Telecom is the fastest growing segment, North America is the largest market globally

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The global high-speed interconnects market is significantly propelled by the escalating demand for data-intensive applications. Modern enterprises increasingly rely on advanced analytics, artificial intelligence, and machine learning to derive actionable insights, necessitating robust infrastructure capable of handling immense data volumes with minimal latency. This surge is evident in the performance of leading technology providers. For instance, according to NVIDIA, in November 2024, their third-quarter fiscal 2025 Data Center revenue reached a record $30.8 billion, demonstrating a substantial 112% increase from the prior year, directly reflecting the accelerated deployment of high-speed interconnects in AI and HPC environments.Key Market Challenges

The global high-speed interconnects market faces a significant impediment due to the substantial costs associated with the implementation and ongoing maintenance of these advanced solutions. These considerable upfront investments, particularly for newer technologies, create a formidable barrier to broader adoption. Organizations, especially those with stringent budget constraints, often struggle to allocate the necessary capital for initial deployment and subsequent operational expenditures, thus hindering their ability to integrate critical high-speed interconnect infrastructure.Key Market Trends

The global high-speed interconnects market is significantly influenced by the rapid adoption of next-generation connectivity standards. This trend is driven by the escalating demand for increased bandwidth and reduced latency in modern computing environments, particularly within data centers and high-performance computing. Newer standards like PCIe 5.0/6.0, 800G Ethernet, CXL, and UCIe are establishing the foundational protocols for faster and more efficient inter-component communication. For instance, the PCI-SIG, an industrial association, anticipates the final version 1.0 of the PCIe 7.0 standard in 2025, aiming to deliver a data transfer rate of 16 GB/s per lane.Key Market Players Profiled:

- Intel Corporation

- NVIDIA Corporation

- Advanced Micro Devices, Inc.

- Cisco Systems, Inc.

- Broadcom Inc.

- Texas Instruments Incorporated

- Analog Devices, Inc.

- Microchip Technology Inc.

- Huawei Technologies Co., Ltd.

Report Scope:

In this report, the Global High-Speed Interconnects Market has been segmented into the following categories:By Type:

- Direct Attach Cables

- Active Optical Cable

By Application:

- Data Centers

- Telecom

- Consumer Electronics

- Networking & Computing

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global High-Speed Interconnects Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Intel Corporation

- NVIDIA Corporation

- Advanced Micro Devices, Inc.

- Cisco Systems, Inc.

- Broadcom Inc.

- Texas Instruments Incorporated

- Analog Devices, Inc.

- Microchip Technology Inc.

- Huawei Technologies Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | November 2025 |

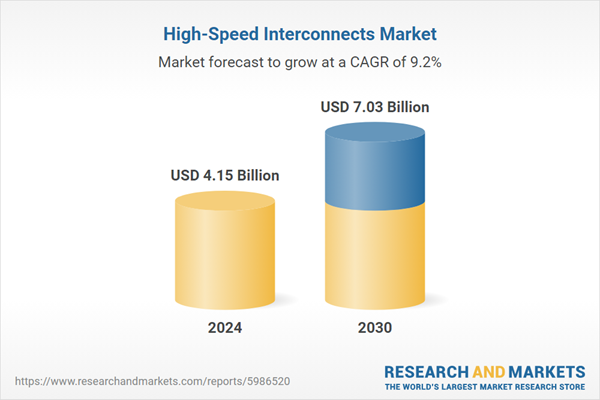

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.15 Billion |

| Forecasted Market Value ( USD | $ 7.03 Billion |

| Compound Annual Growth Rate | 9.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |