and pharmacodynamics.

In February 2022, Equillium, Inc., a US-based biotechnology company, acquired Bioniz Therapeutics Inc. for an undisclosed amount. This acquisition significantly expanded Equillium's immunology pipeline by incorporating two first-in-class clinical-stage assets and a proprietary product discovery platform. Bioniz Therapeutics Inc., a US-based company, develops cytokine-targeted medicines for treating immuno-inflammatory disorders and cancer, which are part of the immunomodulator category. This acquisition underscores the strategic importance of expanding product portfolios to include innovative immunomodulatory treatments.

Major companies operating in the immunomodulator market are Pfizer Inc., Johnson & Johnson, F. Hoffmann-La Roche AG, AbbVie Inc., Bayer AG, Sanofi S.A, Bristol Myers Squibb Company, AstraZeneca plc, Novartis AG, GlaxoSmithKline plc, Takeda Pharmaceutical Company Limited, Eli Lilly and Company, Gilead Sciences Inc., Applied Molecular Genetics Inc., Boehringer Ingelheim International GmbH, Teva Pharmaceutical Industries Ltd., Regeneron Pharmaceuticals Inc., Biogen Inc., Vertex Pharmaceuticals Incorporated, UCB S.A., Horizon Therapeutics plc, Incyte Corporation, Ipsen SA, Kyowa Kirin Co. Ltd., Amicus Therapeutics Inc.

North America was the largest region in the immunomodulator market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the immunomodulator market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the immunomodulator market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

An immunomodulator is a substance or medication utilized to modify or regulate the activity of the immune system, often employed in the treatment of various medical conditions. The specific application of immunomodulators varies depending on the underlying condition being addressed and the desired effect on immune response.

The primary product categories within the immunomodulator market comprise immunosuppressants, immunostimulants, and other product types. Immunosuppressants are medications designed to weaken the body's immune system, thereby reducing its capacity to combat diseases and foreign substances. These products are distributed through channels including hospital pharmacies, online pharmacies, retail pharmacies, and other distribution channels. They find application across various medical fields such as oncology, respiratory diseases, human immunodeficiency virus (HIV), among others, and are utilized by a range of end-users including hospitals, clinics, and others.

The immunomodulator market research report is one of a series of new reports that provides immunomodulator market statistics, including immunomodulator industry global market size, regional shares, competitors with an immunomodulator market share, detailed immunomodulator market segments, market trends, and opportunities, and any further data you may need to thrive in the immunomodulator industry. This immunomodulator research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The immunomodulator market consists of sales of herbal immunomodulators, vaccines, immunomodulatory drugs, monoclonal antibodies, and interferons. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Immunomodulator Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on immunomodulator market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for immunomodulator ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The immunomodulator market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product Type: Immunosuppressants; Immunostimulants; Other Product Types2) By Distribution Channel: Hospital Pharmacy; Online Pharmacy; Retail Pharmacy; Other Distribution Channels

3) By Application: Oncology; Respiratory; Human Immunodeficiency Virus; Other Applications

4) By End-User: Hospitals; Clinics; Other End Users

Subsegments:

1) By Immunosuppressants: Corticosteroids; Calcineurin Inhibitors (Tacrolimus, Cyclosporine); Mtor Inhibitors ( Sirolimus, Everolimus); Antimetabolites ( Azathioprine, Methotrexate); Biologic Immunosuppressants (Monoclonal Antibodies Like Rituximab); Janus Kinase (Jak) Inhibitors; T-Cell Inhibitors; Other Immunosuppressive Agents2) By Immunostimulants: Cytokine and Growth Factor-Based Immunostimulants ( Interferons, Interleukins); Monoclonal Antibodies for Immune Stimulation; Vaccines ( Cancer Vaccines, Preventive Vaccines); Adjuvants and Immune Modulatory Agents; Immunostimulatory Agents for Autoimmune Diseases; Toll-Like Receptor (Tlr) Agonists; Nucleic Acid-Based Immunostimulants ( Dna or Rna Vaccines)

3) By Other Product Types: Biologics ( Fusion Proteins, Immune Checkpoint Inhibitors); Small Molecule Immunomodulators; Immunotherapy Drugs; Stem Cell-Based Immunomodulators; Immuno-Oncology Drugs; Probiotics and Other Natural Immunomodulatory Agents

Key Companies Mentioned: Pfizer Inc.; Johnson & Johnson; F. Hoffmann-La Roche AG; AbbVie Inc.; Bayer AG

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Immunomodulator market report include:- Pfizer Inc.

- Johnson & Johnson

- F. Hoffmann-La Roche AG

- AbbVie Inc.

- Bayer AG

- Sanofi S.A

- Bristol Myers Squibb Company

- AstraZeneca plc

- Novartis AG

- GlaxoSmithKline plc

- Takeda Pharmaceutical Company Limited

- Eli Lilly and Company

- Gilead Sciences Inc.

- Applied Molecular Genetics Inc.

- Boehringer Ingelheim International GmbH

- Teva Pharmaceutical Industries Ltd.

- Regeneron Pharmaceuticals Inc.

- Biogen Inc.

- Vertex Pharmaceuticals Incorporated

- UCB S.A.

- Horizon Therapeutics plc

- Incyte Corporation

- Ipsen SA

- Kyowa Kirin Co. Ltd.

- Amicus Therapeutics Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 237.71 Billion |

| Forecasted Market Value ( USD | $ 319.67 Billion |

| Compound Annual Growth Rate | 7.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |