Speak directly to the analyst to clarify any post sales queries you may have.

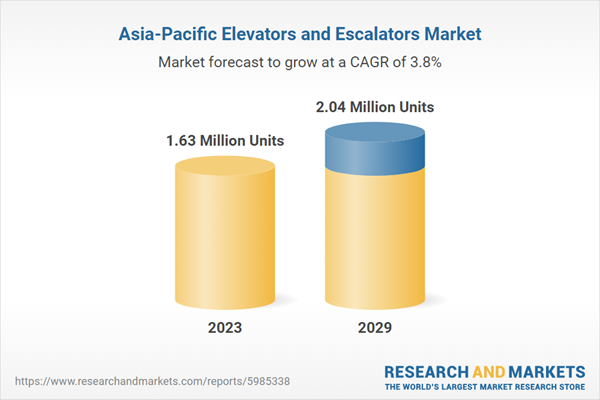

The Asia-Pacific Elevators and Escalators Market consisted of 1.63 million units in 2023, and is expected to reach 2.04 million units by 2029, rising at a CAGR of 3.77%.

KEY HIGHLIGHTS

Ever-growing HNWIs and Smart City Projects Have Driven the Asia Pacific Elevator and Escalator Market

- Increasing HNWIs continued to attract MNEs and their investments to the region. In February 2021, Singapore established the Southeast Asia Manufacturing Alliance to entice manufacturers to invest in Singapore and other ASEAN nations. The Economic Development Board (EDB), Enterprise Singapore, and several business-sector manufacturers are allies in the partnership.

- Hitachi and Nissan Motor had experimented with harnessing energy from mini-EV(Nissan Sakura) to power an elevator in a six-story building in Japan. Concerning this, a 20 KW hour battery was connected to the building using a special adapter developed by Hitachi Building Systems. This experiment had been succeeded for nearly 15 hours, and around 416 times, the elevator could move up and down. Hitachi Building Systems aims to provide the system to apartment buildings in April 2023. These systems are viable for the continuous operation of elevators during power outages.

- The Korea Elevator Safety Agency (KoELSA) is piloting a digital-based elevator smart control platform to prevent many crimes and accidents within elevators. KoELSA announced in August 2023 that this platform, designed to address various hazardous situations and enhance elevator safety, covers monitoring, reporting, initial response, situation propagation, emergency rescue, and follow-up management stages. Currently undergoing pilot testing, this elevator smart control platform integrates fourth-industrial revolution technologies such as AI, IoT, and sensing, along with a vast database comprising three billion elevator safety records.

- India’s Central Railway launched a thorough awareness campaign on April 4-5, 2023, under its "Mission Zero Death" initiative. This campaign, led by the Safety Department of Mumbai division, promoted safer options like using elevators and escalators instead of trespassing on railway tracks. Such regional campaigns contribute to the growth of the Asia Pacific elevator and escalator market.

- In Malaysia, Rapid Rail reported that as of October 2022, 22 out of 362 elevator units and 49 out of 707 escalators were non-functional. The company has introduced the Condition Based Maintenance (CBM) program as a long-term measure. This program involves replacing components deemed damaged or frequently problematic without waiting for the end of the service life.

- In Q4 2023, Fujitec's Asia Pacific operations showed varied performance. East Asia experienced a decline in new installations due to China's real estate recession, contrasting with growth in Hong Kong. South Asia saw increased installations in Singapore and India, with more modernization projects in Singapore. In Japan, domestic orders surged, driving significant growth in new installations and aftermarket services. This was attributed to rebounding from prior order cutbacks and reflecting material and logistics cost increases.

- As of April 2024, the State Railway of Thailand is undertaking efforts to address the maintenance issues plaguing escalators and elevators along the Red Line commuter rail system. Following a recent inspection revealing numerous malfunctions, Ekarat Sriarayanphong, head of the SRT governor's office, reported that 47 of the 228 escalators installed along the Red Line were non-operational. At the same time, 22 of the 133 elevators were also out of order.

Affordable Housing Schemes, Smart City Programs, and Ascending Ultra High Net Worth Individuals to Hike Elevator Demand

- Thailand's National Housing Authority(NHA) will provide financial assistance to about one-third of the targeted group of 2.27 million households (approximately 650,000) that cannot access housing financing from regular financial institutions. During the next five years (2022-2026), the NHA plans to raise B134 billion (about USD 4 billion) to fund 16 national projects.

- Hyundai Elevator agreed with LG Electronics for Robotic Synchronization and Smart Building Solution Supply in August 2021. This will enable it to expand its elevator market through home networks applied with IoT, AI, contactless technologies, and connections with automatic driving robots.

- High-net-worth individuals (HNWIs) have been rising in Asian countries recently. They are likely impacting the landscape of the real estate sector since these individuals invest in luxury properties. The home lift market has been a lucrative and booming business in Asia over the last few years, with a growing wealthy population seeking both luxury and comfort for their homes, driving the demand for luxury products such as home lifts. The growth in the real estate market is estimated to support the growth of the Asia Pacific elevator and escalator market.

- Korea's National Strategic Smart Cities Program will fuel demand for elevators and escalators. The program aims to service 70 cities by 2030, cover 60% of the country's population by 2040, and support the world's most efficient smart city program.

Green Building and Certifications in the Building Sector led to the adoption of energy-efficient vertical transportation installations in the Asia Pacific elevator and escalator market.

- Adopting green building strategies and obtaining green certifications have played crucial roles in the building sector. These green certifications mandate the region's adoption of green or energy-efficient elevators. Furthermore, this leads to a reduction of carbon emissions in the building sector. New regulations in China require that 70% of new urban buildings be certified green buildings by 2022. Major municipalities, including Shanghai, Beijing, and Shenzhen, plan to exceed that goal, requiring all new commercial buildings to be green. This also includes plans to renovate schools, hospitals, and public buildings to be more energy efficient. These strategies will support the Asia Pacific elevator and escalator market during the predicted period.

- Under the 12th Malaysia Plan, 13 urban renewal projects have been authorized (12MP). By the Ministry of Natural Resources and Urban Development, all of these projects are at varying levels of planning and execution. Increasing competition among township developers in Malaysia and their major focus on increasing property value has pushed them towards undertaking various multifunctional development projects in residential, commercial, institutional, and healthcare facilities.

- In 2025, Osaka will host high-profile events such as the G20 and the World Expo. As a result of the city's popularity as a tourist destination, Kansai Airport announced a USD 911 million expansion to enhance its facilities and increase capacity. In contrast, hotel and restaurant building increased six-fold. The addition of a direct train link between Umekita and Kansai Airport has increased demand for vertical transportation equipment. Such growth projects are estimated to support the Asia Pacific elevator and escalator market during the forecast period.

Enhanced Monitoring Services by Major OEMs and Equipment Standard-Setting in Asian Countries Are Pushing the Service Market

- The Ministry of Construction of Vietnam issued Circular 03/2021/TT-BXD, establishing national standards for apartment buildings, following numerous major accidents involving lifts in apartment complexes. By July 2021, there will be more specifications for lifts in residential buildings.

- Some nations, like Malaysia, encourage the elderly to use elevators rather than escalators. It was witnessed that elderly people were responsible for 30% of accidents on moving walkways, escalators, and elevators.

- In 2019, Hitachi introduced an advanced lift remote monitoring and maintenance service in Singapore. The service provides real-time operational data about the lifts and implements preventive maintenance.

- Fire and Rescue NSW data shows elevator rescue numbers have risen 80% since 2014. In 2018, 1,620 people across New South Wales were rescued from elevators. This is a sign that elevators need to undergo regular maintenance to avoid accidents.

- In October 2021, a quake of magnitude 5 on the Japanese seismic intensity scale struck Tokyo's 23 wards, the first time the Japanese capital had been struck so strongly in the 10.5 years since the Great East Japan Earthquake. Around 78,000 elevators were affected. Since this earthquake struck at night, only 25 people were trapped inside.

- According to major elevator manufacturer KONE, China will comprise half of the global service industry by 2025. Since the country has the largest installed base, most equipment might either reach its service life or have gone through wear and tear.

SEGMENTATION ANALYSIS

Elevator Market Segmentation by

- Machine Type

- Hydraulic and Pneumatic

- Machine Room Traction

- Machine Room Less Traction

- Others

- Climbing

- Elevators

- Industrial Elevators

- Carriage Type

- Passenger

- Freight

- Capacity

- 2-15 Persons

- 16-24 Persons

- 25-33 Persons

- 34 Persons and Above

- End-User

- Commercial

- Residential

- Industrial

- Others

- Public Transit

- Institutional

- Infrastructural

Escalator Market Segmentation by

- Product Type

- Parallel

- Multi Parallel

- Walkway

- Crisscross

- End-User

- Public Transit

- Commercial

- Others

- Institutional Sector

- Infrastructure

- Industrial

Segmentation by Region

- China

- India

- Japan

- Australia

- South Korea

- Vietnam

- Thailand

- Indonesia

- Singapore

- Malaysia

- New Zealand

VENDOR LANDSCAPE

- Otis, Schindler, KONE, and Hitachi are the top four manufacturers in the Asia Pacific elevator and escalator market, with a 56% market share.

- Schindler is among 67 businesses operating in New South Wales to have obtained a silver partnership in the NSW Sustainability Advantage Program, which aims to help organizations achieve performance and improve their environmental approach.

- Mitsubishi Elevator Singapore PTE equips employees with the necessary skills and knowledge to provide safe people transportation systems in public and private housing and commercial complexes by establishing a new technical training center and strategic alliances with the Institute of Technical Education and the Building & Construction Authority.

- The company's production site in Korea is the newest Otis factory to receive ISO14001 certification. More than 90% of our factories have achieved this accreditation by meeting international criteria. Otis set some lofty long-term ESG goals earlier this year, including having all its factories achieve ISO 14001 accreditation by 2025.

Key Vendors

- Otis

- KONE

- Schindler

- Hitachi

- TK Elevator

- Mitsubishi Electric

- Fujitec

- Hyundai Elevator

Other Prominent Vendors

- Shanghai SANEI Elevator Co., Ltd.

- SANYO YUSOKI KOGYO

- Johnson Lifts Pvt. Ltd.

- Cibes Lift Group

- Kalea Lifts

- Wittur Elevator Components

- Toshiba Elevator and Building Systems Corporation (TELC)

- Sigma Elevators

- HANDOK ELEVATOR Co., Ltd

- Stannah Lifts Holdings Ltd

- HM Elevator

- Japan Fuji International

- Kunshan Hualong Elevator

- SJEC

- Analogue Holdings Limited

- SUZHOU JIUDE ELECTRICAL AND MECHANICAL TECHNOLOGY CO., LTD.

- Shenyang Yuanda Intellectual Industry Group Co., Ltd

- IFE Elevators

KEY QUESTIONS ANSWERED

1. How big is the Asia Pacific elevator and escalator market?

2. What are the key opportunities in the Asia Pacific elevator and escalator market?

3. How many bases will be installed in the Asia Pacific elevator and escalator market in 2023?

4. What are the key Asia Pacific elevator and escalator market players?

5. What will the growth rate be in the Asia Pacific elevator and escalator market?

Table of Contents

Companies Mentioned

- Otis

- KONE

- Schindler

- Hitachi

- TK Elevator

- Mitsubishi Electric

- Fujitec

- Hyundai Elevator

- Shanghai SANEI Elevator Co., Ltd.

- SANYO YUSOKI KOGYO

- Johnson Lifts Pvt. Ltd.

- Cibes Lift Group

- Kalea Lifts

- Wittur Elevator Components

- Toshiba Elevator and Building Systems Corporation (TELC)

- Sigma Elevators

- HANDOK ELEVATOR Co., Ltd

- Stannah Lifts Holdings Ltd

- HM Elevator

- Japan Fuji International

- Kunshan Hualong Elevator

- SJEC

- Analogue Holdings Limited

- SUZHOU JIUDE ELECTRICAL AND MECHANICAL TECHNOLOGY CO., LTD.

- Shenyang Yuanda Intellectual Industry Group Co., Ltd

- IFE Elevators

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 179 |

| Published | July 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value in 2023 | 1.63 Million Units |

| Forecasted Market Value by 2029 | 2.04 Million Units |

| Compound Annual Growth Rate | 3.7% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 26 |