The robust automotive industry in the United States and Canada, known for incorporating advanced glass technologies in vehicle manufacturing, contributes significantly to the market. The North America segment garnered 22% revenue share in the market in 2023. The thriving construction industry and the growing emphasis on energy-efficient and sustainable building practices primarily drive the region's demand for float glass. Innovations in smart glass and advanced glazing solutions, coupled with stringent building codes and energy efficiency regulations, propel the demand for float glass in North America.

State-of-the-art equipment and techniques are employed in the production of high-quality float glass, ensuring that there are minimal defects. These advancements have made it possible to produce glass with better optical clarity, enhanced strength, and greater uniformity, meeting the stringent requirements of various industries. Automation and precision control systems in production have also played a crucial role in minimizing waste, reducing production costs, and increasing overall output. Hence, these technological advancements have expanded float glass applications, driving the market's growth.

Moreover, there is a significant push to implement materials and building practices that promote sustainable development and enhance energy efficiency as the global community becomes more cognizant of the environmental impact of energy consumption. One of the standout materials in this movement is energy-efficient glass, particularly low-emissivity (Low-E) glass. The level of visible light is not compromised by the special coating that is used to lower the amount of ultraviolet (UV) and infrared light that can travel through low-E glass. The integration of Low-E glass into building designs not only improves occupant comfort and building aesthetics but also improves energy efficiency. Thus, these factors will support the growth of the market.

However, the production of float glass entails the continuous melting of raw materials at extremely high temperatures, followed by the flotation of the molten glass on a bed of molten tin to obtain a flat and uniform surface. This process demands highly specialized equipment, such as large-scale furnaces, tin baths, annealing lehrs, and cutting machines, which are costly to purchase and maintain. Smaller manufacturers, however, may struggle to achieve similar efficiencies, potentially leading to higher per-unit costs and reduced competitiveness in the market. Hence, high production costs are a significant challenge for the float glass industry.

Driving and Restraining Factors

Drivers- Advancements In Manufacturing Technologies

- Increasing Awareness About Energy Efficiency and Sustainability

- Rapid Construction and Infrastructure Development

- Requirement for Significant Capital Investment

- Fluctuating Prices of Raw Materials

- Rapid Urbanization and Population Growth

- Supportive Government Regulations and Initiatives

- Strict Environmental Regulations Regarding Emissions and Waste Management

- Competition From Alternative Materials

Product Outlook

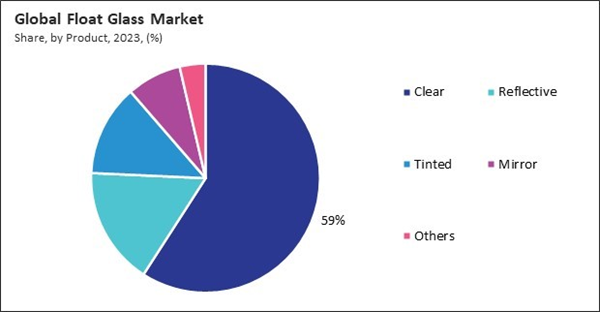

Based on product, the market is characterized into clear, tinted, reflective, mirror, and others. The clear segment garnered 59% revenue share in the market in 2023. This type of glass is known for its high transparency, optical clarity, and smooth surface, making it ideal for applications that require unobstructed views and maximum light transmission. Clear float glass is extensively used in residential and commercial buildings for windows, doors, partitions, and facades. The demand for natural light and open spaces in modern architectural designs has significantly boosted the adoption of clear float glass.End-use Outlook

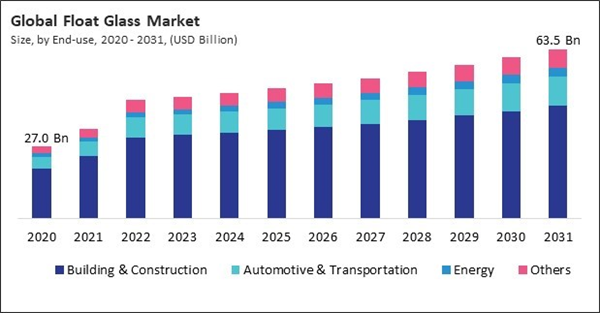

On the basis of end-use, the market is classified into automotive & transportation, building & construction, energy, and others. The energy segment recorded 5% revenue share in the market in 2023. The energy segment is being driven by the increasing emphasis on energy-efficient building materials and renewable energy sources. The rapid expansion of solar photovoltaic installations necessitates using float glass in solar panels to protect photovoltaic cells and ensure optimal performance.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment witnessed 54% revenue share in the float glass market in 2023. This dominance is fueled by the thriving construction industry, significant infrastructure development, and accelerated urbanization in countries such as China, India, and Japan. China, the largest producer and consumer of float glass, significantly influences the market due to its vast construction projects and robust automotive industry.List of Key Companies Profiled

- AGC Inc.

- Asahi India Glass Limited

- Cardinal Glass Industries, Inc.

- Central Glass Co., Ltd.

- Fuyao Glass Industry Group Co., Ltd.

- Guardian Industries Corporation (Koch Industries)

- Nippon Sheet Glass Co. Ltd.

- Saint-Gobain S.A.

- Taiwan Glass Ind. Corp.

- Xinyi Glass Holdings Limited

Market Report Segmentation

By End-use- Building & Construction

- Automotive & Transportation

- Energy

- Others

- Clear

- Reflective

- Tinted

- Mirror

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- AGC Inc.

- Asahi India Glass Limited

- Cardinal Glass Industries, Inc.

- Central Glass Co., Ltd.

- Fuyao Glass Industry Group Co., Ltd.

- Guardian Industries Corporation (Koch Industries)

- Nippon Sheet Glass Co. Ltd.

- Saint-Gobain S.A.

- Taiwan Glass Ind. Corp.

- Xinyi Glass Holdings Limited