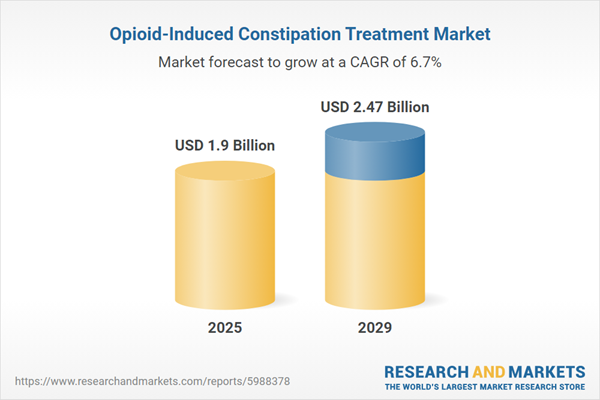

The opioid-induced constipation treatment market size has grown strongly in recent years. It will grow from $1.78 billion in 2024 to $1.9 billion in 2025 at a compound annual growth rate (CAGR) of 7%. The growth in the historic period can be attributed to expanding geriatric population, personalized OIC treatments, availability of effective OIC drugs, increasing prevalence of opioid use, and rising prevalence of gastrointestinal disorders.

The opioid-induced constipation treatment market size is expected to see strong growth in the next few years. It will grow to $2.47 billion in 2029 at a compound annual growth rate (CAGR) of 6.7%. The growth in the forecast period can be attributed to accelerated drug approval initiatives, increasing use of opioid analgesic prescriptions, surging expenditure on the R And D of novel treatments, and an increase in development of biologics. Major trends in the forecast period include patient education and awareness, the emergence of targeted therapies, non-pharmacological interventions, biotechnology innovations, and increased investment.

The increasing use of opioids to manage both cancer and non-cancer pain is expected to drive the growth of the opioid-induced constipation (OIC) treatment market in the future. Cancer pain refers to the pain associated with cancer and its treatment, while non-cancer pain arises from conditions unrelated to cancer. The administration of opioids for these types of pain is driven by the need to effectively manage moderate to severe pain, taking into account factors such as pain intensity, duration, patient response to other treatments, and the goal of improving quality of life while minimizing the risks of addiction and side effects. OIC treatment helps alleviate constipation caused by opioid use, improving patient comfort, adherence to pain management regimens, and overall quality of life without sacrificing pain relief. For example, according to the Government of Canada, up to 8.3 million Canadians are expected to experience chronic pain by 2025, with this number projected to rise to 9 million by 2030. As a result, the growing use of opioids for managing cancer and non-cancer pain is contributing to the expansion of the OIC treatment market.

Leading companies in the opioid-induced constipation (OIC) treatment market are increasingly adopting strategic partnerships to develop innovative medicines. These partnerships enable OIC treatment companies to pool resources and expertise, enhance research and development capabilities, expand their market presence, and accelerate the commercialization of new products, thereby driving innovation and growth in the industry. For example, in November 2022, Kyowa Kirin Co. Ltd., a Japan-based biotechnology company, entered into a partnership with Grünenthal GmbH, a Germany-based pharmaceutical company. This collaboration aims to expand the growth and global availability of a portfolio of transformative pain management medicines, including treatments for opioid-induced constipation, breakthrough cancer pain, and osteoporosis, thereby improving patient outcomes worldwide.

In August 2023, Grünenthal GmbH, a pharmaceutical company headquartered in Germany, finalized a joint venture partnership with Kyowa Kirin International. This collaboration encompasses a collection of 13 brands spanning six therapeutic categories, primarily focusing on pain management, which includes treatments for breakthrough cancer pain, opioid-induced constipation, and osteoporosis. Grünenthal holds a controlling 51% stake in the joint venture, with Kyowa Kirin holding the remaining 49%. Grünenthal aims to acquire the remaining 49% ownership interest at the onset of 2026. Kyowa Kirin International, based in Japan, specializes in developing medications for opioid-induced constipation, including peripherally acting mu-opioid receptor antagonists.

Major companies operating in the opioid-induced constipation treatment market are Pfizer Inc., Merck & Co. Inc., Bayer AG, Sanofi S.A., AstraZeneca plc, Takeda Pharmaceutical Company Limited, Daiichi Sankyo Chemical Pharma Co. Ltd., Bausch Health Companies Inc., Boehringer Ingelheim International GmbH., Shionogi & Co. Ltd., Ono Pharmaceutical Co. Ltd., Dr. Reddy's Laboratories Ltd., Hikma Pharmaceuticals plc, Mundipharma International Limited, Lantheus Holdings Inc., Indivior plc, Mallinckrodt Pharmaceuticals, Collegium Pharmaceutical Inc., Ironwood Pharmaceuticals Inc., Cosmo Pharmaceuticals SA, Nektar Therapeutics, RedHill Biopharma Ltd., Theravance Biopharma Inc., Cumberland Pharmaceuticals Inc., Valinor Pharma LLC.

North America was the largest region in the opioid-induced constipation treatment market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the opioid-induced constipation treatment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the opioid-induced constipation treatment market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Opioid-induced constipation (OIC) treatment encompasses diverse methods and medications employed to address constipation resulting from opioid use. The objective of these treatments is to relieve constipation symptoms while preserving the pain-relieving benefits of opioids, thus enhancing the patient's quality of life and sustaining effective pain management through a combination of pharmacological and non-pharmacological strategies.

Drug categories for treating opioid-induced constipation comprise laxatives, peripherally acting mu-opioid receptor antagonists, serotonin receptor agonists, and prostaglandins. Laxatives are remedies utilized to stimulate bowel movements and alleviate constipation by enhancing stool frequency and softening stool consistency. They can be administered via various routes, including oral and parenteral routes such as subcutaneous injection, and are distributed through hospital pharmacies, online pharmacies, and retail pharmacies.

The opioid-induced constipation market research report is one of a series of new reports that provides opioid-induced constipation market statistics, including the opioid-induced constipation industry global market size, regional shares, competitors with opioid-induced constipation market share, detailed opioid-induced constipation market segments, market trends, and opportunities, and any further data you may need to thrive in the opioid-induced constipation industry. These opioid-induced constipation market research reports deliver a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The opioid-induced constipation treatment market includes revenues earned by entities by providing services such as dietary and lifestyle counselling, medical consultation, diagnostic and telehealth services. The market value includes the value of related goods sold by the service provider or included within the service offering. The opioid-induced constipation treatment market also includes sales of injections, tablets, syrups, lubricants, fibre supplements, enemas, suppositories and probiotics. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Opioid-Induced Constipation Treatment Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on opioid-induced constipation treatment market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for opioid-induced constipation treatment ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The opioid-induced constipation treatment market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Drug Class: Laxatives; Peripherally Acting μ-opioid Receptor Antagonists; Serotonin Receptor Agonists; Prostaglandin2) By Type: Oral; Parenteral

3) By Distribution Channel: Hospital Pharmacies; Online Pharmacies; Retail Pharmacies

Subsegments:

1) By Laxatives: Osmotic Laxatives; Stimulant Laxatives; Bulk-Forming Laxatives2) By Peripherally Acting μ-Opioid Receptor Antagonists: Naloxegol; Methylnaltrexone; Alvimopan

3) By Serotonin Receptor Agonists: Prucalopride; Tegaserod

4) By Prostaglandin: Lubiprostone

Key Companies Mentioned: Pfizer Inc.; Merck & Co. Inc.; Bayer AG; Sanofi S.a.; AstraZeneca plc

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Opioid-Induced Constipation Treatment market report include:- Pfizer Inc.

- Merck & Co. Inc.

- Bayer AG

- Sanofi S.A.

- AstraZeneca plc

- Takeda Pharmaceutical Company Limited

- Daiichi Sankyo Chemical Pharma Co. Ltd.

- Bausch Health Companies Inc.

- Boehringer Ingelheim International GmbH.

- Shionogi & Co. Ltd.

- Ono Pharmaceutical Co. Ltd.

- Dr. Reddy's Laboratories Ltd.

- Hikma Pharmaceuticals plc

- Mundipharma International Limited

- Lantheus Holdings Inc.

- Indivior plc

- Mallinckrodt Pharmaceuticals

- Collegium Pharmaceutical Inc.

- Ironwood Pharmaceuticals Inc.

- Cosmo Pharmaceuticals SA

- Nektar Therapeutics

- RedHill Biopharma Ltd.

- Theravance Biopharma Inc.

- Cumberland Pharmaceuticals Inc.

- Valinor Pharma LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.9 Billion |

| Forecasted Market Value ( USD | $ 2.47 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |