Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

One of the primary drivers of the air-based defense equipment market is the continual evolution of military threats and geopolitical tensions, prompting nations to invest in advanced aerial capabilities. As adversaries develop and enhance their own air forces, there is a constant need for nations to upgrade and modernize their air-based defense systems to maintain strategic advantage. Technological advancements play a pivotal role in shaping the market landscape. The development of fifth-generation fighter aircraft unmanned aerial vehicles (UAVs), and precision-guided munitions reflects the ongoing pursuit of cutting-edge capabilities. Additionally, advancements in radar and sensor technologies contribute to improved situational awareness and enhanced air defense capabilities.

The global air-based defense equipment market is characterized by the presence of major aerospace and defense contractors, each vying for contracts from military forces around the world. These contractors engage in continuous research and development to introduce innovations that enhance aircraft performance, survivability, and mission capabilities. Moreover, international collaborations and partnerships are common in this market, with nations pooling resources for joint development programs and procurement initiatives. Such collaborations allow countries to share the financial burden of research and development while fostering diplomatic and strategic ties. The market is also influenced by budgetary considerations, with defense spending by governments being a critical factor. Economic conditions, geopolitical events, and shifting national priorities impact the allocation of funds to air-based defense programs.

Key Market Drivers

Geopolitical Tensions and Military Modernization

Geopolitical tensions and the imperative for military modernization are significant factors propelling the air-based defense equipment market. Countries are making substantial investments in advanced fighter aircraft, strategic bombers, and sophisticated air defense systems to enhance their military capabilities and address emerging threats. These investments are driven by the need to maintain strategic advantages and respond effectively to both regional and global security challenges. As nations seek to strengthen their defense posture, they prioritize acquiring cutting-edge technologies that offer superior performance and operational effectiveness, reflecting a broader trend of modernization in the face of evolving geopolitical dynamics.Technological Advancements

Continuous technological advancements drive the demand for air-based defense equipment. Fifth-generation fighter aircraft unmanned aerial vehicles (UAVs), and advanced avionics are integral components of modern air forces. Nations prioritize the acquisition of cutting-edge technologies to maintain superiority in the evolving landscape of aerial warfare. For instance, in March 2024, in a significant development for India's defense sector, the Indian government has finalized deals worth USD 4.65 billion to acquire advanced missiles and air defense systems. This substantial investment is aimed at enhancing the country's air defense capabilities amid growing regional security concerns. The agreements include procurement of cutting-edge missiles and advanced air defense guns designed to bolster India’s strategic defense infrastructure. These acquisitions are expected to modernize India's defense forces, improve their operational effectiveness, and provide a robust response to potential aerial threats. The move reflects India's ongoing efforts to strengthen its military readiness and maintain a competitive edge in the region.Threats from Emerging Technologies

The emergence of new technologies poses both challenges and opportunities. The proliferation of advanced anti-access/area denial (A2/AD) systems and the development of hypersonic weapons have led to the need for countermeasures, influencing the market for air defense systems, electronic warfare equipment, and stealth technologies.Global Terrorism and Asymmetric Threats

The evolving nature of security threats, including global terrorism and asymmetric warfare, drives the demand for versatile air-based defense capabilities. Military forces seek equipment that can effectively address a spectrum of threats, ranging from conventional conflicts to counterinsurgency operations.International Collaborations and Alliances

Collaboration and alliances between nations significantly impact the air-based defense equipment market. Joint development programs, where countries pool resources to produce aircraft and systems, enhance interoperability and foster diplomatic ties. These collaborations also contribute to cost-sharing and technology exchange.Rising Defense Budgets

Rising defense budgets worldwide are a crucial catalyst for growth in the air-based defense equipment market. Countries are committing significant financial resources to bolster their air force capabilities, which includes acquiring new aircraft, modernizing existing fleets, and investing in cutting-edge research and development. This substantial investment is aimed at maintaining a strategic advantage and addressing emerging threats. For example, global military expenditure has recently reached an unprecedented USD2.44 trillion, reflecting the largest annual increase in defense spending in over a decade, as reported in April 2024. This surge in funding underscores the priority placed on advancing air-based defense technologies and enhancing military readiness across the globe.Multi-Domain Operations and Integrated Warfare

The shift towards multi-domain operations and integrated warfare strategies influences the demand for air-based defense equipment. Military forces seek platforms and systems that can seamlessly operate across land, air, sea, space, and cyberspace, enhancing their ability to respond to complex and dynamic security challenges.Key Market Challenges

Technological Complexity and Obsolescence

The rapid evolution of technology presents significant challenges in the air-based defense equipment market, particularly concerning the complexity of integrating new systems into existing infrastructure. As advanced technologies such as next-generation fighter aircraft, unmanned aerial systems, and directed energy weapons are developed, ensuring seamless compatibility with legacy systems becomes increasingly difficult. The high rate of technological obsolescence exacerbates this issue, as new innovations quickly render existing equipment outdated. This necessitates frequent upgrades and modifications to maintain effectiveness against evolving threats and to ensure interoperability with emerging technologies. The need for constant technological refreshes not only drives up costs but also demands sophisticated engineering solutions to address integration challenges. As defense systems become more advanced, managing these complexities and mitigating the risk of obsolescence are critical to sustaining operational superiority and ensuring that air-based defense capabilities remain robust and effective.Supply Chain Vulnerabilities

The global aerospace and defense supply chain is susceptible to various vulnerabilities that can disrupt production and operational effectiveness. Geopolitical tensions, trade disruptions, and natural disasters can all impact the flow of materials and components, creating delays and shortages. The complex network of suppliers, often spanning multiple countries, adds layers of dependency that can exacerbate these issues. For instance, trade disputes or diplomatic conflicts may lead to sanctions or export restrictions, affecting the availability of critical parts. Similarly, natural disasters can interrupt logistics and manufacturing processes, leading to unforeseen delays. These supply chain vulnerabilities can compromise the timely production and maintenance of essential defense equipment, ultimately affecting overall operational readiness and capability. Addressing these challenges requires robust risk management strategies, diversified sourcing, and contingency planning to ensure resilience and continuity in the face of potential disruptions.Adaptation to Asymmetric Threats

The evolving security landscape, marked by asymmetric warfare tactics and unconventional technologies, poses significant challenges for air-based defense equipment. Modern threats like drone swarms, cyber attacks, and low-cost yet highly effective technologies demand sophisticated countermeasures. Traditional defense systems, designed for conventional threats, may struggle to address these new forms of aggression. To effectively counter such asymmetric threats, continuous innovation and strategic adaptation are essential. This involves developing advanced technologies capable of neutralizing drone swarms, enhancing cybersecurity measures to protect against digital attacks, and creating versatile systems that can address a broad spectrum of emerging threats. The need for rapid technological advancements and adaptable strategies ensures that air-based defense systems remain effective in an increasingly complex threat environment. As security dynamics shift, ongoing investment in research and development is crucial to maintain operational superiority and safeguard against diverse and evolving threats.Stringent Export Controls and Regulatory Compliance

Stringent export controls and regulatory compliance are significant challenges for manufacturers of air-based defense equipment aiming to enter international markets. Navigating complex regulatory frameworks, licensing requirements, and restrictions on technology transfer can be both time-consuming and costly. These controls, designed to ensure national security and prevent the proliferation of sensitive technologies, can limit market access and affect the global competitiveness of defense contractors. Adherence to these regulations often requires extensive documentation, rigorous audits, and ongoing monitoring to ensure compliance, which can strain resources and impact operational efficiency. As defense contractors seek to expand their reach and compete globally, they must carefully manage these regulatory challenges to effectively navigate international markets while maintaining adherence to stringent export controls. This careful balance is crucial for sustaining growth and ensuring successful global operations in the highly regulated defense sector.Key Market Trends

Shift to Next-Generation Fighter Aircraft

A significant shift towards next-generation fighter aircraft is reshaping the air defense landscape, characterized by advancements in stealth technology, sophisticated avionics, and multi-role capabilities. These modern aircraft are designed to provide superior air superiority and perform diverse operational roles. Programs such as the F-35 Lightning II and Russia's Sukhoi Su-57 exemplify this trend, integrating cutting-edge technologies to enhance operational effectiveness. The F-35, for instance, is renowned for its stealth features and advanced sensor fusion, while the Su-57 offers high-speed performance and advanced maneuverability. This move towards next-generation fighters underscores the growing emphasis on maintaining strategic advantages in an increasingly complex and competitive global security environment. As nations seek to upgrade their air fleets, these advanced aircraft are becoming pivotal in ensuring dominance across multiple domains.Proliferation of Unmanned Aerial Systems (UAS)

The proliferation of Unmanned Aerial Systems (UAS) is transforming modern air-based defense strategies, with drones increasingly pivotal in reconnaissance, surveillance, and combat operations. Their versatility and cost-effectiveness make them indispensable tools for various military applications. Unmanned aircraft can perform high-risk missions without putting human lives at risk, and their ability to gather real-time intelligence and conduct precision strikes enhances operational effectiveness. As technology advances, UAS capabilities continue to expand, with improvements in automation, payloads, and durability. This widespread adoption is driving ongoing development and integration of drones into defense strategies, reflecting their growing importance in contemporary military operations. The trend underscores the shift towards more flexible and technologically advanced approaches to managing airspace and responding to emerging threats.Advancements in Hypersonic Technologies

Hypersonic technologies are gaining prominence, with countries investing in the development of missiles and aircraft that can travel at speeds exceeding Mach 5. Hypersonic capabilities provide strategic advantages, enabling rapid response and precision strikes. The race to achieve hypersonic capabilities is influencing defense strategies globally.Advancements in Directed Energy Weapons (DEWs)

