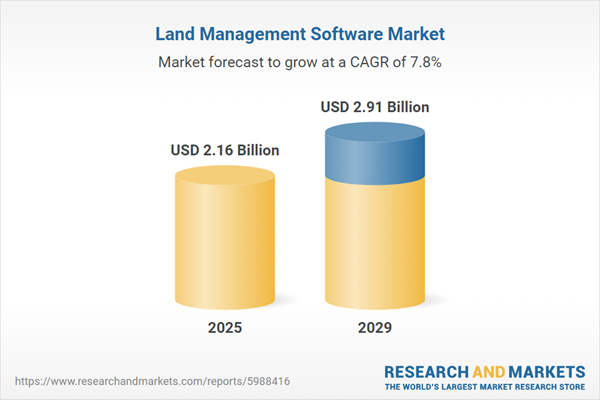

The land management software market size has grown strongly in recent years. It will grow from $2 billion in 2024 to $2.16 billion in 2025 at a compound annual growth rate (CAGR) of 8.1%. The growth in the historic period can be attributed to rising advanced technological infrastructure, adoption of digital solutions in real estate and land-related activities, real estate and urban development sectors, demand for sophisticated land management software, stringent environmental regulations.

The land management software market size is expected to see strong growth in the next few years. It will grow to $2.91 billion in 2029 at a compound annual growth rate (CAGR) of 7.8%. The growth in the forecast period can be attributed to the growing demand for novel software solutions, increasing need for effective land administration, the growing use of digital solutions to improve compliance and productivity. Major trends in the forecast period include integration of advanced geospatial intelligence, technological breakthroughs like AI-powered analytics, rising GIS integration, cutting-edge software development, benchmarks in the development.

The increasing adoption of digital solutions to enhance compliance and productivity is poised to drive the expansion of the land management software market in the future. Digital solutions, which leverage technology to address specific challenges and improve efficiency, accuracy, and user experiences, encompass software, hardware, or hybrid solutions. The growing utilization of digital solutions necessitates heightened efficiency, accuracy improvement, cost reduction, process streamlining, real-time data accessibility, and the provision of scalable and adaptable tools. Within this framework, digital solutions utilize land management software to streamline and optimize land resource planning, development, and maintenance. This is achieved through the integration of data analysis, geographic information systems (GIS), and automated workflows to bolster decision-making and operational efficiency. For instance, data from Augusta Free Press in December 2022 indicated that global spending on digital transformation reached approximately $1.85 trillion, marking a 16% increase from the previous year, underscoring the uptrend in digital solution adoption. Consequently, the mounting use of digital solutions to enhance compliance and productivity serves as a catalyst for the growth of the land management software market.

Key players in the land management software market are directed towards developing marketplace platforms, including integrations for property management software, to streamline the presentation design process, thereby facilitating quicker and more efficient user experiences. These marketplace platforms serve as digital ecosystems connecting property managers, landlords, and tenants with a range of property management tools and services. For example, in June 2022, AppFolio Inc., a US-based software company, introduced the AppFolio Stack Marketplace, a platform aimed at modernizing integrations for property management software. This platform is designed to offer specialized solutions enabling property managers to effectively manage complex portfolios and operate their businesses from a centralized hub. Through the integration of various solutions, property managers can enhance productivity, streamline workflows, and elevate resident experiences.

In September 2022, Guesty, an Israel-based provider of property management software, completed the acquisition of Kigo and HiRUM Software Solutions for an undisclosed sum. This strategic move by Guesty involves the consolidation of teams, expansion of global presence, reinforcement of research and development efforts, and enhancement of product offerings. The acquisition aligns with Guesty's growth strategy of penetrating new markets and delivering a comprehensive solution for property managers and hospitality professionals worldwide. Kigo, headquartered in Spain, specializes in cloud-based property management software for short-term vacation rentals, while HiRUM Software Solutions, based in Australia, focuses on property management software.

Major companies operating in the land management software market are CBRE Group Inc., Jones Lang LaSalle Incorporated, Cushman & Wakefield Inc., Borealis AG, Colliers International Group Inc., Essex Property Trust Inc., Stream Realty Partners LP, Kidder Mathews Inc., Quorum Software Solutions Inc., CSM Technologies, Constellation HomeBuilder Systems, Accela Inc., Pandell Technology Corporation, Peloton Computer Enterprises Inc., Computronix LLC, Building Engines Inc., Avison Young Inc., MaintStar, Cortland, Tyler Technologies Inc., Bitco Software, Citizenserve, CyberSWIFT, Edward Rose Building Enterprise.

North America was the largest region in the land management software market in 2024. The regions covered in the land management software market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the land management software market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Land management software encompasses specialized digital tools and platforms crafted to aid organizations, governments, and individuals in effectively managing, analyzing, and optimizing land resources. Typically, this software includes features for mapping and surveying, property and asset management, environmental monitoring, compliance tracking, and data analysis.

The main product types of land management software are web-based and on-premise. Web-based land management software is hosted on remote servers and accessed through the internet using a web browser. These solutions find applications in various sectors such as residential, commercial, and are utilized by diverse end-users including government agencies, real estate firms, oil and gas companies, among others.

The land management software market research report is one of a series of new reports that provides land management software market statistics, including land management software industry global market size, regional shares, competitors with a land management software market share, detailed land management software market segments, market trends and opportunities, and any further data you may need to thrive in the land management software industry. This land management software market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The land management software market includes revenues earned by entities through annual subscription fees, usage-based pricing, and licensing fees. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Land Management Software Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on land management software market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for land management software ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The land management software market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product Type: Web-Based; on-Premise2) By Application: Residential; Commercial

3) By End-User: Government; Real Estate; Oil and Gas; Other End Users

Subsegments:

1) By Web-Based: Cloud-Based Solutions; SaaS (Software as a Service) Solutions; Hosted Solutions2) By on-Premise: Single-User Solutions; Multi-User Solutions; Enterprise Solutions

Key Companies Mentioned: CBRE Group Inc.; Jones Lang LaSalle Incorporated; Cushman & Wakefield Inc.; Borealis AG; Colliers International Group Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Land Management Software market report include:- CBRE Group Inc.

- Jones Lang LaSalle Incorporated

- Cushman & Wakefield Inc.

- Borealis AG

- Colliers International Group Inc.

- Essex Property Trust Inc.

- Stream Realty Partners LP

- Kidder Mathews Inc.

- Quorum Software Solutions Inc.

- CSM Technologies

- Constellation HomeBuilder Systems

- Accela Inc.

- Pandell Technology Corporation

- Peloton Computer Enterprises Inc.

- Computronix LLC

- Building Engines Inc.

- Avison Young Inc.

- MaintStar

- Cortland

- Tyler Technologies Inc.

- Bitco Software

- Citizenserve

- CyberSWIFT

- Edward Rose Building Enterprise

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.16 Billion |

| Forecasted Market Value ( USD | $ 2.91 Billion |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |