Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite these robust growth drivers, the market faces significant hurdles stemming from the substantial costs associated with sophisticated testing equipment and the necessity for specialized training to interpret the data. These financial and technical barriers often prevent healthcare institutions and smaller clinics in emerging economies from implementing these advanced systems. Consequently, these constraints restrict the accessibility of metabolic testing technologies and serve as a major impediment to the broader development and expansion of the global market.

Market Drivers

The rising global prevalence of obesity and diabetes serves as a major market accelerator, creating an urgent demand for sophisticated diagnostic tools capable of supporting effective metabolic health monitoring and weight management. With metabolic syndrome emerging as a worldwide epidemic, both individuals and healthcare providers are increasingly turning to metabolic testing to customize fitness and nutritional strategies. This escalation in lifestyle-related conditions necessitates immediate access to precise data on substrate utilization and energy expenditure to combat chronic illnesses. The World Obesity Federation emphasized the scale of this issue in March 2024, estimating that over one billion people worldwide are living with obesity, representing a massive patient population in need of metabolic intervention.Concurrently, technological innovations in metabolic testing devices are transforming the industry by evolving complex clinical diagnostics into user-friendly, accessible wearable formats. Devices such as smart rings and continuous glucose monitors now enable real-time tracking of metabolic indicators, expanding the user base from elite athletes to the general public. This transition toward personalized data analytics and remote monitoring has generated significant commercial success for manufacturers. For instance, Abbott reported in October 2024 that sales of its FreeStyle Libre continuous glucose monitoring system surpassed $1.6 billion in the third quarter alone, reflecting a 19.1 percent growth. Furthermore, Outlook Business noted in March 2024 that the metabolic tracking startup Ultrahuman secured $35 million in Series B funding to expand its research and manufacturing capabilities, underscoring the sector's vitality.

Market Challenges

A significant impediment to the growth of the Global Metabolic Testing Market is the prohibitive cost linked to sophisticated testing equipment and the specialized training required for its use. The high initial capital investment needed for advanced metabolic measurement devices establishes a formidable entry barrier for independent clinics, smaller medical facilities, and healthcare systems in developing regions. As a result, the market remains largely confined to premium hospitals and well-funded research institutions, which effectively limits the total addressable market and decelerates the adoption of this technology in general clinical practice.This financial strain is further exacerbated by the operational expenses associated with hiring skilled professionals competent in interpreting complex metabolic data. The combined weight of high operational and capital costs compels many healthcare administrators to lower the priority of these diagnostic tools. This fiscal conservatism is reflected in recent procurement trends; according to the American Hospital Association, 94% of healthcare administrators in 2024 expected to delay equipment upgrades to navigate rising financial pressures. Such widespread postponement of capital investments directly impedes the metabolic testing market by stalling the purchase of modern systems, thereby counteracting the demand generated by the increase in chronic lifestyle diseases.

Market Trends

The integration of artificial intelligence for predictive metabolic analytics is fundamentally transforming the industry by shifting diagnostics from passive observation to dynamic, disease-reversing simulations. Sophisticated algorithms now facilitate the generation of "digital twins" - virtual representations of an individual's specific metabolism - that forecast physiological reactions to particular lifestyle adjustments. This innovation empowers providers to recommend precise, data-informed interventions that adjust in real-time, surpassing traditional static reporting methods. Underscoring this technological advancement, Twin Health raised $53 million in August 2025, as reported by HLTH, to expand its Whole Body Digital Twin platform, which utilizes AI to assist members in reversing chronic metabolic diseases through tailored guidance.Simultaneously, the emergence of metabolically-driven precision nutrition is broadening the market's focus from clinical diabetes management to wider wellness and weight control applications. Manufacturers and regulatory agencies are increasingly validating continuous metabolic monitoring for general use, allowing consumers to refine their diets using real-time glycemic data instead of generic recommendations. This trend has resulted in the commercialization of devices specifically approved for non-medical weight management, effectively separating metabolic testing from insulin dependence. In a notable industry development reported by MedTech Dive in August 2025, Signos received FDA clearance for its glucose monitoring system designed specifically for weight management, signaling a major shift toward providing accessible, over-the-counter metabolic insights to the mass market.

Key Players Profiled in the Metabolic Testing Market

- Becton, Dickinson and Company

- General Electric Company

- Geratherm Medical AG

- MGC DIAGNOSTICS CORPORATION

- OSI Systems, Inc.

- CORTEX Biophysik GmbH

- COSMED srl

- KORR Medical Technology Inc.

- Microlife Medical Home Solutions, Inc.

- Parvomedics, Incorporated

Report Scope

In this report, the Global Metabolic Testing Market has been segmented into the following categories:Metabolic Testing Market, by Product:

- CPET

- Body Composition Analysis

- ECG

- Portable System

Metabolic Testing Market, by Application:

- Critical Care

- Lifestyle Diseases

- Others

Metabolic Testing Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Metabolic Testing Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Metabolic Testing market report include:- Becton, Dickinson and Company

- General Electric Company

- Geratherm Medical AG

- MGC DIAGNOSTICS CORPORATION

- OSI Systems, Inc.

- CORTEX Biophysik GmbH

- COSMED srl

- KORR Medical Technology Inc.

- Microlife Medical Home Solutions, Inc.

- Parvomedics, Incorporated

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

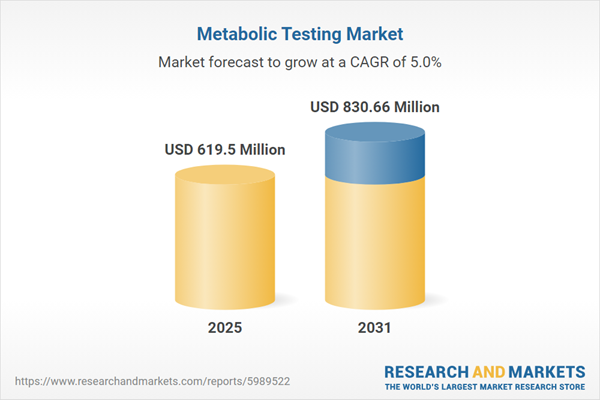

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 619.5 Million |

| Forecasted Market Value ( USD | $ 830.66 Million |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |