The Germany market dominated the Europe Float Glass Market by Country in 2023, and is forecast to continue being a dominant market till 2031; thereby, achieving a market value of $2.52 billion by 2031. The UK market is exhibiting a CAGR of 3.2% during (2024 - 2031). Additionally, The France market is projected to experience a CAGR of 4.9% during (2024 - 2031).

Technological innovations have been instrumental in the development of the market. Innovations in production techniques and material science have enabled the development of specialized glass products that meet the specific needs of various industries. For instance, low-emissivity (Low-E) glass is intended to enhance energy efficiency and mitigate heat transfer in buildings, rendering it a critical element of sustainable construction practices.

Similarly, tempered glass, which undergoes a heat treatment process to increase its strength, is widely used in applications requiring enhanced safety and durability, such as automotive windows and building facades. The expansion of the automotive industry significantly propels the demand for float glass, particularly in the production of vehicle windows and windshields. The automotive sector is a major consumer of float glass due to its essential role in providing vehicles visibility, safety, and structural integrity.

Europe's commitment to renewable energy and the widespread adoption of solar panels drive the demand for float glass in the energy sector. The region's focus on innovation and sustainability continues to propel the growth of the float glass market. In the United Kingdom, the expansion of the energy sector, particularly renewable energy, is a major factor driving the demand for float glass. According to the UK Department for Business, Energy & Industrial Strategy (BEIS), the UK generated 50.9% of its electricity from renewable sources in the first quarter of 2024, with a significant contribution from solar power.

Moreover, France's commitment to renewable energy, particularly solar energy, is significant. The French solar fleet reached 18 GW at the end of the first semester of 2023. This expansion in the solar energy sector increases the demand for float glass used in photovoltaic panels and other solar applications. Hence, the European float glass market is poised for continued growth in the coming years.

List of Key Companies Profiled

- AGC Inc.

- Asahi India Glass Limited

- Cardinal Glass Industries, Inc.

- Central Glass Co., Ltd.

- Fuyao Glass Industry Group Co., Ltd.

- Guardian Industries Corporation (Koch Industries)

- Nippon Sheet Glass Co. Ltd.

- Saint-Gobain S.A.

- Taiwan Glass Ind. Corp.

- Xinyi Glass Holdings Limited

Market Report Segmentation

By End-use- Building & Construction

- Automotive & Transportation

- Energy

- Others

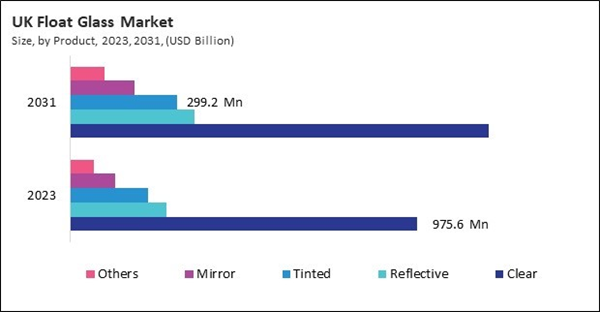

- Clear

- Reflective

- Tinted

- Mirror

- Others

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

Table of Contents

Companies Mentioned

- AGC Inc.

- Asahi India Glass Limited

- Cardinal Glass Industries, Inc.

- Central Glass Co., Ltd.

- Fuyao Glass Industry Group Co., Ltd.

- Guardian Industries Corporation (Koch Industries)

- Nippon Sheet Glass Co. Ltd.

- Saint-Gobain S.A.

- Taiwan Glass Ind. Corp.

- Xinyi Glass Holdings Limited