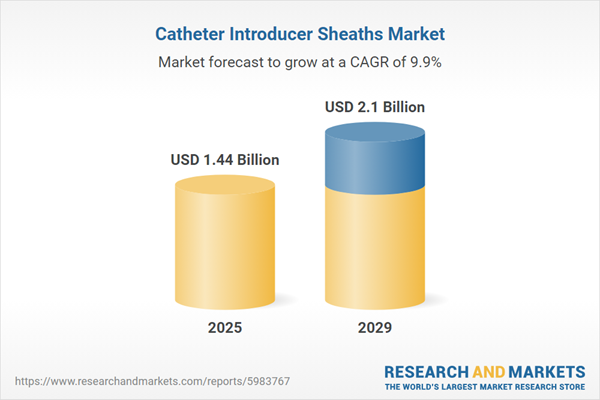

The catheter introducer sheaths market size has grown rapidly in recent years. It will grow from $1.3 billion in 2024 to $1.44 billion in 2025 at a compound annual growth rate (CAGR) of 10.3%. The growth in the historic period can be attributed to demand for improved patient safety, enhanced imaging modalities, demand for vascular access, and feedback from healthcare providers.

The catheter introducer sheaths market size is expected to see strong growth in the next few years. It will grow to $2.1 billion in 2029 at a compound annual growth rate (CAGR) of 9.9%. The growth in the forecast period can be attributed to expansion of interventional procedures, rise in minimally invasive surgery, aging population, and demand for safety and efficacy. Major trends in the forecast period include clinical research and evidence-based medicines, improvements in imaging technologies, miniaturization and integration, integration with imaging technologies, and value-based healthcare models.

The rising prevalence of cardiovascular disease is expected to drive the growth of the catheter introducer sheaths market in the coming years. Cardiovascular disease (CVD) refers to a range of conditions that affect the heart and blood vessels. The increasing rates of CVD are attributed to factors such as aging populations, unhealthy lifestyles, growing obesity rates, socioeconomic influences, and better detection methods. Catheter introducer sheaths are essential for managing cardiovascular diseases, as they provide safe and effective access to the heart and blood vessels for diagnostic and interventional procedures. For example, in June 2024, the Australian Institute of Health and Welfare (AIHW), an independent government agency, reported that approximately 144,000 individuals were diagnosed with heart failure in 2022. Additionally, CVD affected 1.3 million adults, contributing to nearly 12% of the national disease burden and an estimated loss of 666,000 healthy life years in 2023. As a result, the growing prevalence of cardiovascular disease is fueling the demand for catheter introducer sheaths.

Key players in the catheter introducer sheaths market are focused on developing innovative technologies, such as the multi-access blood control septum, to enhance procedural efficiency, reduce complications, and improve patient outcomes. The multi-access blood control septum is a specialized technology integrated into catheter introducer sheaths, enabling multiple access points while maintaining controlled blood flow. For instance, in October 2023, B. Braun SE introduced the Introcan Safety 2 IV Catheter with multi-access blood control, designed to improve safety for clinicians during IV access procedures. This catheter features a blood control mechanism that minimizes the risk of blood exposure with each hub access, offering automatic protection against needlestick injuries and bloodborne pathogens. Additionally, it incorporates Double Flashback Technology for quick visual confirmation of successful vessel puncture, enhancing the efficiency and effectiveness of IV access procedures.

In October 2022, Cordis acquired MedAlliance, combining Cordis's global reach with MedAlliance's innovative SELUTION SLRTM technology, a unique drug delivery system for treating artery diseases. Cordis is a US-based manufacturer of interventional vascular medical devices, while MedAlliance is a Switzerland-based company specializing in catheter introducer sheaths. This acquisition reflects the industry's focus on leveraging advanced technologies to address the evolving needs of cardiovascular care.

Major companies operating in the catheter introducer sheaths market are Johnson & Johnson Services Inc., Abbott Laboratories, Medtronic plc, Becton Dickinson and Company, Boston Scientific Corporation, Terumo Corporation, Edwards Lifesciences Corporation, Smiths Medical International Limited, Teleflex Incorporated, Beijing Lepu Medical Technology Co. Ltd., Integer Holdings Corporation, Merit Medical Systems Inc., Penumbra Inc., C. R. Bard Inc., Asahi Intecc Co. Ltd., AngioDynamics Inc., Argon Medical Devices Inc., Cordis Corporation, B. Braun Melsungen AG, Oscor Inc., BrosMed Medical Co. Ltd., Galt Medical Corp., SCITECH Medical Products (Hefei) Co. Ltd., Vascular Solutions Inc., Cook Incorporated.

North America was the largest region in the catheter introducer sheaths market in 2024. The regions covered in the catheter introducer sheaths market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the catheter introducer sheaths market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Catheter introducer sheaths are medical tools utilized during interventional procedures to aid in the insertion and positioning of catheters within the vascular system or other bodily cavities. These sheaths typically comprise a hollow tube equipped with a dilator and hemostasis valve, intended to create a safe conduit for catheters while reducing the risks of vascular damage, bleeding, and infection.

The primary types of catheter introducer sheaths are integrated introducer sheaths and separate introducer sheaths. Integrated introducer sheaths serve the purpose of facilitating the smooth insertion and placement of catheters or other medical instruments into blood vessels or body cavities. These devices find applications in fields such as cardiology, vascular interventions, and neurology, with end users including hospitals, ambulatory surgical centers, and other healthcare facilities.

The catheter introducer sheaths research report is one of a series of new reports that provides catheter introducer sheaths market statistics, including the catheter introducer sheaths industry's global market size, regional shares, competitors with a catheter introducer sheaths market share, detailed catheter introducer sheaths market segments, market trends and opportunities, and any further data you may need to thrive in the catheter introducer sheaths industry. This catheter introducer sheaths market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The catheter introducer sheaths market consists of sales of standard introducer sheaths, hydrophilic-coated introducer sheaths, radial artery introducer sheaths, pediatric introducer sheaths and hemostatic introducer sheaths. values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Catheter Introducer Sheaths Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on catheter introducer sheaths market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for catheter introducer sheaths ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The catheter introducer sheaths market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product Type: Integrated Introducer Sheaths; Separate Introducer Sheaths2) By Application: Cardiology; Vascular; Neurology

3) By End-Use: Hospitals; Ambulatory Surgical Centers; Other End-Use

Subsegments:

1) By Integrated Introducer Sheaths: Single-Lumen Integrated Sheaths; Multi-Lumen Integrated Sheaths; Hydrophilic Coated Integrated Sheaths; Radiopaque Integrated Sheaths2) By Separate Introducer Sheaths: Single-Lumen Separate Sheaths; Multi-Lumen Separate Sheaths; Sheaths With Check Valves; Radiopaque Separate Sheaths; Hydrophilic Coated Separate Sheaths

Key Companies Mentioned: Johnson & Johnson Services Inc.; Abbott Laboratories; Medtronic plc; Becton Dickinson and Company; Boston Scientific Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Catheter Introducer Sheaths market report include:- Johnson & Johnson Services Inc.

- Abbott Laboratories

- Medtronic plc

- Becton Dickinson and Company

- Boston Scientific Corporation

- Terumo Corporation

- Edwards Lifesciences Corporation

- Smiths Medical International Limited

- Teleflex Incorporated

- Beijing Lepu Medical Technology Co. Ltd.

- Integer Holdings Corporation

- Merit Medical Systems Inc.

- Penumbra Inc.

- C. R. Bard Inc.

- Asahi Intecc Co. Ltd.

- AngioDynamics Inc.

- Argon Medical Devices Inc.

- Cordis Corporation

- B. Braun Melsungen AG

- Oscor Inc.

- BrosMed Medical Co. Ltd.

- Galt Medical Corp.

- SCITECH Medical Products (Hefei) Co. Ltd.

- Vascular Solutions Inc.

- Cook Incorporated

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.44 Billion |

| Forecasted Market Value ( USD | $ 2.1 Billion |

| Compound Annual Growth Rate | 9.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |