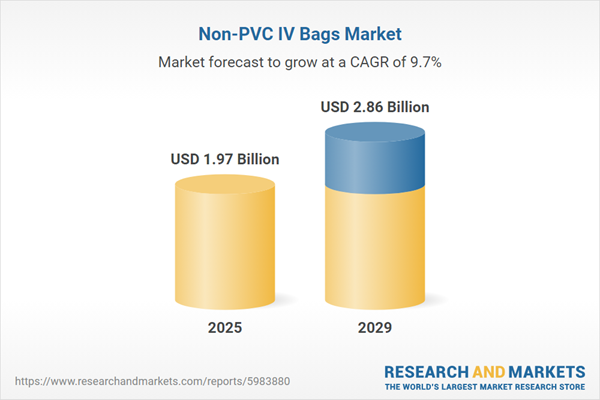

The non-PVC IV bags market size has grown rapidly in recent years. It will grow from $1.79 billion in 2024 to $1.97 billion in 2025 at a compound annual growth rate (CAGR) of 10.1%. The growth in the historic period can be attributed to need for non-toxic material for the packaging of medicines, an increase in chemotherapy, a high prevalence of chronic kidney diseases, an increase in unmet healthcare needs, rise in geriatric population.

The non-PVC IV bags market size is expected to see strong growth in the next few years. It will grow to $2.86 billion in 2029 at a compound annual growth rate (CAGR) of 9.7%. The growth in the forecast period can be attributed to rising cancer incidence, expanding hospitals and ambulatory centers, increasing patient traffic within healthcare settings, increasing government initiatives, and increasing demand for preventative measures against errors. Major trends in the forecast period include infrastructure development within healthcare sectors, development and availability of modern materials in different designs, technological advances in service quality, demand for advanced containers, and adoption of single-chambered non-PVC IV bags.

The increasing patient traffic within healthcare settings is expected to drive the growth of the non-PVC IV bags market in the future. Patient traffic refers to the volume of patients seeking medical care or services within a healthcare facility, such as a hospital, clinic, or doctor's office. There is a higher demand for healthcare services and changes in healthcare policies or insurance coverage. Non-PVC IV bags are needed for patients due to concerns about the potential leaching of harmful chemicals from PVC materials into intravenous fluids, minimizing the risk of patient exposure to toxins. For instance, in January 2024, a report published by the National Health Service (NHS), a UK-based publicly funded healthcare system, stated that 1.63 million patients initiated treatment, and over 2.3 million diagnostic tests were conducted in November 2023. This maintained significant pressure on emergency departments nationwide, with more than 2.1 million accident and emergency (A&E) visits and over 547,000 emergency admissions occurring in December 2023. Therefore, the increasing patient traffic within healthcare settings is driving the growth of the non-PVC IV bags market.

Major players in the non-PVC IV bags market are focusing on developing innovative solutions, such as polyolefin shrink films, to improve safety, sustainability, and compatibility with various IV solutions. Polyolefin shrink films are durable, flexible, and transparent packaging materials that are commonly used for secure, tamper-resistant wrapping in industries such as food, consumer goods, electronics, and pharmaceuticals. Their non-toxic properties and high puncture resistance make them suitable for a wide range of temperature conditions. For example, in February 2024, Innovia Films, a UK-based manufacturer of biaxially-oriented polypropylene film, introduced RayoFloat white APO. This floatable, low-density polyolefin shrink film is designed to protect light-sensitive products. Its key features include easy label detachment during PET recycling, which helps produce high-quality PET flakes for food-grade use. The film's opaque nature offers light-blocking benefits, making it ideal for products like dairy, nutritional, and cosmetics. Moreover, it supports sustainability with up to 20% post-industrial recycled content and complies with the EU’s Packaging and Packaging Waste Regulation (PPWR).

In November 2023, Prange Group, a Germany-based company focused on sales and marketing of pharmaceuticals, and Adragos Pharma, a Germany-based contract development and manufacturing organization (CDMO), acquired Fresenius Kabi’s sterile pharmaceutical production site for an undisclosed amount. As a result of the acquisition, the company aims to expand its existing production network in Europe, North America, and Japan. Through this transaction, Fresenius Kabi will enter into a long-term supply agreement for products manufactured at the site. Fresenius Kabi is a Germany-based manufacturer of non-PVC IV bags.

Major companies operating in the Non-PVC IV bags market are Cardinal Health Inc., Pfizer Inc., Abbott Laboratories, Medline Industries LP, Becton Dickinson and Company, Otsuka Pharmaceutical Co. Ltd., Baxter International Inc., B. Braun Melsungen AG, Fresenius Kabi AG, Grifols S.A., Terumo Corporation, Sealed Air Corporation, Nipro Corporation, ICU Medical Inc., Kraton Corporation, Haemonetics Corporation, JW Life Science, Jiangxi Sanxin Medtec Co. Ltd., Persico S.p.a., Angiplast Pvt. Ltd., Fagron Sterile Services, Technoflex SA, Medi Pharma Plan Co. Ltd., Bausch Advanced Technologies Inc., PolyCine GmbH.

North America was the largest region in the non-PVC IV bags market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the Non-PVC IV bags market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the Non-PVC IV bags market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Non-PVC IV bags are intravenous bags that do not contain polyvinyl chloride (PVC) and are used in healthcare settings to administer fluids, medications, and nutrients directly into a person's vein. These bags are commonly used in hospitals and emergency medical services due to their resistance to chemicals, heat, and UV light, which ensures the quality and stability of IV fluids.

The primary types of non-PVC IV bags are single-chamber and multi-chamber. Single-chamber non-PVC IV bags contain only one compartment and are made from materials other than PVC, such as ethylene vinyl acetate, polypropylene, copolyester ether, and others. They can contain both frozen and liquid mixtures for various applications, including chemotherapy, targeted drug delivery, glucose injection, sodium chloride solution, electrolyte injection, nutrient injection, and more. These bags are utilized by various end-user industries, including hospitals, clinics, emergency service centers, ambulatory surgical centers, and others.

The non-PVC IV bags market research report is one of a series of new reports that provides non-PVC IV bags market statistics, including non-PVC IV bags industry global market size, regional shares, competitors with a non-PVC IV bags market share, detailed non-PVC IV bags market segments, market trends and opportunities, and any further data you may need to thrive in the non-PVC IV bags industry. This non-PVC IV bags market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The non-PVC IV bags market consists of sales of sterilizable IV film or bag, IV tubing, and infusion administration sets. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Non-PVC IV Bags Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on non-pvc iv bags market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for non-pvc iv bags ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The non-pvc iv bags market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Single Chamber; Multi Chamber2) By Material: Ethylene Vinyl Acetate; Polypropylene; Copolyester Ether; Other Materials

3) By Content: Frozen Mixture; Liquid Mixture

4) By Application: Chemotherapy; Targeted Drug Delivery; Glucose Injection; Sodium Chloride Solution; Electrolyte Injection; Nutrient Injection; Other Applications

5) By End User: Hospitals; Clinics; Emergency Service Centers; Ambulatory Surgical Centers; Other End Users

Subsegments:

1) By Single Chamber: Standard Single Chamber Iv Bags; Flexible Single Chamber Iv Bags2) By Multi Chamber: Dual Chamber Iv Bags; Triple Chamber Iv Bags; Multi-Camber Iv Bags (More Than Three Chambers)

Key Companies Mentioned: Cardinal Health Inc.; Pfizer Inc.; Abbott Laboratories; Medline Industries LP; Becton Dickinson and Company

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Non-PVC IV Bags market report include:- Cardinal Health Inc.

- Pfizer Inc.

- Abbott Laboratories

- Medline Industries LP

- Becton Dickinson and Company

- Otsuka Pharmaceutical Co. Ltd.

- Baxter International Inc.

- B. Braun Melsungen AG

- Fresenius Kabi AG

- Grifols S.A.

- Terumo Corporation

- Sealed Air Corporation

- Nipro Corporation

- ICU Medical Inc.

- Kraton Corporation

- Haemonetics Corporation

- JW Life Science

- Jiangxi Sanxin Medtec Co. Ltd.

- Persico S.p.a.

- Angiplast Pvt. Ltd.

- Fagron Sterile Services

- Technoflex SA

- Medi Pharma Plan Co. Ltd.

- Bausch Advanced Technologies Inc.

- PolyCine GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.97 Billion |

| Forecasted Market Value ( USD | $ 2.86 Billion |

| Compound Annual Growth Rate | 9.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |