Automated Suturing Device is the fastest growing segment, North America is the largest regional market

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The global surgical sutures market expansion is significantly propelled by the increasing worldwide volume of surgical procedures. Enhanced healthcare access and a growing prevalence of medical conditions requiring intervention contribute to a consistent rise in operations performed, directly increasing demand for wound closure materials. According to the International Society of Aesthetic Plastic Surgery (ISAPS) Global Survey, in June 2025, over 17.4 million surgical aesthetic procedures were performed by plastic surgeons worldwide in 2024, illustrating a notable increase in this key segment. This expanding procedural volume underscores the continuous need for diverse suture types to facilitate tissue approximation and support optimal patient healing.Key Market Challenges

The global surgical sutures market faces a significant challenge from the ongoing development and adoption of alternative wound closure techniques. Products such as surgical staplers, tissue adhesives, and sealants are increasingly favored in various clinical settings. These alternatives often offer distinct benefits, including potentially faster closure times, a reduced risk of needle-stick injuries for surgical staff, and enhanced cosmetic outcomes for patients. Such advantages directly influence clinical preferences and divert demand away from traditional suturing products.Key Market Trends

The rising adoption of minimally invasive and robotic-assisted surgical techniques is significantly shaping the global surgical sutures market. These advanced surgical methods, characterized by smaller incisions and enhanced precision, necessitate specialized wound closure materials. The increasing volume of robotic-assisted procedures directly influences the demand for sutures compatible with robotic arms, such as barbed sutures that eliminate the need for knot tying, thereby streamlining surgical workflows and potentially reducing operative times.Key Market Players Profiled:

- Johnson & Johnson

- Medtronic Plc

- Braun Melsungen Ag

- Advanced Medical Solutions Group Plc

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

- Smith & Nephew Plc

- Corza Medical

- Boston Scientific Corporation

- DemeTECH Corporation

Report Scope:

In this report, the Global Surgical Sutures Market has been segmented into the following categories:By Product Type:

- Automated Suturing Device

- Suture Thread

By Application:

- Cardiovascular Surgery

- General Surgery

- Gynecological Surgery

- Orthopedic Surgery

- Ophthalmic Surgery

- Others

By End User:

- Hospitals & Clinics

- Ambulatory Care Centers

- Others

By Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Surgical Sutures Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Surgical Sutures market report include:- Johnson & Johnson

- Medtronic Plc

- Braun Melsungen Ag

- Advanced Medical Solutions Group Plc

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

- Smith & Nephew Plc

- Corza Medical

- Boston Scientific Corporation

- DemeTECH Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | November 2025 |

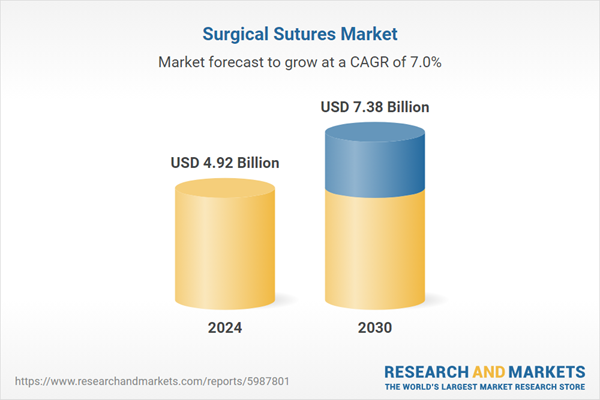

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.92 Billion |

| Forecasted Market Value ( USD | $ 7.38 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |