Global Fetal and Neonatal Care Equipment Market Overview

Fetal neonatal care equipment include a variety of medical tools and equipment that are intended for the monitoring, diagnosis, and care of developing fetuses and newborn children. Some of the key equipment involves X-ray, blood pressure monitor, nasogastric tube or orogastric tube, and ventilators, among others. Increasing incidence of neonatal disorders pose a major burden with 2.3 million children dying in the first 20 days of life in 2022. Furthermore, as per the data of World Health Organization (WHO), about 47% of deaths in children under 5 years of age occurred in the newborns. The market is driven by the premature birth, birth complications (birth asphyxia/trauma), neonatal infections among others.Global Fetal and Neonatal Care Equipment Market Growth Drivers

Increasing Prevalence of Preterm birth to Affect the Market Landscape Significantly

Preterm birth profoundly requires intensive medical intervention due to their underdeveloped organs and increased vulnerability to complications. According to the WHO, approximately 13.4 million babies were born preterm in 2020 (before 37 completed weeks of gestation) which means 1 in in 10 babies are born early. The preterm birth rates declined 1% in 2022 to 10.4%, following an increase of 4% from 2020 to 2021. Thus, the market growth is driven by the increase of neonatal care equipment.Increasing Incidence of Neonatal Disorders to Boost the Global Fetal and Neonatal Care Equipment Market Demand

According to the CDC data, every 33 newborns (or roughly 3% of all babies) born in the United States have issues at the time of birth each year. It is worth noting that among different disorders, the leading cause of death involves complications such as birth asphyxia or trauma, neonatal infections and congenital anomalies. Cumulatively, they account for nearly 4 out of every 10 deaths in children under the age of five. Rising incidence of neonatal disorders underscores the requirement of technically advanced equipment, thereby boosting the market growth.

Global Fetal and Neonatal Care Equipment Market Trends

The market is witnessing several trends and developments to improve the current global scenario. Some of the notable trends are as follows:Technological Innovations Targeting Preterm Birth Complications

Since preterm babies frequently have low birth weights, they need equipment made especially for their special requirements. To mitigate this, there has been a surge in technically advanced products in the market. Newborns are given proper care and support through includes tiny incubators, soft warming pads, and specialized feeding pumps, among others.Advancements in Perinatal Medicine

Development and uptake of fetal newborn care equipment are made possible by ongoing advances in perinatal medicine, including fetal therapy and interventions. With this, there is increase in the demand of safe and efficient equipment.Shift towards Non-invasive Monitoring

In fetal and neonatal care, there is a rising preference for non-invasive monitoring techniques due to the desire to reduce patient pain and the potential for problems from invasive procedures. Therefore, the demand of pulse oximeters, blood pressure monitors, among others is increasing.Emphasis on Infection Control and Safety

Infection control and safety are important in the neonatal care setting. To reduce the risk of neonatal infections, manufacturers are creating equipment with improved infection control characteristics, such as antimicrobial surfaces, disposable parts, and sophisticated sterilization techniques.Global Fetal and Neonatal Care Equipment Market Segmentation

The report titled “Fetal and Neonatal Care Equipment Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Product Type

- Fetal Care Equipment

- Fetal Dopplers

- Fetal Magnetic Resonance Imaging (MRI) Devices

- Fetal Ultrasound Devices

- Fetal Pulse Oximeters

- Other Fetal Care Equipment

- Neonatal Care Equipment

- Neonatal Incubators

- Neonatal Monitoring Devices

- Neonatal Phototherapy Equipment

- Neonatal Respiratory Assistance and Monitoring Devices

- Other Neonatal Care Equipment

Market Breakup by End User

- Hospitals

- Specialty Clinics

- Diagnostic Centers

- Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Global Fetal and Neonatal Care Equipment Market Share

Market Segmentation Based on Product Type is Anticipated to Witness Substantial Growth

Based on product type, the market segmentation includes fetal care equipment, and neonatal care equipment. Fetal care equipment usually includes fetal dopplers, fetal magnetic resonance imaging (MRI) devices, fetal ultrasound devices, fetal pulse oximeters and other fetal care equipment. Whereas neonatal care equipment is further divided into neonatal incubators, neonatal monitoring devices, neonatal phototherapy equipment, neonatal respiratory assistance and monitoring devices and other equipment. It provides support to newborn in the first 28 days. These market segments are anticipated to have a favorable impact on market dynamics over the projected period as demand for specialized care at all stages of pregnancy and infancy grows.Global Fetal and Neonatal Care Equipment Market Analysis by Region

Regionally, the market report offers an insight into North America, Europe, Asia Pacific, Latin America, Middle East, and Africa. North America and Europe, having a robust and technologically advanced healthcare infrastructure, is estimated to hold a high market value in the forecast period. Increasing collaborations between academic institutions and MedTech companies to boost research initiatives also fuel the region's market share.Asia Pacific is projected to witness substantial growth. It can be accredited to rising improvements in the healthcare infrastructure and rising birth rates. With rising demand for advanced medical equipment and improving access to healthcare services, countries like India and China are witnessing significant investments in maternal and child healthcare.

Leading Players in the Global Fetal and Neonatal Care Equipment Market

The key features of the market report include patent analysis, grants analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- Arjo

- Becton, Dickinson and Company

- Drägerwerk AG & Co. KGaA

- Fisher & Paykel Appliances Ltd

- GE Healthcare

- Masimo

- Medtronic

- Natus Medical Incorporated

- Koninklijke Philips N.V.

- Phoenix Medical Systems

- Smiths Group plc

- Utah Medical Products, Inc.

- Vyaire Medical, Inc.

Key Questions Answered in the Global Fetal and Neonatal Care Equipment Market Report

- What was the global fetal and neonatal care equipment market value in 2024?

- What is the global fetal and neonatal care equipment market forecast outlook for 2025-2034?

- What are the regional markets covered in the report?

- What is market segmentation based on product type?

- Who are the major end users in the market?

- What are the major factors aiding the global fetal and neonatal care equipment market demand?

- How has the fetal and neonatal care equipment market performed so far and how is it anticipated to perform in the coming years?

- What are the major market trends influencing the market?

- What are the market's major drivers, opportunities, and restraints?

- Which regional market is expected to lead the market share in the forecast period?

- Which country is expected to experience expedited growth during the forecast period?

- How does the incidence of nenonatal disorders affect the market landscape?

- How does the rise in the preterm birth impact the market size?

- What product type will dominate the market share?

- Which region is expected to have a high market value in the coming years?

- Which end-user will experience the highest demand in the market segment?

- Who are the key players involved in the fetal and neonatal care equipment market?

- What is patent landscape of the market?

- What are the current unmet needs and challenges in the market?

- How are partnerships, collaborations, mergers and acquisitions among the key market players shaping the market dynamics?

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Arjo

- Becton, Dickinson and Company

- Drägerwerk AG & Co. KGaA

- Fisher & Paykel Appliances Ltd

- GE Healthcare

- Masimo

- Medtronic plc

- Natus Medical Incorporated

- Koninklijke Philips N.V.

- Phoenix Medical Systems

- Smiths Group plc (ICU Medical Inc.)

- Utah Medical Products, Inc.

- Vyaire Medical, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 350 |

| Published | July 2025 |

| Forecast Period | 2025 - 2034 |

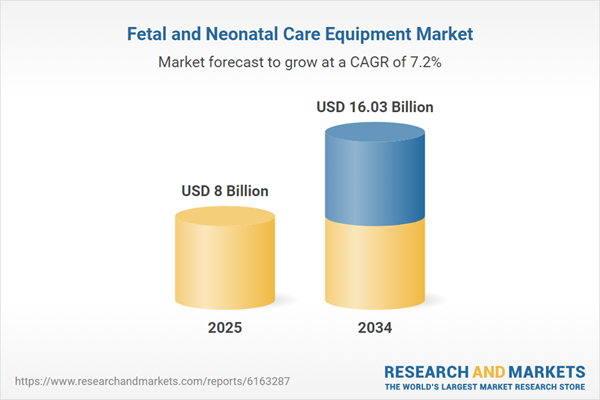

| Estimated Market Value ( USD | $ 8 Billion |

| Forecasted Market Value ( USD | $ 16.03 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |