PVC, or polyvinyl chloride, is a safe, non-toxic material made from a combination of vinyl and plastic. As compared to their alternatives, pipes made from PVC are light in weight which makes them easier to transport and install. These pipes are flexible, durable and long-lasting in nature as they exhibit optimal resistance against bending and extreme movement. Other than this, they also possess anti-fouling, anti-rust and anti-mist properties, and are highly resistant to fire and bacterial contamination. On account of these characteristics, these pipes find applications in construction, cold water systems, vent systems, and drainage systems.

The upcoming international events are currently driving the demand for PVC pipes in Qatar. The country will host the FIFA World Cup in 2022 and the World Aquatics Championships in 2023. To accommodate the tourist inflow attracted by these events, the government is focusing on the expansion of the hospitality sector. Apart from this, there has been a rise in the overall domestic production of PVC products in the country owing to the efforts for diversifying the nation’s economy under the Qatar National Vision 2030. Moreover, the rising consumption of desalinated water has created a substantial demand for large diameter plastic pipes such as UPVC/CPVC pipes. These pipes can bear high water pressure and offer resistance to rust and corrosion.

The latest report provides a deep insight into the Qatar PVC pipes market covering all its essential aspects. This ranges from macro overview of the market to micro details of the industry performance, recent trends, key market drivers and challenges, SWOT analysis, Porter’s five forces analysis, value chain analysis, etc. This report is a must-read for entrepreneurs, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into the Qatar PVC pipes market in any manner.

Key Market Segmentation:

The publisher provides an analysis of the key trends in each segment of the Qatar PVC pipes market report, along with forecasts for the period 2025-2033. Our report has categorized the market based on applicationBreakup by Application:

- Sewerage and Drainage

- Plumbing

- Water Supply

- HVAC

- Oil and Gas

- Irrigation

Competitive Landscape:

The market is moderately concentrated in nature with the presence of a few manufacturers who compete in terms of quality and prices. Some of the leading players operating in the market are:- Qatar National Plastic Factory

- Al Khayarin Plastic Factory

- Uniplast

- Hepworth

Key Questions Answered in This Report:

- How has the Qatar PVC pipes market performed so far and how will it perform in the coming years?

- What are the key application segments in the Qatar PVC pipes market?

- What has been the impact of COVID-19 on the Qatar PVC pipes market?

- What are the price trends of PVC pipes?

- What are the various stages in the value chain of the Qatar PVC pipes market?

- What are the key driving factors and challenges in the Qatar PVC pipes market?

- What is the structure of the Qatar PVC pipes market and who are the key players?

- What is the degree of competition in the Qatar PVC pipes market?

- How are PVC pipes manufactured?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 GCC PVC Pipes Market

5.1 Market Overview

5.2 Market Performance

5.2.1 Volume Trends

5.2.2 Value Trends

5.3 Price Trends

5.4 Market Breakup by Region

5.5 Market Breakup by Application

5.6 Market Forecast

6 Qatar PVC Pipes Market

6.1 Market Overview

6.2 Market Performance

6.2.1 Volume Trends

6.2.2 Value Trends

6.3 Impact of COVID-19

6.4 Market Breakup by Application

6.5 Market Forecast

7 Market Breakup by Application

7.1 Sewerage and Drainage

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Plumbing

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Water Supply

7.3.1 Market Trends

7.3.2 Market Forecast

7.4 HVAC

7.4.1 Market Trends

7.4.2 Market Forecast

7.5 Oil and Gas

7.5.1 Market Trends

7.5.2 Market Forecast

7.6 Irrigation

7.6.1 Market Trends

7.6.2 Market Forecast

8 SWOT Analysis

8.1 Overview

8.2 Strengths

8.3 Weaknesses

8.4 Opportunities

8.5 Threats

9 Value Chain Analysis

9.1 Overview

9.2 Research and Development

9.3 Raw Material Procurement

9.4 Manufacturing

9.5 Marketing

9.6 Distribution

9.7 End-Use

10 Porters Five Forces Analysis

10.1 Overview

10.2 Bargaining Power of Buyers

10.3 Bargaining Power of Suppliers

10.4 Degree of Competition

10.5 Threat of New Entrants

10.6 Threat of Substitutes

11 Price Analysis

11.1 Price Trends

11.2 Key Price Indicators

11.3 Price Forecast

11.4 Industry Best Practices

12 PVC Pipes Manufacturing Process

12.1 Product Overview

12.2 Detailed Process Flow

12.3 Various Types of Unit Operations Involved

12.4 Mass Balance and Raw Material Requirements

13 Requirements for Setting Up a PVC Pipes Manufacturing Plant

13.1 Land Location and Site Development

13.2 Construction Requirements

13.3 Machinery Requirements

13.4 Machinery Pictures

13.5 Raw Material Requirements

13.6 Raw Material and Final Product Pictures

13.7 Packaging Requirements

13.8 Transportation Requirements

13.9 Utilities Requirements

13.10 Manpower Requirements

14 Competitive Landscape

14.1 Market Structure

14.2 Key Players

15 Key Player Profiles

15.1 Qatar National Plastic Factory

15.2 Al Khayarin Plastic Factory

15.3 Uniplast

15.4 Hepworth

List of Figures

Figure 1: Qatar: PVC Pipes Market: Major Drivers and Challenges

Figure 2: GCC: PVC Pipes Market: Consumption Volume (in ‘000 Tons), 2019-2024

Figure 3: GCC: PVC Pipes Market: Consumption Value (in Million USD), 2019-2024

Figure 4: GCC: PVC Pipes Market: Price Trends (in USD/Ton), 2019-2024

Figure 5: GCC: PVC Pipes Market: Consumption Volume Breakup by Region (in %), 2024

Figure 6: GCC: PVC Pipes Market: Consumption Volume Breakup by Application (in %), 2024

Figure 7: GCC: PVC Pipes Market Forecast: Consumption Volume (in ‘000 Tons), 2025-2033

Figure 8: GCC: PVC Pipes Market Forecast: Consumption Value (in Million USD), 2025-2033

Figure 9: Qatar: PVC Pipes Market: Consumption Volume (in ‘000 Tons), 2019-2024

Figure 10: Qatar: PVC Pipes Market: Consumption Value (in Million USD), 2019-2024

Figure 11: Qatar: PVC Pipes Market: Price Trends (in USD/Ton), 2019-2024

Figure 12: Qatar: PVC Pipes Market Forecast: Price Trends (in USD/Ton), 2025-2033

Figure 13: Qatar: PVC Pipes Market: Consumption Volume Breakup by Application (in %), 2024

Figure 14: Qatar: PVC Pipes Market Forecast: Consumption Volume (in ‘000 Tons), 2025-2033

Figure 15: Qatar: PVC Pipes Market Forecast: Consumption Value (in Million USD), 2025-2033

Figure 16: Qatar: PVC Pipes Industry: SWOT Analysis

Figure 17: Qatar: PVC Pipes Industry: Value Chain Analysis

Figure 18: Qatar: PVC Pipes Industry: Porter’s Five Forces Analysis

Figure 19: PVC Pipes Manufacturing Plant: Detailed Process Flow

Figure 20: PVC Pipes Manufacturing Plant: Various Types of Unit Operations Involved

Figure 21: PVC Pipes Manufacturing Process: Conversion Rate of Feedstocks

Figure 22: Qatar: PVC Pipes (Sewerage and Drainage Applications) Market: Consumption Volume (in Tons), 2019 & 2024

Figure 23: Qatar: PVC Pipes (Sewerage and Drainage Applications) Market Forecast: Consumption Volume (in Tons), 2025-2033

Figure 24: Qatar: PVC Pipes (Plumbing Applications) Market: Consumption Volume (in Tons), 2019 & 2024

Figure 25: Qatar: PVC Pipes (Plumbing Applications) Market Forecast: Consumption Volume (in Tons), 2025-2033

Figure 26: Qatar: PVC Pipes (Water Supply Applications) Market: Consumption Volume (in Tons), 2019 & 2024

Figure 27: Qatar: PVC Pipes (Water Supply Applications) Market Forecast: Consumption Volume (in Tons), 2025-2033

Figure 28: Qatar: PVC Pipes (HVAC Applications) Market: Consumption Volume (in Tons), 2019 & 2024

Figure 29: Qatar: PVC Pipes (HVAC Applications) Market Forecast: Consumption Volume (in Tons), 2025-2033

Figure 30: Qatar: PVC Pipes (Oil and Gas Applications) Market: Consumption Volume (in Tons), 2019 & 2024

Figure 31: Qatar: PVC Pipes (Oil and Gas Applications) Market Forecast: Consumption Volume (in Tons), 2025-2033

Figure 32: Qatar: PVC Pipes (Irrigation Applications) Market: Consumption Volume (in Tons), 2019 & 2024

Figure 33: Qatar: PVC Pipes (Irrigation Applications) Market Forecast: Consumption Volume (in Tons), 2025-2033

List of Tables

Table 1: GCC: PVC Pipes Market: Key Industry Highlights, 2024 and 2033

Table 2: Qatar: PVC Pipes Market: Key Industry Highlights, 2024 and 2033

Table 3: Qatar: PVC Pipes Market Forecast: Consumption Breakup by Application (in Tons), 2025-2033

Table 4: PVC Pipes Manufacturing Plant: Raw Material Requirements (in Tons/Day)

Table 5: PVC Pipes Manufacturing Plant: Land and Site Requirements

Table 6: PVC Pipes Manufacturing Plant: Construction’s Requirements

Table 7: PVC Pipes Manufacturing Plant: Machinery and Infrastructure Requirements

Table 8: PVC Pipes Manufacturing Plant: Raw Materials Requirements (in Tons/Day)

Table 9: PVC Pipes Manufacturing Plant: Utilities Requirements

Table 10: PVC Pipes Manufacturing Plant: Manpower Requirements

Table 11: Qatar: PVC Pipes Market Structure

Companies Mentioned

- Qatar National Plastic Factory

- Al Khayarin Plastic Factory

- Uniplast

- Hepworth

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 117 |

| Published | August 2025 |

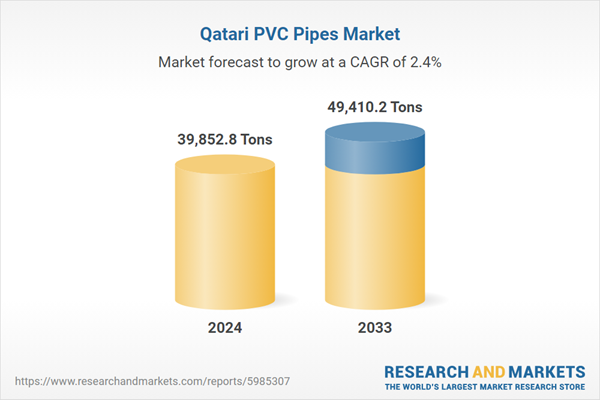

| Forecast Period | 2024 - 2033 |

| Estimated Market Value in 2024 | 39852.8 Tons |

| Forecasted Market Value by 2033 | 49410.2 Tons |

| Compound Annual Growth Rate | 2.4% |

| Regions Covered | Qatar |

| No. of Companies Mentioned | 4 |