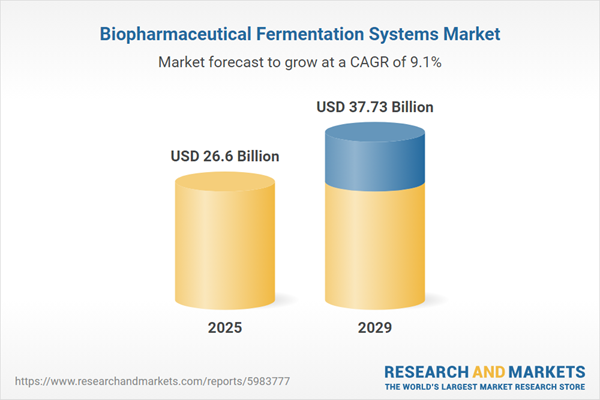

The biopharmaceutical fermentation systems market size is expected to see strong growth in the next few years. It will grow to $37.73 billion in 2029 at a compound annual growth rate (CAGR) of 9.1%. The growth in the forecast period can be attributed to expansion of biopharmaceutical pipeline, shift towards personalized medicine, adoption of continuous bioprocessing, emerging market expansion, and advancements in automation and digitalization. Major trends in the forecast period include increased adoption of continuous manufacturing, growth in personalized medicine, expansion of biosimilars market, adoption of advanced analytics and AI, and focus on sustainability and environmental impact.

The forecast of 9.1% growth over the next five years reflects a modest reduction of 0.2% from the previous estimate for this market. This reduction is primarily due to the impact of tariffs between the US and other countries. Tariff barriers are expected to hamper U.S. biomanufacturing capacity by increasing the cost of single-use bioreactors sourced from France and Singapore, thereby delaying vaccine production and elevating cell culture infrastructure costs by $1.2-1.8 million per facility. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

The expansion of the biologics pipeline is set to drive the growth of the biopharmaceutical fermentation systems market in the coming years. Biologics encompass medicinal products derived from living organisms or their components, including vaccines, gene therapies, and recombinant therapeutic proteins. This growth in the biologics pipeline is fueled by advancements in biotechnology, deeper insights into disease mechanisms, and the increasing demand for targeted and personalized therapies. Biopharmaceutical fermentation systems play a crucial role in biologics production by cultivating genetically engineered cells or microorganisms, enabling the large-scale synthesis of complex therapeutic proteins, antibodies, and vaccines. For example, in 2023, the Food and Drug Administration (FDA) approved 55 new drugs, including 29 new chemical entities (NCEs) and 25 new biological entities (NBEs), marking a 50% increase compared to the 37 approvals in 2022. Hence, the growing biologics pipeline is propelling the biopharmaceutical fermentation systems market forward.

Key players in the biologics fermentation systems market are focusing on developing advanced systems such as automated bioreactors to improve efficiency, scalability, and reproducibility. Automated bioreactors integrate automated control and monitoring technologies to optimize growth conditions for microorganisms or cells in biopharmaceutical production. For instance, Froilabo, a France-based laboratory equipment company, launched fully automated lab-scale bioreactors in October 2022. These bioreactors offer versatility and precision for various applications, providing high-grade aseptic conditions with customizable options for impeller placement and type.

In December 2022, MilliporeSigma, a US-based life sciences company, acquired Erbi Biosystems Inc., enhancing its upstream portfolio in therapeutic proteins. This acquisition integrated Erbi Biosystems' Breez micro-bioreactor platform technology, facilitating scalable cell-based perfusion bioreactor processes from 2ml to 2000L and promoting innovation in continuous bioprocessing. Erbi Biosystems Inc. is a US-based company specializing in bioprocess instrumentation for cell therapy and bioprocessing process development.

Major companies operating in the biopharmaceutical fermentation systems market are F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific Inc., 3M Company, Danaher Corporation, Merck KGaA, Becton Dickinson and Company, GE Healthcare, Agilent Technologies Inc., Lonza Group AG, GEA Group AG, Sartorius Stedim Biotech, Bio-Rad Laboratories Inc., Pall Corporation, Nova Biomedical, Eppendorf AG, Repligen Corporation, ZETA Holding GmbH, New Brunswick Scientific, ABEC Inc., Pierre Guérin Technologies, AntoXa Corporation, Applikon Biotechnology, Cellexus Ltd., Infors HT, BioPharm Process Associates LLC.

North America was the largest region in the biopharmaceutical fermentation systems market in 2024. The regions covered in the biopharmaceutical fermentation systems market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the biopharmaceutical fermentation systems market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The biopharmaceutical fermentation system market consists of revenues earned by entities by providing services such as analytical services, maintenance services, regulatory support, contract manufacturing, and integration services. The market value includes the value of related goods sold by the service provider or included within the service offering. The biopharmaceutical fermentation systems market also includes sales of bioreactors, media and buffers, and microorganisms and cell lines which are used in providing the services. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sudden escalation of U.S. tariffs and the resulting trade tensions in spring 2025 are having a significant impact on the pharmaceutical sector. Companies are grappling with higher costs on imported active pharmaceutical ingredients (APIs), glass vials, and laboratory equipment - many of which have limited alternative sources. Generic drug manufacturers, already operating with minimal profit margins, are particularly affected, with some scaling back production of low-margin medications. Biotech firms are also experiencing delays in clinical trials due to shortages of specialized reagents linked to tariffs. In response, the industry is shifting API production to regions like India and Europe, building up inventory reserves, and advocating for tariff exemptions on essential medicines.

The biopharmaceutical fermentation systems market research report is one of a series of new reports that provides biopharmaceutical fermentation systems market statistics, including biopharmaceutical fermentation systems industry global market size, regional shares, competitors with biopharmaceutical fermentation systems market share, detailed biopharmaceutical fermentation systems market segments, market trends, and opportunities, and any further data you may need to thrive in the biopharmaceutical fermentation systems industry. This biopharmaceutical fermentation systems market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

A biopharmaceutical fermentation system is a specialized arrangement designed to cultivate microorganisms or cells for the production of biopharmaceutical products in controlled environments. These systems are crucial in the biomanufacturing process, facilitating the generation of biologically active compounds such as proteins, antibodies, vaccines, and other therapeutic agents. Key components of biopharmaceutical fermentation systems include bioreactors or fermenters, which create optimal conditions for cell growth and product formation by regulating factors such as temperature, pH, oxygen levels, and nutrient availability.

The primary products of biopharmaceutical fermentation systems can be categorized into upstream and downstream products. Upstream products encompass materials, equipment, or processes involved in the initial production stages, focusing on raw materials, cultivation, and early manufacturing processes. These systems find applications in producing various substances such as recombinant proteins, monoclonal antibodies, antibiotics, probiotics, among others. End-users of these products include biopharmaceutical companies, contract manufacturing organizations, contract research organizations, academic research institutes, the food industry, and other relevant sectors.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Biopharmaceutical Fermentation Systems Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on biopharmaceutical fermentation systems market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for biopharmaceutical fermentation systems? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The biopharmaceutical fermentation systems market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Upstream Products; Downstream Products2) By Application: Recombinant Proteins; Monoclonal Antibodies; Antibiotics; Probiotics; Other Applications

3) By End-User: Biopharmaceutical Companies; Contract Manufacturing Organizations; Contract Research Organizations; Academic Research Institutes; Food Industry; Other End-Users

Subsegments:

1) By Upstream Products: Fermenters or Bioreactors; Culture Media; Inoculum Preparation Systems; Gas and Liquid Flow Control Systems; Process Monitoring and Control Systems; Sterilization Systems2) By Downstream Products: Filtration Systems; Centrifuges; Chromatography Systems; Ultrafiltration and Microfiltration Systems; Concentration and Purification Systems; Packaging and Storage Systems

Companies Mentioned: F. Hoffmann-La Roche Ltd.; Thermo Fisher Scientific Inc.; 3M Company; Danaher Corporation; Merck KGaA; Becton Dickinson and Company; GE Healthcare; Agilent Technologies Inc.; Lonza Group AG; GEA Group AG; Sartorius Stedim Biotech; Bio-Rad Laboratories Inc.; Pall Corporation; Nova Biomedical; Eppendorf AG; Repligen Corporation; ZETA Holding GmbH; New Brunswick Scientific; ABEC Inc.; Pierre Guérin Technologies; AntoXa Corporation; Applikon Biotechnology; Cellexus Ltd.; Infors HT; BioPharm Process Associates LLC

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Biopharmaceutical Fermentation Systems market report include:- F. Hoffmann-La Roche Ltd.

- Thermo Fisher Scientific Inc.

- 3M Company

- Danaher Corporation

- Merck KGaA

- Becton Dickinson and Company

- GE Healthcare

- Agilent Technologies Inc.

- Lonza Group AG

- GEA Group AG

- Sartorius Stedim Biotech

- Bio-Rad Laboratories Inc.

- Pall Corporation

- Nova Biomedical

- Eppendorf AG

- Repligen Corporation

- ZETA Holding GmbH

- New Brunswick Scientific

- ABEC Inc.

- Pierre Guérin Technologies

- AntoXa Corporation

- Applikon Biotechnology

- Cellexus Ltd.

- Infors HT

- BioPharm Process Associates LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 26.6 Billion |

| Forecasted Market Value ( USD | $ 37.73 Billion |

| Compound Annual Growth Rate | 9.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |