This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

Heavy industries, including mining, chemical manufacturing, and oil and gas, are major contributors to environmental contamination. The adoption of remediation practices in these sectors is crucial for mitigating the impact of past activities and ensuring compliance with environmental regulations. Urban areas often contain brownfields - abandoned or underutilized properties contaminated by previous industrial or commercial activities. Remediating these sites is essential for safe redevelopment, transforming blighted areas into viable spaces for housing, business, and recreation. Agricultural practices can lead to soil and water contamination through the use of pesticides and fertilizers.

Remediation techniques, such as phytoremediation, are being increasingly adopted to clean up agricultural land and promote sustainable farming practices. In developing countries, the penetration of environmental remediation is gaining momentum with support from international organizations and non-governmental organizations (NGOs). Projects focus on addressing severe pollution issues and improving public health outcomes. The future of environmental remediation lies in sustainable and innovative approaches. Emphasizing green technologies, such as enhanced bioremediation and the use of renewable energy in remediation processes, can reduce the environmental footprint of cleanup efforts. Additionally, community engagement and transparent communication are vital for successful remediation projects, ensuring that local needs and concerns are addressed.

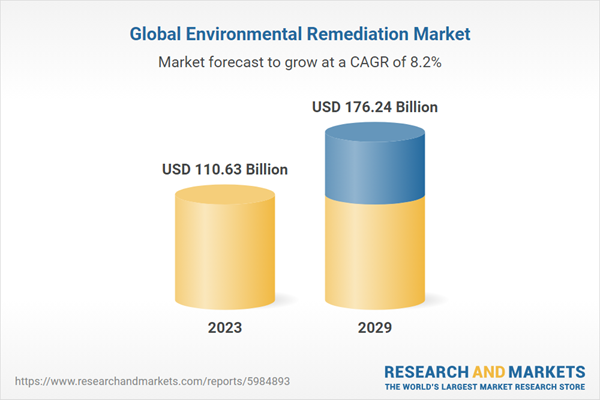

According to the report, the market is anticipated to cross USD 175 Billion by 2029, increasing from USD 110.63 Billion in 2023. The market is expected to grow with 8.24% CAGR by 2024-29. Governments worldwide are implementing stringent environmental regulations to control pollution and protect natural resources. Laws such as the Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA) in the United States mandate the cleanup of contaminated sites, compelling industries to adopt remediation practices. Increased public awareness of environmental issues and the health risks associated with pollution has led to greater demand for clean environments.

Advocacy groups and community organizations play a significant role in pushing for remediation efforts and holding polluters accountable. Governments and international bodies offer financial incentives, grants, and subsidies to encourage the adoption of remediation technologies. Remediation can also enhance property values and make previously unusable land viable for development, providing economic benefits to property owners and developers. Many companies are embracing corporate social responsibility (CSR) and sustainability goals, which include reducing their environmental impact. Adopting remediation practices helps companies meet these goals, improve their public image, and comply with environmental standards.

Innovations in remediation technologies have made the process more efficient and cost-effective. Advanced methods such as bioremediation, nanotechnology, and in situ remediation are increasingly accessible, encouraging wider adoption. Despite the benefits, the adoption of environmental remediation faces challenges, including high costs, technical complexities, and the need for ongoing monitoring. Addressing these challenges requires continued investment in research and development, interdisciplinary collaboration, and the integration of remediation with broader environmental and land-use planning initiatives.

Market Drivers

- Climate Change Adaptation and Mitigation: Climate change is increasingly recognized as a significant driver for environmental remediation. As rising temperatures, extreme weather events, and changing precipitation patterns exacerbate pollution problems, there is a growing need to address contaminated sites to enhance ecosystem resilience and reduce greenhouse gas emissions. For example, remediating wetlands and other carbon-rich environments can help sequester carbon dioxide, contributing to climate mitigation efforts.

- Technological Integration and Innovation: Advances in digital technologies, such as Geographic Information Systems (GIS), remote sensing, and big data analytics, are driving more precise and effective environmental remediation efforts. These technologies enable better site assessments, real-time monitoring, and predictive modeling, improving the efficiency and effectiveness of remediation projects. Additionally, the integration of artificial intelligence and machine learning helps optimize remediation strategies by analyzing vast amounts of environmental data.

Market Challenges

- Long-term Monitoring and Maintenance: One significant challenge in environmental remediation is ensuring the long-term effectiveness of remediation efforts. Contaminants can resurface or migrate over time, requiring continuous monitoring and maintenance. This long-term oversight is often costly and resource-intensive, posing difficulties for sustained commitment, particularly in areas with limited financial resources or regulatory frameworks.

- Stakeholder Coordination and Collaboration: Effective environmental remediation often requires coordination among multiple stakeholders, including government agencies, private companies, community groups, and environmental organizations. Aligning the interests and actions of these diverse groups can be challenging. Disputes over responsibility, funding, and remediation methods can delay projects and complicate decision-making processes, hindering the timely and effective cleanup of contaminated sites.

Market Trends

- Green and Sustainable Remediation (GSR) : There is a growing trend towards adopting Green and Sustainable Remediation (GSR) practices, which aim to minimize the environmental footprint of remediation activities. This involves using renewable energy sources, recycling materials, and incorporating ecosystem-based approaches. GSR practices not only address contamination but also enhance ecological value and contribute to broader sustainability goals.

- Community-driven Remediation Projects: Increasingly, communities affected by pollution are taking an active role in remediation projects. Community-driven remediation involves local residents in planning, decision-making, and implementation processes. This trend is empowering communities to advocate for their health and environmental rights, ensuring that remediation efforts are tailored to local needs and gain stronger public support. Additionally, involving communities helps build trust and ensures long-term project sustainability through local stewardship.

Bioremediation is leading in the environmental remediation market due to its cost-effectiveness, sustainability, and ability to harness natural processes for the efficient degradation of contaminants.

Bioremediation has emerged as a frontrunner in the environmental remediation market primarily because it offers a unique blend of economic efficiency, ecological sustainability, and adaptability. This method involves the use of natural biological processes, primarily driven by microorganisms such as bacteria, fungi, and plants, to degrade, transform, or detoxify pollutants present in the environment. One of the most compelling reasons for its leading position is cost-effectiveness. Traditional remediation methods, such as soil excavation and chemical treatments, often require extensive labor, equipment, and chemical inputs, which can be prohibitively expensive.In contrast, bioremediation typically uses naturally occurring organisms that can proliferate and sustain the degradation process with minimal external inputs, significantly reducing operational costs. The sustainability aspect of bioremediation is another critical factor contributing to its prominence. Unlike physical or chemical remediation techniques, which can be invasive and environmentally disruptive, bioremediation is designed to work with natural processes, thereby minimizing ecological disturbance. This approach not only preserves the integrity of the environment but also enhances it by restoring the natural microbial communities and ecological functions of the site.

Moreover, bioremediation processes are often carried out in situ, meaning they treat the contamination on-site without the need to transport contaminated materials to off-site facilities. This reduces the carbon footprint associated with remediation efforts, aligning with global sustainability goals and regulatory frameworks that emphasize reducing environmental impact. Bioremediation's versatility also plays a crucial role in its widespread adoption.

It can be effectively applied to a broad range of contaminants, including hydrocarbons, heavy metals, pesticides, and chlorinated compounds, across various environmental media such as soil, groundwater, and surface water. The ability to tailor bioremediation strategies to specific contaminants and site conditions makes it an attractive option for many remediation projects. For instance, the use of bioreactors, phytoremediation (using plants to absorb or degrade contaminants), and bioaugmentation (adding specific strains of microorganisms to boost degradation) allows for customized solutions that can be optimized for efficiency and effectiveness.

The oil and gas industry is leading in the environmental remediation market due to its extensive history of environmental contamination and stringent regulatory requirements mandating the cleanup of polluted sites.

The oil and gas industry occupies a prominent position in the environmental remediation market because of its long-standing and widespread impact on the environment. Over decades of exploration, extraction, refining, and transportation activities, this industry has been responsible for significant contamination, including oil spills, leaks of hazardous chemicals, and the generation of byproducts that have polluted soil, groundwater, and surface water. Such contamination poses severe risks to ecosystems and human health, necessitating comprehensive remediation efforts.Governments and regulatory bodies worldwide have imposed stringent regulations that mandate the cleanup of these contaminated sites, compelling the oil and gas industry to invest heavily in remediation technologies and practices. This regulatory pressure is coupled with the industry's need to maintain social license to operate, as public awareness and scrutiny regarding environmental issues have intensified. The economic implications of non-compliance, including hefty fines, legal liabilities, and damage to corporate reputation, further drive the industry to prioritize remediation efforts.

Additionally, the technological and financial resources available within the oil and gas sector enable the implementation of large-scale and sophisticated remediation projects, positioning it at the forefront of the market. The industry's commitment to environmental stewardship and sustainability goals also fosters innovation in remediation techniques, such as advanced bioremediation, in situ treatments, and the use of cutting-edge monitoring systems. These efforts not only address current contamination but also aim to prevent future incidents, reinforcing the industry's leadership in the environmental remediation market.

Public sites are leading in the environmental remediation market due to their high visibility, direct impact on community health and safety, and the imperative to restore valuable land for public use.

Public sites, including parks, schools, residential areas, and municipal lands, are at the forefront of the environmental remediation market because of their significant visibility and the direct impact they have on community health and well-being. These sites are often located in densely populated areas where contamination poses immediate risks to large populations, including vulnerable groups such as children and the elderly. The contamination of public sites can lead to severe health issues, ranging from respiratory problems to cancer, making remediation not only a matter of environmental protection but also a critical public health imperative.The high visibility of public sites means that any environmental issues are quickly noticed and can lead to public outcry, media attention, and political pressure, prompting swift action to address contamination. Furthermore, restoring these sites has substantial social and economic benefits, transforming polluted areas into safe, usable spaces that enhance community quality of life. For instance, remediated parks and recreational areas provide residents with clean, green spaces for leisure and physical activity, promoting overall health and well-being. Schools and residential zones free from contamination ensure safe living and learning environments, fostering a sense of security and well-being among community members.

Additionally, remediating public sites can lead to significant economic revitalization by increasing property values, attracting investments, and encouraging development. Government agencies and municipalities often lead these efforts, supported by regulatory frameworks and public funding dedicated to environmental cleanup. The political and social impetus to remediate public sites, combined with the tangible benefits of restoring these areas for public use, drives their leading position in the environmental remediation market.

Soil is leading in the environmental remediation market because it is the most commonly contaminated medium and plays a crucial role in ecosystem health, agricultural productivity, and human well-being, necessitating extensive and ongoing remediation efforts.

Soil contamination is a pervasive environmental issue, making soil the leading medium in the environmental remediation market. This is due to several interconnected factors that highlight the critical importance of soil health. Firstly, soil is the foundational element of terrestrial ecosystems, supporting plant growth, which in turn sustains wildlife and human agriculture. Contaminated soil can disrupt these ecosystems, leading to a cascade of negative environmental impacts. Pollutants such as heavy metals, pesticides, petroleum hydrocarbons, and industrial chemicals can degrade soil quality, reducing its fertility and harming the plants and organisms that depend on it.This contamination can also leach into groundwater, further expanding the scope of environmental damage. Secondly, soil contamination poses direct risks to human health. People can be exposed to soil pollutants through direct contact, inhalation of dust, and consumption of contaminated food and water. This exposure can lead to serious health issues, including respiratory problems, skin conditions, and chronic diseases such as cancer. The pervasive nature of soil contamination means that many residential, agricultural, and industrial areas require remediation to ensure safety and compliance with health standards. The economic implications of soil contamination are significant as well, particularly for agriculture.

Contaminated soil can lead to reduced crop yields and quality, affecting food security and livelihoods. Remediating soil helps restore its productivity, ensuring sustainable agricultural practices and protecting food supply chains. The widespread and critical need for soil remediation is further driven by regulatory frameworks that mandate the cleanup of contaminated sites to protect public health and the environment. These regulations, coupled with public awareness and advocacy for clean environments, drive significant investment in soil remediation technologies and practices. Additionally, advances in remediation methods, such as bioremediation, phytoremediation, and soil washing, provide effective solutions for addressing soil contamination. The multifaceted importance of soil in supporting ecosystems, human health, and economic activities underscores why it is the leading medium in the environmental remediation market, necessitating comprehensive and sustained efforts to address contamination and restore soil health.

The Asia-Pacific region is leading in the environmental remediation market due to its rapid industrialization, urbanization, and the resulting severe environmental pollution, combined with increasing regulatory measures and substantial investments in cleanup initiatives.

The Asia-Pacific region's leadership in the environmental remediation market is driven by its unprecedented pace of industrialization and urbanization over the past few decades. This rapid development has resulted in significant environmental challenges, including widespread contamination of soil, water, and air. Countries such as China, India, and Southeast Asian nations have experienced massive growth in manufacturing, mining, and other industrial activities, which have contributed to severe pollution problems. For instance, heavy metals, industrial chemicals, and agricultural runoff have extensively polluted soil and water bodies, necessitating urgent and large-scale remediation efforts.In response to these environmental issues, governments across the Asia-Pacific region are implementing stringent regulatory frameworks aimed at controlling pollution and mandating the cleanup of contaminated sites. National policies and environmental protection laws are becoming more robust, driving the demand for advanced remediation technologies and services. Additionally, there is a growing recognition of the public health impacts of pollution, which has led to increased public and political pressure to address these environmental problems. Consequently, substantial investments are being made in environmental remediation projects, supported by both public and private sectors.

The availability of funding and the establishment of environmental agencies and initiatives reflect a strong commitment to tackling pollution and restoring environmental quality. Moreover, the Asia-Pacific region is home to a burgeoning market for innovative remediation technologies. Local companies, alongside international firms, are actively engaged in developing and deploying cutting-edge solutions tailored to the unique environmental challenges faced by this region. Technologies such as bioremediation, phytoremediation, and advanced chemical treatments are being applied to effectively manage and remediate contaminated sites.

The collaboration between governments, industries, and research institutions fosters a dynamic environment for innovation and implementation of best practices in environmental remediation. In summary, the combination of severe pollution issues, stringent regulations, significant investments, and a focus on technological innovation positions the Asia-Pacific region as a leader in the environmental remediation market. This leadership is a direct response to the pressing need to mitigate the environmental impacts of rapid development and ensure a sustainable future for the region.

- In October 2023, Exeltainer was acquired by Cold Chain Technologies, to spread its presence in Europe and Latin America.

- In January 2023, Tetra Tech Inc. acquired all of the outstanding shares of RPS Group, with the help of a U.K.-court-approved scheme.

- In October 2022, H20 Engineering Inc. was acquired by Newterra, to grow and invent technologies associated with the environment and water challenges.

- In September 2022, the environment & infrastructure business of John Wood Group was acquired by the WSP.

Years considered in this report:

- Historic year: 2018

- Base year: 2023

- Estimated year: 2024

- Forecast year: 2029

Aspects covered in the report:

- Environmental Remediation market outlook with its value and forecast, along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Technology:

- Bioremediation

- Excavation

- Permeable Reactive Barriers

- Air Sparing

- Soil Washing

- Chemical Treatment

- Electro kinetic Remediation

- Others

By Application:

- Oil & Gas

- Manufacturing, Industrial, & Chemical Production/Processing

- Automotive

- Construction & Land Development

- Agriculture

- Mining & Forestry

- Landfills & Waste Disposal Sites

- Others

By Site type:

- public

- Private

By Medium:

- Soil

- Groundwater

The approach of the report:

This report consists of a combined approach of primary and secondary research. Initially, secondary research was used to get an understanding of the market and list the companies that are present in it. The secondary research consists of third-party sources such as press releases, annual reports of companies, and government-generated reports and databases. After gathering the data from secondary sources, primary research was conducted by conducting telephone interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. After this, the research team made primary calls to consumers by equally segmenting them in regional aspects, tier aspects, age group, and gender. Once the research team attained the primary data, they verified the details obtained from secondary sources.Intended Audience

This report can be useful to industry consultants, manufacturers, suppliers, associations, and organizations related to the Environmental Remediation industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing and presentations, it will also increase competitive knowledge about the industry.Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- WSP Global Inc.

- AECOM

- Tetra Tech, Inc.

- Arcadis NV

- Dredging, Environmental and Marine Engineering NV

- Clean Harbors, Inc.

- HDR, Inc.

- Bechtel Corporation

- Veolia Environnement S.A.

- Stantec Inc.

- Waste Management, Inc.

- Augean plc

- Black & Veatch

- Thermax Ltd

- Republic Services Inc

- Sembcorp Industries

- BEEAH Group

- Averda International Ltd

- Metito

- Tata Projects Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 214 |

| Published | June 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 110.63 Billion |

| Forecasted Market Value ( USD | $ 176.24 Billion |

| Compound Annual Growth Rate | 8.2% |

| Regions Covered | Global |