This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

In the 20th century, advancements in welding technologies, such as MIG and TIG welding, further enhanced the precision and strength of metal fabrications. The metal fabrication industry is a significant contributor to the global economy. It encompasses various processes that transform raw materials into finished goods, essential for infrastructure, transportation, consumer products, and more. This industry's economic influence extends to job creation, with millions employed worldwide in various roles, from skilled laborers to engineers and designers. Metal fabrication's versatility is evident in its widespread applications.

In construction, fabricated metal products are used in building frames, roofs, and facades. The automotive industry relies on metal fabrication for manufacturing car bodies, engine components, and structural parts. Additionally, the aerospace sector uses advanced fabrication techniques to produce lightweight yet durable components for aircraft. Metal fabrication is also critical in the production of everyday items such as kitchen appliances, furniture, and electronic devices.

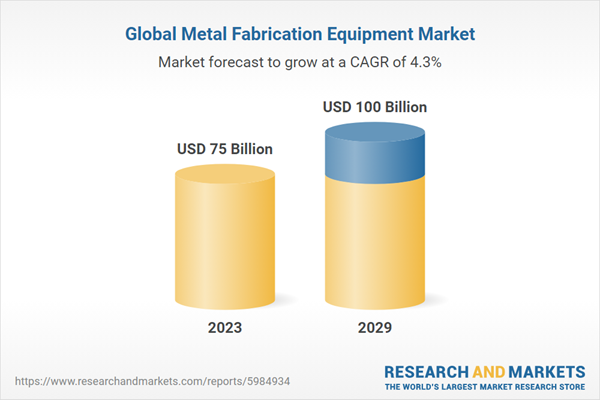

According to the report, the market is anticipated to cross USD 100 Billion by 2029, increasing from USD 75 Billion in 2023. The market is expected to grow with 4.30% CAGR by 2024-29. The adoption of automation and robotics is transforming the metal fabrication industry. Automated systems improve production speed, accuracy, and consistency while reducing labor costs and human error. Robotic welding, cutting, and assembly are becoming increasingly common, allowing for high-volume, high-precision manufacturing. Additive manufacturing, or 3D printing, is gaining traction in metal fabrication.

This technology builds objects layer by layer, enabling the creation of complex geometries that are difficult or impossible to achieve with traditional methods. Additive manufacturing offers advantages in prototyping, customization, and reducing material waste. Sustainability is a growing focus in metal fabrication. Efforts to reduce waste, energy consumption, and emissions are driving innovations in recycling, material selection, and process optimization.

Sustainable practices not only benefit the environment but also enhance the industry's reputation and competitiveness. The development of advanced materials, such as high-strength alloys and composites, is expanding the capabilities of metal fabrication. These materials offer improved performance, such as increased strength-to-weight ratios and enhanced resistance to wear and corrosion. Incorporating advanced materials into fabrication processes enables the production of more durable and efficient products.

Market Drivers

- Technological Advancements: Technological advancements are a significant driver in the metal fabrication industry. The integration of advanced technologies such as automation, robotics, and CNC (Computer Numerical Control) machines has revolutionized production processes, enhancing efficiency, precision, and scalability. Automation reduces human error, increases production speed, and lowers labor costs, making it a vital component of modern metal fabrication.

- Growing Demand in Key Industries: The metal fabrication industry is propelled by the growing demand in key sectors such as construction, automotive, aerospace, and consumer electronics. Infrastructure development, urbanization, and increased industrial activities fuel the need for fabricated metal products. The automotive industry's shift towards electric vehicles (EVs) and lightweight materials also boosts the demand for specialized metal fabrication.

Market Challenges

- Supply Chain Disruptions: Supply chain disruptions pose a significant challenge to the metal fabrication industry. Factors such as geopolitical tensions, natural disasters, and pandemics can interrupt the supply of raw materials, causing delays and increasing costs. The industry's reliance on global supply chains makes it vulnerable to such disruptions, necessitating strategies for risk management and supply chain resilience.

- Skilled Labor Shortage: The shortage of skilled labor is another pressing challenge. The metal fabrication industry requires workers with specialized skills in welding, machining, and CNC operation. However, there is a growing gap between the demand for skilled workers and their availability. This shortage can lead to production delays, increased labor costs, and challenges in maintaining high-quality standards.

Market Trends

- Digital Transformation: Digital transformation is reshaping the metal fabrication industry. The adoption of Industry 4.0 technologies, including the Internet of Things (IoT), artificial intelligence (AI), and big data analytics, enables real-time monitoring, predictive maintenance, and smart manufacturing. These technologies enhance operational efficiency, reduce downtime, and improve decision-making processes.

- Sustainable Practices: Sustainability is becoming a central focus in the metal fabrication industry. Companies are increasingly adopting eco-friendly practices such as recycling, reducing energy consumption, and minimizing waste. The use of sustainable materials and green manufacturing processes is gaining traction, driven by regulatory requirements and consumer demand for environmentally responsible products. Sustainable practices not only help in reducing the environmental impact but also improve the industry's reputation and competitiveness.

Cutting is leading in the metal fabrication industry because it is the fundamental process that allows raw metal to be accurately shaped and prepared for subsequent fabrication steps.

Cutting is indispensable in metal fabrication due to its role as the initial and often most critical step in transforming raw metal sheets, bars, or pipes into usable components. Precision cutting ensures that materials are sized and shaped correctly from the outset, which is essential for maintaining accuracy throughout the entire fabrication process. Advanced cutting technologies such as laser cutting, plasma cutting, and water jet cutting have revolutionized the industry by offering unparalleled precision, speed, and versatility. These methods can handle a wide range of materials and thicknesses, enabling fabricators to produce complex and intricate designs with minimal waste.For instance, laser cutting can achieve tight tolerances and fine details, making it ideal for applications requiring high precision. Plasma cutting is highly efficient for thicker materials, while water jet cutting offers the advantage of no heat-affected zones, preserving the integrity of the material being cut. The ability to cut metal with such precision not only improves the efficiency of the fabrication process but also reduces the need for extensive rework and adjustments in later stages, thereby saving time and costs. Moreover, modern CNC (Computer Numerical Control) systems have further enhanced cutting capabilities by automating the process, reducing human error, and increasing repeatability.

This automation allows for the production of high volumes of parts with consistent quality, essential for industries like automotive, aerospace, and construction, where reliability and precision are paramount. Additionally, cutting is a versatile process that can be adapted to different project requirements, whether it’s creating large structural components for buildings or small, intricate parts for machinery. This versatility makes cutting the backbone of metal fabrication, as every subsequent step - whether it’s welding, forming, or assembling - depends on the initial precision and quality achieved during the cutting process. By ensuring that each piece of metal is correctly sized and shaped from the beginning, fabricators can maintain high standards throughout the entire manufacturing cycle.

Automotive applications are leading in the metal fabrication industry because the production of vehicles requires a vast array of precisely fabricated metal components that are essential for safety, performance, and aesthetic appeal.

The automotive industry is a major driver of the metal fabrication sector due to its demand for a wide variety of metal parts and assemblies, each requiring high precision and quality. From the chassis and body panels to the engine and suspension components, metal fabrication plays a crucial role in ensuring that these parts meet stringent safety standards, performance requirements, and design specifications. The need for lightweight yet durable materials has led to the adoption of advanced fabrication techniques, such as laser cutting, hydroforming, and robotic welding, which enable the production of complex geometries and high-strength structures essential for modern vehicles.Additionally, the automotive industry’s focus on innovation and efficiency drives continuous improvements in fabrication processes, contributing to the development of more fuel-efficient, environmentally friendly, and technologically advanced vehicles. The shift towards electric vehicles (EVs) further amplifies the importance of metal fabrication, as it involves creating new types of components like battery housings and lightweight frames to maximize energy efficiency.

The high volume production requirements of the automotive industry also necessitate automated and scalable fabrication solutions, fostering advancements in CNC machining, robotic automation, and additive manufacturing. These technologies not only enhance production speed and consistency but also allow for greater customization and flexibility in design. In summary, the critical need for precisely fabricated metal parts across various automotive applications underscores why this sector is a leading force in the metal fabrication industry, driving technological advancements and setting high standards for quality and efficiency.

Asia-Pacific is leading in the metal fabrication industry due to its combination of robust industrial infrastructure, cost-effective labor, and significant demand from rapidly growing manufacturing sectors.

The Asia-Pacific region has emerged as a powerhouse in the metal fabrication industry, driven by several key factors that collectively create an advantageous environment for fabrication activities. The region boasts a robust and expansive industrial infrastructure, including advanced manufacturing facilities and extensive supply chains, which support efficient and large-scale production processes. Countries such as China, Japan, South Korea, and India have heavily invested in industrial capabilities, enabling them to produce high-quality fabricated metal products at competitive prices.The cost-effective labor force in many Asia-Pacific countries significantly reduces production costs, making the region an attractive destination for both domestic and international manufacturing companies. This affordability does not come at the expense of skill, as many countries in the region have also focused on enhancing their workforce’s technical proficiency through education and training programs, ensuring that labor is not only inexpensive but also highly skilled. Additionally, the region's substantial demand from rapidly growing sectors such as automotive, electronics, construction, and infrastructure further fuels the metal fabrication industry.

The automotive industry, for instance, is a major consumer of fabricated metal parts, with countries like China being among the largest automobile producers in the world. Similarly, the booming construction industry, driven by urbanization and infrastructure development in emerging economies, generates significant demand for metal fabrication services. Furthermore, government policies and incentives in many Asia-Pacific countries support industrial growth and technological innovation.

These policies include tax incentives, subsidies, and investment in research and development, which foster an environment conducive to industrial advancement and competitiveness on a global scale. The region's strategic geographic location and well-established logistics networks facilitate the efficient movement of raw materials and finished goods, enhancing the overall efficiency of the metal fabrication industry. Ports, railways, and road networks in the Asia-Pacific region are among the most developed in the world, ensuring that supply chain operations are smooth and cost-effective.

- In March 2022, Vulcan Industries plc acquired Aptec Ltd., a sheet metal fabrication company specializing in metal forming, bending, and laser cutting.

- In February 2022, CGI Automated Manufacturing acquired Richlind Metal Fabricators, a provider of precision sheet metal fabrication and machining services.

- In September 2022, Victaulic Acquired Tennessee Metal Fabricating Corporation. The Tennessee Metal Fabricating Corporation brings decades of construction fabrication experience specializing in water, wastewater and infrastructure projects throughout North America.

- In September 2022, Attard Engineering unveiled a complete range of cnc machining, welding and metal fabrication services to design and manufacture different products in Australia.

- In August 2022, Desktop Metal Introduces All-New Digital Sheet Metal Forming Technology with Figur G15. The Figur G15 uses patent-pending Digital Sheet Forming (DSF) technology in which a software-driven ceramic tool head on a gantry shapes standard sheet metal into parts with up to 2,000 lbs of force.

Years considered in this report:

- Historic year: 2018

- Base year: 2023

- Estimated year: 2024

- Forecast year: 2029

Aspects covered in the report:

- Metal Fabrication Equipment market outlook with its value and forecast, along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Type:

- Cutting

- Welding

- Bending

- Machining

- Other Types

By Application:

- Automotive

- Job Shops

- Aerospace and Defence

- Mechanical Components

- Other Applications

The approach of the report:

This report consists of a combined approach of primary and secondary research. Initially, secondary research was used to get an understanding of the market and list the companies that are present in it. The secondary research consists of third-party sources such as press releases, annual reports of companies, and government-generated reports and databases. After gathering the data from secondary sources, primary research was conducted by conducting telephone interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. After this, the research team made primary calls to consumers by equally segmenting them in regional aspects, tier aspects, age group, and gender. Once the research team attained the primary data, they verified the details obtained from secondary sources.Intended Audience

This report can be useful to industry consultants, manufacturers, suppliers, associations, and organizations related to the Metal Fabrication Equipment industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing and presentations, it will also increase competitive knowledge about the industry.Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Trumpf SE + Co. KG

- DMG Mori Co., Ltd

- FANUC Corporation

- Amada Co. Ltd.

- IPG Photonics Corporation

- Okuma Corporation

- OMAX Corporation

- Atlas Copco Group

- ESAB Corporation

- Bystronic Laser AG

- Yamazaki Mazak Corporation

- Lincoln Electric Holdings, Inc.

- Haas Automation, Inc

- Prima Industrie S.p.A.

- Komatsu Ltd

- Flow International Corporation

- Shenyang Machine Tool Co., Ltd.

- Dürr AG

- HMT Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 156 |

| Published | June 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 75 Billion |

| Forecasted Market Value ( USD | $ 100 Billion |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Global |