This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

It not only improves cardiovascular health and strengthens muscles but also enhances flexibility and boosts mood through the release of endorphins. Whether it's brisk walking, running, yoga, or weightlifting, finding an activity that user enjoy and can sustain is key. A nutritious diet fuels the body for optimal performance. This includes consuming a variety of whole foods such as fruits, vegetables, lean proteins, and whole grains. Avoiding excessive sugar, saturated fats, and processed foods helps maintain energy levels and supports overall health. Mental health is often overlooked in discussions about fitness but is equally vital.

Stress management techniques such as meditation, deep breathing exercises, or engaging in hobbies can significantly contribute to overall well-being. A positive mindset and emotional resilience are essential for sustaining long-term fitness goals. Adequate rest is crucial for allowing the body to recover and repair itself after physical activity. This includes both nightly sleep and incorporating rest days into user’s exercise routine. Sleep is when the body consolidates memories, regulates hormones, and repairs tissues, making it essential for overall health and fitness.

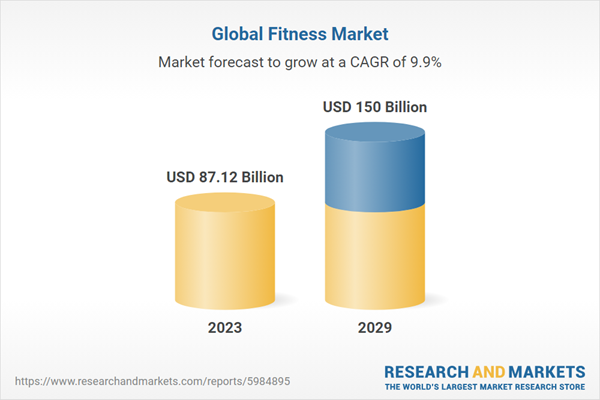

According to the report, the market is anticipated to cross USD 150 Billion by 2029, increasing from USD 87.12 Billion in 2023. The market is expected to grow with 9.92% CAGR by 2024-29. The fitness industry has undergone a profound transformation in recent years, driven by changing consumer preferences, technological advancements, and a growing awareness of health and wellness. From traditional gyms to boutique fitness studios and online platforms, the industry is diversifying to cater to a broader range of fitness enthusiasts. Boutique fitness studios specializing in specific workouts such as HIIT (High-Intensity Interval Training), yoga, Pilates, and cycling have gained popularity.

These studios offer personalized experiences, smaller class sizes, and specialized training that appeal to niche markets. Technology has revolutionized the fitness industry, enabling the development of wearable fitness trackers, mobile apps for workout guidance and nutrition tracking, virtual fitness classes, and AI-powered personal trainers. These innovations enhance convenience, personalization, and accessibility for consumers. There is a growing emphasis on holistic wellness beyond physical fitness, including mental health, mindfulness practices, nutrition counseling, and recovery services like cryotherapy and massage therapy. Fitness facilities are increasingly offering integrated wellness programs to meet these holistic needs.

Online fitness platforms and streaming services have surged in popularity, especially during the COVID-19 pandemic. These platforms offer flexibility and convenience, allowing users to access a wide range of workouts from home or while traveling. Environmental consciousness is becoming more important in the fitness industry. Gyms and fitness studios are adopting sustainable practices such as using eco-friendly equipment, reducing energy consumption, and promoting initiatives to minimize waste.

Fitness, as a concept, has evolved significantly throughout human history, reflecting changes in culture, technology, and societal norms. From its origins in ancient civilizations to its current prominence in global health and wellness industries, the adoption and evolution of fitness have shaped not only physical health but also cultural perceptions and societal values. This article explores the historical roots, key milestones, and modern trends that have defined the journey of fitness through the ages. The roots of fitness can be traced back to ancient civilizations, where physical activity was integral to survival, warfare, and religious practices.

In ancient Greece, for example, physical fitness and athletic prowess were celebrated through events like the Olympic Games, which emphasized strength, endurance, and agility. Similarly, in ancient China and India, practices such as martial arts, yoga, and qigong promoted physical and spiritual well-being. After a period of relative decline during the Middle Ages, the Renaissance and Enlightenment periods saw a renewed interest in physical culture and the human body. Scholars and thinkers like Leonardo da Vinci and Galileo Galilei explored anatomy and biomechanics, laying the groundwork for modern scientific approaches to fitness and health.

The Industrial Revolution brought about significant changes in lifestyle and work patterns, leading to concerns about physical health and fitness. The late 19th and early 20th centuries witnessed the rise of organized fitness movements and gymnastics programs aimed at improving public health and physical education. Figures like Friedrich Ludwig Jahn in Germany and Per Henrik Ling in Sweden pioneered gymnastics systems that emphasized strength, flexibility, and coordination.

The 20th century witnessed a proliferation of fitness trends and methodologies that continue to shape the industry today. The mid-20th century saw the emergence of aerobics and cardiovascular training, popularized by figures like Jack LaLanne and Jane Fonda. These movements emphasized the benefits of sustained aerobic exercise for cardiovascular health and weight management. In the late 20th and early 21st centuries, fitness trends diversified further with the advent of strength training, functional fitness, and high-intensity interval training (HIIT). These approaches prioritize functional movements, muscular strength, and overall fitness capacity, appealing to a wide range of enthusiasts from athletes to everyday fitness enthusiasts.

The 21st century has brought about a digital fitness revolution, driven by advancements in technology and the rise of online platforms. Fitness apps, wearable devices, and virtual training programs have democratized access to fitness information and personalized workout routines. Consumers can now track their progress, participate in virtual classes, and connect with fitness communities from anywhere in the world. Today, fitness is increasingly viewed within the broader context of wellness, encompassing physical, mental, and emotional well-being. Integrative approaches that combine fitness with nutrition, mindfulness practices, and stress management techniques are gaining popularity. Wellness retreats, holistic fitness centers, and wellness coaching services reflect this evolving understanding of health and fitness as interconnected facets of overall well-being.

Market Drivers

- Aging Population and Health Concerns: The aging population globally is increasingly prioritizing health and fitness to maintain quality of life and independence as they age. This demographic shift has created a demand for fitness programs tailored to older adults, including low-impact exercises, senior fitness classes, and specialized wellness programs aimed at preventing age-related health issues.

- Corporate Wellness Programs: Companies are investing more in employee wellness programs as a means to improve productivity, reduce healthcare costs, and enhance employee satisfaction. Corporate wellness initiatives often include fitness memberships, onsite gyms, wellness challenges, and access to virtual fitness platforms. The integration of fitness into workplace culture is driving the adoption of fitness services among working professionals.

Market Challenges

- Digital Transformation and Privacy Concerns: While technological advancements have enriched the fitness experience, they also pose challenges related to data privacy and security. Fitness apps and wearable devices collect sensitive health data, raising concerns about data protection and user privacy. Fitness businesses must navigate regulatory compliance and build trust with consumers regarding data handling practices to mitigate these concerns.

- Inclusivity and Accessibility: Ensuring inclusivity and accessibility within the fitness industry remains a challenge. Accessibility barriers, such as physical accessibility of facilities and affordability of fitness services, can limit participation among diverse populations. Fitness businesses are increasingly focusing on creating inclusive environments, offering adaptive equipment, and providing culturally sensitive programming to cater to a broader range of individuals.

Market Trends

- Personalization and AI-Driven Fitness: The trend towards personalized fitness experiences continues to grow, supported by advancements in artificial intelligence and machine learning. AI-powered fitness apps analyze user data to deliver customized workout plans, nutritional recommendations, and real-time feedback. Personalization enhances engagement and adherence by tailoring fitness experiences to individual goals, preferences, and fitness levels.

- Outdoor and Adventure Fitness: There is a rising trend towards outdoor and adventure-based fitness activities, driven by a desire for novel experiences and connection with nature. Outdoor fitness classes, hiking clubs, obstacle course races, and adventure fitness retreats appeal to individuals seeking unconventional ways to stay active while enjoying outdoor environments. This trend reflects a shift towards experiential fitness offerings that blend physical activity with exploration and social engagement.

Cardiovascular training equipment is leading in the fitness market due to its widespread appeal and essential role in improving cardiovascular health, which is a primary concern for many individuals seeking fitness solutions.

Cardiovascular training equipment, such as treadmills, stationary bikes, ellipticals, and rowing machines, holds a prominent position in the fitness market for several compelling reasons. Firstly, cardiovascular exercise is crucial for improving heart health, increasing lung capacity, and enhancing overall endurance. These benefits resonate with a broad spectrum of consumers, from fitness enthusiasts aiming to optimize performance to individuals managing health conditions like obesity or hypertension. The accessibility and ease of use of cardio equipment make it suitable for users of varying fitness levels and ages, contributing to its widespread adoption in both home and commercial fitness settings.Moreover, the versatility of cardiovascular workouts appeals to users seeking diverse fitness routines. Treadmills offer options for walking, jogging, or running at various intensities, catering to different fitness goals and preferences. Stationary bikes provide low-impact exercise suitable for individuals with joint issues, while ellipticals offer a full-body workout with minimal impact on joints. The availability of interactive features such as digital screens, virtual training programs, and connectivity options further enhances the user experience, making cardio equipment engaging and motivating. In the commercial sector, gyms and fitness centers often prioritize cardiovascular equipment due to its popularity among members and its ability to attract and retain clientele. From a business perspective, investing in quality cardio equipment can differentiate a facility, offering a comprehensive fitness experience that meets the diverse needs of members.

Health clubs and gyms are leading in the fitness market due to their comprehensive facilities, professional guidance, community atmosphere, and diverse range of fitness offerings that cater to varied consumer needs and preferences.

Health clubs and gyms occupy a central role in the fitness market for several compelling reasons. They provide a comprehensive fitness solution under one roof, offering a wide array of equipment and amenities that cater to different types of workouts and fitness goals. From cardio machines and strength training equipment to group exercise classes and specialized training areas, health clubs offer versatility that appeals to individuals seeking varied and customizable fitness experiences. Professional guidance is another key advantage of health clubs.Qualified fitness instructors and personal trainers are available to provide expertise, personalized workout plans, and motivation, which are crucial for individuals looking to achieve specific fitness goals or maintain accountability in their exercise routines. This professional support enhances the effectiveness and safety of workouts, making health clubs a preferred choice for those seeking structured fitness programs. Moreover, health clubs foster a sense of community and social interaction among members. Group exercise classes, social events, and fitness challenges create opportunities for members to connect, share experiences, and support each other in their fitness journeys.

This community aspect not only enhances motivation and adherence to fitness routines but also contributes to a positive and supportive environment that encourages long-term engagement. In terms of facilities and amenities, health clubs often include additional features such as locker rooms, showers, saunas, childcare services, nutrition counseling, and sometimes even cafes or wellness centers. These amenities enhance the overall member experience, providing convenience and comfort before, during, and after workouts. From a business perspective, health clubs and gyms benefit from economies of scale and recurring revenue streams through membership subscriptions. They can invest in quality equipment, facilities maintenance, and ongoing staff training to continually improve service offerings and member satisfaction.

North America is leading in the fitness market due to a combination of high health consciousness, disposable income, widespread gym culture, and innovation in fitness trends and technologies.

North America has emerged as a leader in the global fitness market for several interconnected reasons. Firstly, there is a strong cultural emphasis on health and fitness across the region. With a significant portion of the population prioritizing physical well-being and leading active lifestyles, there is a robust demand for fitness products and services. This health consciousness is complemented by relatively higher disposable incomes, allowing individuals to invest in gym memberships, personal training, specialized fitness classes, and premium fitness equipment. The widespread gym culture in North America also plays a pivotal role.Gyms and health clubs are prevalent in urban and suburban areas, offering a variety of amenities and services that cater to diverse consumer preferences. From traditional gym facilities to boutique fitness studios specializing in yoga, Pilates, or high-intensity interval training (HIIT), there is a wide range of options available to accommodate different fitness interests and goals. This accessibility and variety contribute to the popularity of fitness as a lifestyle choice. Furthermore, North America leads in fitness market innovation, continually introducing new trends and technologies that enhance the exercise experience.

Innovations such as wearable fitness trackers, virtual fitness platforms, AI-powered fitness apps, and connected fitness equipment have gained widespread adoption, offering users personalized workout routines, real-time performance metrics, and interactive training experiences. These technological advancements not only attract tech-savvy consumers but also improve engagement and retention rates among fitness enthusiasts. From a business standpoint, North America benefits from a competitive landscape with numerous fitness chains, franchises, and independent operators driving innovation and service excellence. The entrepreneurial spirit in the region fosters continuous improvement in fitness offerings, customer service, and facility management, further solidifying its leadership position in the global fitness market.

- Peloton Bike+ and Tread+ (September 2020): Peloton introduced upgraded versions of their original products, featuring larger HD touchscreens, enhanced audio systems, and integration with new workout types such as bootcamp classes.

- Apple Fitness+ (December 2020): Apple launched Fitness+, a service integrated with Apple Watch offering studio-style workout classes across various fitness disciplines, synchronized metrics, and integration with Apple Music.

- MYX Fitness Bike (March 2020): MYX Fitness launched its smart bike offering personalized coaching, heart rate monitoring, and a range of cycling, strength training, and recovery workouts accessible via an interactive touchscreen.

- Tempo Studio (February 2020): Tempo introduced its smart home gym featuring a 3D motion-capture camera, AI technology for form feedback, and a variety of strength training and HIIT workouts led by expert trainers.

- Mirror Home Gym (September 2018): The Mirror, acquired by Lululemon, launched as an interactive fitness mirror streaming live and on-demand workout classes including cardio, strength training, yoga, and meditation.

- TONAL Smart Home Gym (August 2018): TONAL launched its all-in-one smart home gym featuring digital weight technology, electromagnetic resistance, and an interactive touchscreen display for personalized strength training workouts.

- Hydrow Rower (November 2017): Hydrow introduced its rowing machine combining sleek design with immersive outdoor rowing experiences through a connected platform, featuring scenic visuals and real-time performance metrics.

Years considered in this report:

- Historic year: 2018

- Base year: 2023

- Estimated year: 2024

- Forecast year: 2029

Aspects covered in the report:

- Fitness market outlook with its value and forecast, along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Product:

- Cardiovascular training Equipment

- Strength training Equipment

- Fitness monitoring Equipment

- Fitness Accessories

- Others

By Application:

- Health Club And Gyms

- Online Fitness

- Home fitness

- Others

The approach of the report:

This report consists of a combined approach of primary and secondary research. Initially, secondary research was used to get an understanding of the market and list the companies that are present in it. The secondary research consists of third-party sources such as press releases, annual reports of companies, and government-generated reports and databases. After gathering the data from secondary sources, primary research was conducted by conducting telephone interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. After this, the research team made primary calls to consumers by equally segmenting them in regional aspects, tier aspects, age group, and gender. Once the research team attained the primary data, they verified the details obtained from secondary sources.Intended Audience

This report can be useful to industry consultants, manufacturers, suppliers, associations, and organizations related to the Fitness industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing and presentations, it will also increase competitive knowledge about the industry.Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Fitbit LLC

- ClassPass Inc.

- Barry's

- Technogym SpA

- Peloton Interactive, Inc

- Johnson Health Tech. Co., Ltd.

- Apple Inc.

- iFIT Health & Fitness Inc.

- Brunswick Corporation

- BowFlex, Inc

- Decathlon

- The Beachbody Company

- Equinox Holdings, Inc

- Planet Fitness

- PureGym Limited

- Snap Fitness

- Hammer Sport AG

- Garmin Ltd

- Crunch Holdings LLC

- Viva Leisure Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 155 |

| Published | June 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 87.12 Billion |

| Forecasted Market Value ( USD | $ 150 Billion |

| Compound Annual Growth Rate | 9.9% |

| Regions Covered | Global |