This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

Polyolefin is a polymer made from olefin monomers, compounds containing carbon and hydrogen atoms. Polyethylene (PE) and polypropylene (PP) materials are widely used in various applications due to their excellent properties, including high strength, flexibility, chemical resistance, and low cost. PE and PP are used to produce a wide range of products, such as packaging materials, automotive parts, toys, and pipes. They are also used in the construction industry for insulation and roofing materials. Additionally, the versatility of these products has led to the development of specialty grades, such as high-performance product, which are used in more demanding applications. The COVID-19 pandemic had a notable impact on the market.

The global economic slowdown decreased the demand for this product across several industries, such as automotive, packaging, and construction. Furthermore, the disrupted supply chains and volatility of raw material prices also adversely affected the market. Nevertheless, as economies gradually reopen and the demand for sustainable and recyclable materials continues to grow, the market is expected to recover in the coming years. The growth of e-commerce and the rising consumer preference for packaged goods have fueled the demand for polyolefin-based packaging solutions.

Additionally, the lightweight nature of polyolefins helps reduce transportation costs and carbon emissions, making them a preferred choice for sustainable packaging. The demand for lightweight vehicles to enhance fuel efficiency and reduce emissions has led to the increased adoption of polyolefins in the automotive sector. Moreover, polyolefins offer advantages such as chemical resistance, durability, and design flexibility, making them suitable for various automotive applications.

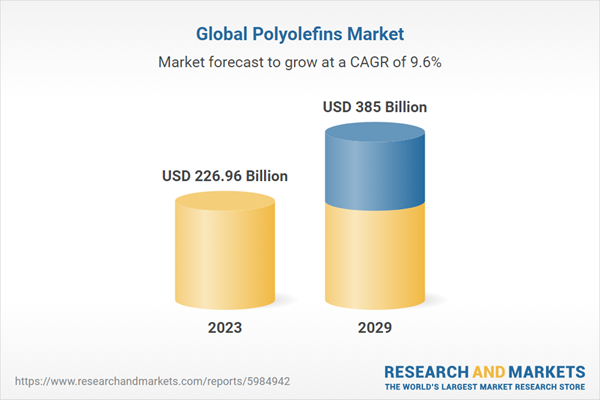

According to the report, the market is anticipated to cross USD 380 Billion by 2029, increasing from USD 226.96 Billion in 2023. The market is expected to grow with 9.61% CAGR by 2024-29. The global polyolefins market has experienced steady growth over the past few years, driven by increasing demand from end-user industries, particularly packaging and automotive. The rising population, urbanization, and changing consumer lifestyles have contributed to the growth in demand for polyolefin products. To meet the growing demand, major polyolefin producers have been investing in capacity expansions, particularly in regions with abundant feedstock availability and favorable regulatory environments.

These expansions are expected to further boost the global polyolefins market. The increasing focus on environmental sustainability has led to a growing demand for recycled and bio-based polyolefins. Industry players are investing in research and development to create more sustainable polyolefin products and processes. With growing environmental concerns, there is a significant push towards developing recyclable and biodegradable polyolefins. Companies are investing in advanced recycling technologies to reduce plastic waste. Innovations in catalyst technology and polymerization processes are leading to new grades of polyolefins with enhanced performance characteristics.

In addition to that, emphasis on the circular economy is driving initiatives to improve the recyclability of polyolefins and incorporate more recycled content into new products. The growing demand for polyolefins in emerging markets, particularly in Asia-Pacific, presents significant opportunities for industry players. These regions offer attractive investment prospects due to their favorable demographic trends, economic growth, and increasing consumption of polyolefin products. The development of innovative polyolefin products and processes can provide a competitive edge for industry players. This includes the creation of advanced materials with enhanced properties, as well as more sustainable and cost-effective production methods. The transition towards a circular economy presents opportunities for the industry to develop recycling and waste management solutions.

Market Drivers

- Growing Demand in Packaging and Consumer Goods: The packaging sector is the largest consumer of polyolefins, driven by the material's exceptional properties such as flexibility, strength, moisture resistance, and cost-effectiveness. In food packaging, polyolefins provide excellent barrier properties that preserve freshness and extend shelf life, essential for both retail and e-commerce applications. The surge in online shopping has further boosted demand for durable, lightweight packaging solutions that protect products during transit. Additionally, the versatility of polyolefins in producing a wide range of consumer goods, from household items to toys, underpins their growing market demand.

- Expansion in Emerging Markets: Rapid industrialization and urbanization in emerging markets, particularly in Asia-Pacific regions like China and India, are significant drivers for the polyolefins industry. These regions are witnessing increased manufacturing activities, infrastructural development, and a burgeoning middle class with rising disposable incomes, which collectively drive the demand for polyolefin-based products. The expansion of the automotive, construction, and healthcare sectors in these markets further contributes to the growing need for polyolefins, as these materials are integral to producing automotive parts, building materials, and medical devices.

Market Challenges

- Environmental Impact and Waste Management: One of the most pressing challenges for the polyolefins industry is the environmental impact associated with plastic waste. Polyolefins are non-biodegradable, contributing significantly to plastic pollution in landfills and oceans. Addressing this issue requires substantial advancements in recycling technologies and the development of biodegradable alternatives. The industry faces increasing pressure from governments, environmental organizations, and consumers to adopt sustainable practices, reduce plastic waste, and improve the recyclability of polyolefin products.

- Raw Material Price Volatility: The polyolefins industry is heavily dependent on petrochemical raw materials such as ethylene and propylene, which are derived from crude oil and natural gas. Fluctuations in the prices of these raw materials due to geopolitical tensions, supply chain disruptions, and market dynamics can significantly impact production costs and profitability. Managing this volatility requires strategic sourcing, cost management, and investment in alternative feedstocks, such as bio-based materials, to ensure a stable and sustainable supply chain.

Market Trends

- Sustainability and Circular Economy Initiatives: The industry is increasingly focused on sustainability, driven by regulatory pressures and growing environmental awareness. Companies are investing in advanced recycling technologies, such as chemical recycling, to convert waste polyolefins back into virgin-quality polymers. There is also a push towards incorporating more recycled content into new products and developing biodegradable polyolefins. These initiatives aim to create a circular economy where materials are reused and recycled, reducing the environmental footprint of polyolefin products.

- Technological Advancements and Innovation: Technological advancements are transforming the polyolefins industry, particularly in catalyst technology and polymerization processes. Innovations in metallocene catalyst polymerization, for instance, allow for precise control over polymer architecture, resulting in polyolefins with enhanced performance characteristics tailored for specific applications. Digitalization and Industry 4.0 technologies are also being leveraged to optimize production processes, improve efficiency, and reduce environmental impact. These advancements enable the development of new polyolefin grades that meet the evolving needs of various industries, from automotive to healthcare.

Polyethylene leads the polyolefins market due to its unparalleled versatility and broad applicability across various industries.

Polyethylene's dominance in the polyolefins market is driven by its wide range of grades and properties, which make it suitable for numerous applications. Low-Density Polyethylene (LDPE) offers excellent flexibility and transparency, making it ideal for film wraps, plastic bags, and flexible packaging. High-Density Polyethylene (HDPE), on the other hand, is known for its strength and rigidity, which are essential for products like bottles, containers, and pipes. Linear Low-Density Polyethylene (LLDPE) combines the properties of both LDPE and HDPE, providing the perfect balance of strength and flexibility for applications such as stretch films and industrial packaging.Additionally, polyethylene's chemical resistance, ease of processing, and cost-effectiveness further enhance its appeal. The material's ability to be produced in large volumes at relatively low costs allows it to meet the high demand from sectors like packaging, construction, automotive, and consumer goods. Innovations in polymerization processes and catalyst technologies have also enabled the production of polyethylene with tailored properties, expanding its application potential even further. Consequently, polyethylene's versatility, combined with its economic and performance advantages, cements its leadership position in the polyolefins market.

HDPE is leading the polyolefins market due to its exceptional strength-to-density ratio, making it highly suitable for a wide range of demanding applications.

High-Density Polyethylene (HDPE) stands out in the polyolefins market primarily because of its superior strength-to-density ratio, which offers a unique combination of durability, rigidity, and lightweight properties. This makes HDPE the material of choice for applications requiring high mechanical strength and resistance to impact, such as in the production of containers, pipes, and geomembranes. Its excellent chemical resistance further broadens its application scope, allowing it to be used in environments where other plastics might degrade, such as in chemical storage tanks and industrial piping systems.Additionally, HDPE's high tensile strength and ability to withstand extreme temperatures make it indispensable in the construction industry for products like corrosion-resistant piping, plastic lumber, and durable tarpaulins. The material's processability and recyclability also contribute to its popularity, enabling manufacturers to efficiently produce high-quality products at scale while addressing sustainability concerns. Innovations in catalyst technology have further improved HDPE's performance characteristics, leading to the development of specialized grades for specific applications, such as higher resistance to stress cracking and enhanced toughness. These attributes collectively make HDPE a versatile and reliable material, driving its leadership in the polyolefins market and ensuring its continued dominance in various industrial and consumer applications.

Film and sheet applications are leading in the polyolefins market due to their extensive use in packaging, which demands materials that combine flexibility, strength, and cost-efficiency.

Film and sheet applications dominate the polyolefins market because these materials are indispensable in the packaging industry, which is the largest consumer of polyolefins. Polyolefin films, primarily made from polyethylene (PE) and polypropylene (PP), are used extensively in both flexible and rigid packaging solutions due to their excellent mechanical properties and economic advantages. Flexible packaging, such as plastic bags, shrink wraps, and stretch films, relies on polyolefins for their flexibility, tear resistance, and barrier properties that protect products from moisture, air, and contaminants.These characteristics are crucial for preserving the quality and extending the shelf life of food and beverages, pharmaceuticals, and other perishable goods. Additionally, the cost-efficiency of producing polyolefin films and sheets allows manufacturers to meet high-volume demands without significantly raising costs, making them ideal for large-scale packaging operations. The versatility of polyolefin films, which can be tailored for specific applications through adjustments in polymer blends and additives, further enhances their appeal.

For instance, multi-layer films can provide enhanced strength and barrier properties, while anti-static or UV-resistant films serve niche markets. The recyclability of polyolefin films and sheets also supports the growing trend towards sustainable packaging solutions, addressing consumer and regulatory demands for environmentally friendly products. This combination of functionality, adaptability, and economic benefits ensures that film and sheet applications remain at the forefront of the polyolefins market, driving its growth and innovation.

Packaging is leading in the polyolefins market due to the material's ideal properties for protecting and preserving products, combined with its cost-effectiveness and versatility.

The dominance of packaging in the polyolefins market is primarily driven by the material's optimal balance of properties that make it essential for protecting and preserving a wide array of products. Polyolefins, especially polyethylene (PE) and polypropylene (PP), offer excellent barrier properties against moisture, air, and contaminants, which are critical for maintaining the integrity and extending the shelf life of food, beverages, pharmaceuticals, and other perishable items. This makes them indispensable in the food and beverage industry, where maintaining product freshness and safety is paramount.Furthermore, polyolefins are highly flexible and can be easily molded into various forms, including films, sheets, and rigid containers, catering to diverse packaging needs from flexible wraps and bags to sturdy bottles and jars. The cost-efficiency of polyolefin production allows manufacturers to produce high volumes at relatively low costs, making them a preferred choice for large-scale packaging operations. Additionally, the lightweight nature of polyolefins reduces transportation costs and energy consumption, further enhancing their appeal.

Innovations in polymer technology have led to the development of advanced polyolefin materials with enhanced properties such as improved clarity, puncture resistance, and environmental stress crack resistance, enabling them to meet specific packaging requirements and adapt to evolving market demands. Moreover, the recyclability of polyolefins aligns with the growing emphasis on sustainable packaging solutions, addressing environmental concerns and regulatory pressures. This combination of functional advantages, economic benefits, and environmental considerations ensures that packaging remains the leading application in the polyolefins market, driving continuous growth and innovation in the sector.

Asia-Pacific is leading in the polyolefins market due to its rapid industrialization, urbanization, and the significant expansion of manufacturing and consumer markets.

The Asia-Pacific region's leadership in the polyolefins market can be attributed to its dynamic economic growth, marked by rapid industrialization and urbanization. Countries like China, India, and Southeast Asian nations are experiencing substantial increases in manufacturing activities, driven by rising domestic and international demand for consumer goods, automotive parts, and construction materials. The region's burgeoning middle class, characterized by higher disposable incomes and changing consumption patterns, fuels the demand for packaged products, electronics, and automobiles, all of which rely heavily on polyolefins for their production.The packaging industry, in particular, is booming due to increased demand for food safety and convenience products, which require durable, flexible, and cost-effective packaging solutions provided by polyolefins. Additionally, the construction sector's expansion, driven by urbanization and infrastructure development projects, has led to heightened demand for polyolefins in applications such as pipes, insulation, and protective films. Furthermore, the availability of cost-competitive raw materials and labor, coupled with favorable government policies supporting industrial growth, attracts significant investments in polyolefin production capacities in the region.

Major global and regional chemical companies are establishing and expanding production facilities in Asia-Pacific to capitalize on the growing market and to meet local and export demands. This strategic positioning not only enhances supply chain efficiencies but also fosters innovation and technological advancements in polyolefin production. Consequently, the convergence of economic growth, industrial expansion, and strategic investments positions Asia-Pacific at the forefront of the global polyolefins market, driving its continued leadership and growth.

- In January 2024, PetroChina Lanhai Advanced Material announced its plans to construct a polyolefin plant in Nantong, Jiangsu province to expand its production capabilities and meet rising product demands. The facility will produce 200,000 tons of polyethylene (PE) per year, 100,000 tons of alpha-olefins per year, 100,000 tons of polyolefin elastomer (POE) per year, and 50,000 tons of ethylene-propylene-diene monomer (EPDM) per year. The investment for this project is approximately USD 1.6 billion, indicating the scale and strategic importance of the venture.

- In June 2023, LyondellBasell announced the opening of a new polyolefins plant in Saudi Arabia. This plant will produce high-density polyethylene (HDPE) and polypropylene (PP) resins for the Middle East and North Africa region.

- In May 2023, ExxonMobil announced the expansion of its polyolefins production capacity in the United States. This expansion will increase ExxonMobil's production of HDPE and PP resins by 1.5 million tons per year.

- In April 2023, Sinopec announced the construction of a new polyolefins plant in China. This plant will produce HDPE and PP resins for the domestic market.

- In March 2023, SABIC announced the acquisition of Reliance Industries' polyolefins business in India. This acquisition will give SABIC a major foothold in the Indian polyolefins market.

Years considered in this report:

- Historic year: 2018

- Base year: 2023

- Estimated year: 2024

- Forecast year: 2029

Aspects covered in the report:

- Polyolefins market outlook with its value and forecast, along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Type:

- Polyethylene

- Polypropylene

- Others

By Application:

- Film & Sheet

- Injection moulding

- Blow moulding

- Fibres & Raffia

- Others

By End User:

- Packaging

- Automotive

- Construction

- Consumer Goods

- Healthcare

The approach of the report:

This report consists of a combined approach of primary and secondary research. Initially, secondary research was used to get an understanding of the market and list the companies that are present in it. The secondary research consists of third-party sources such as press releases, annual reports of companies, and government-generated reports and databases. After gathering the data from secondary sources, primary research was conducted by conducting telephone interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. After this, the research team made primary calls to consumers by equally segmenting them in regional aspects, tier aspects, age group, and gender. Once the research team attained the primary data, they verified the details obtained from secondary sources.Intended Audience

This report can be useful to industry consultants, manufacturers, suppliers, associations, and organizations related to the Polyolefins industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing and presentations, it will also increase competitive knowledge about the industry.Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BASF SE

- ExxonMobil Corporation

- Chevron Corporation

- LyondellBasell Industries N.V.

- LG Chem Ltd.

- Braskem S.A

- Formosa Plastics Corporation

- Saudi Basic Industries Corporation

- Reliance Industries Limited

- Borealis AG

- Repsol S.A.

- INEOS Group Limited

- Hanwha Group

- Mitsubishi Chemical Corporation

- Clariant AG

- NOVA Chemicals Corporation

- Sasol Limited

- DL E&C Co., Ltd.

- Arkema S.A.

- Ducor Petrochemicals B.V.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 168 |

| Published | June 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 226.96 Billion |

| Forecasted Market Value ( USD | $ 385 Billion |

| Compound Annual Growth Rate | 9.6% |

| Regions Covered | Global |