Hospitals prioritize food safety and hygiene to prevent cross-contamination and ensure patient health. These knives designed for sanitation and easy cleaning contribute to maintaining high food safety standards in hospital kitchens. Consequently, the hospitals & medical establishments segment would acquire nearly, 14% of the total market share by 2031. Also, the Russian hospitals & medical establishments would register a volume of 588.71 thousand units by 2031. Hospitals cater to the diverse dietary requirements of patients, including specialized diets prescribed for medical conditions.

With increasing interest in cooking and culinary arts, consumers are placing greater importance on using professional-grade equipment, including knives. Similarly, professional chefs and cooking enthusiasts recognize the superior performance of high-quality knives in cutting precision, balance, and comfort. Hence, rising consumer demand for high-quality kitchen tools drives the market's growth. Additionally, Culinary schools and training programs emphasize the importance of using professional-grade knives to develop essential knife skills among aspiring chefs and culinary professionals. Moreover, culinary education institutions adhere to industry standards that emphasize using professional-grade knives in culinary practices. Therefore, expansion of education and training in culinary arts is driving the market's growth.

However, Commercial kitchen operators often face budget limitations, especially for small or independent establishments. In addition, the availability of cheaper knives in the market provides viable alternatives for cost-conscious buyers. Therefore, the high cost of quality knives hinders the market's growth.

Driving and Restraining Factors

Drivers- Rising consumer demand for high-quality kitchen tools

- Expansion of the education and training in culinary arts

- Growth of the food service industry worldwide

- High cost of quality knives

- Maintenance and sharpening requirements

- Rising Prominence of culinary arts and cooking shows

- Adoption of subscription-based models

- Availability of cheaper alternatives

- Shift towards pre-packaged and pre-cut foods

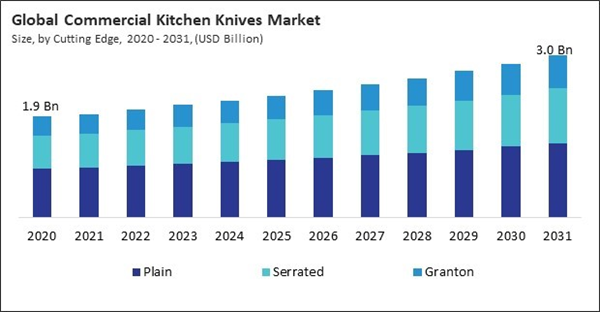

Cutting Edge Outlook

Based on cutting edge, the market is divided into plain, granton, and serrated. The serrated segment attained a 32.9% revenue share in the market in 2023. Also, the segment registered a volume of 23.48 million units in 2023. Serrated knives excel in cutting through tough crusts and delicate interiors of bread, cakes, and pastries without crushing them. This capability ensures clean and precise cuts, which is crucial for maintaining the integrity and presentation of baked goods in commercial settings.Type Outlook

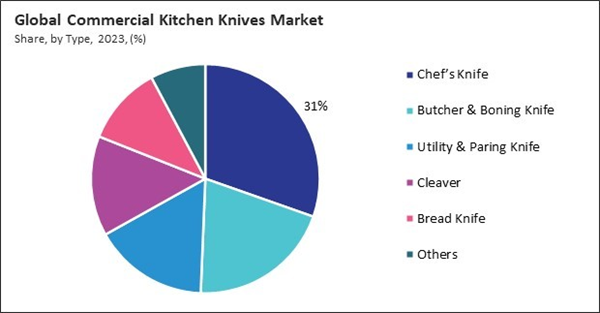

On the basis of type, the market is segmented into chef’s knife, utility & paring knife, butcher & boning knife, bread knife, cleaver, and others. In 2023, the butcher & boning knife segment attained a 20.2% share in the market. Butcher and boning knives are designed specifically for deboning, trimming, and portioning meats, poultry, and fish. Their specialized blade shapes and profiles allow chefs and butchers to perform these tasks efficiently and precisely, ensuring maximum yield and minimal waste.End Use Outlook

By end use, the market is divided into food service, hospitality, hospitals & medical establishments, meat processing industry, butcher shops, slaughterhouses, institutional, and others. The hospitality segment procured 19.5% revenue share in the market in 2023. Also, the segment procured registered a volume of 12.19 million units in 2023. Hospitality establishments prioritize delivering high-quality dining experiences to guests. These knives are crucial for chefs and kitchen staff to maintain consistency and excellence in food preparation, ensuring that meals meet the expectations of discerning guests.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region witnessed 36.15% revenue share in the market in 2023. North America, particularly the United States and Canada, strongly emphasizes food quality, presentation, and culinary innovation. To maintain these high standards across various food service establishments, these knives are essential for chefs and kitchen professionals.List of Key Companies Profiled

- Werhahn KG

- Morakniv AB

- Wüsthof

- YOSHIDA METAL INDUSTRY CO., LTD.

- MAC Knife, Inc.

- Dick GmbH & Co. KG

- Kyocera Corporation

- KAI CORPORATION

- Mercer Tool Corporation

- Dexter-Russell, Inc.

Market Report Segmentation

By Cutting Edge (Volume, Thousand Units, USD Billion, 2020-2031)- Plain

- Serrated

- Granton

- Chef’s Knife

- Butcher & Boning Knife

- Utility & Paring Knife

- Cleaver

- Bread Knife

- Others

- Food Service

- Hospitality

- Hospitals & Medical Establishments

- Meat Processing Industry

- Butcher Shops

- Slaughterhouses

- Institutional

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Wilh. Werhahn KG

- Morakniv AB

- Wüsthof

- YOSHIDA METAL INDUSTRY CO., LTD.

- MAC Knife, Inc.

- Friedr. Dick GmbH & Co. KG

- Kyocera Corporation

- KAI CORPORATION

- Mercer Tool Corporation

- Dexter-Russell, Inc.