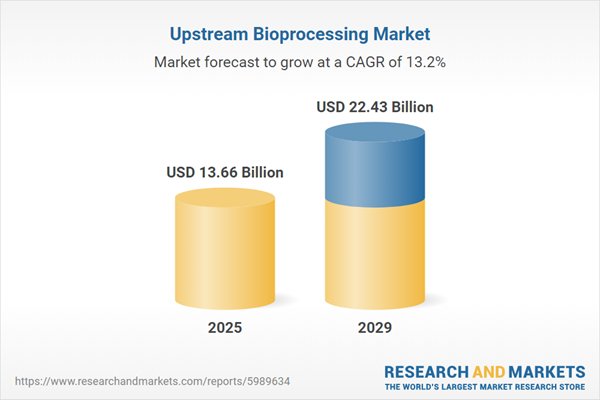

The upstream bioprocessing market size has grown rapidly in recent years. It will grow from $12.03 billion in 2024 to $13.66 billion in 2025 at a compound annual growth rate (CAGR) of 13.6%. The growth in the historic period can be attributed to rise in need for process optimization and contamination free, safe and efficient production of biomolecules, commercial success and rising demand for bio-therapeutics, rise in the implementation of process analytical technology, rise in chronic disease prevalence, and increased research into the production of biosimilar.

The upstream bioprocessing market size is expected to see rapid growth in the next few years. It will grow to $22.43 billion in 2029 at a compound annual growth rate (CAGR) of 13.2%. The growth in the forecast period can be attributed to commercial use of single-use bioreactors, outsourcing of biopharmaceutical manufacturing, rapid growth of pharmaceutical and biotechnology industries, rising adoption of single-use upstream bioprocessing, and increasing partnerships, mergers, acquisitions, and collaborations. Major trends in the forecast period include increasing investments in R&D in biopharmaceutical industry, technological advancements, advanced upstream bioprocessing technologies, development of new technologies and advanced filtration technologies.

The growth of the upstream bioprocessing market is expected to be propelled by the outsourcing of biopharmaceutical manufacturing. This outsourcing involves delegating certain production stages to external entities such as contract manufacturing organizations (CMOs) or contract development and manufacturing organizations (CDMOs). It is driven by factors such as cost efficiency, focus on core competencies, flexibility in production scaling, access to specialized expertise, and risk mitigation. Outsourcing biopharmaceutical manufacturing accelerates product development by leveraging external expertise, streamlining operations, and reducing costs. For instance, BDO USA predicts that by 2025, contract development and manufacturing organizations along with hybrid manufacturing companies will control 44% of the global mammalian capacity of around 7,500kL. Hence, the outsourcing of biopharmaceutical manufacturing is a key driver of the upstream bioprocessing market's growth.

Leading companies in the upstream bioprocessing market are concentrating on developing advanced bioreactors tailored to cell culture processes, enhancing performance, flexibility, and scalability. Bioreactors are crucial tools in upstream bioprocessing, enabling efficient and controlled biopharmaceutical production through cell culture and biomolecule manufacturing. For example, in April 2023, Cytiva introduced X-platform bioreactors designed to streamline single-use upstream bioprocessing procedures. These bioreactors feature a modular design consisting of a tank, cabinet assembly, and human-machine interface (HMI), allowing flexible arrangements without the need for custom hardware or single-use bags. User-friendly features include an optimized vessel with a full-opening door, baffles, and improved cable management. Additionally, the online Bioreactor Scaler tool aids in determining optimal parameters for successful scale-up.

In May 2022, Lonza entered into a license agreement with Adva Biotechnology, granting Adva access to key intellectual property for the global expansion of automated bioreactors. This agreement provides Adva Biotechnology with a non-exclusive license to specific patents in Lonza's portfolio related to smart automation and bioreactor control. Adva Biotechnology, based in Israel, is focused on developing innovative technologies for upstream bioprocessing in the cell therapy industry.

Major companies operating in the upstream bioprocessing market are Thermo Fisher Scientific Inc., Danaher Corp, Merck KGaA, GE HealthCare Technologies, Parker Hannifin Corp, Corning Inc., AGC Biologics, Avantor, AGC Inc., Boehringer Ingelheim International GmbH, Catalent Inc., Sartorius AG, Entegris Inc., Getinge AB, Bio-Rad Laboratories Inc., Samsung Biologics Co. Ltd., Eppendorf AG, Repligen Corporation, Takara Bio Inc., KBI Biopharma Inc., Rentschler Biopharma SE, Just Biotherapeutics Inc., PBS Biotech Inc., Stobbe Group, Applikon Biotechnology.

North America was the largest region in the upstream bioprocessing market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the upstream bioprocessing market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the upstream bioprocessing market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Upstream bioprocessing involves preparing and cultivating cells to produce biological products such as proteins and vaccines. It focuses on cell line development and cell culture to create a scalable system that maximizes yield and quality, ensuring reproducibility and efficiency for downstream purification and formulation.

The primary products of upstream bioprocessing include bioreactors, fermenters, cell culture media, filters, and bags and containers. Bioreactors are vessels or tanks where biological reactions and processes occur under controlled conditions. The workflow includes media preparation, cell culture, and cell separation, with usage options including single-use and multi-use systems. These processes can be performed in-house or outsourced by various end users such as contract development and manufacturing organizations (CDMOs), contract research organizations (CROs), research and academic institutes, and biopharmaceutical companies.

The upstream bioprocessing market research report is one of a series of new reports that provides upstream bioprocessing market statistics, including upstream bioprocessing industry global market size, regional shares, competitors with a upstream bioprocessing market share, detailed upstream bioprocessing market segments, market trends and opportunities, and any further data you may need to thrive in the upstream bioprocessing industry. This upstream bioprocessing market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The upstream bioprocessing market consists of revenues earned by entities by providing services such as cell line development, inoculum preparation, process development and optimization, scale-up production, quality control and monitoring and raw material supply and management. The market value includes the value of related goods sold by the service provider or included within the service offering. The upstream bioprocessing market also includes sales of recombinant proteins, monoclonal antibodies, vaccines, gene therapy vectors, cell therapy products, enzymes, peptides, bio therapeutics and biosimilars. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Upstream Bioprocessing Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on upstream bioprocessing market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for upstream bioprocessing ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The upstream bioprocessing market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product type: Bioreactors; Fermenters; Cell Culture Media; Filters; Bags and Containers2) By Workflow: Media Preparation; Cell Culture; Cell Separation

3) By Usage type: Single-Use; Multi-Use

4) By Mode: in House; Outsourced

5) By End User: Contract Development and Manufacturing Organization (CDMOs) Or Contract Research Organization (CROs); Research and Academic Institutes; Biopharmaceutical Companies

Subsegments:

1) By Bioreactors: Single-Use Bioreactors; Multi-Use Bioreactors2) By Fermenters: Laboratory Fermenters; Pilot Scale Fermenters; Industrial Fermenters

3) By Cell Culture Media: Powdered Media; Liquid Media

4) By Filters: Sterile Filters; Air Filters; Capsule Filters

5) By Bags and Containers: Single-Use Bags; Bioprocess Containers; Storage Bags

Key Companies Mentioned: Thermo Fisher Scientific Inc.; Danaher Corp; Merck KGaA; GE HealthCare Technologies; Parker Hannifin Corp

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Upstream Bioprocessing market report include:- Thermo Fisher Scientific Inc.

- Danaher Corp

- Merck KGaA

- GE HealthCare Technologies

- Parker Hannifin Corp

- Corning Inc.

- AGC Biologics

- Avantor

- AGC Inc.

- Boehringer Ingelheim International GmbH

- Catalent Inc.

- Sartorius AG

- Entegris Inc.

- Getinge AB

- Bio-Rad Laboratories Inc.

- Samsung Biologics Co. Ltd.

- Eppendorf AG

- Repligen Corporation

- Takara Bio Inc.

- KBI Biopharma Inc.

- Rentschler Biopharma SE

- Just Biotherapeutics Inc.

- PBS Biotech Inc.

- Stobbe Group

- Applikon Biotechnology

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 13.66 Billion |

| Forecasted Market Value ( USD | $ 22.43 Billion |

| Compound Annual Growth Rate | 13.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |