Industrial laser systems are highly specialized tools used in various manufacturing and industrial processes that rely on the controlled application of laser light. These systems utilize the unique properties of laser beams, such as high intensity, precision, and focus, to perform a wide range of tasks in industries such as manufacturing, healthcare, aerospace, automotive, electronics offering precise and efficient solutions for cutting, welding, marking, drilling, additive manufacturing, cleaning, and various research and development purposes. These systems play a pivotal role in enhancing the quality, efficiency, and innovation of industrial processes across the globe.

The increasing utilization of lasers for personalized markings and engravings across a spectrum of industries, including automotive, medical, aerospace, defense, and packaging represents a primary driver propelling market expansion. Furthermore, the extensive adoption of fiber lasers for engraving and marking on semiconductors and electronics is exerting substantial impetus on market growth. Fiber lasers, renowned for their output power and optical excellence, present in both continuous and modulated wave modes, are instrumental in imprinting enduring alphanumeric particulars on products. These include brand identities, batch codes, manufacturer insignias, barcodes, logos, and dates. Additionally, the integration of laser systems into additive manufacturing serves as another influential driver. Industrial lasers assume a pivotal role in 3D printing, bolstering efficiency, personalization, while minimizing waste generation and errors in product fabrication.

Industrial Lasers Systems Market Trends/Drivers:

Increasing adoption of lasers for custom markings and engravings

Lasers have found widespread use in various industries, including automotive, medical, aerospace, defense, and packaging, for custom markings and engravings. These applications range from branding and labeling products to enhancing traceability and aesthetic appeal. Moreover, laser markings and engravings are permanent, resistant to wear and tear, and maintain high-quality appearances over time. This durability is especially valuable in sectors where products are subjected to harsh environments or frequent handling. Besides, these systems offer rapid and efficient marking and engraving processes. They can complete tasks quickly, making them ideal for high-throughput manufacturing environments. Moreover, in addition to functional benefits, lasers offer aesthetic advantages. They can create visually appealing and customizable designs, logos, and artwork on products. This customization capability is particularly appealing to industries seeking to differentiate their products and enhance their branding efforts.Escalating demand for automation and high-end processing

In industries like automotive, aerospace, and electronics manufacturing, precision and consistency are paramount. Industrial laser systems offer a level of precision that is challenging to achieve with manual processes. They can consistently create precise markings, cuts, welds, and engravings, ensuring that each product meets the required quality standards. Besides, industrial laser systems follow programmed instructions with pinpoint accuracy, minimizing defects and variations in the final products. This is crucial for industries where safety, reliability, and product quality are critical. Moreover, automated laser systems can operate at high speeds and work continuously, reducing production time significantly compared to manual methods. This accelerated production is essential for meeting tight deadlines and increasing output.Various technological advancements

The development of high-power fiber lasers has significantly improved the efficiency and cutting capabilities of industrial laser systems. These lasers provide a more concentrated and intense beam, enabling faster and cleaner cutting, welding, and marking processes. Besides, ultrafast lasers, such as femtosecond and picosecond lasers, offer incredibly short pulse durations. This precision is essential for micro-machining, surface structuring, and delicate material processing, particularly in industries like electronics and medical device manufacturing. Moreover, technological advancements have improved the control of laser beams through advanced optics and beam delivery systems. This allows for precise beam shaping and steering, critical for complex cutting, welding, and drilling tasks.Industrial Lasers Systems Industry Segmentation:

This report provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional and country levels from 2025-2033. The report categorizes the market based on type, application and end use industry.Breakup by Type:

- Fiber Laser

- Solid State Laser

- CO2 Laser

- Others

Fiber lasers represent the most used type

The report has provided a detailed breakup and analysis of the market based on the type. This includes fiber laser, solid state laser, CO2 laser, and others. According to the report, fiber lasers represented the largest segment.Fiber lasers produce high-quality laser beams characterized by excellent focusability and stability. This means they can maintain a consistent beam profile over long distances, ensuring precision in various industrial applications. Moreover, fiber lasers are highly efficient, converting a large percentage of electrical power into laser output. Their efficiency leads to energy savings, making them environmentally friendly and cost-effective for businesses. Besides, these lasers are highly efficient, converting a large percentage of electrical power into laser output. Their efficiency leads to energy savings, making them environmentally friendly and cost-effective for businesses.

Breakup by Application:

- Cutting

- Welding

- Marking

- Drilling

- Others

Cutting holds the largest market share

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes cutting, welding, marking, drilling, and others. According to the report, cutting represented the largest segment.Laser cutting systems offer unparalleled precision at a microscopic level. They can cut intricate patterns and shapes with utmost accuracy, making them ideal for industries where precision is critical, such as aerospace and medical device manufacturing. Besides, laser cutting is compatible with a wide variety of materials, including metals (e.g., steel, aluminum, titanium), plastics, wood, ceramics, and composites. This versatility is invaluable as it allows industries to work with diverse materials as per their requirements. Moreover, it can handle intricate and complex designs that may be challenging to achieve with traditional cutting methods. This flexibility is vital for industries where aesthetics and design intricacies matter, such as in jewelry and architectural applications.

Breakup by End Use Industry:

- Semiconductor and Electronics

- Automotive

- Aerospace and Defense

- Medical

- Others

Semiconductor and electronics sector accounts for majority of market share

A detailed breakup and analysis of the market based on the end use industry has also been provided in the report. This includes semiconductor and electronics, automotive, aerospace and defense, medical, and others. According to the report, semiconductor and electronics sector represented the largest segment.The semiconductor industry relies heavily on precision microfabrication processes to produce ICs. Laser systems are essential for tasks such as wafer dicing, scribing, and drilling tiny holes in silicon wafers, which are the building blocks of electronic devices. Besides, the ongoing trend towards miniaturization in electronics requires increasingly precise and fine-scale manufacturing processes. Laser systems excel in achieving the microscopic accuracy needed for cutting-edge electronic components. Moreover, printed circuit boards (PCBs) are fundamental to electronics manufacturing. Laser systems are used for cutting and drilling PCBs, creating intricate circuit patterns, and marking component placements with precision. This contributes to the quality and reliability of electronic devices.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest industrial lasers systems market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.Asia Pacific, particularly countries like China, Japan, South Korea, and Taiwan, boasts a robust and diverse manufacturing sector. This region has become a global hub for electronics, automotive, aerospace, and consumer goods manufacturing. The high demand for precision machining and marking in these industries drives the adoption of industrial laser systems. Besides, as industries in the Asia Pacific region increasingly embrace automation and Industry 4.0 technologies, there is a growing need for advanced tools like industrial laser systems. These systems play a pivotal role in automated manufacturing processes, offering precision, speed, and consistency, which are vital for maintaining competitiveness.

Competitive Landscape:

The competitive landscape of the market is characterized by the presence of multiple players that include established brands, emerging startups, and specialty manufacturers. Presently, leading companies are allocating significant resources to research and development to innovate and introduce advanced laser technologies. This includes improving laser efficiency, power, precision, and versatility. They are also expanding their product portfolios by introducing new laser systems with different power levels, wavelengths, and capabilities. This allows them to serve a broader range of industries and applications. Moreover, key companies are collaborating with technology partners, research institutions, and universities for co-developing cutting-edge laser technologies and staying at the forefront of innovation.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- ACSYS Lasertechnik US Inc.

- Amonics Ltd.

- Coherent Inc.

- Han's Laser Technology Industry Group Co. Ltd

- II-VI Incorporated

- IPG Photonics Corporation

- Jenoptik Laser GmbH

- Lumibird Group

- Newport Corporation (MKS Instruments Inc.)

- NKT Photonics A/S

- Toptica Photonics AG

- TRUMPF

Key Questions Answered in This Report

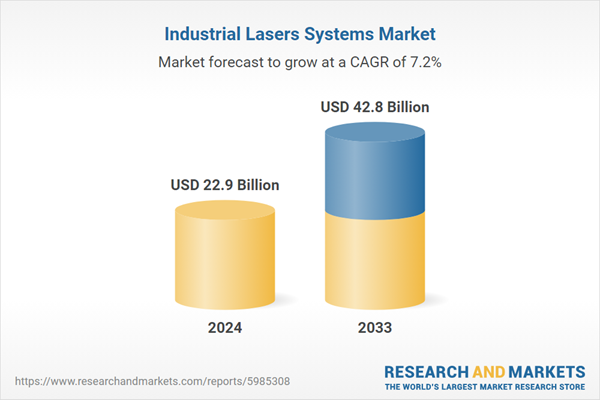

- 1.What was the size of the global industrial lasers systems market in 2024?

- 2.What is the expected growth rate of the global industrial lasers systems market during 2025-2033?

- 3.What are the key factors driving the global industrial lasers systems market?

- 4.What has been the impact of COVID-19 on the global industrial lasers systems market?

- 5.What is the breakup of the global industrial lasers systems market based on the type?

- 6.What is the breakup of the global industrial lasers systems market based on the application?

- 7.What is the breakup of the global industrial lasers systems market based on end use industry?

- 8.What are the key regions in the global industrial lasers systems market?

- 9.Who are the key players/companies in the global industrial lasers systems market?

Table of Contents

Companies Mentioned

- ACSYS Lasertechnik US Inc.

- Amonics Ltd.

- Coherent Inc.

- Han's Laser Technology Industry Group Co. Ltd

- II-VI Incorporated

- IPG Photonics Corporation

- Jenoptik Laser GmbH

- Lumibird Group

- Newport Corporation (MKS Instruments Inc.)

- NKT Photonics A/S

- Toptica Photonics AG

- TRUMPF.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 149 |

| Published | May 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 22.9 Billion |

| Forecasted Market Value ( USD | $ 42.8 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |