Latin America Generic Drugs Market Analysis

Generic drugs use the same active ingredient and offer a similar therapeutic effect as their brand-name drugs. They don't need to go through expensive clinical studies to establish their efficacy and safety and thus typically cost less than their brand-name counterparts. The increasing demand for generic drugs in Latin American countries presents attractive growth opportunities for global generic drug manufacturers, especially as these economies are less saturated compared to North American or European markets. The rising penetration of international players in the region not only supports the global generic drug market expansion but also facilitates the introduction of a broad range of high-quality and cost-effective generic medications in the healthcare system. Further, the growing burden of chronic diseases and increasing patent expiration of branded medications is expected to accelerate the Latin America generic drugs market growth.The market is witnessing increased merger and acquisition activities among the key market players to enhance their technological capabilities and expand market reach. In October 2023, a multinational pharmaceutical company EuroPharma Inc., completed its acquisition of Colombia-based generic pharmaceutical company Genfar, making it the unified brand for generic medications in Latin America excluding Brazil. With this acquisition, EuroPharma took the second position in retail sales in Latin America and further reinforced its consolidation and internationalization strategy. Such partnerships are likely to improve the access and use of generic medications and are anticipated to augment market demand.

The Latin America generic drugs market share is influenced by the rising government initiatives that aim at increasing access, reducing costs, and addressing shortages of generic drugs. For instance, the Brazilian government has incorporated publicly funded production of generic medications as a key part of its national public health strategy, which is poised to ease access of generic drugs in the region. Additionally, in March 2024, a national public health foundation in Brazil, Fundação Oswaldo Cruz (Fiocruz) struck an agreement with pharmaceutical company Boehringer Ingelheim, allowing the foundation to manufacture generic empagliflozin, a diabetes drug known by the brand name Jardiance, for distribution in Brazil's public health system. Such initiatives are likely to ensure generic medication supply security and also bolster market growth.

Latin America Generic Drugs Market Segmentation

The report offers a detailed analysis of the market based on the following segments:Market Breakup by Therapy Area

- Cardiovascular

- Dermatology

- Respiratory

- Oncology

- Rheumatology

- Others

Market Breakup by Route of Administration

- Oral

- Injectables

- Dermal/Topical

- Inhalers

- Others

Market Breakup by Distribution Channels

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Others

Market Breakup by Region

- Brazil

- Mexico

- Others

Leading Players in the Latin America Generic Drugs Market

The key features of the market report include patent analysis, grants analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- Teva Pharmaceutical Industries Ltd

- Viatris Inc.

- Sun Pharmaceutical Industries Ltd

- Lupin

- AstraZeneca

- Baxter

- Takeda Pharmaceutical Company Limited

- GSK plc

- Bausch + Lomb

- Novartis AG

- Sanofi

- Pfizer Inc.

- Fresenius SE & Co. KGaA

- Aurobindo Pharma

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Teva Pharmaceutical Industries Ltd

- Viatris Inc.

- Sun Pharmaceutical Industries Ltd

- Lupin

- AstraZeneca

- Baxter

- Takeda Pharmaceutical Company Limited

- GSK plc

- Bausch + Lomb

- Novartis AG

- Sanofi

- Pfizer Inc.

- Fresenius SE & Co. KGaA

- Aurobindo Pharma

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | July 2025 |

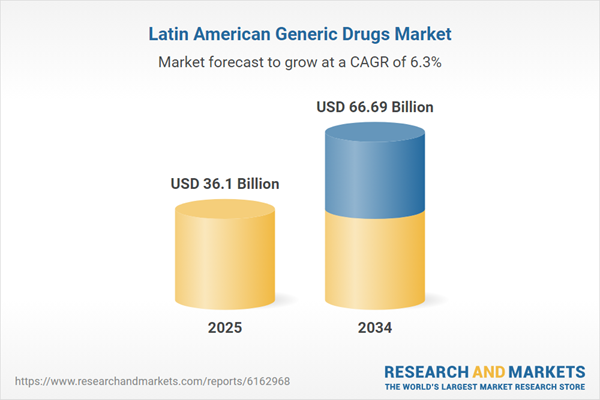

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 36.1 Billion |

| Forecasted Market Value ( USD | $ 66.69 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Latin America |

| No. of Companies Mentioned | 14 |