This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

These technologies include air source heat pumps (ASHP), ground source heat pumps (GSHP), and water source heat pumps, each tailored to specific environmental conditions and user requirements. Rapidly rising greenhouse gas (GHG) emissions leading to adverse environmental impacts coupled with the introduction of new measures to support clean energy alternatives will augment the product deployment by 2032. In addition, high energy efficiency, low carbon footprint, availability of financial incentive schemes, and quiet operations are some of the key factors bolstering the industry landscape.

The growing need for energy efficient space & water heating technologies along with continuous research & development initiatives by public and private players will augment the market outlook. Moreover, introduction of favorable regulatory framework and the promptly increasing new & retrofitting construction activities with energy efficient alternatives will boost the industry landscape. The market for heat pumps has expanded significantly in recent years due to the growing focus on sustainable heating solutions and energy efficiency. Heat pumps are becoming increasingly well-liked as adaptable and environmentally responsible replacements for conventional heating systems.

Heat pumps draw heat from the air, earth, or water. The market is growing due to factors such as increasing public awareness of environmental issues, government subsidies encouraging the use of renewable energy, and developments in heat pump technology. With an emphasis on lowering carbon footprints, the market for heat pumps is expected to grow further because it is essential to shift to more sustainable and environmentally friendly heating options.

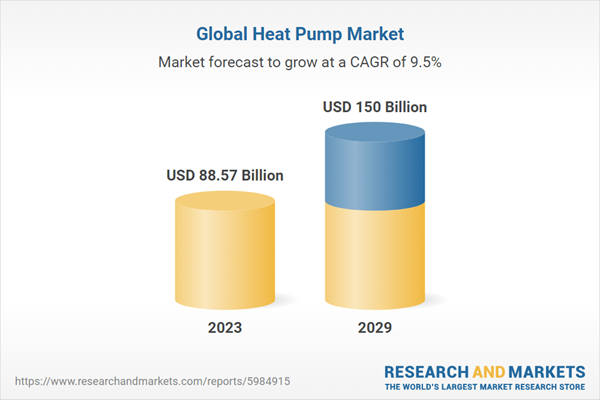

According to the report, the market is anticipated to cross USD 150 Billion by 2029, increasing from USD 88.57 Billion in 2023. The market is expected to grow with 9.50% CAGR by 2024-29. As governments worldwide implement stricter regulations and incentives aimed at reducing carbon emissions, the demand for energy-efficient heating and cooling solutions has surged. Heat pumps, with their ability to deliver up to four times the energy they consume, have emerged as a preferred choice for environmentally conscious consumers and businesses. Ongoing research and development efforts have led to significant advancements in heat pump technology.

Improvements in compressor efficiency, refrigerant choices, and system controls have enhanced overall performance, reliability, and durability of heat pump systems. The versatility of heat pumps has enabled their adoption across various sectors beyond traditional residential applications. They are increasingly utilized in commercial buildings, industrial processes, and even district heating and cooling systems, further expanding the market reach and application diversity. Heat pumps synergize effectively with renewable energy sources such as solar and wind power, aligning with global efforts to transition towards sustainable energy solutions.

This integration not only reduces dependency on fossil fuels but also contributes to energy independence and resilience. Implementation of building codes and standards that mandate minimum energy performance requirements for HVAC systems, including heat pumps, drives demand for higher-efficiency equipment. Smart home platforms provide detailed insights into energy usage patterns, allowing users to monitor and analyze the performance of their heat pump systems in real time. This visibility empowers users to identify opportunities for further energy savings and make informed decisions about their heating and cooling needs.

Market Drivers

- Technological Advancements and Innovation: Ongoing advancements in heat pump technology are driving significant improvements in efficiency, reliability, and performance. Innovations in compressor design, heat exchangers, and refrigerants have enhanced the overall effectiveness of heat pumps, making them more efficient and versatile. These technological improvements enable heat pumps to operate effectively in a wider range of climates and applications, from residential homes to large-scale commercial and industrial settings. By continuously pushing the boundaries of technology, the industry is not only improving energy efficiency but also contributing to the broader adoption of sustainable heating and cooling solutions worldwide.

- Resilience and Energy Independence: Heat pumps play a critical role in enhancing energy resilience and independence by reducing dependency on imported fossil fuels and integrating with renewable energy sources like solar and wind power. This shift towards locally available and sustainable energy resources promotes energy security and supports economic growth by keeping energy dollars within local communities. In regions vulnerable to energy supply disruptions or facing geopolitical uncertainties, heat pumps provide a reliable alternative that strengthens energy independence while reducing carbon footprints. As governments and businesses prioritize sustainable energy solutions, heat pumps emerge as a strategic investment towards achieving long-term energy goals.

Market Challenges

- Installation and Retrofitting Challenges: One of the primary challenges in the widespread adoption of heat pumps is the complexity associated with retrofitting existing buildings and infrastructure. Retrofit projects often face logistical hurdles such as space constraints, existing HVAC system configurations, and the need for adequate ventilation and heat distribution. Ensuring proper installation is crucial for maximizing the efficiency and performance of heat pump systems, requiring skilled labor and specialized knowledge. Addressing these challenges requires innovative solutions in design and installation practices, as well as collaborative efforts among stakeholders to streamline processes and overcome retrofitting barriers.

- Public Perception and Consumer Confidence: Despite their proven benefits, heat pumps continue to face challenges related to public perception and consumer confidence. Misconceptions about performance, reliability, and cost-effectiveness persist among consumers and businesses, influencing decision-making processes. Educating the public through demonstrations, case studies, and transparent communication about the benefits and successful implementations of heat pump technology is essential. Building consumer confidence and trust in heat pumps will play a pivotal role in accelerating market acceptance and driving widespread adoption of sustainable HVAC solutions.

Market Trends

- Decentralized and Community-Based Heating and Cooling Systems: A growing trend within the heat pump industry is the integration of decentralized and community-based heating and cooling systems. These systems leverage the collective energy demand of multiple buildings or neighborhoods to optimize efficiency and reduce overall energy consumption. By sharing resources and infrastructure, community-based systems enhance energy resilience, promote renewable energy integration, and offer cost-effective solutions for heating and cooling needs. This trend supports local energy initiatives, facilitates scalability, and adapts to diverse environmental conditions, positioning heat pumps as key components of future-proofed urban energy strategies.

- Circular Economy and Sustainable Practices: The heat pump industry is increasingly embracing principles of the circular economy and sustainable practices. Manufacturers are focusing on designing products for durability, recyclability of materials, and reducing environmental impact throughout the product lifecycle. By adopting eco-design principles and promoting closed-loop resource management, stakeholders aim to minimize waste, optimize resource use, and meet regulatory requirements. Emphasizing sustainability not only enhances market competitiveness but also aligns with global environmental goals and enhances the industry's contribution to a low-carbon economy. As stakeholders collaborate and innovate, the adoption of sustainable practices ensures the long-term viability and resilience of the heat pump industry in addressing current and future challenges.

Air-to-air heat pumps are leading in the heat pump market due to their versatility, cost-effectiveness, and relatively straightforward installation process compared to other types of heat pumps.

Air-to-air heat pumps have emerged as the predominant choice in the heat pump market primarily because of their versatility and cost-effectiveness. These systems extract heat from the ambient air outside the building and transfer it indoors for heating purposes. They also reverse this process to provide cooling during warmer months, making them suitable for both heating and air conditioning needs. One of the key advantages of air-to-air heat pumps is their relatively straightforward installation process compared to other types such as ground source heat pumps (GSHPs) or water source heat pumps. GSHPs, for example, require the installation of ground loops, which can be more complex and costly.In contrast, air-to-air heat pumps typically require less invasive installation procedures, which can lead to lower upfront costs and faster implementation times. This simplicity makes them more accessible to a broader range of consumers and businesses looking to adopt energy-efficient HVAC solutions. Additionally, air-to-air heat pumps are well-suited for a variety of climates, including moderate to cold climates where they can still operate efficiently. Technological advancements have improved their performance in colder temperatures, although their efficiency may decrease in extreme cold conditions.

Despite this limitation, the overall benefits of energy savings, reduced carbon emissions, and year-round comfort make air-to-air heat pumps a popular choice in residential, commercial, and institutional buildings. Moreover, the ongoing development of smart technologies and controls has further enhanced the appeal of air-to-air heat pumps by enabling remote monitoring, energy management, and optimization of HVAC operations. These features not only improve system efficiency but also enhance user convenience and control.

Up to 10 kW heat pumps are leading in the heat pump market due to their suitability for residential and light commercial applications, offering efficient heating and cooling solutions while catering to a wide range of building sizes and energy demands.

Up to 10 kW heat pumps have established themselves as a leading choice in the heat pump market primarily because of their versatility and effectiveness in meeting the heating and cooling needs of residential and light commercial buildings. These heat pumps typically have a heating capacity ranging from a few kilowatts up to around 10 kW, making them suitable for smaller spaces such as single-family homes, apartments, small offices, and retail establishments. One of the key advantages of up to 10 kW heat pumps is their efficiency in energy usage.They leverage advanced compressor technology, improved heat exchangers, and optimized system controls to deliver heating and cooling with high energy efficiency ratios (EER) and coefficient of performance (COP). This efficiency translates into lower energy bills for consumers and reduced environmental impact, aligning with global efforts towards sustainability. Another significant factor contributing to their popularity is the scalability and adaptability of up to 10 kW heat pumps. They are designed to provide reliable performance across a range of building sizes and climates, from moderate to colder regions.

In residential settings, these heat pumps offer year-round comfort, efficiently transferring heat from the outside air to inside during winter and vice versa during summer, thereby serving dual purposes of heating and cooling. Furthermore, the installation and maintenance of up to 10 kW heat pumps are generally straightforward compared to larger and more complex systems. This ease of installation, coupled with their compact size and quiet operation, enhances their appeal to homeowners, small businesses, and property developers seeking cost-effective and space-efficient HVAC solutions.

As technological advancements continue to improve the performance and capabilities of up to 10 kW heat pumps, including integration with smart home technologies for enhanced control and energy management, their market dominance is expected to persist. They remain a cornerstone of sustainable building practices and energy-efficient HVAC solutions, driving the transition towards greener and more efficient heating and cooling systems in residential and light commercial sectors globally.

Residential applications are leading in the heat pump market due to the widespread adoption of heat pumps in homes for efficient heating and cooling, driven by energy efficiency goals and increasing consumer awareness of environmental sustainability.

Residential applications have emerged as the dominant sector in the heat pump market primarily because of the growing recognition and adoption of heat pumps as efficient and sustainable HVAC solutions for homes. Heat pumps offer a versatile alternative to traditional heating and cooling systems by utilizing renewable energy sources such as the air, ground, or water to provide efficient heating in winter and cooling in summer. This dual functionality appeals to homeowners seeking year-round comfort while reducing energy consumption and carbon footprints. One of the key drivers behind the popularity of heat pumps in residential settings is their energy efficiency.Modern heat pump systems are designed to achieve high coefficients of performance (COP) and energy efficiency ratios (EER), meaning they can deliver more heating or cooling energy per unit of electricity consumed. This efficiency not only lowers utility bills but also contributes to reduced greenhouse gas emissions, aligning with environmental sustainability goals promoted by governments and environmental organizations worldwide. Moreover, residential heat pumps are increasingly supported by government incentives, rebates, and energy efficiency programs aimed at promoting renewable energy adoption and reducing reliance on fossil fuels.

These incentives make heat pumps more accessible and affordable for homeowners, encouraging widespread adoption across various geographical regions and climate zones. Another significant factor driving the market leadership of residential heat pumps is technological advancements. Innovations in compressor technology, heat exchangers, and smart controls have improved system performance, reliability, and user experience. These advancements have addressed historical challenges such as cold climate operation, noise levels, and system longevity, making heat pumps a viable and attractive option for residential heating and cooling. Furthermore, the scalability and flexibility of heat pump systems allow them to cater to diverse housing types and sizes, from single-family homes to multi-unit dwellings and apartments. Their compact size, quiet operation, and low maintenance requirements enhance their appeal to homeowners looking for efficient and hassle-free HVAC solutions.

The Asia-Pacific region is leading in the heat pump market due to rapid urbanization, increasing demand for energy-efficient HVAC solutions, supportive government policies, and technological advancements driving adoption across residential, commercial, and industrial sectors.

The Asia-Pacific region has emerged as a frontrunner in the global heat pump market primarily due to several key factors driving adoption and growth. Rapid urbanization and economic development in countries like China, Japan, South Korea, and India have fueled a surge in construction activities and infrastructure development, leading to a significant demand for energy-efficient heating and cooling solutions. Heat pumps, with their ability to provide both heating and cooling functions while reducing energy consumption and operating costs, have gained popularity as sustainable alternatives to traditional HVAC systems.Supportive government policies and initiatives promoting energy efficiency and renewable energy adoption have also played a pivotal role in fostering the market leadership of heat pumps in the Asia-Pacific region. Governments across various countries have introduced incentives, subsidies, and regulations to encourage the installation of heat pump systems in residential, commercial, and industrial buildings. These measures aim to mitigate climate change, reduce greenhouse gas emissions, and enhance energy security by promoting the use of renewable energy sources such as air, ground, and water. Technological advancements in heat pump technology have further accelerated market growth in the Asia-Pacific region.

Innovations in compressor technology, heat exchangers, and smart controls have improved the efficiency, reliability, and performance of heat pumps, making them suitable for a wide range of applications and environmental conditions. These advancements have addressed challenges such as cold climate operation and noise levels, making heat pumps more attractive and feasible for adoption in diverse climates across the region. Additionally, the Asia-Pacific region's diverse market landscape, encompassing densely populated urban centers, rapid industrialization, and varying climatic conditions, provides ample opportunities for heat pump manufacturers and suppliers to cater to diverse customer needs and preferences. The scalability and adaptability of heat pump systems make them suitable for residential homes, commercial buildings, and industrial facilities alike, contributing to their widespread adoption and market leadership in the region.

- In January 2023, Johnson Controls acquired Hybrid Energy AS. Hybrid Energy's innovative technology will provide customers with fresh, cost-effective solutions while tackling decarbonization and sustainability efforts in Europe and beyond.

- In November 2023, LG Electronics is setting up a research facility in Alaska, US, aimed at advancing its research and development in heating, ventilation, and air conditioning (HVAC). This initiative falls under the Consortium for Advanced Heat Pump Research (CAHR), a partnership between LG and local universities. The collaboration aims to bolster the competitiveness of LG's HVAC products by pioneering innovations in cold climate technology.

- In November 2023, Daikin Industries Ltd. launched new air-to-air heat pumps. The new products use difluoromethane (R32) as the refrigerant. The VRV 5 systems are available in two models - the Mini-VRV system with an output of up to 33.5 kW and the Top-Blow series reaching 56 kW. This new product launch will help the company to enhance its product portfolio in heat pump.

- In September 2023, Fujitsu General Australia and Fujitsu General New Zealand announced a new partnership with Sensibo to extend smart home air conditioning (AC) solutions to the Australian and New Zealand markets. Sensibo is a leading climate technology Internet of Things (IoT) company that develops smart AC and heat pump solutions.

- In March 2023, Mitsubishi Electric developed an air-source heat pump that uses propane (R290) as the refrigerant. It can produce between 5 kW and 8.5 kW of heat and domestic hot water to a temperature of up to 75 C.

Years considered in this report:

- Historic year: 2018

- Base year: 2023

- Estimated year: 2024

- Forecast year: 2029

Aspects covered in the report:

- Heat Pump market outlook with its value and forecast, along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Type:

- Air-to-Air Heat Pump

- Air-to-Water Heat Pump

- Water Source Heat Pump

- Ground Source Heat Pump

- Hybrid Heat Pump

By Capacity:

- Up to 10 kW

- 10-20 kW

- 20-30 kW

- Above 30 kW

By End User:

- Residential

- Commercial

- Industrial

The approach of the report:

This report consists of a combined approach of primary and secondary research. Initially, secondary research was used to get an understanding of the market and list the companies that are present in it. The secondary research consists of third-party sources such as press releases, annual reports of companies, and government-generated reports and databases. After gathering the data from secondary sources, primary research was conducted by conducting telephone interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. After this, the research team made primary calls to consumers by equally segmenting them in regional aspects, tier aspects, age group, and gender. Once the research team attained the primary data, they verified the details obtained from secondary sources.Intended Audience

This report can be useful to industry consultants, manufacturers, suppliers, associations, and organizations related to the Heat Pump industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing and presentations, it will also increase competitive knowledge about the industry.Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Denso Corporation

- Trane Technologies plc

- Mitsubishi Electric Corporation

- Midea Group

- Panasonic Holdings Corporation

- Daikin Industries, Ltd

- Fujitsu Limited

- Johnson Controls International plc

- Rheem Manufacturing Company

- Robert Bosch GmbH

- GlenDimplex

- Lennox International Inc.

- Emerson Electric Co.

- Stiebel Eltron GmbH & Co. KG

- Viessmann Group

- LG Corporation

- Carrier Global Corporation

- GEA Group AG

- Thermax Limited

- Danfoss A/S

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 184 |

| Published | June 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 88.57 Billion |

| Forecasted Market Value ( USD | $ 150 Billion |

| Compound Annual Growth Rate | 9.5% |

| Regions Covered | Global |