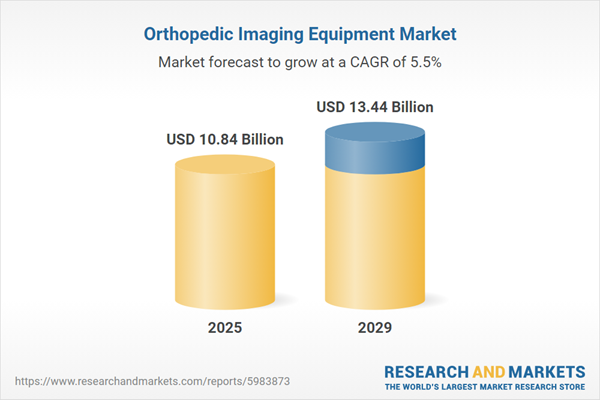

The orthopedic imaging equipment market size has grown strongly in recent years. It will grow from $10.24 billion in 2024 to $10.84 billion in 2025 at a compound annual growth rate (CAGR) of 5.9%. The growth in the historic period can be attributed to the increased aging population, rise in orthopedic conditions, increased healthcare expenditure, and sports and fitness trends.

The orthopedic imaging equipment market size is expected to see strong growth in the next few years. It will grow to $13.44 billion in 2029 at a compound annual growth rate (CAGR) of 5.5%. The growth in the forecast period can be attributed to regulatory initiatives, increasing prevalence of orthopedic disorders, growing awareness and screening programs, rising healthcare expenditure, and expanding applications. Major trends in the forecast period include the integration of artificial intelligence (AI), a shift towards 3D imaging, an increasing focus on radiation reduction, miniaturization and portability, and telemedicine and remote imaging services.

The increasing number of road accidents is expected to drive the growth of the orthopedic imaging equipment market. Road accidents, which involve vehicles, pedestrians, cyclists, or other road users, result in property damage, injuries, or fatalities. Factors contributing to the rise in accidents include distracted driving, speeding, impaired driving, inadequate infrastructure, and human error, all compounded by urbanization and technological distractions. Orthopedic imaging equipment plays a crucial role in diagnosing and treating injuries resulting from road accidents, including bone fractures, joint dislocations, and soft tissue injuries. These imaging tools help provide detailed images, aiding accurate diagnosis, treatment planning, and improving patient outcomes. For example, in May 2023, the Department for Transport, a UK-based government agency, reported that fatalities on UK roads rose from 1,560 in 2021 to 1,695 in 2022. As the number of road accidents continues to increase, the demand for orthopedic imaging equipment is expected to grow.

Prominent companies operating in the orthopedic imaging equipment market are directing their efforts towards the development of advanced technologies, such as augmented reality (AR) guidance systems, to enhance the precision and efficacy of orthopedic procedures. AR guidance systems integrate real-time imaging with digital overlays, furnishing surgeons with detailed visual guidance during surgical interventions. For instance, in March 2022, Pixee Medical, a France-based developer of computer-assisted surgery tools, unveiled its Knee+ AR computer-assisted orthopedic solution in the US. This groundbreaking technology represents the inaugural augmented reality (AR) navigation system tailored for total knee arthroplasty, designed to assist orthopedic surgeons in pinpointing implant locations during knee arthroplasty procedures through augmented reality glasses that ascertain the 3D coordinates of surgical instruments.

In August 2023, MXR Imaging Inc., a US-based provider of diagnostic imaging equipment sales, completed the acquisition of Advanced Imaging Group for an undisclosed sum. This strategic move positions MXR to bolster customer relationships by offering a more comprehensive and robust overall solution encompassing MRI, CT, PET CT, X-ray, and Ultrasound imaging modalities. Advanced Imaging Group specializes in the development of orthopedic imaging solutions and equipment, augmenting MXR's portfolio with innovative offerings in this segment.

Major companies operating in the orthopedic imaging equipment market are Hitachi Ltd., Siemens AG, Toshiba Corporation, FUJIFILM Corporation, Koninklijke Philips N.V, Stryker Corporation, GE HealthCare Technologies Inc., Hologic Inc., Shenzhen Mindray Bio-Medical Electronics Co. Ltd., Shimadzu Corporation, Canon Medical Systems Corporation, Neusoft Corporation, Planmed Oy, Agfa-Gevaert N.V., Carestream Health, Brainlab, Esaote SpA, Ziehm Imaging GmbH, EOS imaging, NeuroLogica Corp., Swissray International Inc., Xoran Technologies LLC., Allengers Medical Systems Ltd., Konica Minolta Healthcare Americas Inc., Hi-Tech Medical Imaging.

North America was the largest region in the orthopedic imaging equipment market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the orthopedic imaging equipment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the orthopedic imaging equipment market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Orthopedic imaging equipment comprises specialized medical devices designed to capture detailed images of the musculoskeletal system, encompassing bones, joints, and soft tissues. These tools play a crucial role in diagnosing injuries, diseases, or conditions affecting the skeletal system, aiding clinicians in effective management and treatment.

The main types of orthopedic imaging equipment are drill guides, guide tubs, implant holders, custom camps, distracters, and screwdrivers. Drill guides, for instance, assist in accurately positioning and guiding the drilling of holes for screws or implants during orthopedic surgeries. These tools utilize various technologies such as x-ray systems, computed tomography (CT) scanners, magnetic resonance imaging (MRI) systems, electron optical system (EOS) imaging systems, ultrasound, and nuclear imaging systems. They find application across a range of indications including acute injuries, sports injuries, trauma cases, chronic disorders such as osteoarthritis and osteoporosis, as well as degenerative joint diseases such as prolapsed disc. End-users of orthopedic imaging equipment include hospitals, radiology centers, emergency care facilities, and ambulatory surgical centers.

The orthopedic imaging equipment market research report is one of a series of new reports that provides orthopedic imaging equipment market statistics, including orthopedic imaging equipment industry global market size, regional shares, competitors with a orthopedic imaging equipment market share, detailed orthopedic imaging equipment market segments, market trends and opportunities, and any further data you may need to thrive in the orthopedic imaging equipment industry. This orthopedic imaging equipment market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The orthopedic imaging equipment market consists of sales of portable imaging systems, fluoroscopy systems, and c-arm machines, and bone densitometers. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Orthopedic Imaging Equipment Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on orthopedic imaging equipment market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for orthopedic imaging equipment ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The orthopedic imaging equipment market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Drill Guide; Guide Tubs; Implant Holders; Custom Camps; Distracters; Screwdrivers2) By Systems: X-Ray Systems; Computed Tomography (CT) Scanner; Magnetic Resonance Imaging (MRI) Systems; Electron Optical System (EOS) Imaging Systems; Ultrasound; Nuclear Imaging Systems

3) By Indication: Acute injuries; Sports injuries; Trauma cases; Chronic Disorders; Osteoarthritis; Osteoporosis; Prolapsed Disc; Degenerative joint diseases; Other Indications

4) By End-User: Hospitals; Radiology Centers; Emergency Care Facility; Ambulatory Surgical Centers

Subsegments:

1) By Drill Guide: Manual Drill Guides; Powered Drill Guides2) By Guide Tubes: Single-Use Guide Tubes; Reusable Guide Tubes

3) By Implant Holders: Fixed Implant Holders; Adjustable Implant Holders

4) By Custom Camps: Custom Surgical Camps; Standard Surgical Camps

5) By Distracters: External Fixation Distractors; Internal Distractors; Spine Distractors

6) By Screwdrivers: Manual Orthopedic Screwdrivers; Powered Orthopedic Screwdrivers

Key Companies Mentioned: Hitachi Ltd.; Siemens AG; Toshiba Corporation; FUJIFILM Corporation; Koninklijke Philips N.V

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Orthopedic Imaging Equipment market report include:- Hitachi Ltd.

- Siemens AG

- Toshiba Corporation

- FUJIFILM Corporation

- Koninklijke Philips N.V

- Stryker Corporation

- GE HealthCare Technologies Inc.

- Hologic Inc.

- Shenzhen Mindray Bio-Medical Electronics Co. Ltd.

- Shimadzu Corporation

- Canon Medical Systems Corporation

- Neusoft Corporation

- Planmed Oy

- Agfa-Gevaert N.V.

- Carestream Health

- Brainlab

- Esaote SpA

- Ziehm Imaging GmbH

- EOS imaging

- NeuroLogica Corp.

- Swissray International Inc.

- Xoran Technologies LLC.

- Allengers Medical Systems Ltd.

- Konica Minolta Healthcare Americas Inc.

- Hi-Tech Medical Imaging

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 10.84 Billion |

| Forecasted Market Value ( USD | $ 13.44 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |