Plastic Manifolds is the fastest growing segment, Asia-Pacific is the largest market globally

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Stricter automotive emission regulations significantly influence the intake manifold market by compelling manufacturers to adopt more advanced designs and materials to meet increasingly rigorous environmental standards. These regulations often demand optimized air-fuel mixing and reduced particulate matter, leading to the integration of features such as variable runner lengths and swirl flaps directly into manifold designs. According to the European Automobile Manufacturers’ Association (ACEA), in December 2023, ACEA stated that the Euro 7 regulation’s stringent targets for pollutants from conventional engines would require substantial technological adaptations across vehicle components, including intake systems.Key Market Challenges

The accelerating transition towards electric vehicles represents a significant challenge for the global automotive intake manifold market. Electric powertrains, integral to these vehicles, inherently do not utilize traditional internal combustion engine intake manifolds. Consequently, the increasing adoption of electric vehicles directly diminishes the overall demand for these specific components. According to the International Energy Agency, global electric car sales reached nearly 14 million units in 2023, constituting approximately 18% of all cars sold worldwide.Key Market Trends

The integration of smart sensors and electronic controls represents a significant trend aimed at enhancing the precision and adaptability of automotive intake manifolds. This involves embedding sophisticated sensing elements directly into the manifold structure, enabling real-time data acquisition on critical parameters such as airflow, temperature, and pressure. These data points allow for dynamic adjustments to the air-fuel mixture, optimizing combustion efficiency, reducing emissions, and improving overall engine performance. The broader automotive industry's commitment to advanced manufacturing processes, which are vital for producing such intricate electronic components, is evident.Key Market Players Profiled:

- Mann+Hummel

- Mahle

- Sogefi

- Aisin Seiki

- Magneti Marelli

- Rochling

- Novares

- Mikuni

- Inzi Controls

- Toyota Boshoku

Report Scope:

In this report, the Global Automotive Intake Manifold Market has been segmented into the following categories:By Vehicle Type:

- Light Commercial Vehicle

- Heavy Commercial Vehicles

- Sports Cars

By Product Type:

- Single Plane Manifolds

- Dual Plane Manifolds

- EFI Manifolds

- HI-RAM Manifolds

- Supercharger Intake Manifolds

By Material:

- Aluminum

- Plastic

- Magnesium

- Other Composites

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Automotive Intake Manifold Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Mann+Hummel

- Mahle

- Sogefi

- Aisin Seiki

- Magneti Marelli

- Rochling

- Novares

- Mikuni

- Inzi Controls

- Toyota Boshoku

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | November 2025 |

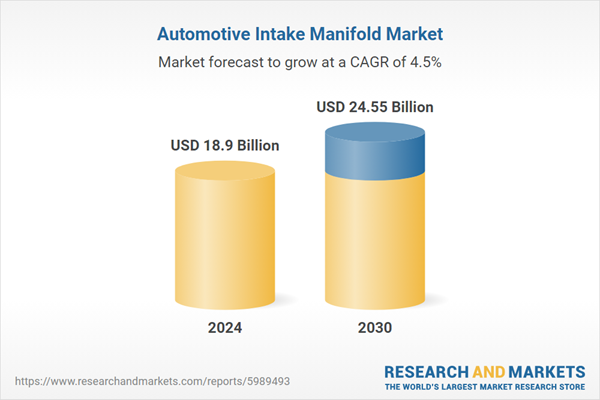

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 18.9 Billion |

| Forecasted Market Value ( USD | $ 24.55 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |