Expansion of E-commerce has made baby strollers more accessible to a broader audience. According to the International Trade Administration (ITA), over 80% of internet users in France, or 41.8 million people, made purchases online in 2021. Online buyers tend to shop more frequently, about 50 times a year, with an average transaction value of $73 (€62) in 2021. Therefore, the E-commerce segment registered $763.1 million revenue in the market in 2023. In terms of volume, it is expected that 1.16 million units of baby strollers would be sold by the year 2031.

Online retailers often provide detailed product descriptions, customer reviews, and support services that enhance decision-making and the shopping experience. Parents and caregivers can peruse a variety of stroller models, compare prices, read reviews, and make a purchase from the convenience of their homes or via mobile devices.

As economies grow and household incomes rise, parents have more discretionary income for their children’s needs, including baby strollers. Higher disposable incomes enable families to invest in premium strollers with advanced features and durability. Modern parents prioritize safety, comfort, and convenience when selecting baby products, including strollers. They are willing to invest in high-quality strollers that offer superior design, materials, and functionality to ensure the well-being of their children. Hence, growing consumer spending on baby care products propels the market's growth.

Moreover, traveling with infants or toddlers requires convenient and easy-to-use transportation solutions. Baby strollers provide a comfortable way to move children around airports, train stations, tourist attractions, and other destinations. They offer parents and caregivers the ability to easily navigate crowded places, ensuring both safety and comfort for the child. With increasing globalization and easier access to travel opportunities, more families travel domestically and internationally. Hence, rising tourism and travelling trends is driving the growth of the market.

However, Baby strollers have a relatively short period of use compared to other durable goods. Infants and toddlers quickly outgrow strollers as they transition to walking independently. This limited usage phase means that parents may not perceive strollers as long-term investments, potentially impacting their willingness to invest in higher-priced or premium models. Unlike products with longer life cycles, such as furniture or electronics, strollers do not typically undergo frequent replacement. Hence, the shorter life cycle is hindering the growth of the market.

Driving and Restraining Factors

Drivers- Growing Consumer Spending on Baby Care Products

- Rising Tourism and Travelling Trends

- E-Commerce And Online Retail Growth

- Shorter Life Cycle of Strollers

- Safety And Liability Concerns

- Aging Population and Grandparent Influence

- Growing Cultural Shifts and Parenting Trends

- Limited Use of Strollers

- Declining Birth Rates in Developed Countries

Product Type Outlook

Based on product type, the market is divided into lightweight strollers, full size stroller, jogging stroller, and double stroller. In 2023, the lightweight stroller segment garnered 38% revenue share in the market. In terms of volume, 12.34 million units of Lightweight strollers are expected to be sold by the year 2031. Lightweight strollers are easy to carry, lift, and maneuver, making them highly convenient for parents who are often on the go. They are ideal for navigating crowded spaces, public transportation, and traveling.Age Outlook

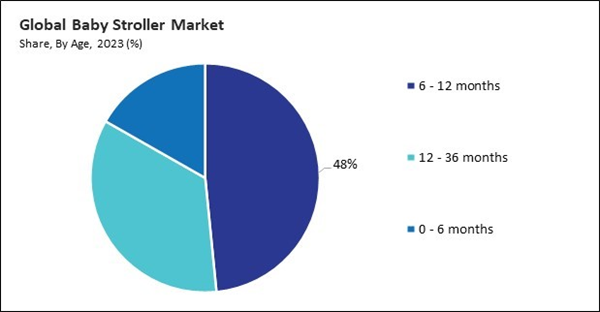

On the basis of age, the market is segmented into 12 - 36 months, 0 - 6 months, and 6 - 12 months. In 2023, the 12 - 36 months segment attained 35% revenue share in the market. In terms of volume, 12.57 million units of baby strollers for 12 - 36 months children are expected to be sold by the year 20361. Many parents continue using strollers beyond the infant stage to accommodate toddlers who may still benefit from occasional rest or naps during outings. Strollers for this age group are designed to support larger weights and heights.Distribution Channel Outlook

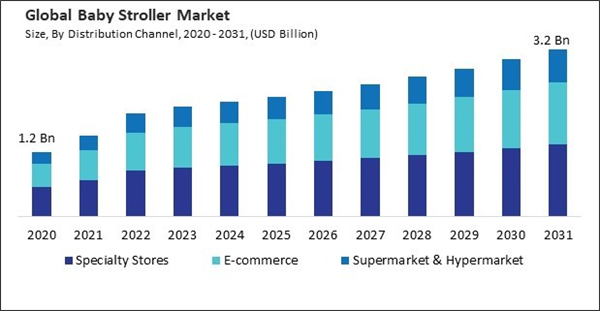

By distribution channel, the market is classified into supermarket & hypermarket, specialty store, and e-commerce. In 2023, the specialty store segment registered 45% revenue share in the market. In terms of volume, 8.01 million units of baby strollers were sold through Specialty stores in 2023. Specialty stores specializing in baby products typically have knowledgeable staff who can advise and guide parents. They understand the nuances of different stroller brands, models, and features, helping customers make informed purchasing decisions.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region witnessed 37% revenue share in the market in 2023. In North America, 11.08 million units of baby strollers would be utilized by the year 2031. North America has stringent safety standards and regulations governing baby products, including strollers. Consumers prioritize products that meet these standards, ensuring the safety and well-being of their children, which influences purchasing decisions.List of Key Companies Profiled

- Britax Child Safety, Inc. (BRITAX Childcare Group Ltd.)

- Dorel Juvenile Group, Inc.

- Peg Perego

- Artsana USA, Inc. (Artsana Group)

- Baby Bunting

- Newell Brands, Inc.

- Mothercare PLC

- Pigeon Corporation

- Summer Infant, Inc. (Kids2, Inc.)

- Goodbaby Internationl Holdings Ltd.

Market Report Segmentation

By Distribution Channel (Volume, Thousand Units, USD Billion, 2020-2031)- Specialty Stores

- E-commerce

- Supermarket & Hypermarket

- 6 - 12 months

- 12 - 36 months

- 0 - 6 months

- Lightweight Stroller

- Full Size Stroller

- Jogging Stroller

- Double Stroller

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Britax Child Safety, Inc. (BRITAX Childcare Group Ltd.)

- Dorel Juvenile Group, Inc.

- Peg Perego

- Artsana USA, Inc. (Artsana Group)

- Baby Bunting

- Newell Brands, Inc.

- Mothercare PLC

- Pigeon Corporation

- Summer Infant, Inc. (Kids2, Inc.)

- Goodbaby Internationl Holdings Ltd.