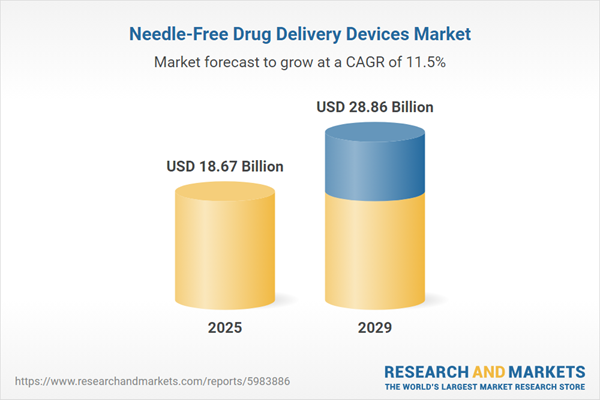

The needle-free drug delivery devices market size has grown rapidly in recent years. It will grow from $16.7 billion in 2024 to $18.67 billion in 2025 at a compound annual growth rate (CAGR) of 11.8%. The growth in the historic period can be attributed to the increased prevalence of chronic diseases, increased demand for painless drug delivery methods, high geriatric population, emphasis on patient compliance and safety, regulatory support for needle-free technologies, and expanded pharmaceutical industry.

The needle-free drug delivery devices market size is expected to see rapid growth in the next few years. It will grow to $28.86 billion in 2029 at a compound annual growth rate (CAGR) of 11.5%. The growth in the forecast period can be attributed to increasing demand for painless medication administration, growing emphasis on patient-centric healthcare solutions, expanding applications in pediatric and geriatric populations, rising prevalence of chronic diseases necessitating frequent injections, technological advancements enhancing device efficiency and usability, expanding access to healthcare in emerging markets, and growing investments in research and development for innovative delivery systems. Major trends in the forecast period include increased adoption of wearable and connected devices, the emergence of novel microfluidic technologies, a growing focus on pediatric-friendly needle-free solutions, the integration of artificial intelligence and machine learning algorithms, and expanding applications in home healthcare settings.

The growing prevalence of diabetes is expected to drive the expansion of the needle-free drug delivery device market in the coming years. Diabetes is a chronic condition characterized by elevated blood sugar levels, resulting from insufficient insulin production or the body’s inability to effectively use insulin. The rise in diabetes cases can be attributed to factors such as sedentary lifestyles, poor dietary habits, genetic factors, urbanization, aging populations, limited healthcare access, and increasing obesity rates globally. Needle-free drug delivery devices offer an alternative to traditional insulin injections in diabetes management. These devices, including jet injectors and transdermal patches, administer insulin through the skin without the need for needles, reducing the discomfort and anxiety associated with injections while improving user comfort. For instance, in June 2024, the UK’s National Health Service reported that in 2023, over half a million (549,000) more individuals in England were found to be at risk of developing type 2 diabetes, bringing the total number of people with non-diabetic hyperglycemia, or pre-diabetes, registered with a GP to 3,615,330. This represents an increase of nearly 20% from 3,065,825 in 2022, highlighting the growing incidence of diabetes. Consequently, the rising prevalence of diabetes is fueling the growth of the needle-free drug delivery device market.

Prominent companies in the needle-free drug delivery device market are concentrating on innovative solutions such as dual-chamber inhalers to enhance effectiveness and ease of administration, addressing the evolving needs of patients and healthcare providers. A dual-chamber inhaler comprises two compartments capable of holding different medications separately, facilitating the combination of multiple drugs in a single device for streamlined treatment and enhanced patient convenience. For instance, Berry Global, a US-based plastic manufacturing company, introduced the BerryHaler in April 2024, a state-of-the-art dry powder inhaler (DPI) designed to revolutionize patient-centered healthcare solutions. Equipped with a dose counter, this dual-chamber inhaler ensures precise medication administration and features an all-plastic construction devoid of metal parts, ideal for complex inhalation treatments. Advanced functionalities such as a bi-directional mouthpiece cover for convenience and hygiene, along with audible signals indicating proper usage, enhance user experience. The integrated dose counter facilitates accurate monitoring of medication usage, minimizing dosage errors.

In May 2022, Halozyme Therapeutics Inc., a US-based biotechnology company, acquired Antares Pharma Inc. for $960 million, aiming to strengthen its position as a leading drug delivery company. Leveraging Antares' auto-injector platform and specialty commercial business, Halozyme expands its strategy to include specialty products, accelerating long-term revenue growth. Antares Pharma Inc., a US-based pharmaceutical company, specializes in developing needle-free injectors used for insulin delivery in diabetes treatment.

Major companies operating in the needle-free drug delivery devices market are Pfizer Inc., Merck & Co. Inc., Bayer AG, 3M Company, Medtronic plc, Novo Nordisk AS, Becton, Dickinson and Company, Endo International plc, Insulet Corporation, Purdue Pharma L.P., Antares Pharma Inc., MannKind Corporation, Med-Jet Inc., Portal Instruments, PharmaJet, Inovio Pharmaceuticals, Inc., National Medical Products Inc., Mika Medical Co. Ltd., Medical International Technology Inc. (MTI), NanoPass Technologies Ltd., PenJet Corporation, Akra Dermojet S.A., NuGen Medical Devices Inc., Crossject SA, Injex Pharma AG.

North America was the largest region in the needle-free drug delivery devices market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the needle-free drug delivery devices market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the needle-free drug delivery devices market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Needle-free drug delivery devices are medical tools designed to administer medication without the use of traditional needles. They provide an alternative method for delivering drugs, vaccines, or therapeutic agents into the body through the skin or mucosal membranes, aiming to reduce patient discomfort and the risk of needle-related injuries.

The primary types of needle-free drug delivery devices include inhalers, jet injectors, novel needles, transdermal patches, and others. Inhalers are portable devices that deliver medication directly into the lungs through a mist or spray. They find applications in various areas such as pain management, vaccine delivery, pediatric injections, insulin delivery, among others, and are utilized by a range of end-users including hospitals and clinics, as well as home healthcare settings.

The needle-free drug delivery devices market research report is one of a series of new reports that provides needle-free drug delivery devices market statistics, including needle-free drug delivery devices industry global market size, regional shares, competitors with a needle-free drug delivery devices market share, detailed needle-free drug delivery devices market segments, market trends and opportunities, and any further data you may need to thrive in the needle-free drug delivery devices industry. This needle-free drug delivery devices market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The needle-free drug delivery devices market consists of sales of nasal sprays, buccal patches, and oral inhalers. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Needle-Free Drug Delivery Devices Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on needle-free drug delivery devices market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for needle-free drug delivery devices ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The needle-free drug delivery devices market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Device Type: Inhalers; Jet Injectors; Novel Needles; Transdermal Patches; Other Device Types2) By Application: Pain Management; Vaccine Delivery; Pediatric Injections; Insulin Delivery; Other Applications

3) By End-User: Hospitals and Clinics; Home Healthcare

Subsegments:

1) By Inhalers: Dry Powder Inhalers (Dpi); Metered Dose Inhalers (Mdi); Nebulizers2) By Jet Injectors: High-Pressure Jet Injectors; Spring-Powered Jet Injectors; Battery-Operated Jet Injectors

3) By Novel Needles: Micro-Needle Arrays; Nano-Needle Arrays

4) By Transdermal Patches: Microneedle Patches; Conventional Patches ( Nicotine, Hormonal, Pain Relief)

5) By Other Device Types: Oral Drug Delivery Devices; Implantable Drug Delivery Systems; Sublingual Drug Delivery Devices

Key Companies Mentioned: Pfizer Inc.; Merck & Co. Inc.; Bayer AG; 3M Company; Medtronic plc

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Needle-Free Drug Delivery Devices market report include:- Pfizer Inc.

- Merck & Co. Inc.

- Bayer AG

- 3M Company

- Medtronic plc

- Novo Nordisk AS

- Becton, Dickinson and Company

- Endo International plc

- Insulet Corporation

- Purdue Pharma L.P.

- Antares Pharma Inc.

- MannKind Corporation

- Med-Jet Inc.

- Portal Instruments

- PharmaJet

- Inovio Pharmaceuticals, Inc.

- National Medical Products Inc.

- Mika Medical Co. Ltd.

- Medical International Technology Inc. (MTI)

- NanoPass Technologies Ltd.

- PenJet Corporation

- Akra Dermojet S.A.

- NuGen Medical Devices Inc.

- Crossject SA

- Injex Pharma AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 18.67 Billion |

| Forecasted Market Value ( USD | $ 28.86 Billion |

| Compound Annual Growth Rate | 11.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |