This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

The modern event management industry began to take shape in the early 20th century, driven initially by entertainment and sports events. The post-World War II era witnessed a surge in corporate events, spurred by economic growth and the need for businesses to connect with stakeholders in meaningful ways. Today, the industry encompasses a vast ecosystem of professionals and businesses. Event planners, coordinators, venue managers, caterers, decorators, audiovisual technicians, and marketing specialists all collaborate to create seamless experiences. Beyond these, technology firms offering event management software and virtual event platforms have revolutionized how events are planned, executed, and measured.

These events range from small-scale private parties to large-scale public festivals, corporate meetings, conferences, weddings, and more. Event management is a comprehensive process that involves several stages, including conceptualization, planning, coordination, execution, and evaluation. It requires a blend of creativity, organizational skills, and technical knowledge to successfully manage and deliver an event. The industry is broadly segmented into corporate events, social events, and leisure events.

Corporate events include meetings, conferences, product launches, and trade shows. Social events primarily consist of weddings, anniversaries, and birthday parties. Leisure events encompass concerts, festivals, and sporting events. The event management industry comprises various key players, including event planners, event managers, venue managers, caterers, decorators, audio-visual technicians, and security personnel. Each of these professionals plays a crucial role in ensuring the smooth execution of an event.

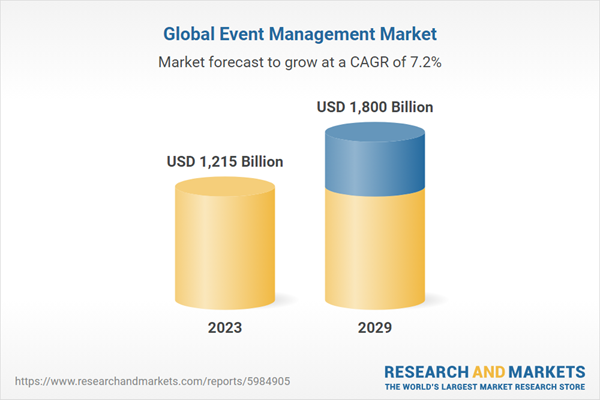

According to the report, the market is anticipated to cross USD 1.80 trillion by 2029, increasing from USD 1.21 trillion in 2023. The market is expected to grow with 7.17% CAGR by 2024-29. With the advent of technology and the impact of the COVID-19 pandemic, virtual and hybrid events have become increasingly popular. These events allow attendees to participate from any location, increasing accessibility and reach. There is a growing emphasis on making events more sustainable. This includes reducing waste, using eco-friendly materials, and opting for venues that prioritize energy efficiency. Personalized experiences are in high demand.

Event planners are using data and technology to create tailored experiences for attendees, enhancing engagement and satisfaction. Artificial Intelligence (AI) and Virtual Reality (VR) are being used to create immersive experiences, improve event planning, and enhance attendee interaction. Social media has significantly influenced the event industry. Events are now used as opportunities for creating shareable content, increasing brand visibility, and reaching wider audiences. This trend has led to an increase in the number of events being organized. The growth of the tourism and hospitality industry has positively impacted the event management market.

More people are traveling for leisure and business, leading to an increase in events such as cultural festivals, concerts, and corporate meetings. The advent of technology has opened up new avenues in the event management industry. Virtual and hybrid events, use of AI and VR, and personalization through data analytics have made events more engaging and accessible, driving market growth. With rising disposable incomes, people are spending more on social events such as weddings, anniversaries, and birthday parties. This trend has led to an increase in demand for event management services. Businesses are increasingly focusing on experiential marketing to engage customers and build brand loyalty.

This involves creating unique and memorable experiences, often through events, leading to a surge in demand for event management services. After a period of decline due to the pandemic, the event management industry is now recovering as restrictions ease and events resume. There is pent-up demand for events, contributing to market growth. Event planners are responsible for conceptualizing the event, while event managers oversee the entire event execution. Venue managers ensure that the chosen location is prepared and equipped for the event. Caterers handle the food and beverage aspect, while decorators transform the venue to match the event's theme. Audio-visual technicians manage the sound and visual elements, and security personnel ensure the safety of all attendees.

Market Drivers

- Technological Advancements: Technology continues to revolutionize the event management industry. Innovations such as virtual reality (VR), augmented reality (AR), live streaming capabilities, and advanced event management software have enhanced the attendee experience and operational efficiency. These technologies enable event organizers to create immersive environments, extend reach through virtual participation, and gather real-time data for analytics-driven decision-making.

- Shift towards Experiential Marketing: In today's experience-driven economy, businesses increasingly recognize the value of events as powerful tools for brand engagement and customer loyalty. Events offer unique opportunities to create memorable, personalized experiences that foster deeper connections between brands and their audiences. As such, experiential marketing through events has become a key driver, driving companies to invest in impactful, immersive event experiences that resonate with attendees.

Market Challenges

- Risk Management and Security: Ensuring the safety and security of attendees, staff, and stakeholders is a critical challenge facing the event management industry. Events are vulnerable to various risks, including natural disasters, security breaches, health emergencies (like pandemics), and logistical disruptions. Event planners must implement robust risk management strategies, contingency plans, and crisis response protocols to mitigate these risks effectively.

- Sustainability Concerns: With increasing global awareness of environmental issues, sustainability has emerged as a significant challenge for event organizers. Events often generate substantial waste, consume resources, and leave carbon footprints. Addressing sustainability concerns involves adopting eco-friendly practices such as waste reduction, energy efficiency, ethical sourcing, and promoting sustainable transportation options. Meeting these challenges requires collaboration with suppliers, venues, and participants to achieve meaningful progress towards sustainability goals.

Market Trends

- Hybrid Events: The rise of hybrid events represents a notable trend in the industry, accelerated by the COVID-19 pandemic. Hybrid events combine in-person elements with virtual components, allowing organizers to reach broader audiences, enhance accessibility, and provide flexible attendance options. This trend is expected to continue as organizations embrace hybrid models to maximize event impact and engagement.

- Personalization and Data-driven Insights: Attendee expectations for personalized event experiences are driving the adoption of data analytics and AI-driven technologies. Event organizers leverage attendee data to tailor content, sessions, networking opportunities, and marketing efforts based on individual preferences and behaviors. Personalized experiences not only enhance attendee satisfaction but also contribute to higher engagement and return on investment (ROI) for event stakeholders.

- Popularity of Sports & Entertainment Events: The surge in large-scale sports and entertainment events underpins the rising popularity of sports & entertainment events. These events, from sports tournaments like the FIFA World Cup and the Olympics to music concerts featuring global superstars, substantially impact the event management industry. The increasing prominence of sports and entertainment events drives the demand for professional event management services. Moreover, the popularity of entertainment events has increased in the event management market due to increasing demand for immersive and memorable experiences. In today's fast-paced digital age, people seek opportunities to disconnect from their daily routines and engage in real-life, shared experiences. Entertainment events provide a unique platform for individuals to come together and enjoy live performances, shows, and interactive experiences, allowing them to create lasting memories.

Corporate events and seminars lead the event management industry market due to their strategic importance in fostering business relationships, knowledge sharing, and brand positioning.

Corporate events and seminars hold a prominent position within the event management industry primarily because they serve as critical platforms for businesses to achieve strategic objectives. Unlike social or entertainment-focused events, corporate events and seminars are designed with specific goals in mind, such as enhancing brand visibility, launching new products or services, facilitating networking opportunities, and sharing industry knowledge. These events play a pivotal role in fostering meaningful connections between stakeholders, including clients, partners, investors, and employees.They provide a structured environment where professionals can engage in discussions, exchange insights, and build relationships that are crucial for business growth and development. Additionally, corporate events offer a unique opportunity for companies to showcase their expertise, innovation, and corporate culture, thereby strengthening their market position and competitive advantage. From large-scale conferences to intimate seminars and workshops, corporate events cater to diverse needs and objectives across industries. They are meticulously planned and executed by event professionals who understand the intricacies of corporate environments and the importance of aligning event outcomes with business goals. Moreover, advancements in technology have further enhanced the effectiveness of corporate events, enabling virtual participation, real-time interaction, and data-driven insights that contribute to measurable outcomes and ROI.

Sponsorship is leading in the event management industry market due to its ability to provide financial support, enhances brand visibility, and reaches target audiences effectively.

Sponsorship has emerged as a dominant force in the event management industry market primarily because it offers a mutually beneficial relationship between event organizers and sponsors. For event organizers, sponsorship provides crucial financial support necessary for planning and executing successful events. This financial backing allows organizers to enhance event production quality, secure premium venues, hire top-tier speakers or performers, and implement innovative technologies that elevate attendee experience. On the other hand, sponsors view events as powerful platforms to enhance brand visibility, engage with target audiences, and achieve marketing objectives.By associating their brand with well-executed events, sponsors can leverage the event's credibility, audience trust, and reach to strengthen brand positioning and increase brand awareness. Depending on the event's scale and audience demographics, sponsors can target specific market segments, generate leads, and cultivate customer relationships in a targeted and cost-effective manner. Moreover, sponsorship goes beyond financial support by fostering strategic partnerships that extend beyond the event itself. Sponsors often collaborate with event organizers on marketing campaigns, promotional activities, and content creation efforts that amplify their brand message before, during, and after the event.

This integrated approach maximizes exposure and engagement, driving tangible results such as increased sales, brand loyalty, and return on investment (ROI) for sponsors. In today's competitive business landscape, where traditional advertising channels face challenges in capturing consumer attention, sponsorship offers a more personalized and experiential marketing approach. It allows brands to connect with audiences in meaningful ways, align with shared values or interests, and create memorable experiences that leave a lasting impression.

Corporate organizers are leading in the event management industry market due to their deep understanding of corporate needs, ability to align events with strategic business goals, and expertise in delivering high-impact, professional experiences.

Corporate organizers have established themselves as leaders in the event management industry market because of their specialized focus on planning and executing events tailored to meet the specific needs and objectives of businesses. Unlike general event planners who cater to a wide range of events, corporate organizers possess a nuanced understanding of corporate environments, industry dynamics, and the strategic imperatives that drive business success. These organizers excel in aligning events with the strategic goals of their corporate clients, whether it involves launching new products, fostering client relationships, training employees, or positioning the brand as an industry leader.They leverage their expertise to design and execute events that not only meet but exceed client expectations, ensuring every aspect of the event - from logistics and venue selection to content development and attendee engagement is meticulously planned and flawlessly executed. Moreover, corporate organizers bring a level of professionalism and attention to detail that is essential for corporate events. They understand the importance of maintaining brand integrity, adhering to corporate guidelines, and delivering seamless experiences that reflect positively on the organization.

This expertise extends to managing complex schedules, handling VIP guests, integrating advanced technology solutions, and mitigating potential risks, ensuring that events run smoothly and achieve their intended outcomes. Furthermore, corporate organizers often have extensive networks and partnerships within the corporate sector, enabling them to access top-notch suppliers, venues, speakers, and entertainment options that elevate the quality and prestige of the events they manage. This network advantage, combined with their strategic acumen and operational excellence, positions corporate organizers as trusted partners capable of driving measurable results and ROI for their clients.

The 21-40 age group is leading in the event management industry market due to their tech-savvy nature, diverse interests, and strong preference for experiential activities that foster social connections and personal growth.

The 21-40 age group has emerged as a driving force in the event management industry market primarily because of their unique characteristics and preferences that align closely with the evolving trends in event experiences. This demographic cohort, often referred to as Millennials and Generation Z, is known for their digital fluency, comfort with technology, and desire for immersive, interactive experiences. They actively seek out events that go beyond traditional formats, offering opportunities for hands-on engagement, learning, and social interaction.One of the key factors driving this demographic's dominance in the event management industry is their strong affinity for experiential activities that contribute to personal development, networking, and community building. Events catering to this age group often incorporate elements of education, entertainment, and social impact, creating holistic experiences that resonate on both personal and professional levels. Moreover, this demographic cohort places a high premium on authenticity, sustainability, and social responsibility when choosing which events to attend. They are more likely to support events and brands that demonstrate a commitment to environmental conservation, ethical practices, and inclusivity.

Event organizers targeting this age group must therefore prioritize transparency, diversity, and sustainability in their event planning and execution strategies to appeal to their values and preferences. Furthermore, the 21-40 age group's influence extends beyond mere attendance; they are also active participants and promoters of events through social media, online communities, and word-of-mouth referrals. Their digital connectivity and social media engagement amplify the reach and impact of events, making them invaluable stakeholders in driving event success and increasing audience engagement.

Europe is leading in the event management industry market due to its rich cultural heritage, diverse and vibrant event offerings, strategic geographical location, and robust infrastructure supporting tourism and business.

Europe has established itself as a global leader in the event management industry market for several compelling reasons. One of the primary factors contributing to Europe's dominance is its rich cultural heritage and historical significance, which provide a captivating backdrop for a wide range of events. From ancient castles and palaces to modern architectural marvels, Europe's cities offer unique venues that enhance the allure and prestige of events, attracting both domestic and international attendees. Furthermore, Europe boasts a diverse and vibrant spectrum of events spanning cultural festivals, music concerts, sports championships, fashion shows, corporate conferences, and trade fairs.This variety caters to diverse interests and demographics, drawing participants and spectators from around the world. The continent's cultural diversity and openness contribute to a dynamic event landscape that continuously evolves and innovates, setting trends and standards in event management globally. Strategically located between major global markets, Europe serves as a convenient and accessible hub for international travel and business. Its well-connected transportation infrastructure, including airports, high-speed rail networks, and efficient public transportation systems, facilitates seamless mobility for event attendees and participants.

This logistical advantage makes Europe an attractive destination for hosting large-scale international events and conferences, contributing to its leadership in the global event management industry. Moreover, Europe's commitment to sustainability, environmental stewardship, and innovation aligns with evolving global trends and consumer preferences. Many cities and event organizers prioritize sustainability practices, such as eco-friendly venues, waste reduction initiatives, and carbon-neutral event strategies, demonstrating leadership in responsible event management practices. In addition to its cultural appeal and logistical advantages, Europe benefits from a robust tourism industry and a well-established network of event management professionals, suppliers, and service providers. This ecosystem supports the seamless planning and execution of events, ensuring high standards of quality, efficiency, and attendee satisfaction.

- In April 2023, Cevent, Inc. announced a strategic partnership with Jifflenow, a B2B meeting platform. The partnership is aimed at streamlining bookings of in-person meetings at corporate events and tradeshows for customers of both companies.

- In April 2023, Eventbrite launched RECONVENE Accelerator in 2022, a mentorship and award program, to empower and motivate the next generation of event creators. In addition to the following development, the company introduced a panel of judges to select five winners, who are expected to receive a sum of USD 20 thousand, along with a personal mentorship program from Eventbrite.

- In March 2023, Whova announced that its event registration system is now available in 39 countries, with newly added 16 countries in the list. The following initiative is expected to help Whova in expanding its global reach and serve customers globally.

- In March 2022, Cevent, Inc. announced the acquisition of Blackstone in a transaction of USD 4.6 billion. Blackstone has expertise in the hospitality and event industry. Cevent, Inc. aimed to expand its business and launch innovative solutions to power the events and meetings ecosystem.

- In October 2022, Events.com, a global provider of frictionless, user-friendly event planning and sponsorship management software, acquired HelpGetSponsors.com (HGS), an event sponsorship technology company. The acquisition allows Events.com to provide its current and future customers with the tools and skills to find, sell, and manage sponsors, in-kind partners, vendors, and expo sales.

Years considered in this report:

- Historic year: 2018

- Base year: 2023

- Estimated year: 2024

- Forecast year: 2029

Aspects covered in the report:

- Event Services market outlook with its value and forecast, along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Type:

- Corporate Event and seminars

- Festival

- Sports

- Music Concert

- Exhibitions

- Others

By Revenue Source:

- Sponsorship

- Ticket Sale

- Others

By Organizer:

- Corporate

- Sports

- Education

- Entertainment

- Others

By Age Group:

- below 20 years

- 21-40 years

- above 40 years

The approach of the report:

This report consists of a combined approach of primary and secondary research. Initially, secondary research was used to get an understanding of the market and list the companies that are present in it. The secondary research consists of third-party sources such as press releases, annual reports of companies, and government-generated reports and databases. After gathering the data from secondary sources, primary research was conducted by conducting telephone interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. After this, the research team made primary calls to consumers by equally segmenting them in regional aspects, tier aspects, age group, and gender. Once the research team attained the primary data, they verified the details obtained from secondary sources.Intended Audience

This report can be useful to industry consultants, manufacturers, suppliers, associations, and organizations related to the Event Services industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing and presentations, it will also increase competitive knowledge about the industry.Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Fiera Milano SpA

- BCD Travel Services B.V.

- MCH Group AG

- GL events

- Informa plc

- Emerald Holding, Inc.

- Live Nation Entertainment, Inc

- Anschutz Entertainment Group, Inc.

- ATPI Limited

- Freeman

- Viad Corp

- CWT

- Reed Exhibitions Limited

- Maritz

- Carlson

- Vivid Seats Inc

- SeatGeek

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | June 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 1215 Billion |

| Forecasted Market Value ( USD | $ 1800 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |