Key Highlights:

- The North America market dominated Global Virtual Studio Market in 2024, accounting for a 32% revenue share in 2024.

- The U.S. market is projected to maintain its leadership in North America, reaching a market size of USD 6.66 billion by 2032.

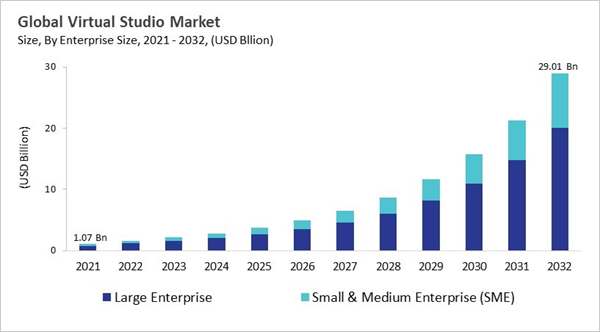

- Among the various Enterprise Size, the Large Enterprise segment dominated the global market, contributing a revenue share of 70.70% in 2024.

- In terms of End Use, Online Videos segment are expected to lead the global market, with a projected revenue share of 30.50% by 2032.

- Software emerged as the leading Component in 2024, capturing a 54.67% revenue share, and is projected to retain its dominance during the forecast period.

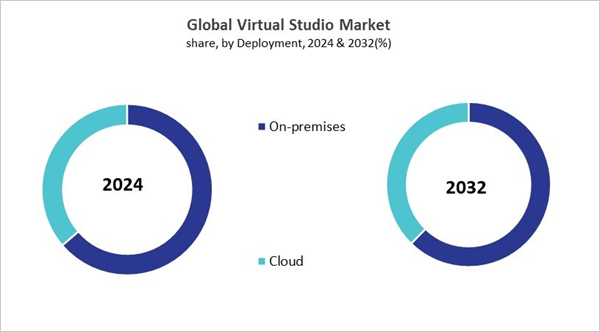

- The On-premises segment in Deployment is poised to grow at the market in 2032 with a market size of USD 18.07 billion and is projected to maintain its dominant position throughout the forecast period.

- By Application the Virtual Sets and Environments Segment captured the market size of USD 893.52 million in 2024 and this segment will maintain its position during the forecast period.

The global virtual studio market has evolved as highly advanced, AI-based production eco-systems that integrate LED walls, real-time CGI, remote workflows, and cloud integration. Elements such as the adoption of decentralized production by BT Sport, the partnership between Sony and USC, and government supported initiatives such as Belfast’s Studio Ulster indicates how academia, public, and industry initiatives altogether are supporting the growth of the virtual studio market. Additionally, key players like Industrial Light & Magic (ILM), Epic Games, NVIDIA, ARWALL, and Disguise are creating the technological foundation of the industry through LED volume technologies, cutting-edge rendering engines, high-performance computing, and XR platforms. These enhancements are making virtual studios versatile, deeply immersive, and cost-effective alternatives to traditional production approaches.

Competition in the virtual studio market is now increasing as infrastructure operators and technology providers such as Studio Ulster and Amazon are establishing LED stages deployed with automation and cloud technology to expand the capabilities. The virtual studio market growth is mainly driven by factors such as decentralized production workflow assuring continuity and scalability, partnerships within industry, academia, and government to support upskilling & reskilling, and imagery via LED volumes for real-time immersive in-camera visuals. These factors have evolved the virtual studio market to essential production hubs globally capable of optimising creativity, accessibility, as well as efficiency in content creation.

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In June, 2025, Sony Corporation unveiled the Crystal LED CAPRI series to make virtual production more accessible. With high brightness, advanced color accuracy, and flexible installation, CAPRI supports Sony’s virtual production ecosystem. It offers cost-effective, high-quality display solutions for TV, film, and broadcast, complementing the premium VERONA series with seamless integration. Additionally, In June, 2025, Autodesk, Inc. unveiled MotionMaker, an AI-powered animation tool in Maya that enables artists to animate characters using minimal input like keyframes or motion paths. Designed for layout to hero animation, it speeds up workflows, simulating mocap studio effects virtually and significantly reducing animation time while enhancing creative control.

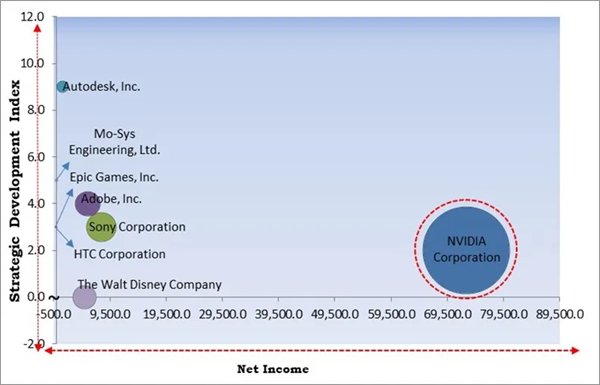

KBV Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the KBV Cardinal matrix; NVIDIA Corporation is the forerunner in the Virtual Studio Market. Companies such as Sony Corporation, Adobe, Inc., and The Walt Disney Company are some of the key innovators in Virtual Studio Market.

COVID-19 Impact Analysis

The COVID-19 pandemic speed up the use of virtual studio technologies by a lot because traditional film, TV, and live event production were severely disrupted. When lockdowns happened, content creators used real-time rendering engines, virtual sets, and augmented reality to keep working from home. Broadcasters, teachers, and event planners used cloud-based workflows, motion tracking, and virtual collaboration more and more to connect with people without being there in person. The change brought about problems like upgrading infrastructure and training staff on new technologies, but it also sped up the industry's digital transformation. Thus, the COVID-19 had negative impact on the market.Driving and Restraining Factors

Drivers- Rising Demand for Real-Time Content Production

- Cost Efficiency and Reduced Physical Infrastructure

- Adoption of Remote and Virtual Collaboration Tools

- Technological Advancements in Virtual Production Software

- High Initial Setup Cost and Infrastructure Requirements

- Technical Complexity and Steep Learning Curve

- Limited Accessibility in Emerging and Rural Markets

- Integration of AI and Machine Learning for Smart Virtual Production

- Expansion into Healthcare, Training, and Crisis Simulation

- Monetization through Virtual Events, Sponsorships, and Interactive Commerce

- Maintaining Creative Authenticity and Storytelling Depth in Virtual Environments

- Fragmented Ecosystem and Lack of Interoperability Between Tools

- Difficulty in Measuring ROI and Long-Term Value of Virtual Studio Investments

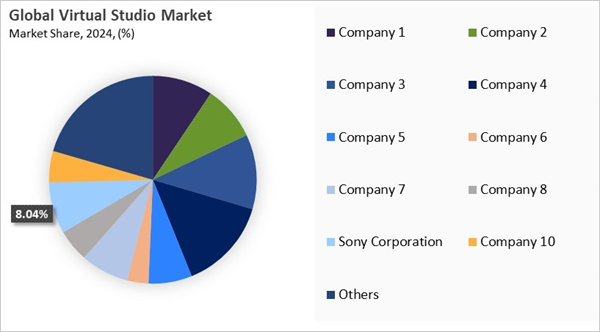

Market Share Analysis

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, Product Launches and Product Expansions, and Partnerships & Collaborations.

Deployment Outlook

Based on Deployment, the market is segmented into On-premises and Cloud. The Cloud segment acquired a 36.3% revenue share in the market in 2024. Cloud deployment offers seamless access to virtual production tools from anywhere, enabling remote collaboration and quicker project turnaround times. It is particularly attractive to small and medium-sized enterprises and content creators with limited infrastructure.Application Outlook

Based on Application, the market is segmented into Virtual Sets and Environments, Motion Capture and Tracking, Rendering and Animation, Live Streaming and Broadcasting, Post-Production Editing, and Other Application. The Motion Capture and Tracking segment acquired 20.6% revenue share in the market in 2024. Motion capture and tracking technologies are widely adopted for creating realistic character movements and interactive scenes. They are essential in applications such as gaming, movies, and live events, where precision and fluidity of movement are crucial. These systems help translate human performance into digital formats, enhancing storytelling through lifelike animations.Enterprise Size Outlook

Based on Enterprise Size, the market is segmented into Large Enterprise and Small & Medium Enterprise (SME). The Small & Medium Enterprise (SME) segment gained a 29.3% revenue share in the market in 2024. These businesses are embracing flexible, affordable virtual production tools that don’t require major infrastructure investments. With the growth of cloud-based platforms and mobile-friendly technologies, SMEs are increasingly able to produce high-quality content on tighter budgets. This accessibility is helping smaller studios, independent creators, and boutique agencies to compete in digital storytelling and marketing.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The North America segment recorded 32% revenue share in the market in 2024. In North America and Europe regions, the virtual studio market is predicted to witness growth supported by rising acceptance of broadcasting technologies, increased investment in real-time rendering and AR/VR, and significant penetration of digital media. Live event organizers, film studios, and broadcasters across these regions are integrating virtual studios to decrease production costs and increase viewer engagement. The presence of significant tech giants and growing acceptance by media giants in nations like the US is resulting in expansion in the North American market. Further, Europe region experiences expansion from sports networks, public broadcasters, and entertainment hubs such as Germany and the UK, where demand for immersive virtual production and content is continuously growing.The virtual studio market in the Asia-Pacific and LAMEA regions is also growing, mainly led by nations such as Japan, India, South Korea, and China. These nations are witnessing increased acceptance from the growing film industry, the growth of esports, and governments' supportive behaviour towards the digital transformation of entertainment and media. In addition, the rising consumption of virtual content and the affordability of advanced graphic solutions are supporting the market expansion. The virtual studio market in the LAMEA region is also promising because of steady investment in regional entertainment industries, live events, and digital broadcasting, especially in the Middle East region. These regions represent numerous opportunities for market players as virtual production becomes widely adopted across the globe.

Market Competition and Attributes

Competition in the virtual studio market remains high as numerous mid-sized companies, startups, and regional providers aggressively innovate with cost-effective solutions and niche offerings. The absence of dominant leaders creates a fragmented environment where firms compete heavily on technology, customization, pricing, and service quality, intensifying rivalry to capture market share.

Recent Strategies Deployed in the Market

- Jun-2025: HTC Corporation unveiled Viverse Worlds, a web-based platform for sharing interactive 3D content with no downloads. It allows creators to build and distribute immersive scenes using no-code tools, with features like polygon streaming, WebXR support, and Gaussian splats - enabling high-fidelity, accessible virtual experiences across devices for gaming, e-commerce, and more.

- May-2025: Autodesk, Inc. teamed up with Varjo, a Finnish manufacturer of virtual reality, augmented reality and mixed reality headsets to integrate its VRED 2025.1 software with Varjo’s XR-4 mixed reality headset. This collaboration enhances virtual studio capabilities for industrial design, especially in automotive sectors, offering advanced tools like hand tracking, eye tracking, and real-time collaboration for immersive, efficient 3D design workflows.

- Oct-2024: Epic Games, Inc. unveiled Fab, a unified marketplace combining Unreal Engine Marketplace, Quixel, Sketchfab, and soon ArtStation. It offers developers assets for games, film, and virtual production. Despite concerns over content preservation and limited features, Epic assures creators their assets remain accessible and future platform enhancements are underway.

- May-2024: Autodesk, Inc. acquired Wonder Dynamics, creators of the AI-powered Wonder Studio platform, to simplify 3D animation and VFX creation. This cloud-based tool integrates with Autodesk Maya, enabling artists to animate 3D characters in live-action scenes more efficiently, supporting Autodesk’s mission to make media production more accessible and streamlined.

- Nov-2023: Adobe, Inc. acquired Rephrase, a text-to-video AI platform, to strengthen its generative AI video capabilities. Rephrase allows users to create professional videos using digital avatars and custom scripts. This move enhances Adobe’s Creative Cloud suite, enabling faster video content creation with AI-powered tools for enterprises and content creators.

List of Key Companies Profiled

- Adobe, Inc.

- Autodesk, Inc.

- NVIDIA Corporation

- Epic Games, Inc.

- Mo-Sys Engineering, Ltd.

- 360Rize

- The Walt Disney Company

- HTC Corporation

- Sony Corporation

- Boris FX, Inc.

Market Report Segmentation

By Enterprise Size

- Large Enterprise

- Small & Medium Enterprise (SME)

By End Use

- Online Videos

- Movies

- TV Shows

- Commercial Ads

- Other End Use

By Component

- Software

- Services

By Deployment

- On-premises

- Cloud

By Application

- Virtual Sets and Environments

- Motion Capture and Tracking

- Rendering and Animation

- Live Streaming and Broadcasting

- Post-Production Editing

- Other Application

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Adobe, Inc.

- Autodesk, Inc.

- NVIDIA Corporation

- Epic Games, Inc.

- Mo-Sys Engineering, Ltd.

- 360Rize

- The Walt Disney Company

- HTC Corporation

- Sony Corporation

- Boris FX, Inc.