Dermatology Diagnostic Devices Market Overview

Dermatology diagnostic devices help in the diagnosis and monitoring of various skin conditions. 3D imaging systems help to capture detailed, three-dimensional images of the skin whereas dermatoscopes are widely used to get magnified images of skin lesions. The market is experiencing a rising integration of artificial intelligence into dermatology diagnostic devices to achieve optimal diagnostic accuracy. The increasing burden of skin disorders, including skin cancer, psoriasis, and dermatitis, is a major factor propelling the market demand for advanced diagnostic solutions. Moreover, the expansion of specialized dermatology clinics and the growing investment in healthcare infrastructure are expected to support market growth in the coming years.Dermatology Diagnostic Devices Market Growth Drivers

Increasing Prevalence of Skin Diseases Drives Market Growth

According to the World Health Organisation (WHO), 1.8 billion individuals are estimated to be affected by skin conditions at any point in time. Skin-related neglected tropical diseases (skin NTDs) are reported to form around 10% of skin diseases. Further, it is reported that melanoma (a type of skin cancer) kills roughly 20 Americans every day, with around 8,290 deaths projected to be caused by this skin cancer in 2024. Thus, the rising prevalence of skin disorders is anticipated to drive the demand for dermatology diagnostic devices.Use of Artificial Intelligence Set to Boost Dermatology Diagnostic Devices Market Demand

In April 2024, a Stanford Medicine-led meta-analysis findings indicated that artificial intelligence (AI)-powered tools can help in improving skin cancer diagnostic accuracy of healthcare practitioners, revealing the potential of AI in imaging-heavy specialties such as dermatology. In this study, the researchers compared the diagnostic performance of physicians with and without AI assistance. It was reported that the practitioners working with AI accurately diagnosed 81.1% and 86.1% of skin cancer cases and cancer-like skin conditions, respectively. The development of such AI-driven skin cancer diagnostic tools is likely to bolster the market demand in the forecast period.Dermatology Diagnostic Devices Market Trends

The market is witnessing several trends and developments to improve the current global scenario. Some of the notable trends are as follows:

Advancements in Imaging Technologies

One of the major market trends is the rising advancements in high-resolution imaging technologies. The introduction of multispectral imaging and 3D imaging are improving the capabilities of diagnostic devices for dermatology applications and are expected to fuel market growth.Growth of Aesthetic Dermatology

There is a growing demand for cosmetic dermatology procedures such as laser treatments, chemical peels, and microneedling. The rising popularity of aesthetic dermatology is propelling the adoption of diagnostic solutions to examine skin health and monitor treatment outcomes, which is likely to boost the dermatology diagnostic devices market value.Innovation in Non-Invasive Diagnostics

The rising patient preference towards non-invasive and minimally invasive diagnostic techniques is a major market trend that is fuelling the demand for advanced dermatology diagnostic devices. For instance, techniques such as optical coherence tomography (OCT) and reflectance confocal microscopy (RCM) help in offering detailed skin imaging without the need for surgical biopsies.Surge in Strategic Collaborations and Partnerships

The market is witnessing a rise in strategic partnerships between device manufacturers, healthcare providers, and research institutions in order to stimulate innovation and development of advanced diagnostic tools. Several market players are collaborating with tech companies to develop diagnostic devices with enhanced capabilities.Dermatology Diagnostic Devices Market Segmentation

The report titled “Global Dermatology Diagnostic Devices Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Product

- Imaging Devices

- Dermatoscopes

- Microscope

- Others

Market Breakup by Application

- Skin cancer

- Psoriasis

- Dermatitis

- Hair & Scalp Disorders

- Acne

- Others

Market Breakup by End User

- Dermatology Centers

- Hospitals

- Clinics

- Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Dermatology Diagnostic Devices Market Share

Market Segmentation Based on Product is Anticipated to Witness Substantial Growth

The market segmentation by product includes imaging devices, dermatoscopes, microscopes, and others. The imaging devices segment holds a significant market share, owing to the increasing prevalence of skin disorders and rising innovations in imaging tools. Advanced imaging technologies, such as 3D imaging systems and digital ultrasound imaging devices, are increasingly used in various dermatological assessments and thus are widely adopted in dermatology clinics and hospitals.Dermatology Diagnostic Devices Market Analysis by Region

On the basis of region, North America covers the largest market share which can be attributed to the rising burden of skin cancer and other skin conditions in the region. The presence of a high number of dermatology clinics and hospitals also makes diagnostic services more accessible to the population. Moreover, the rapid adoption of advanced dermatology diagnostic solutions and a substantial R&D investment in the healthcare sector are some of the factors propelling the market growth.Europe also holds a significant dermatology diagnostic devices market value, driven by the implementation of favorable regulations that stimulate innovation and the accelerated entry of innovative diagnostic tools to the market. Additionally, increasing cases of skin diseases such as melanoma and eczema are also contributing to the growing market demand for dermatology services and devices in European countries.

Leading Players in the Dermatology Diagnostic Devices Market

The key features of the market report comprise the patent analysis, grant analysis, funding and investment analysis, and strategic initiatives by the leading key players. The major companies in the market are as follows:Carl Zeiss Meditec AG

Multinational medical technology, Carl Zeiss Meditec AG is a Germany-based subsidiary of Carl Zeiss AG. The company is known for its advanced imaging solutions, including high-resolution microscopes and optical coherence tomography (OCT) devices.Caliber I.D. Inc

Caliber Imaging & Diagnostics Inc., a medical device company, develops and markets point-of-care cellular imaging systems designed to diagnose skin cancer. The company is widely recognized for its clinical imaging solutions that help in the visualization of tissue at the cellular level. Caliber I.D. boasts a robust portfolio including VivaScope, VivaNet, and VivaScan.Michelson Diagnostic Devices Limited

Based in Bromley, United Kingdom, Michelson Diagnostic Devices Limited specializes in the development of multi-beam optical coherence tomography-based products that can enable the imaging of living tissue microstructure at less than 10 µm resolution. One of its leading products is VivoSight Dx, an innovative optical coherence tomography (OCT) system.Other key players in the market include Bomtech Electronics Co., Canfield Imaging Systems, ILLUCO Corporation Ltd., Nikon Corporation, DermoScan GmbH, DermLite, LLC., and Leica Microsystems GmbH.

Key Questions Answered in the Dermatology Diagnostic Devices Market Report

- What was the global dermatology diagnostic devices market value in 2024?

- What is the global dermatology diagnostic devices market forecast outlook for 2025-2034?

- What are the regional markets covered in the report?

- What is market segmentation based on the product?

- What is the market breakup based on application?

- Who are the major end users in the market?

- What are the major factors aiding the global dermatology diagnostic devices market demand?

- How has the market performed so far and how is it anticipated to perform in the coming years?

- What are the market's major drivers, opportunities, and restraints?

- Which regional market is expected to lead the market share in the forecast period?

- Which country is expected to experience expedited growth during the forecast period?

- How does the prevalence and incidence of skin diseases affect the market landscape?

- What are the major global dermatology diagnostic devices market trends?

- How does the rise in the geriatric population impact the market size?

- Which product will dominate the market share?

- Which application is expected to have a high market value in the coming years?

- Which end user is projected to contribute to the highest market growth?

- Who are the key players involved in the dermatology diagnostic devices market?

- What is the patent landscape of the market?

- What are the current unmet needs and challenges in the market?

- How are partnerships, collaborations, mergers and acquisitions among the key market players shaping the market dynamics?

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Carl Zeiss Meditec AG

- Caliber I.D. Inc

- Michelson Diagnostic Devices Limited

Table Information

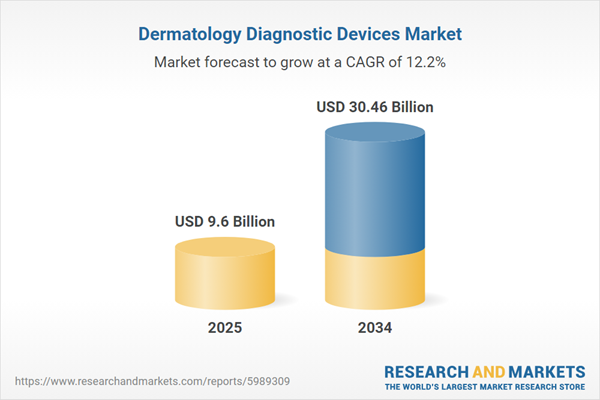

| Report Attribute | Details |

|---|---|

| No. of Pages | 400 |

| Published | June 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 9.6 Billion |

| Forecasted Market Value ( USD | $ 30.46 Billion |

| Compound Annual Growth Rate | 12.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 3 |