Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Technological Advancements

Rapid advancements in endoscopic technology are revolutionizing the landscape of medical diagnostics and treatments within the Japan Endoscopes Market. One of the key drivers propelling this transformation is the continuous evolution towards high-definition imaging systems. These systems provide clinicians with exceptionally clear and detailed visuals of internal organs and tissues, enabling more accurate diagnoses and precise treatment planning. The shift towards 3D visualization capabilities further enhances the depth perception and spatial awareness during procedures, which is particularly beneficial for complex surgeries and intricate interventions. The miniaturization of endoscopic devices has significantly expanded their utility across various medical specialties. Smaller, more maneuverable instruments enable minimally invasive procedures, reducing patient discomfort, shortening recovery times, and lowering the risk of complications compared to traditional surgical approaches. This has led to increased adoption among healthcare providers who seek to offer patients safer and more effective treatment options. In January 2021, NEC Corporation has introduced "WISE VISION Endoscopy," an AI-driven medical device software designed to support diagnoses during colonoscopies. This innovative software, launched in Japan and anticipated for release in Europe soon, integrates seamlessly with existing endoscopy equipment. It utilizes artificial intelligence to autonomously identify and annotate potential lesions based on images captured during the procedure.Technological innovations have also focused on improving the flexibility and versatility of endoscopes. Devices with advanced articulation capabilities allow for better navigation through anatomical structures and access to hard-to-reach areas, further expanding the scope of applications across gastroenterology, urology, pulmonology, and gynecology fields. These enhancements not only improve patient outcomes but also drive efficiency in healthcare delivery by reducing procedure times and hospital stays. In addition to technological advancements, the integration of artificial intelligence (AI) and machine learning into endoscopic systems holds promise for further enhancing diagnostic accuracy and procedural efficiency. AI-powered algorithms can analyze real-time endoscopic images, detect abnormalities, and provide decision support to clinicians, thereby augmenting their diagnostic capabilities and improving patient management.

Rising Prevalence of Chronic Diseases

Japan is confronting a mounting burden of chronic diseases, encompassing a spectrum from gastrointestinal disorders and cancers to respiratory conditions. This escalating health challenge has placed endoscopes at the forefront of medical diagnostics and treatments within the country. Endoscopic procedures are pivotal in the comprehensive management of these chronic illnesses, serving critical roles in both diagnosis and therapeutic interventions. Gastrointestinal disorders, including inflammatory bowel disease, colorectal cancer, and gastroesophageal reflux disease, are prevalent in Japan's population. Endoscopes are indispensable tools in the early detection of gastrointestinal cancers through procedures such as colonoscopy and upper gastrointestinal endoscopy. These diagnostic capabilities are essential for timely intervention and effective treatment planning, contributing significantly to improved patient outcomes and survival rates.Endoscopic techniques enable precise staging of cancers, guiding clinicians in determining the extent of disease spread and formulating optimal treatment strategies. In the realm of therapeutic interventions, endoscopes facilitate minimally invasive procedures such as polypectomy, endoscopic mucosal resection (EMR), and endoscopic submucosal dissection (ESD). These techniques offer patients less invasive alternatives to traditional surgery, with reduced risks of complications, shorter recovery times, and improved quality of life post-treatment.

Respiratory conditions, including chronic obstructive pulmonary disease (COPD) and lung cancer, also benefit significantly from endoscopic evaluations. Procedures such as bronchoscopy play crucial roles in the diagnosis of lung diseases, allowing for direct visualization of the airways, biopsy collection, and the removal of respiratory tract obstructions. Early detection facilitated by endoscopic examinations enhances treatment efficacy and patient prognosis, underscoring the critical role of endoscopes in respiratory care.

The increasing prevalence of lifestyle-related diseases and an aging population in Japan has further amplified the demand for endoscopic services. With an emphasis on preventive healthcare and early disease detection, endoscopes are instrumental in screening programs aimed at identifying asymptomatic individuals at risk of developing chronic diseases. In response to these healthcare challenges, technological advancements in endoscopic imaging, instrumentation, and therapeutic modalities continue to drive innovation within the field. High-definition imaging systems, advanced endoscopic accessories, and robotic-assisted platforms enhance procedural precision, diagnostic accuracy, and patient safety. These innovations empower healthcare providers to deliver more personalized and effective care, meeting the evolving needs of Japan's diverse patient population.

Shift Towards Minimally Invasive Surgeries

In Japan, there is a notable shift towards embracing minimally invasive surgical techniques, driven by several compelling advantages over traditional surgical approaches. The adoption of endoscopic procedures, in particular, has gained significant traction across a spectrum of medical specialties, including gastroenterology, pulmonology, urology, and gynecology. Minimally invasive surgeries are increasingly favored due to their ability to minimize trauma to surrounding tissues, resulting in reduced recovery times and post-operative pain for patients. Compared to open surgeries, which often require larger incisions and longer hospital stays, endoscopic procedures involve smaller incisions or entry points. This not only accelerates healing but also lowers the risk of surgical site infections and other complications, thereby enhancing patient safety and comfort.In gastroenterology, endoscopic techniques such as colonoscopy, upper gastrointestinal endoscopy, and endoscopic retrograde cholangiopancreatography (ERCP) allow for the diagnosis and treatment of various gastrointestinal conditions. These procedures enable direct visualization of the digestive tract, biopsy collection, and the removal of polyps or tumors, often without the need for surgical intervention. Similarly, in pulmonology, bronchoscopy plays a pivotal role in diagnosing and treating respiratory disorders. It enables clinicians to examine the airways, obtain tissue samples through biopsy, and manage conditions such as lung cancer, chronic obstructive pulmonary disease (COPD), and pulmonary infections.

Aging Population

Japan's demographic landscape is undergoing significant transformation, marked by a rapidly aging population that presents unique challenges and opportunities within the healthcare sector. With one of the world's largest proportions of elderly citizens, Japan faces a heightened prevalence of age-related diseases that necessitate advanced medical interventions, including endoscopic procedures. The preference among elderly patients for minimally invasive treatments underscores a fundamental shift towards enhancing quality of life and reducing healthcare burdens associated with prolonged recovery periods. Endoscopic technologies have emerged as indispensable tools in addressing a spectrum of age-related conditions, ranging from gastrointestinal disorders to respiratory ailments and urological issues.In gastroenterology, for instance, conditions like colorectal cancer, gastric ulcers, and diverticulitis are prevalent among older adults. Endoscopic examinations such as colonoscopies and upper gastrointestinal endoscopies play a pivotal role in early detection, biopsy collection, and the management of these diseases. These procedures not only provide accurate diagnostic information but also facilitate therapeutic interventions such as polyp removal or tissue ablation, often without the need for more invasive surgeries. Pulmonology also benefits significantly from endoscopic innovations, particularly in diagnosing and treating respiratory diseases prevalent in older adults, such as lung cancer, chronic obstructive pulmonary disease (COPD), and interstitial lung diseases. Bronchoscopy enables direct visualization of the airways, biopsy sampling, and therapeutic interventions like bronchial stent placement or tumor resection, all while minimizing patient discomfort and recovery times.

Key Market Challenges

Cost and Pricing Pressures

The cost dynamics surrounding endoscopic equipment and procedures in Japan present a multifaceted challenge that intersects with various aspects of healthcare economics and policy. Endoscopic technologies offer substantial clinical benefits, such as improved diagnostic accuracy, minimally invasive treatments, and reduced recovery times, which are increasingly valued by healthcare providers and patients alike. However, the high initial costs associated with acquiring and maintaining advanced endoscopic equipment pose significant barriers to adoption and utilization.Healthcare providers in Japan face stringent budget constraints and complex reimbursement policies that influence their purchasing decisions. The upfront investment required for purchasing state-of-the-art endoscopic systems, along with ongoing maintenance and upgrade costs, can strain financial resources. Negotiating favorable pricing agreements with healthcare payers becomes crucial for manufacturers and suppliers seeking to penetrate the market and maintain profitability. Managing procurement costs while balancing affordability for healthcare facilities adds another layer of complexity.

Infection Control and Safety Concerns

Endoscopic procedures carry inherent risks of infection transmission if proper disinfection and sterilization protocols are not strictly followed. Japan has experienced incidents of nosocomial infections linked to inadequately cleaned endoscopes, prompting regulatory scrutiny and public concern. Healthcare facilities must adhere to rigorous disinfection guidelines and invest in state-of-the-art cleaning technologies to mitigate infection risks effectively. Enhancing staff training on infection control measures and conducting regular audits are critical to maintaining patient safety and regulatory compliance.Key Market Trends

Healthcare Reforms and Infrastructure Development

Government initiatives in Japan are pivotal in shaping the landscape of healthcare infrastructure and the adoption of advanced medical technologies, particularly in the field of endoscopy. With a proactive approach towards enhancing healthcare delivery and improving patient outcomes, government policies play a crucial role in driving the widespread adoption of endoscopic procedures across the country. One of the key drivers of endoscopic technology adoption is the government's commitment to improving healthcare infrastructure. Initiatives aimed at upgrading medical facilities, enhancing diagnostic capabilities, and expanding healthcare access in both urban and rural areas have catalyzed the demand for state-of-the-art endoscopic equipment. By investing in modernizing healthcare facilities and equipping them with advanced technologies, the government aims to ensure equitable access to high-quality medical care across Japan.Government-supported reimbursement policies under the national health insurance schemes significantly incentivize healthcare providers to offer endoscopic procedures. These policies cover a substantial portion of the costs associated with endoscopic examinations, treatments, and surgeries, thereby reducing financial barriers for patients and healthcare facilities alike. This reimbursement framework not only enhances affordability for patients but also fosters confidence among healthcare providers to invest in advanced endoscopic equipment and technologies. Regulatory frameworks and standards set by government agencies ensure the safety, efficacy, and quality of endoscopic procedures in Japan. Compliance with rigorous regulatory requirements instills trust in endoscopic technologies and encourages healthcare facilities to maintain high standards of patient care and procedural excellence. These regulatory measures contribute to the overall growth and credibility of the endoscopy market by safeguarding patient interests and promoting best practices in medical device utilization.

Expanding Applications in Diagnostic and Therapeutic Procedures

Endoscopes have evolved into indispensable tools in modern medicine, serving dual roles in diagnosis and therapy across a spectrum of medical disciplines. In Japan, their versatility spans crucial diagnostic procedures such as cancer screening and tissue biopsy, where high-definition imaging and precision allow for accurate detection and early intervention. These capabilities are particularly crucial in oncology, gastroenterology, and pulmonology, where timely diagnosis significantly impacts patient outcomes. In September 2022, Olympus Corporation, unveiled VISERA ELITE III, its latest surgical visualization platform tailored to meet the diverse needs of healthcare professionals (HCPs) performing endoscopic procedures across various medical disciplines. VISERA ELITE III integrates multiple imaging functionalities into a single system, supporting minimally invasive therapies such as Laparoscopic Colectomy and Laparoscopic Cholecystectomy. Future software updates promise to advance surgical imaging technologies further, allowing for customized configurations that streamline support for a wide range of surgical applications, ultimately reducing investment costs. Scheduled for release in September 2022 or later, VISERA ELITE III will be available in Europe, the Middle East, Africa (EMEA), parts of Asia, Oceania, and Japan. By amalgamating the technologies from its predecessors VISERA ELITE II and VISERA 4K UHD onto one platform, VISERA ELITE III enhances the quality of endoscopic surgery, boosts operating room efficiency, and raises the standard of patient care.Beyond diagnostics, endoscopes facilitate a wide array of therapeutic interventions. Procedures like polypectomy for the removal of polyps and stent placement to alleviate obstructions are routinely performed with endoscopic guidance. This therapeutic versatility extends to urology, gynecology, and otolaryngology, where minimally invasive techniques reduce patient discomfort, recovery times, and hospital stays. The increasing adoption of endoscopic equipment across these diverse medical specialties underscores its expanding market scope and utility in clinical practice. As technology continues to advance with features like 3D visualization and miniaturization, endoscopes are poised to play an even more significant role in improving diagnostic accuracy, enhancing therapeutic outcomes, and ultimately, advancing patient care in Japan and beyond.

Segmental Insights

Product Insights

Based on the Product, Rigid endoscopes have emerged as the dominant segment in the Japan Endoscopes market, driven by several key factors. Rigid endoscopes provide superior image quality and enhanced visualization compared to their flexible counterparts. The rigid design allows for better maneuverability and control, enabling surgeons to obtain high-definition, magnified views of the target anatomy. This improved visualization translates to more accurate diagnosis and more precise surgical interventions, making rigid endoscopes the preferred choice for many medical procedures in Japan.Rigid endoscopes are versatile and have widespread applications across a wide range of medical specialties in Japan, including gastroenterology, orthopedics, urology, and gynecology. Their versatility allows them to be used for both diagnostic and therapeutic purposes, from examining internal organs to performing minimally invasive surgeries. This broad applicability has driven the adoption of rigid endoscopes in the Japanese healthcare system. Continuous innovations in rigid endoscope design and optics have further bolstered their dominance in the Japanese market. Advancements such as improved image resolution, enhanced illumination, and the integration of digital imaging capabilities have made rigid endoscopes more powerful and user-friendly. These technological improvements have increased the appeal of rigid endoscopes among Japanese healthcare providers, who value the enhanced capabilities for improved patient outcomes.

Regional Insights

The Kanto region, which includes the Greater Tokyo Area, has emerged as the dominant force in the Japan Endoscopes market, accounting for the largest market share. This regional dominance can be attributed to several key factors. The Kanto region is home to a significant concentration of leading healthcare institutions and medical facilities in Japan. The region boasts a high density of renowned hospitals, specialized clinics, and advanced medical research centers that are at the forefront of endoscopic procedures and technologies. These healthcare providers in the Kanto region have been quick to adopt the latest endoscopic devices and techniques, driving the demand for cutting-edge endoscopy equipment.The Kanto region, particularly the Tokyo metropolitan area, has a large and aging population, which has contributed to the region's prominence in the Endoscopes market. As the population ages, the prevalence of age-related diseases and conditions that require endoscopic diagnosis and treatment has increased, fueling the demand for endoscopic devices in the Kanto region. The concentration of major medical device manufacturers and distributors in the Kanto region has also been a significant factor in the region's dominance. Many of the leading global and domestic players in the Endoscopes market, such as Olympus, Fujifilm, and Pentax Medical, have their headquarters or major production facilities located in the Kanto region. This proximity to the manufacturing and distribution hubs has enabled healthcare providers in the Kanto region to have easier access to the latest endoscopic technologies and maintain a competitive edge. The Kanto region's well-developed healthcare infrastructure and favorable reimbursement policies have contributed to the widespread adoption of endoscopic procedures. The region's comprehensive health insurance coverage and government initiatives to promote minimally invasive surgical techniques have made endoscopic services more accessible and affordable for patients, further driving the demand for Endoscopes.

Key Market Players

- Boston Scientific Japan K.K.

- Medtronic Japan Co., Ltd.

- Olympus Corporation

- Johnson & Johnson K.K.

- Cook Medical Japan G.K.

- KARL STORZ Endoscopy Japan K. K.

- Conmed Japan Co., Ltd.

- Fujifilm Holdings Corporation

- Nipro Corporation

- Machida Endoscope Co., Ltd.

Report Scope:

In this report, the Japan Endoscopes Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Japan Endoscopes Market, By Product:

- Disposable

- Flexible

- Rigid

Japan Endoscopes Market, By End Use:

- Hospitals

- Outpatient Facilities

Japan Endoscopes Market, By Region:

- Hokkaido

- Tohoku

- Kanto

- Chubu

- Kansai

- Chugoku

- Shikoku

- Kyushu

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Japan Endoscopes Market.Available Customizations:

Japan Endoscopes Market report with the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Boston Scientific Japan K.K.

- Medtronic Japan Co., Ltd.

- Olympus Corporation

- Johnson & Johnson K.K.

- Cook Medical Japan G.K.

- KARL STORZ Endoscopy Japan K. K.

- Conmed Japan Co., Ltd.

- Fujifilm Holdings Corporation

- Nipro Corporation

- Machida Endoscope Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 80 |

| Published | July 2024 |

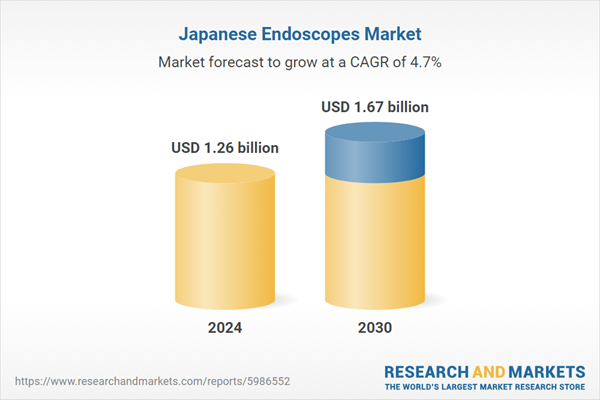

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.26 billion |

| Forecasted Market Value ( USD | $ 1.67 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Japan |

| No. of Companies Mentioned | 10 |