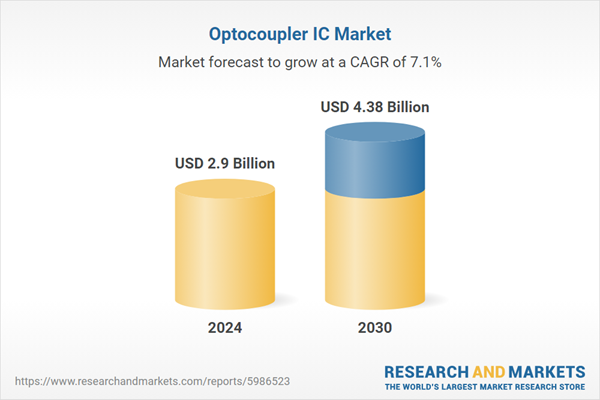

High-Speed Optocouplers is the fastest growing segment, Asia-Pacific is the largest regional market

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The expanding adoption of industrial automation and smart manufacturing significantly influences the global optocoupler IC market. Modern industrial environments demand reliable electrical isolation to protect sensitive control circuitry from high voltage transients and noise, prevalent in heavy machinery and power electronics. Optocouplers provide this essential galvanic isolation, ensuring signal integrity and operational safety in programmable logic controllers, motor drives, and power supply units. The shift towards Industry 4.0, characterized by interconnected systems and real-time data exchange, intensifies the need for robust isolation. According to the International Federation of Robotics, in a September 2025 press release on "World Robotics 2025 statistics," industrial robot installations neared a record 542,000 units globally in 2024, reflecting accelerating automation and increasing optocoupler integration.Key Market Challenges

The inherent complexity and substantial cost associated with developing advanced optocoupler technologies pose a significant challenge to the growth of the global optocoupler IC market. This includes the demanding task of maintaining product reliability while simultaneously achieving the higher data rates necessitated by evolving application requirements. The intricate design and fabrication processes for these specialized components, especially those engineered for enhanced performance and robust electrical isolation in critical systems, necessitate considerable investments in research and development.Key Market Trends

The relentless demand for faster data exchange across advanced telecommunications infrastructure, high-performance data centers, and industrial networking drives significant advancements in optocoupler technology. These components are critical for maintaining signal integrity and electrical isolation. According to the Ethernet Alliance, in January 2024, its leaders predicted the push for 200Gb/lane and greater speeds would be a critical component of the AI and machine learning market, with advancements potentially leading to 800Gb/lane solutions. Such developments enable efficient handling of increasing data volumes and reduce latency, essential for real-time operations and cloud computing applications. Growing bandwidth requirements for emerging technologies like AI and 5G networks accelerate innovation in high-speed optocouplers.Key Market Players Profiled:

- Broadcom Inc.

- Toshiba Corporation

- Renesas Electronics Corporation

- Vishay Intertechnology, Inc.

- Lite-On Technology Corporation

- Everlight Electronics Co., Ltd.

- Semiconductor Components Industries, LLC

- Panasonic Corporation

- SurplusGLOBAL, Inc.

- Littelfuse, Inc.

Report Scope:

In this report, the Global Optocoupler IC Market has been segmented into the following categories:By Type:

- High Linearity Optocouplers

- High-Speed Optocouplers

- Logic Output Optocouplers

- MOSFET Output Optocouplers

- Transistor Output Optocouplers

- TRIAC & SCR Output Optocouplers

- Others

By Pin:

- 4-Pin

- 5 Pin

- 6 Pin

- 7 Pin

By Vertical:

- Automotive

- Aerospace & Defense

- Solar

- Consumer Electronics

- Others

By Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Optocoupler IC Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Optocoupler IC market report include:- Broadcom Inc.

- Toshiba Corporation

- Renesas Electronics Corporation

- Vishay Intertechnology, Inc.

- Lite-On Technology Corporation

- Everlight Electronics Co., Ltd.

- Semiconductor Components Industries, LLC

- Panasonic Corporation

- SurplusGLOBAL, Inc.

- Littelfuse, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | November 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.9 Billion |

| Forecasted Market Value ( USD | $ 4.38 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |