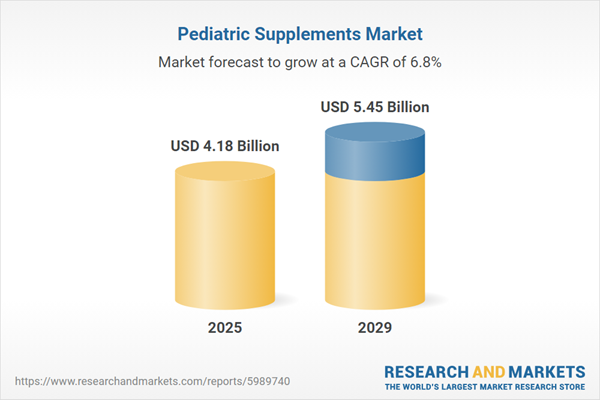

The pediatric supplements market size is expected to see strong growth in the next few years. It will grow to $5.45 billion in 2029 at a compound annual growth rate (CAGR) of 6.8%. The growth in the forecast period can be attributed to rising demand for supplements with purified protein, increasing healthcare expenditure, rising awareness of pediatric health, increasing health and wellness trends, growing population of children. Major trends in the forecast period include innovative product formulations, increasing demand for immunity-boosting supplements, innovation in delivery forms, natural and organic ingredients, quality control and ingredient sourcing.

The forecast of 6.8% growth over the next five years reflects a modest reduction of 0.7% from the previous estimate for this market. This reduction is primarily due to the impact of tariffs between the US and other countries. Tariff barriers are expected to hamper U.S. pediatric nutrition programs by increasing the cost of vitamin and mineral supplements imported from Germany and Denmark, thereby limiting access to essential nutrients and raising child wellness program expenses. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

The anticipated rise in nutritional deficiencies is set to drive the pediatric supplement market's growth in the future. Nutritional deficiencies denote the absence of crucial nutrients necessary for proper growth, development, and overall well-being. The surge in the consumption of highly processed foods, often lacking vital nutrients and abundant in empty calories, sugars, and unhealthy fats, substantially contributes to these deficiencies. Pediatric supplements play a vital role in averting such deficiencies in infants and children by supplementing essential nutrients missing from their diets. For instance, as of June 2023, UNICEF reported that malnutrition prevention programs had reached 356.3 million children under 5 and mothers in 2022, up from 336.4 million in 2021. Hence, the increasing prevalence of nutritional deficiencies is fueling the pediatric supplement market's expansion.

Leading pediatric supplement firms are prioritizing the development of natural and organic ingredients tailored for children, such as vitamin D and probiotic drops, to meet the rising demand for healthier alternatives. Vitamin D and probiotic drops serve as dietary supplements aimed at providing infants and young children with the necessary nutrients for their growth and development. For instance, Bobbie, a US-based pediatric nutrition company, introduced its inaugural non-formula products, organic vitamin D and probiotic drops, in February 2024. Bobbie Organic Vitamin D Drops offer infants aged 0-12 months 100% of the daily vitamin D recommendation (400 IU) in a 3-drop dosage. Made with certified organic, non-GMO ingredients, these drops are suitable for breastfed and combination-fed infants, promoting robust bone and teeth development, immune health, and calcium absorption. These new supplements are tailored to address common pediatric deficiencies and support the distinct requirements of infants and toddlers. Organic probiotic drops comprise a blend of probiotic strains clinically proven to alleviate colic in infants.

In July 2022, JB Pharma, an India-based pharmaceutical company, acquired four pediatric formulation brands from Dr. Reddy's Laboratories Limited for Rs 98.3 crore ($8.23 million). This acquisition forms part of JB Pharma's strategy to broaden its offerings in the pediatric segment and fortify its domestic operations. Dr. Reddy's Laboratories Limited, an India-based pharmaceutical company, is renowned for manufacturing pediatric supplements.

Major companies operating in the pediatric supplements market are Nestlé S.A., Archer Daniels Midland Company, Pfizer Inc., BASF SE, Johnson & Johnson (JNJ), The Procter & Gamble Company, Bayer AG, Sanofi S.A., Abbott, Beximco Pharmaceuticals Limited, Danone S.A., Reckitt Benckiser Group plc, Otsuka Pharmaceutical Co. Ltd., DuPont de Nemours Inc., Koninklijke DSM N.V., Alexion Pharmaceuticals Inc., Church & Dwight Co. Inc., Perrigo Company, Glenmark Pharmaceuticals Ltd., Himalaya Wellness Company, Hero Nutritionals Inc., Bioglan Pty Ltd.

North America was the largest region in the pediatric supplements market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the pediatric supplements market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the pediatric supplements market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The pediatric supplements market consists of sales of parents and caregivers, healthcare professionals, children and adolescents and schools and daycare centers. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sudden escalation of U.S. tariffs and the resulting trade tensions in spring 2025 are having a significant impact on the pharmaceutical sector. Companies are grappling with higher costs on imported active pharmaceutical ingredients (APIs), glass vials, and laboratory equipment - many of which have limited alternative sources. Generic drug manufacturers, already operating with minimal profit margins, are particularly affected, with some scaling back production of low-margin medications. Biotech firms are also experiencing delays in clinical trials due to shortages of specialized reagents linked to tariffs. In response, the industry is shifting API production to regions like India and Europe, building up inventory reserves, and advocating for tariff exemptions on essential medicines.

The pediatric supplements market research report is one of a series of new reports that provides pediatric supplements market statistics, including pediatric supplements industry global market size, regional shares, competitors with a procedure trays market share, detailed pediatric supplements market segments, market trends, and opportunities, and any further data you may need to thrive in the pediatric supplements industry. This pediatric supplements market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Pediatric supplements, crafted to deliver crucial vitamins, minerals, and nutrients, are tailored for infants, children, and adolescents, meeting their distinct nutritional requirements throughout various stages of growth and development. Targeting individuals up to 18 years old, these dietary supplements aim to complement their diets.

These supplements encompass a range of product types including vitamins, minerals, probiotics, omega-3 fatty acids, amino acids, and more. Vitamins, indispensable for bodily functions and development, are organic nutrients that the body cannot synthesize adequately on its own. Available in forms such as gummies, chewables, liquids, powders, and tablets, these products are accessible through diverse channels such as pharmacies, supermarkets, online retailers, and specialty stores, catering to age groups spanning from infants to adolescents. Their applications span immunity enhancement, brain and cognitive support, bone and dental health, gastrointestinal support, overall well-being, and more.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Pediatric Supplements Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on pediatric supplements market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for pediatric supplements? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The pediatric supplements market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product Type: Vitamins; Minerals; Probiotics; Omega-3 Fatty Acids; Amino Acids; Other Product Types2) By Form: Gummies; Chewable; Liquids; Powders; Tablets; Other Forms

3) By Distribution Channel: Pharmacies; Supermarkets or Hypermarkets; Online Retailers; Specialty Stores; Other Distribution Channels

4) By Age Group: Infants; Toddlers; Middle Childhood; Adolescents

5) By Application: Immunity Enhancement; Brain and Cognitive Support; Bone and Teeth Support; Gastrointestinal Support; General Well-Being; Other Applications

Subsegments:

1) By Vitamins: Vitamin a; Vitamin B (B1, B2, B3, B6, B12, Etc.); Vitamin C; Vitamin D; Vitamin E; Vitamin K; Multivitamins2) By Minerals: Calcium; Iron; Magnesium; Zinc; Potassium; Selenium

3) By Probiotics: Lactobacillus; Bifidobacterium; Streptococcus Thermophilus; Other Probiotic Strains

4) By Omega-3 Fatty Acids: DHA (Docosahexaenoic Acid); EPA (Eicosapentaenoic Acid); ALA (Alpha-Linolenic Acid)

5) By Amino Acids: L-Arginine; L-Carnitine; L-Glutamine; L-Leucine; L-Isoleucine; L-Valine

6) By Other Product Types: Herbal Supplements; Protein Supplements; Fiber Supplements; Enzyme Supplements

Companies Mentioned: Nestlé S.A.; Archer Daniels Midland Company; Pfizer Inc.; BASF SE; Johnson & Johnson (JNJ); the Procter & Gamble Company; Bayer AG; Sanofi S.A.; Abbott; Beximco Pharmaceuticals Limited; Danone S.A.; Reckitt Benckiser Group plc; Otsuka Pharmaceutical Co. Ltd.; DuPont de Nemours Inc.; Koninklijke DSM N.V.; Alexion Pharmaceuticals Inc.; Church & Dwight Co. Inc.; Perrigo Company; Glenmark Pharmaceuticals Ltd.; Himalaya Wellness Company; Hero Nutritionals Inc.; Bioglan Pty Ltd

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Pediatric Supplements market report include:- Nestlé S.A.

- Archer Daniels Midland Company

- Pfizer Inc.

- BASF SE

- Johnson & Johnson (JNJ)

- The Procter & Gamble Company

- Bayer AG

- Sanofi S.A.

- Abbott

- Beximco Pharmaceuticals Limited

- Danone S.A.

- Reckitt Benckiser Group plc

- Otsuka Pharmaceutical Co. Ltd.

- DuPont de Nemours Inc.

- Koninklijke DSM N.V.

- Alexion Pharmaceuticals Inc.

- Church & Dwight Co. Inc.

- Perrigo Company

- Glenmark Pharmaceuticals Ltd.

- Himalaya Wellness Company

- Hero Nutritionals Inc.

- Bioglan Pty Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 4.18 Billion |

| Forecasted Market Value ( USD | $ 5.45 Billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |