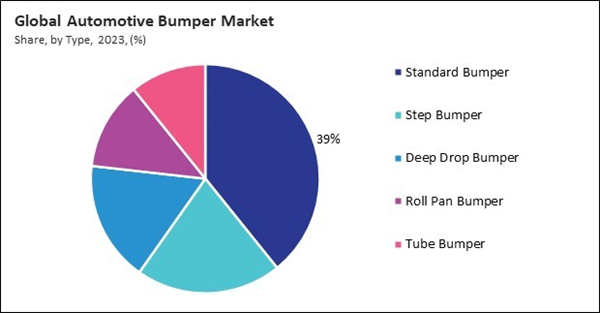

Step bumpers are particularly popular in utility vehicles and trucks, where their design offers additional functionality. The step bumper segment procured $3.05 billion revenue in the market in 2023. The built-in step feature provides easier access to the vehicle's cargo area, making them highly valued in applications where loading and unloading are frequent. This practical advantage has driven their adoption in both commercial and personal vehicles, contributing to their robust revenue performance in the market.

Rapid urbanization in emerging markets significantly transforms transportation needs, increasing demand for private and public vehicles. As cities expand and populations grow, efficient and reliable transportation becomes paramount. This surge in vehicle usage directly impacts the demand for automotive components, including bumpers, which are essential for vehicle safety and aesthetics.

Additionally, Technological advancements in the automotive industry have significantly reshaped the design and functionality of vehicle components, including bumpers. One key technological advancement in bumper manufacturing is using lightweight composites and advanced polymers. Traditional steel bumpers, while robust, are relatively heavy and can negatively impact a vehicle's fuel efficiency. In contrast, lightweight composites, such as carbon fiber-reinforced polymers and thermoplastics, offer superior strength-to-weight ratios. Thus, technological advancements in materials and manufacturing have revolutionized the automotive bumper market.

However, the cost of raw materials is a critical concern for manufacturers in the automotive bumper market, where price volatility can significantly impact production costs. Steel, aluminum, and advanced polymers are among the key commodities that are sensitive to market alterations. These alterations are impacted by a variety of circumstances, including fluctuations in global demand and supply, geopolitical conflicts, and changes in economic policy. In the event of tariffs on steel and aluminum or disruptions in the supply chain, bumper manufacturers may experience abrupt price spikes, which can result in increased expenses. Hence, the volatility in the prices of raw materials presents significant challenges for bumper manufacturers.

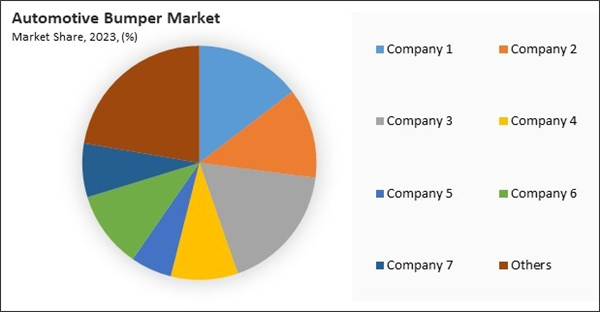

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Driving and Restraining Factors

Drivers- Urbanization And Infrastructure Development

- Innovations In Materials and Manufacturing Processes

- Growing Demand for Electric Vehicles (EVs)

- Price Volatility of Raw Materials

- Recycling And End-Of-Life Disposal

- Consumers’ Growing Preference for Aesthetics and Customization

- Substantial Growth of Aftermarket

- Intense Competition in The Automotive Bumper Market

- Shift Towards Alternative Mobility Solutions

Material Outlook

On the basis of material, the market is classified into steel, aluminum, fiber, and plastic. The plastic segment recorded 46% revenue share in the market in 2023. Plastic bumpers are primarily made from high-strength polymers and composites, providing excellent impact resistance and durability while significantly lighter than metal counterparts. This weight reduction is consistent with the industry's initiative to promote more environmentally favorable and efficient vehicles, as it enhances fuel efficiency and vehicle performance.Type Outlook

Based on type, the market is characterized into deep drop bumper, roll pan bumper, step bumper, tube bumper, and standard bumper. The tube bumper segment acquired 11% revenue share in the market in 2023. Tube bumpers are favored for their ruggedness and aesthetic appeal, making them popular among off-road enthusiasts and owners of sport utility vehicles (SUVs) and trucks. These bumpers are typically constructed from heavy-duty steel or aluminum tubing, providing enhanced protection and a distinctive look that appeals to consumers seeking durability and style.Vehicle Type Outlook

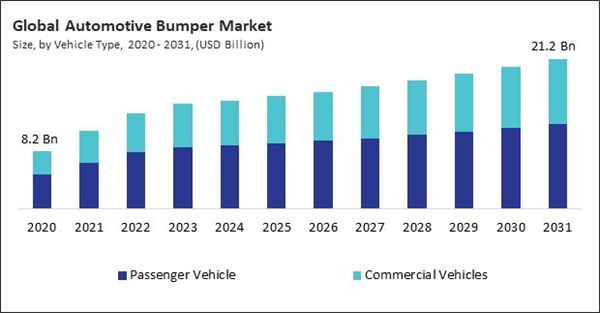

By vehicle type, the market is divided into passenger vehicle and commercial vehicles. The passenger vehicle segment garnered 59% revenue share in the market in 2023. The increasing demand for personal transportation, urbanization, and the increasing availability of disposable incomes have resulted in a high demand for passenger vehicles, such as sedans, hatchbacks, SUVs, and crossovers. These vehicles require bumpers that balance aesthetics, safety, and performance, driving continuous innovation in materials and design.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment acquired 38% revenue share in the market in 2023. This region's dominance is due to its substantial automotive production and sales volumes, which are fueled by large markets such as China, India, Japan, and South Korea. In these countries, the demand for automotive components, such as bumpers, has been fueled by a surge in vehicle ownership, which has been facilitated by rapid economic growth, urbanization, and increasing disposable incomes.List of Key Companies Profiled

- Forvia SE

- TOYOTA BOSHOKU CORPORATION

- Magna International, Inc.

- Hyundai Motor Company

- Flex-N-Gate Corporation

- OPmobility (Burelle SA)

- MONTAPLAST GmbH

- Warn Industries, Inc. (LKQ Corporation)

- Tong Yang Group

- Valeo SA

Market Report Segmentation

By Vehicle Type- Passenger Vehicle

- Commercial Vehicles

- Standard Bumper

- Step Bumper

- Deep Drop Bumper

- Roll Pan Bumper

- Tube Bumper

- Plastic

- Steel

- Aluminum

- Fiber

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Forvia SE

- TOYOTA BOSHOKU CORPORATION

- Magna International, Inc.

- Hyundai Motor Company

- Flex-N-Gate Corporation

- OPmobility (Burelle SA)

- MONTAPLAST GmbH

- Warn Industries, Inc. (LKQ Corporation)

- Tong Yang Group

- Valeo SA