Advancements in Directed Energy Weapons (DEWs), such as lasers and microwave technologies, are becoming a significant trend in modern defense systems. DEWs provide precise and rapid response capabilities, offering a highly effective means of countering threats like unmanned aerial vehicles (UAVs) and incoming missiles. These weapons can deliver targeted energy to neutralize or disable threats with minimal collateral damage, enhancing operational efficiency and effectiveness. The development of DEWs is driven by ongoing research and technological advancements, focusing on improving power, range, and accuracy. Integration of DEWs into defense systems reflects a strategic shift towards high-tech solutions that offer scalable and adaptable responses to evolving threats. As research progresses, DEWs are expected to play an increasingly critical role in modern military operations, providing new ways to safeguard airspace and protect assets against a range of aerial and missile threats.Sustainability and Green Technologies

There is a growing trend toward sustainability and green technologies in the air-based defense equipment market. Manufacturers are exploring eco-friendly materials, energy-efficient propulsion systems, and sustainable practices to reduce the environmental impact of military aviation. This trend aligns with global efforts to address climate change concerns.Segmental Insights

Type Insights

The fighter aircraft segment is rapidly becoming the fastest-growing sector within the global air-based defense equipment market. This growth is driven by several factors, including the increasing geopolitical tensions and the rising need for advanced aerial capabilities. Nations are investing heavily in modernizing their air fleets to ensure superior air superiority and maintain strategic advantages. This trend is reflected in the development and procurement of next-generation fighter jets equipped with cutting-edge technologies, such as advanced avionics, stealth capabilities, and enhanced weaponry.The demand for multi-role fighters, which can perform various functions from air superiority to ground attack missions, is also on the rise. This versatility makes them crucial for modern defense strategies. Additionally, ongoing advancements in materials science and propulsion technology are leading to the production of more efficient and effective aircraft, further fueling market expansion. As countries continue to prioritize their defense capabilities, the fighter aircraft segment is expected to see sustained growth, supported by both defense budgets and technological innovations that promise to enhance operational performance and mission effectiveness.

Regional Insights

North America stands as the leading region in the global air-based defense equipment market, primarily due to its substantial defense budgets and advanced technological capabilities. The United States, as a major player in this sector, invests heavily in developing and maintaining a robust air defense infrastructure. This investment covers a broad range of equipment, from fighter jets and bombers to advanced surveillance systems and unmanned aerial vehicles (UAVs).The region's dominance is further supported by its strategic focus on maintaining air superiority and addressing emerging threats through state-of-the-art technology. North American defense contractors are at the forefront of innovation, producing highly sophisticated systems that enhance operational efficiency and combat effectiveness. Additionally, the presence of leading defense companies and extensive research and development facilities in the U.S. and Canada contributes significantly to the region’s market leadership.

Geopolitical dynamics, including ongoing military engagements and defense collaborations with allied nations, also play a crucial role in sustaining North America's position. The region's commitment to upgrading and expanding its air-based defense capabilities ensures it remains the most influential player in the global market.

Key Market Players

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- RTX Corporation

- BAE Systems PLC

- The Boeing Company

- Dassault Aviation

- Airbus S.E.

- Leonardo S.p.A.

- Elbit Systems Ltd.

- Saab AB

Report Scope:

In this report, the Global Air Based Defense Equipment Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Air Based Defense Equipment Market, By Type:

- Fighter Aircrafts

- Military Helicopters

- Military Gliders

- Drones

Air Based Defense Equipment Market, By Operation:

- Autonomous Air Based Defense Equipment

- Manual

Air Based Defense Equipment Market, By Component:

- Weapon System

- Fire Control System

- Command and Control System

Air Based Defense Equipment Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe & CIS

- Germany

- Spain

- France

- Russia

- Italy

- United Kingdom

- Belgium

- Asia-Pacific

- China

- India

- Japan

- Indonesia

- Thailand

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- Turkey

- Iran

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents in the Global Air Based Defense Equipment Market.Available Customizations:

Global Air Based Defense Equipment Market report with the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- RTX Corporation

- BAE Systems PLC

- The Boeing Company

- Dassault Aviation

- Airbus S.E.

- Leonardo S.p.A.

- Elbit Systems Ltd.

- Saab AB

Table Information

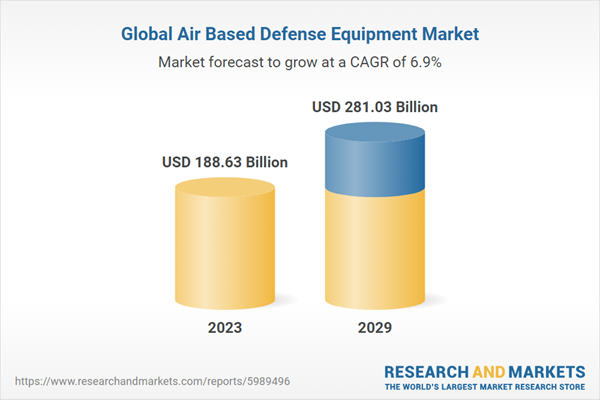

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | August 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 188.63 Billion |

| Forecasted Market Value ( USD | $ 281.03 Billion |

| Compound Annual Growth Rate | 6.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |