Unsecured Business Loans - Key Trends and Drivers

Unsecured business loans are a type of financing that does not require the borrower to provide collateral, such as property or other assets, to secure the loan. This type of loan is particularly appealing to small businesses and startups that may not have significant assets to pledge or prefer to avoid risking their property. Unsecured loans are typically based on the creditworthiness of the borrower, which is assessed through credit scores, business performance, and other financial metrics. Lenders take on more risk with unsecured loans, which often results in higher interest rates compared to secured loans. Despite this, unsecured business loans offer a flexible and accessible solution for businesses seeking quick capital to fund operations, expand, or cover unexpected expenses.The application process for unsecured business loans has been streamlined with the advent of fintech innovations, making it easier and faster for businesses to access funds. Online lenders and alternative financing platforms have emerged as significant players in the market, providing competitive options alongside traditional banks. These platforms utilize advanced algorithms and data analytics to evaluate loan applications, often delivering decisions within minutes and disbursing funds within days. This rapid turnaround time is crucial for businesses needing immediate capital to seize opportunities or manage cash flow challenges. Additionally, unsecured business loans can come in various forms, including term loans, lines of credit, and merchant cash advances, each catering to different financial needs and repayment capabilities of businesses.

The growth in the unsecured business loans market is driven by several factors. Firstly, the increasing number of small businesses and startups seeking flexible financing options fuels demand for unsecured loans. The expansion of the fintech industry and the development of sophisticated lending platforms have made it easier for businesses to apply for and receive loans without the lengthy processes associated with traditional banking. Additionally, economic uncertainties and the need for rapid response to market changes drive businesses to seek quick and unsecured financing solutions. Improved access to credit information and the use of alternative data sources for credit assessment have also enabled more businesses to qualify for these loans. Furthermore, the competitive landscape among lenders encourages the development of innovative loan products and better terms for borrowers. These factors collectively ensure robust growth in the unsecured business loans market, meeting the evolving financial needs of businesses across various sectors.

Report Scope

The report analyzes the Unsecured Business Loans market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Loan Type (Working Capital Loan, Term Business Loan, Loan on Business Credit Cards, Overdraft, Other Loan Types); Enterprise Size (Small & Medium-sized Enterprises, Large Enterprises).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Working Capital Loan segment, which is expected to reach US$3.6 Trillion by 2030 with a CAGR of a 9.6%. The Term Business Loan segment is also set to grow at 8.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.5 Trillion in 2024, and China, forecasted to grow at an impressive 12.8% CAGR to reach $2.0 Trillion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Unsecured Business Loans Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Unsecured Business Loans Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Unsecured Business Loans Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as American Express Co., Axis Bank Ltd., Bank of America Corp, Bank of China (Hong Kong) Limited, Bank of Ireland and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 86 companies featured in this Unsecured Business Loans market report include:

- American Express Co.

- Axis Bank Ltd.

- Bank of America Corp

- Bank of China (Hong Kong) Limited

- Bank of Ireland

- Clix Capital Services Pvt. Ltd.

- Funding Circle Ltd

- HDB Financial Services Limited

- HDFC Bank Ltd

- JPMorgan Chase and Co

- National Funding, Inc.

- OnDeck Capital

- Poonawalla Fincorp Ltd.

- Starling Bank Limited

- Toronto-Dominion Bank

- Wells Fargo and Co.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- American Express Co.

- Axis Bank Ltd.

- Bank of America Corp

- Bank of China (Hong Kong) Limited

- Bank of Ireland

- Clix Capital Services Pvt. Ltd.

- Funding Circle Ltd

- HDB Financial Services Limited

- HDFC Bank Ltd

- JPMorgan Chase and Co

- National Funding, Inc.

- OnDeck Capital

- Poonawalla Fincorp Ltd.

- Starling Bank Limited

- Toronto-Dominion Bank

- Wells Fargo and Co.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 326 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

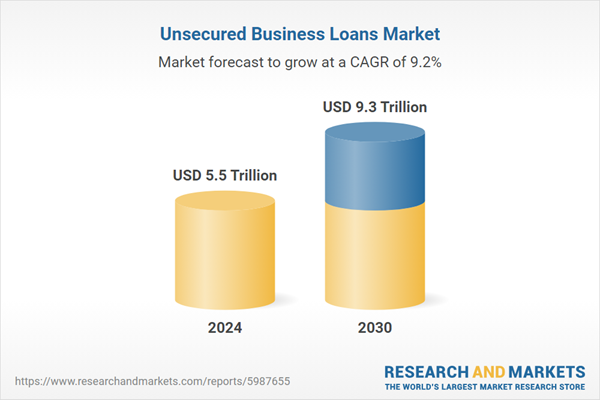

| Estimated Market Value ( USD | $ 5.5 Trillion |

| Forecasted Market Value ( USD | $ 9.3 Trillion |

| Compound Annual Growth Rate | 9.2% |

| Regions Covered | Global |