Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

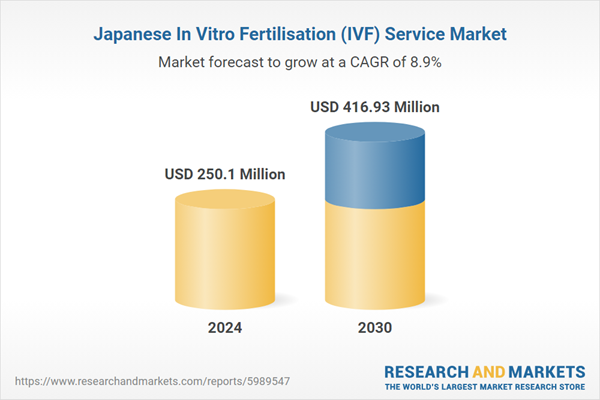

Despite facing challenges such as high treatment costs and regulatory constraints, the market remains robust. It is projected to continue its upward trajectory, bolstered by both domestic and international patient demand. The continued expansion of the Japan IVF service market is underpinned by ongoing technological advancements, heightened awareness, and growing acceptance of fertility treatments. Government support and a competitive landscape further contribute to the market’s positive outlook.

Key Market Drivers

Increasing Prevalence of Infertility

The increasing prevalence of infertility significantly drives the growth of the Japan In Vitro Fertilisation (IVF) service market, reflecting a direct correlation between rising infertility rates and the expanding demand for assisted reproductive technologies. The prevalence of infertility in Japan has been on the rise due to several factors, including delayed childbearing, lifestyle changes, and increasing incidence of reproductive health conditions. In Japan, late marriage and childbearing have become increasingly common, leading more women to have their first child in their early to late 30s. As a result, many women recognize their infertility and recurrent pregnancy loss in their late 30s. With aging, ovarian reserve decreases and abnormalities of the genital organs increase, making infertility more challenging to address. Given the current social situation in Japan, women younger than 35 who have failed to conceive after one year of trying and those aged 35 or older who have failed to conceive after six months of trying are likely to be infertile and should undergo early infertility examinations, regardless of the current definition of infertility. As infertility rates increase, the demand for effective solutions, including IVF, rises correspondingly. As infertility becomes more widespread, the pool of individuals and couples seeking fertility treatments expands. This growing patient population directly increases the demand for IVF services. The need for assisted reproductive technologies is no longer limited to a small segment of the population but has become a common requirement for a larger demographic. The surge in patients seeking IVF treatment is a primary driver of market growth, as fertility clinics and healthcare providers respond to this expanding need by offering more services and investing in advanced technologies.The rise in infertility rates has also led to greater awareness and better diagnostic capabilities. Increased public awareness about infertility and available treatments encourages individuals to seek medical advice and explore IVF options. It is estimated that 10-15% of the population of reproductive age in Japan may experience infertility, resulting in approximately 2,400,000 individuals potentially facing infertility issues. Enhanced diagnostic tools enable more accurate identification of infertility issues, leading to earlier and more frequent referrals to fertility specialists. This increased awareness and improved diagnostic capabilities contribute to a higher volume of patients opting for IVF treatments, thereby driving market growth. The growing prevalence of infertility has spurred significant advancements in IVF technology, which in turn drives market growth. As infertility rates rise, there is greater investment in research and development to improve IVF success rates and outcomes. Innovations such as preimplantation genetic testing (PGT), improved embryo culture techniques, and advancements in cryopreservation enhance the effectiveness of IVF treatments. These technological improvements make IVF a more viable and attractive option for patients, further boosting demand and market expansion.

In response to increasing infertility rates, the Japanese healthcare system has adapted to provide more comprehensive fertility services. Fertility clinics are expanding their offerings to include a range of assisted reproductive technologies, including advanced IVF procedures. The healthcare system's adaptation to higher infertility rates ensures that there are sufficient resources and infrastructure to meet the growing demand, supporting the overall growth of the IVF market. The increasing prevalence of infertility drives the growth of the Japan IVF service market through rising patient numbers, heightened awareness, advancements in IVF technology, and adaptations within the healthcare system. As infertility rates continue to rise, the demand for IVF services is expected to grow, fueling market expansion and encouraging ongoing investment in reproductive technologies.

Technological Advancements in Reproductive Medicine

Technological advancements in reproductive medicine play a pivotal role in driving the growth of the Japan In Vitro Fertilisation (IVF) service market. These innovations not only enhance the effectiveness and efficiency of IVF treatments but also expand the range of options available to patients. Technological advancements have significantly increased the success rates of IVF treatments. Innovations such as advanced embryo culture techniques, time-lapse imaging, and improved culture media create optimal conditions for embryo development. These advancements reduce the likelihood of embryo abnormalities and improve implantation rates. Higher success rates make IVF a more attractive option for patients, driving greater demand for these services. As success rates continue to improve, more individuals and couples are likely to opt for IVF, thereby expanding the market. It is estimated that approximately 12% of Japanese women of childbearing age who wish to become pregnant require medical assistance. Infertility treatment is now most prevalent among women in their late 30s, as age exacerbates fertility challenges. The introduction and refinement of Preimplantation Genetic Testing (PGT) has revolutionized IVF treatments by allowing for the genetic screening of embryos before implantation. PGT helps in identifying genetic abnormalities and selecting the most viable embryos for transfer. This not only increases the likelihood of a successful pregnancy but also reduces the risk of genetic disorders. The availability of PGT enhances the appeal of IVF services by offering a higher level of personalized and precise care, thereby boosting market demand.Improved cryopreservation techniques, including vitrification, have transformed the process of freezing and thawing embryos and oocytes. Vitrification, a rapid freezing method, has shown higher survival rates for frozen embryos compared to traditional slow-freezing techniques. This advancement allows for greater flexibility in treatment timing and the option to preserve embryos for future use. As cryopreservation techniques continue to evolve, they enhance the overall effectiveness of IVF treatments and contribute to market growth by providing patients with more choices and better outcomes. Technological advancements in fertility monitoring and diagnostic tools have improved the ability to assess and manage reproductive health. Innovations such as advanced imaging technologies, hormone assays, and fertility tracking devices provide more accurate and detailed information about reproductive status. Enhanced diagnostic capabilities enable earlier detection of fertility issues and more tailored treatment plans, leading to more successful IVF outcomes. This improved diagnostic precision drives demand for IVF services as patients seek the benefits of cutting-edge technology in managing their fertility. The development of innovative IVF platforms, such as embryo monitoring systems and automated laboratory equipment, has streamlined and enhanced the IVF process. These platforms use sophisticated algorithms and automation to optimize embryo handling, culture conditions, and data analysis. The integration of such platforms into IVF clinics improves operational efficiency, reduces the risk of human error, and ensures consistent quality in embryo handling. As clinics adopt these advanced platforms, they can offer higher-quality services and attract more patients, contributing to market growth.

The integration of Artificial Intelligence (AI) into IVF practices is emerging as a transformative development. AI algorithms can analyze large volumes of data to predict embryo viability, optimize treatment protocols, and personalize patient care. AI-driven insights enable more accurate predictions of treatment outcomes and improve decision-making in IVF procedures. As AI technology becomes more prevalent, it enhances the precision and effectiveness of IVF treatments, driving increased adoption and growth in the market. Technological advancements in reproductive medicine - ranging from improved success rates and genetic testing to enhanced cryopreservation and AI integration - are driving the growth of the Japan IVF service market. These innovations enhance treatment effectiveness, expand patient options, and increase the overall appeal of IVF services, thereby contributing to the market’s expansion and development.

Increasing Awareness and Acceptance of Fertility Treatments

Increasing awareness and acceptance of fertility treatments significantly drive the growth of the Japan In Vitro Fertilisation (IVF) service market by influencing patient behaviors, societal attitudes, and healthcare dynamics. Growing awareness about infertility and fertility treatments has played a crucial role in transforming public perception. Previously, infertility was often stigmatized, and seeking treatment was not widely discussed. However, increased public education and media coverage have brought infertility and its treatment options into the spotlight. Awareness campaigns and informational resources have demystified fertility issues and promoted the benefits of IVF. This reduction in stigma encourages more individuals and couples to openly discuss their fertility concerns and seek medical help, thereby increasing the demand for IVF services. In Japan, one in 4.4 couples has undergone tests or treatment for infertility. In 2021, one in 11.6 babies was born as a result of assisted reproductive technologies such as in vitro fertilization.Social changes, including delayed marriage and childbearing, have influenced the growing acceptance of fertility treatments. As individuals and couples prioritize career development and personal goals, they often delay starting families. This trend leads to age-related fertility issues, making IVF a more relevant and necessary option. The societal shift towards accepting and seeking advanced fertility treatments, including IVF, aligns with these changing social norms. As people become more comfortable with the idea of using reproductive technologies to achieve their family planning goals, the demand for IVF services continues to rise. The proliferation of online resources, support groups, and educational platforms has increased access to information about fertility treatments. Patients can now easily access information about IVF procedures, success rates, and available technologies through various digital channels. This accessibility empowers individuals to make informed decisions about their fertility treatment options. As more people become knowledgeable about IVF and its benefits, the likelihood of them pursuing these services increases, driving market growth. The establishment of support networks and advocacy groups dedicated to infertility and reproductive health has also contributed to market growth. These organizations provide resources, counseling, and community support to individuals undergoing fertility treatments. They play a vital role in advocating for better access to IVF services and influencing public and policy attitudes towards fertility treatment. The support and advocacy provided by these groups help normalize the use of IVF and encourage more individuals to seek treatment, thereby expanding the market.

Increased awareness has also led to greater inclusion of fertility treatments in employer-sponsored health insurance plans and employee benefits. Many companies and health insurance providers now offer coverage for IVF and other fertility treatments as part of their benefits packages. This inclusion makes IVF more accessible and affordable for a broader segment of the population. As more employers and insurers recognize the importance of supporting reproductive health, the availability and affordability of IVF services improve, further driving market growth. In response to the increasing acceptance of fertility treatments, the Japanese government has introduced policies and subsidies to support individuals seeking IVF. Government initiatives, such as financial assistance and expanded insurance coverage for fertility treatments, help reduce the financial burden associated with IVF. These policy changes reflect a commitment to addressing demographic challenges and improving access to reproductive health services. The supportive policy environment enhances the attractiveness of IVF services and contributes to market growth. Increasing awareness and acceptance of fertility treatments drive the growth of the Japan IVF service market by reducing stigma, aligning with changing social norms, increasing access to information, supporting advocacy efforts, and influencing insurance and policy frameworks. These factors collectively enhance the demand for IVF services, leading to a more robust and expanding market.

Key Market Challenges

High Cost of IVF Treatments

The cost of IVF treatments remains one of the primary barriers to market growth. Despite efforts to provide financial support through government subsidies and insurance coverage, the overall expense of IVF procedures can still be prohibitively high for many individuals and couples. The cost includes not only the treatment itself but also associated expenses such as medication, laboratory fees, and additional procedures like genetic testing. These high costs can limit access to IVF services, particularly for those without adequate insurance coverage or financial resources. As a result, many potential patients may delay or forego treatment, which restricts the growth of the IVF market.Limited Availability of Fertility Clinics and Specialists

The distribution of fertility clinics and specialized reproductive healthcare providers is uneven across Japan, with a concentration in major urban areas like Tokyo and Osaka. In rural or less populated regions, access to high-quality IVF services may be limited due to the scarcity of specialized clinics and experienced fertility specialists. This geographic disparity can lead to longer wait times for treatment and reduced accessibility for patients residing outside major metropolitan areas. The limited availability of services in these regions can hinder the overall growth of the IVF market by excluding a significant portion of the population from accessing necessary fertility treatments.Regulatory and Ethical Constraints

Stringent regulatory and ethical guidelines surrounding IVF procedures in Japan can pose challenges to market growth. The Japanese government imposes strict regulations on various aspects of IVF, including the number of embryos that can be transferred and the use of reproductive technologies such as egg or sperm donation. These regulations are intended to ensure the safety and ethical standards of fertility treatments but can also limit the scope of services offered and the flexibility of treatment options available to patients. Additionally, ethical concerns and societal attitudes towards certain reproductive technologies may influence the adoption and availability of advanced IVF treatments. Navigating these regulatory and ethical constraints can create barriers for both fertility clinics and patients, impacting the overall growth and development of the IVF service market.Key Market Trends

Advancements in Reproductive Technology

The rapid development of reproductive technologies is a significant driver of growth in the IVF service market. Innovations such as preimplantation genetic testing (PGT) and advanced embryo culture techniques are enhancing the success rates of IVF treatments. PGT allows for the screening of embryos for genetic abnormalities before implantation, thereby increasing the likelihood of a successful pregnancy and reducing the risk of genetic disorders. Furthermore, improvements in embryo culture media and time-lapse imaging systems provide better conditions for embryo development and more precise monitoring, leading to higher success rates and better outcomes for patients. As these technologies continue to evolve, they will further boost the demand for IVF services by offering more personalized and effective treatment options.Growing Awareness and Acceptance of Fertility Treatments

Increasing awareness and acceptance of fertility treatments among the Japanese population are driving market growth. Social and cultural shifts are reducing the stigma associated with infertility and encouraging more individuals and couples to seek medical assistance. Public awareness campaigns and educational programs are highlighting the availability and benefits of IVF, leading to a higher number of patients seeking these services. Additionally, changing societal norms, such as delayed marriage and childbearing, are contributing to a rise in the number of individuals and couples requiring fertility treatments. This growing acceptance is expanding the patient base and driving demand for IVF services across Japan.Government Initiatives and Support

Government initiatives and policies aimed at addressing the declining birth rate and supporting fertility treatments are contributing to the growth of the IVF market. In Japan, the government has introduced various measures to alleviate the financial burden of IVF treatments, such as subsidies and insurance coverage for fertility procedures. These initiatives make IVF treatments more accessible and affordable for a broader segment of the population. Moreover, policies promoting research and development in reproductive medicine and supporting fertility clinics enhance the overall quality and availability of IVF services. As the government continues to prioritize fertility issues and support related treatments, these measures will drive further growth in the IVF service market.Segmental Insights

Type Insights

Based on the category of Type, the Fresh IVF Cycle segment emerged as the dominant in the market for Japan In Vitro Fertilisation (IVF) Service in 2024. clinical efficacy plays a significant role. Fresh IVF cycles, where eggs are retrieved and fertilized immediately before being transferred to the uterus, are associated with higher success rates compared to frozen cycles. This immediate approach reduces the potential for loss of embryo quality during the freezing and thawing process, leading to better implantation rates and higher overall success rates. As a result, many patients and fertility clinics prefer fresh cycles for their improved outcomes, driving the segment's dominance. Patient preference heavily influences the market dynamics. Patients often opt for fresh IVF cycles due to the perception of greater effectiveness and faster results. Fresh cycles offer the advantage of addressing infertility issues in a more direct and immediate manner, which appeals to those seeking quicker solutions. This preference drives higher demand for fresh cycles over frozen alternatives, reinforcing its dominant position in the market. Also, technological advancements have bolstered the prominence of fresh IVF cycles. Innovations in laboratory techniques, such as improvements in egg retrieval and fertilization methods, have enhanced the success rates of fresh cycles. Enhanced protocols and technology enable clinics to manage and monitor the IVF process with greater precision, contributing to the overall effectiveness of fresh cycles and making them a more attractive option for patients.Market dynamics also support the dominance of fresh IVF cycles. In Japan, the emphasis on high success rates and the ability to offer immediate treatment align with the expectations of both patients and fertility clinics. The focus on delivering optimal results quickly drives clinics to prioritize fresh IVF cycles, which in turn influences market trends and growth. The Fresh IVF Cycle segment's dominance in the Japanese IVF service market is driven by its superior clinical efficacy, strong patient preference for immediate results, technological advancements enhancing cycle outcomes, and market dynamics that prioritize high success rates. These factors collectively establish fresh IVF cycles as the preferred option within the market, reinforcing their dominant position. These factors collectively contribute to the growth of this segment.

Regional Insights

Kanto emerged as the dominant in the Japan In Vitro Fertilisation (IVF) Service market in 2024, holding the largest market share in terms of value. the Kanto Region, which encompasses Tokyo and its surrounding prefectures, benefits from a well-established healthcare system with a high concentration of specialized fertility clinics and advanced medical facilities. This concentration is supported by substantial investments in healthcare technology and research, enabling the region to offer state-of-the-art IVF services. The presence of numerous fertility clinics in metropolitan areas like Tokyo provides patients with a wide range of treatment options and cutting-edge techniques, contributing to the region's market leadership.The Kanto Region's high population density translates into a large potential patient base for IVF services. The region's urban centers attract a significant number of residents seeking fertility treatments, driven by both demographic trends and lifestyle factors. The region's diverse and affluent population also enables a higher rate of discretionary spending on fertility treatments, further bolstering demand. Economic affluence is another critical factor. The Kanto Region, being Japan's economic hub, has higher income levels and greater access to private healthcare funding compared to other regions. This economic strength allows individuals and couples to afford premium IVF services, including advanced diagnostic and therapeutic options that might be less accessible in other parts of Japan.

Also, the Kanto Region benefits from its strong network of research institutions and academic centers, which foster innovation in reproductive medicine. Collaborations between these institutions and fertility clinics facilitate the continuous improvement and availability of advanced IVF techniques and technologies. The Kanto Region's dominance in the Japanese IVF service market is driven by its advanced healthcare infrastructure, high population density, economic affluence, and strong research and development environment. These factors combine to make the region a leading hub for fertility treatments, attracting patients from across Japan and contributing to its prominent position in the IVF market.

Key Market Players

- WORLD FERTILITY SERVICES

- Kitazato Corporation

- Fartility clinic tokyo

- We Care IVF Surrogacy

- HARA MEDICAL CLINIC

- GO IVF SURROGACY

- KATO REPRO BIOTECH CENTER

- Fertility Institute of Hawaii

- IVFClinicsWorldwide

Report Scope:

In this report, the Japan In Vitro Fertilisation (IVF) Service Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Japan In Vitro Fertilisation (IVF) Service Market, By Type:

- Fresh IVF Cycle

- Thawed IVF Cycle

- Donor Egg IVF Cycle

Japan In Vitro Fertilisation (IVF) Service Market, By End User:

- Fertility Clinics

- Hospitals

- Surgical Centers

- Clinical Research Institutes

Japan In Vitro Fertilisation (IVF) Service Market, By Region:

- Hokkaido

- Tohoku

- Kanto

- Chubu

- Kansai

- Chugoku

- Shikoku

- Kyushu

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Japan In Vitro Fertilisation (IVF) Service Market.Available Customizations:

Japan In Vitro Fertilisation (IVF) Service market report with the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- WORLD FERTILITY SERVICES

- Kitazato Corporation

- Fartility clinic tokyo

- We Care IVF Surrogacy

- HARA MEDICAL CLINIC

- GO IVF SURROGACY

- KATO REPRO BIOTECH CENTER

- Fertility Institute of Hawaii

- IVFClinicsWorldwide

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 82 |

| Published | August 2024 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 250.1 Million |

| Forecasted Market Value ( USD | $ 416.93 Million |

| Compound Annual Growth Rate | 8.8% |

| Regions Covered | Japan |

| No. of Companies Mentioned | 9 |