Gastrointestinal Stents Market Overview

A gastrointestinal (GI) stent is an artificial vascular graft that is implanted to unblock the gullet, stomach, and small intestine. It is an expandable metal or plastic mesh tube that is installed within a body channel, like the bile ducts, oesophagus, or colon, or a blockage caused by cancerous tissues. Biliary and colonic stents are frequently used in practice, with other stents that are commonly employed being duodenal, oesophageal, and pancreatic stents.Gastrointestinal Stents Market Growth Drivers

Rising Prevalence of Gastrointestinal Disorders Drives the Market Demand

The American Cancer Society estimates that around 152,810 (81,540 men and 71,270 women) new cases of colorectal cancer are expected to affect the United States population in 2024. Out of this, 106,590 cases will be colon cancer, and 46,220 cases will be diagnosed as rectal cancer, respectively. The rising prevalence of gastrointestinal diseases, like colon cancer, narrowing lining in the throat, and bowel irritation, accelerates the demand for gastrointestinal stents. These devices are very efficient in removing blockages in the tract by either expanding or moving them out of the way of the obstruction and, subsequently, creating comfortability for the patient.Minimally Invasive Procedure Fuels the Market Growth

Minimally invasive methods like endoscopy or laparoscopy are commonly used for placing gastrointestinal stents. These processes provide advantages like decreased hospitalization periods, quicker healing durations, and lower illness rates in comparison to conventional open surgeries. The rising popularity of minimally invasive techniques is fueling the need for GI stents.Gastrointestinal Stents Market Trends

Technological Advancements in Gastrointestinal Stents

Current research and development in stent design, materials, and delivery systems present opportunities for development and improvement in gastrointestinal stent technology. Advancements in bioabsorbable stents, the concept of drug-eluting stents, and the availability of various designs of stents hold promise for better outcomes in patient care while also driving market growth.Expansion of Endoscopic Procedures

Endoscopic interventions like the use of endoscopic stents are slowly becoming more common when it comes to dealing with gastrointestinal disorders. The improvement of endoscopic techniques that encompass EUS and ERCP provides opportunities for gastrointestinal stent manufacturers to develop specific stents for these procedures.Increasing Awareness and Access to Healthcare

With increased accessibility to healthcare services, especially in developing regions, the application of gastrointestinal stents has increased in surgeries, contributing to the market growth. Rising awareness of their multiple benefits and prompt diagnosis and treatment are also impacting the market landscape significantly.Increasing Preference for Biodegradable Stents

Biodegradable gastrointestinal stents as a treatment option are preferred because of their ability to dissolve, cause less harm and provide support during the healing period. They also offer a less invasive and, therefore, more comfortable treatment option for the patients, reducing the need for additional procedures.Recent Developments in the Global Gastrointestinal Stents Market

In February 2023, Olympus Corporation acquired Taewoong Medical Co., Ltd. The acquisition was intended to expand Olympus's GI EndoTherapy product portfolio, boost R&D capabilities, and increase revenue.In June 2022, Boston Scientific Corporation revealed a strategic partnership with Synergy Innovation Co., Ltd. to acquire a majority stake in M.I.Tech Co., Ltd. This manufacturer produces HANAROSTENT technology, offering flexible, non-vascular, self-expanding metal stents. This strategic decision enabled the company to incorporate advanced technologies into their operations, expand their clientele, and establish a competitive advantage over competitors.

Gastrointestinal Stents Market Segmentation

Market Breakup by Product

- Biliary stent

- Duodenal stent

- Colonic stent

- Pancreatic stent

- Esophageal stent

Market Breakup by Material

- Plastic Stents

- Self-Expanding Metal Stents

- Stainless Steel Stents

- Nitinol Stents

Market Breakup by Application

- Biliary Disease

- Colorectal Cancer

- Stomach Cancer

- Others

Market Breakup by End User

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centres

- Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Gastrointestinal Stents Market Share

Market Segmentation Based on Products to Witness Substantial Growth

Based on the product, the global gastrointestinal stent market is segmented into the biliary stent, esophageal stent, colonic stent, pancreatic stent, and duodenal stent. The biliary stents are expected to dominate the market. These stents are important for treating problems that block the bile ducts, such as blockages caused by gallstones or pancreatic cancer. Biliary stents have a large popularity because they are useful in clearing these blockages. Moreover, there have been advancements in their fabrication and deployment.Gastrointestinal Stents Market Analysis by Region

Based on the region, the market is segmented into North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. The North American region is expected to dominate the market because of its sophisticated healthcare industry, increasing incidence of digestive-related disorders, and adoption of new technologies. There are many active researchers and leading companies that promote market development in the region. The rising geriatric population as well as growing awareness also contribute to the market share.The Asia-Pacific market is anticipated to witness growth in the forecast period due to a greater expenditure on health, and improved infrastructure. Consumer awareness regarding the availability of non-invasive treatments, constant improvements and enhancements in technology, and the transition to higher-quality and personalized healthcare are contributing to the growth of the market.

Leading Players in the Gastrointestinal Stents Market

The key features of the market report include patent analysis, funding and investment analysis, and strategic initiatives by the leading players. The major companies are:Boston Scientific Corporation

Founded in 1979 and based in the United States, the company provides WallFlex™ stents, which are self-expanding stents constructed of fine metal.Cook

Established in 1881 and based in India, the company offers Evolution® Controlled-Release Stent for the management of malignant structures in the oesophagus, biliary tract, and duodenum.CONMED Corporation

It was founded in 1970 and headquartered in Utica, New York. Their product portfolio comprises self-expanding metal stents that can be used in the oesophagus, biliary tract, and colon. These stents are intended to have maximum radial force and flexibility, making them ideal for stricture management and causing less discomfort to patients.W. L. Gore & Associates, Inc.

Established in 1958 and headquartered in the United States, it involves products such as the GORE® VIABIL® Biliary Endoprosthesis, a self-expanding, totally covered metallic stent intended for use in relieving malignant biliary obstructions.Other companies include TAEWOONG, Hobbs Medical, Inc., BD, Merit Medical System, Olympus, MICRO-TECH (Nanjing) Co., Ltd., ENDO-FLEX GmbH, CITEC, QualiMed, and Medivators Inc.

Kindly note that this only represents a partial list of companies, and the complete list has been in the report.

Key Questions Answered in the Gastrointestinal Stents Market

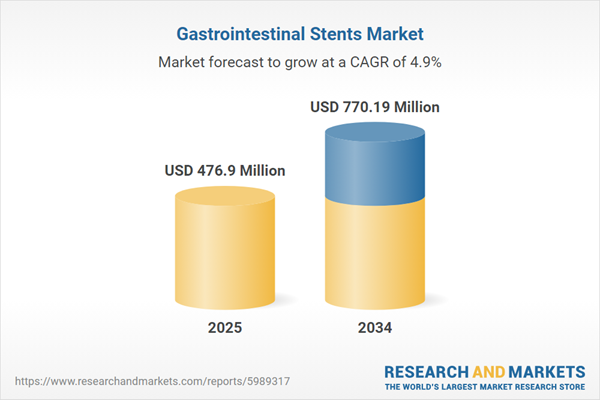

- What was the global gastrointestinal stents market value in 2023?

- What is the global gastrointestinal stents market forecast outlook for 2025-2034?

- What are the regional markets covered in the report?

- What are the major factors aiding the global gastrointestinal stents market demand?

- What are the market's major drivers, opportunities, and restraints?

- Which regional market is expected to lead the market share in the forecast period?

- Which country is expected to experience expedited growth during the forecast period?

- What are the major global gastrointestinal stents market trends?

- How does the rise in the geriatric population impact the market size?

- Who are the key players involved in the gastrointestinal stents market?

- What are the current unmet needs and challenges in the market?

- How are partnerships, collaborations, mergers and acquisitions among the key market players shaping the market dynamics?

- What is the market segmentation based on the product?

- Which factors are driving the demand for biliary stents?

- What are the major benefits of using esophageal stents?

- What is the market breakup based on material?

- What are the potential benefits of biodegradable or drug-eluting stents?

- What innovations are being seen in stainless steel stent designs?

- What is the market segmentation based on the application?

- What are the primary factors influencing the use of stents in colorectal cancer treatment?

- What is the market breakup based on end users?

- How are hospitals influencing the market dynamics for gastrointestinal stents?

- What is the market segmentation based on region?

- What is the current market share of gastrointestinal stents in North America?

- What growth opportunities exist for gastrointestinal stents in the Asia Pacific region?

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Boston Scientific Corporation

- Cook

- CONMED Corporation

- W. L. Gore & Associates, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 400 |

| Published | June 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 476.9 Million |

| Forecasted Market Value ( USD | $ 770.19 Million |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 4 |