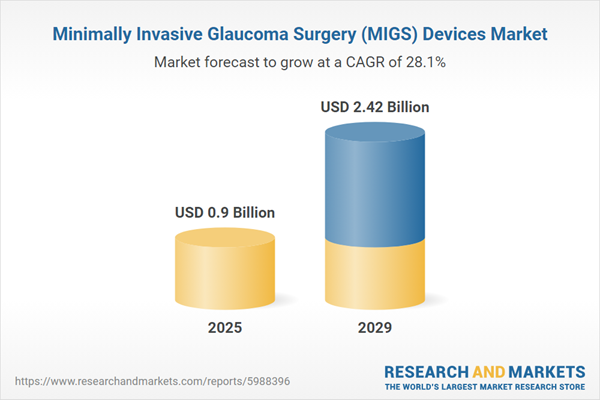

The minimally invasive glaucoma surgery (MIGS) devices market size has grown exponentially in recent years. It will grow from $0.7 billion in 2024 to $0.9 billion in 2025 at a compound annual growth rate (CAGR) of 28.3%. The growth in the historic period can be attributed to increased awareness for the prevention of blindness, increased investments in healthcare infrastructure, increased patient awareness surrounding advanced corrective vision treatments, rise in awareness surrounding advanced corrective vision treatments, increased government initiatives.

The minimally invasive glaucoma surgery (MIGS) devices market size is expected to see exponential growth in the next few years. It will grow to $2.42 billion in 2029 at a compound annual growth rate (CAGR) of 28.1%. The growth in the forecast period can be attributed to increasing prevalence of eye disorders like glaucoma, rise in geriatric population, growing healthcare infrastructure, growing need for safer and more efficient treatment. Major trends in the forecast period include adoption of MIGS devices, advancements in technology, development of innovative minimally invasive glaucoma surgery devices, development of advanced implantable devices, advances in ophthalmic technology.

The increasing prevalence of eye disorders is anticipated to drive the growth of minimally invasive glaucoma surgery (MIGS) devices in the future. Eye disorders cover a wide range of conditions affecting the eyes and vision, with their prevalence rising due to lifestyle changes, environmental factors, and aging populations. MIGS devices are innovative tools used to manage various eye diseases, primarily by reducing intraocular pressure (IOP) to prevent or control the progression of glaucoma. For example, according to the National Eye Institute, a US-based government agency, approximately 2.2 million Americans will be blind or partially blind by 2030. Consequently, the growing prevalence of eye disorders is propelling the MIGS devices market.

Leading companies in the MIGS devices market are focused on developing innovative products, such as stent injectable systems, to address unmet needs in glaucoma management and enhance patient outcomes. A stent injectable system is a MIGS device that delivers and implants a small stent into the body through an injection-like procedure, typically using a specialized delivery mechanism commonly employed in minimally invasive surgeries to treat conditions such as blocked or narrowed blood vessels. For instance, in August 2022, Glaukos Corporation, a US-based ophthalmic medical technology company, received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for the iStent Infinite Trabecular Micro-Bypass System. The iStent Infinite is a novel three-stent injectable system designed to provide foundational, 24/7 IOP control for patients with primary open-angle glaucoma (POAG) whose IOP remains uncontrolled despite prior medication and surgical therapy.

In July 2024, Alcon Inc., a Switzerland-based medical device company, acquired BELKIN Vision Inc. for $81 million. This strategic acquisition is intended to boost the global adoption of Direct Selective Laser Trabeculoplasty (DSLT) as a first-line treatment for glaucoma. BELKIN Vision Inc., an Israel-based medical device company, specializes in developing and manufacturing laser therapy devices for glaucoma treatment.

Major companies operating in the minimally invasive glaucoma surgery (MIGS) devices market are AbbVie Inc., Novartis AG, Alcon Inc., Bausch Health Companies Inc., Bausch & Lomb Incorporated Inc., Carl Zeiss Meditec AG, Santen Pharmaceutical Co. Ltd., Johnson & Johnson Vision Care Inc., Lumenis Ltd., Staar Surgical Company, Glaukos Corporation, Sight Sciences Inc., Ocular Therapeutix Inc., Iridex Corporation, Ellex Medical Lasers Ltd., New World Medical Inc, MicroSurgical Technology Inc., Nova Eye Medical Limited, Asico LLC, Ziemer Ophthalmic Systems AG, Transcend Medical, iSTAR Medical SA, Ivantis Group Inc., Allergan, InnFocus Inc.

North America was the largest region in the minimally invasive glaucoma surgery (MIGS) devices market in 2024. Asia Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the minimally invasive glaucoma surgery (MIGS) devices market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the minimally invasive glaucoma surgery (MIGS) devices market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Minimally invasive glaucoma surgery (MIGS) devices are medical tools designed to lower intraocular pressure (IOP) in glaucoma patients using less invasive techniques compared to traditional glaucoma surgeries. These devices aim to reduce complications, shorten recovery times, and improve patient outcomes by providing a safer, less invasive surgical option for managing glaucoma.

The main types of MIGS devices include valves, glaucoma drainage implants, glaucoma tube shunts, stents, and others. A glaucoma drainage implant, also known as an aqueous shunt or tube shunt, is a small device surgically placed in the eye to treat glaucoma. These devices are used in various surgeries, such as those for glaucoma combined with cataracts or stand-alone glaucoma procedures, targeting areas such as the trabecular meshwork and suprachoroidal space. They are distributed through various channels, including direct tender and retail sales, and are utilized by end users such as ophthalmology clinics and ambulatory surgery centers (ASCs).

The minimally invasive glaucoma surgery (MIGS) devices market research report is one of a series of new reports that provides minimally invasive glaucoma surgery (MIGS) devices market statistics, including minimally invasive glaucoma surgery (MIGS) devices industry global market size, regional shares, competitors with a minimally invasive glaucoma surgery (MIGS) devices market share, detailed minimally invasive glaucoma surgery (MIGS) devices market segments, market trends and opportunities, and any further data you may need to thrive in the minimally invasive glaucoma surgery (MIGS) devices industry. This minimally invasive glaucoma surgery (MIGS) devices research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The minimally invasive glaucoma surgery (MIGS) devices market consists of revenues earned by entities by providing canal-based procedures, viscocanalostomy, and canaloplasty procedures. The market value includes the value of related goods sold by the service provider or included within the service offering. The minimally invasive glaucoma surgery (MIGS) devices market also includes sales of glaucoma drainage implants, glaucoma tube shunts, and invasive devices. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Minimally Invasive Glaucoma Surgery (MIGS) Devices Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on minimally invasive glaucoma surgery (migs) devices market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for minimally invasive glaucoma surgery (migs) devices ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The minimally invasive glaucoma surgery (migs) devices market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Valves; Glaucoma Drainage Implant; Glaucoma Tube Shunts; Stents; Other Products2) By Surgery: Glaucoma in Conjunction With Cataract; Stand Alone Glaucoma

3) By Target: Trabecular Meshwork; Suprachoroidal Space; Other Targets

4) By Distribution Channel: Direct Tender; Retail Sales

5) By End User: Ophthalmology Clinics; Ambulatory Surgery Centers (ASCS); Other End Users

Subsegments:

1) By Valves: Micro Shunt Valves; Non-penetrating Valves2) By Glaucoma Drainage Implant: Scleral Drainage Implants; Subconjunctival Drainage Implants

3) By Glaucoma Tube Shunts: Ahmed Tube Shunt; Baerveldt Tube Shunt

4) By Stents: Ab-Interno Stents; Ab-Externo Stents

5) By Other Products: Cyclodestructive Devices; Trabecular Bypass Devices

Key Companies Mentioned: AbbVie Inc.; Novartis AG; Alcon Inc.; Bausch Health Companies Inc.; Bausch & Lomb Incorporated Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Minimally Invasive Glaucoma Surgery (MIGS) Devices market report include:- AbbVie Inc.

- Novartis AG

- Alcon Inc.

- Bausch Health Companies Inc.

- Bausch & Lomb Incorporated Inc.

- Carl Zeiss Meditec AG

- Santen Pharmaceutical Co. Ltd.

- Johnson & Johnson Vision Care Inc.

- Lumenis Ltd.

- Staar Surgical Company

- Glaukos Corporation

- Sight Sciences Inc.

- Ocular Therapeutix Inc.

- Iridex Corporation

- Ellex Medical Lasers Ltd.

- New World Medical Inc

- MicroSurgical Technology Inc.

- Nova Eye Medical Limited

- Asico LLC

- Ziemer Ophthalmic Systems AG

- Transcend Medical

- iSTAR Medical SA

- Ivantis Group Inc.

- Allergan

- InnFocus Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 0.9 Billion |

| Forecasted Market Value ( USD | $ 2.42 Billion |

| Compound Annual Growth Rate | 28.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |