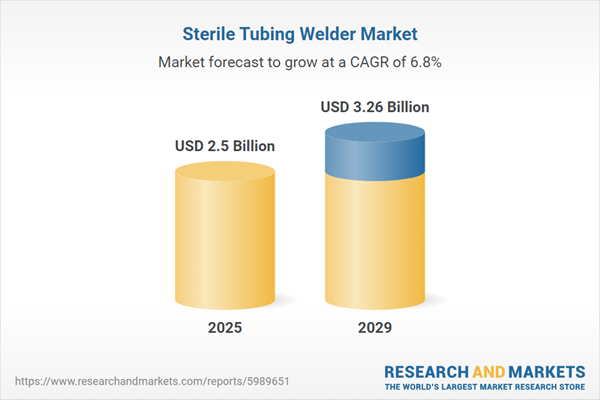

The sterile tubing welder market size has grown strongly in recent years. It will grow from $2.34 billion in 2024 to $2.5 billion in 2025 at a compound annual growth rate (CAGR) of 7.2%. The growth in the historic period can be attributed to innovations in medical devices, increased demand for biopharmaceuticals, stringent regulatory standards, rise in chronic diseases, and globalization of healthcare.

The sterile tubing welder market size is expected to see strong growth in the next few years. It will grow to $3.26 billion in 2029 at a compound annual growth rate (CAGR) of 6.8%. The growth in the forecast period can be attributed to growing biotechnology sector, rapid expansion of pharmaceutical industry, increasing focus on patient safety, emergence of advanced materials, and shift towards automation and robotics. Major trends in the forecast period include adoption of single-use systems, integration of automation and robotics, development of advanced sterilization technologies, expansion of bioprocessing capabilities, and emphasis on eco-friendly and sustainable solutions.

The expanding pipeline of biologics is anticipated to drive the advancement of the sterile tubing welder market in the future. Biologics encompass medicinal products sourced from living organisms or their constituents, such as vaccines, blood derivatives, gene therapies, tissues, and recombinant therapeutic proteins. This growth in biologics is fueled by advancements in biotechnology and a deeper understanding of disease mechanisms. Sterile tubing welders play a crucial role in the production of biologics by facilitating aseptic connections, thereby ensuring the integrity of fluid transfer systems essential for preserving product purity. For example, in January 2024, as reported by the National Library of Medicine, the Food and Drug Administration (FDA) sanctioned 55 new drugs, including 29 new chemical entities (NCEs) and 25 new biological entities (NBEs), marking a 50% surge from the 37 approvals in 2022. Hence, the burgeoning biologics pipeline is fostering the expansion of the sterile tubing welder market.

The rising prevalence of chronic diseases is expected to drive the growth of the sterile tubing welder market in the coming years. Chronic diseases are long-term health conditions that generally progress slowly and require continuous medical management. The increase in chronic diseases can be attributed to factors such as aging populations, unhealthy lifestyle choices (including poor diet, lack of exercise, and smoking), environmental influences, and advancements in detection and diagnosis. Sterile tubing welders are crucial for producing intravenous therapies and other sterile medical treatments for chronic diseases, ensuring contamination-free delivery systems. For example, in January 2023, the National Center for Biotechnology Information (NCBI) reported that by 2050, the number of individuals aged 50 and older with at least one chronic illness is expected to nearly double, reaching 142.66 million, a 99.5% increase. Therefore, the growing prevalence of chronic diseases is a key factor driving the expansion of the sterile tubing welder market.

Major companies within the sterile tubing welder market are innovating by introducing advanced products such as genderless connectors to streamline the sterile connection and disconnection processes while upholding stringent sterility standards in biopharmaceutical manufacturing settings. Genderless connectors are adaptable, sterile connectors engineered to facilitate swift and effortless sterile connections and disconnections without the need for specific male or female components. For instance, in June 2022, CPC (Colder Products Company), a US-based manufacturer of couplings and connectors, unveiled the AseptiQuik G DC Series Connector. This product is designed to optimize closed-system liquid processing for biopharmaceutical manufacturers, allowing rapid and sterile tubing connections and disconnections, even in non-sterile environments, without the necessity for supplementary equipment.

Major companies operating in the sterile tubing welder market are GE Healthcare, Terumo BCT Inc., Sartorius AG, Entegris Inc., Racer Technology, LePure Biotech, NewAge Industries, GDM Electronics, Bioengineering AG, Biopharm Engineering, Schunk Sonosystems, Hangzhou Wu Zhou Medical Equipment, Vesta Pharmaceuticals, MGA Technologies, Aseptic Group, Sunbelt Technology, Genesis BPS, Biomen Biosystems Co. Ltd., Sentinel Process Systems Inc., AdvantaPure.

North America was the largest region in the sterile tubing welder market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the sterile tubing welder market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the sterile tubing welder market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

A sterile tubing welder is a specialized apparatus employed in the biopharmaceutical, medical, and laboratory sectors to join two segments of thermoplastic tubing while preserving sterility. Its role is to safeguard the internal sterility of the tubing throughout the welding process, a critical aspect in preventing contamination in procedures involving sterile fluids.

The primary modes of sterile tubing welders include manual and automatic varieties. A manual sterile tubing welder is a tool utilized to connect sterile tubing manually, commonly found in laboratory or small-scale production environments. These welders are applied in various settings, including biopharmaceuticals, blood processing, diagnostic laboratories, and others, catering to end users such as hospitals, research clinics, and blood centers.

The sterile tubing welder research report is one of a series of new reports that provides sterile tubing welder market statistics, including the sterile tubing welder industry's global market size, regional shares, competitors with a sterile tubing welder market share, detailed sterile tubing welder market segments, market trends and opportunities, and any further data you may need to thrive in the sterile tubing welder industry. This sterile tubing welder market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The sterile tubing welder market consists of sales of portable sterile tubing welders, fully automatic sterile tubing welders, single-use sterile tubing welders, bench-top sterile tubing welders, and high-performance sterile tubing welders. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Sterile Tubing Welder Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on sterile tubing welder market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for sterile tubing welder ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The sterile tubing welder market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Mode: Manual; Automatic2) By Application: Biopharmaceutical; Blood Processing; Diagnostic Laboratories; Other Applications

3) By End-Use: Hospitals; Research Clinics; Blood Centers; Other End-Users

Subsegments:

1) By Manual: Handheld Manual Sterile Tubing Welders; Bench-Top Manual Sterile Tubing Welders2) By Automatic: Fully Automatic Sterile Tubing Welders; Semi-Automatic Sterile Tubing Welders

Key Companies Mentioned: GE Healthcare; Terumo BCT Inc.; Sartorius AG; Entegris Inc.; Racer Technology

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Sterile Tubing Welder market report include:- GE Healthcare

- Terumo BCT Inc.

- Sartorius AG

- Entegris Inc.

- Racer Technology

- LePure Biotech

- NewAge Industries

- GDM Electronics

- Bioengineering AG

- Biopharm Engineering

- Schunk Sonosystems

- Hangzhou Wu Zhou Medical Equipment

- Vesta Pharmaceuticals

- MGA Technologies

- Aseptic Group

- Sunbelt Technology

- Genesis BPS

- Biomen Biosystems Co. Ltd.

- Sentinel Process Systems Inc.

- AdvantaPure

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.5 Billion |

| Forecasted Market Value ( USD | $ 3.26 Billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |