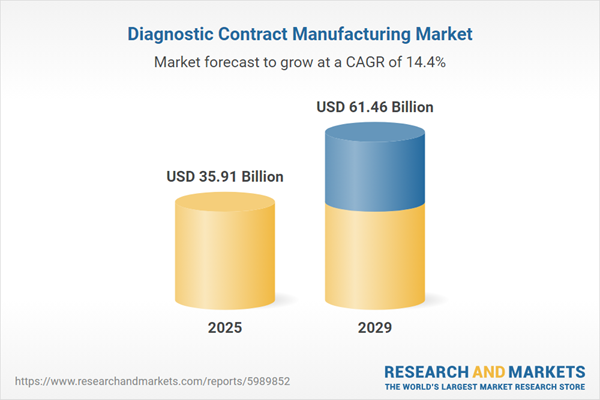

The diagnostic contract manufacturing market size has grown rapidly in recent years. It will grow from $31.29 billion in 2024 to $35.91 billion in 2025 at a compound annual growth rate (CAGR) of 14.7%. The growth in the historic period can be attributed to increasing demand for outsourcing, cost efficiency achieved through outsourcing manufacturing, increasing regulatory requirements for quality and compliance in the diagnostic industry, shortened product lifecycles in the diagnostic market necessitated flexible manufacturing solutions, and globalization of diagnostic companies' operations and supply chains increasing.

The diagnostic contract manufacturing market size is expected to see rapid growth in the next few years. It will grow to $61.46 billion in 2029 at a compound annual growth rate (CAGR) of 14.4%. The growth in the forecast period can be attributed to increasing demand for personalized diagnostic tests and companion diagnostics, expansion of point-of-care testing and decentralized diagnostic platforms, tightening regulatory requirements for diagnostic products, increase in outsourcing of specialty testing, such as molecular diagnostics and immunoassays, and shift towards flexible manufacturing. Major trends in the forecast period include adoption of automation and robotics in diagnostic manufacturing processes, utilization of 3D printing technologies for rapid prototyping and customization of diagnostic devices, integration of artificial intelligence (AI) and data analytics into diagnostic manufacturing processes, and implementation of digital twin technology to simulate and optimize manufacturing processes in the virtual environment before physical implementation.

An increasing emphasis on preventive healthcare is expected to drive the growth of the diagnostic contract manufacturing market in the coming years. Preventive healthcare involves measures aimed at preventing the onset or progression of diseases, illnesses, or injuries. The growing focus on preventive healthcare is driven by factors such as rising healthcare costs, changing healthcare priorities, an increase in chronic diseases, and an aging population. Diagnostic contract manufacturing plays a crucial role in supporting preventive healthcare by providing essential diagnostic tools and tests, offering customized solutions, ensuring quality and regulatory compliance, supporting scalability, and delivering cost-effective solutions for disease prevention and early intervention. For example, in March 2022, the Centers for Medicare & Medicaid Services, a U.S.-based Department of Health and Human Services agency, predicted that national health spending would increase by an average of 5.1% annually from 2021 to 2030, reaching approximately $6.8 trillion by 2030, according to the 2021-2030 National Health Expenditure (NHE) report. Therefore, the growing focus on preventive healthcare is fueling the growth of the diagnostic contract manufacturing market.

Key players in the diagnostic contract manufacturing sector are embracing strategic partnerships to bolster the production of diagnostic equipment and gain competitive advantages. Strategic partnerships entail collaborative endeavors between multiple organizations pooling their resources, expertise, and efforts to achieve shared objectives. For instance, Highfield Diagnostics Ltd., a UK-based diagnostics company, partnered with SCIENION GmbH, a Germany-based bio convergence company specializing in diagnostic contract manufacturing services, to develop and deploy equipment for mass manufacturing lateral flow tests (LFTs) incorporating HDx's flowDx technology. This collaboration leverages SCIENION's manufacturing capabilities to finalize equipment designs and manufacturing processes for the cost-effective and high-throughput production of flowDx-enabled LFTs. flowDx technology, developed over seven years of academic research, facilitates precise control of fluidic flows in LFTs, enabling parallel multiplexing, improved accuracy, and semi-quantitative results.

In August 2023, RQM Ltd., a US-based MedTech service provider, acquired Kottmann GmbH, aiming to enhance operational efficiency, expedite client market entry, and strengthen its position as a leading MedTech contract research organization (CRO) in Europe and globally. Kottmann GmbH, based in Germany, specializes in conducting clinical studies involving medical devices, in vitro diagnostics (IVDs), and pharmaceuticals.

Major companies operating in the diagnostic contract manufacturing market are Thermo Fisher Scientific Inc., Abbott Laboratories, Jabil Inc., Flex Ltd., Becton Dickinson and Company (BD), TE Connectivity Ltd., Sekisui Diagnostics LLC, Sanmina Corporation, Celestica Inc., Nipro Medical Corporation, Philips-Medisize Corporation, Plexus Corp, West Pharmaceutical Services Inc., Benchmark Electronics Inc., Bio-Rad Laboratories, QIAGEN N.V., Kimball Electronics Inc., Integer Holdings Corporation, Bio-Techne Corporation, Nolato AB, Nova Biomedical Corporation, Meridian Bioscience Inc., Fujirebio Inc., Biokit S.A., Invetech Pty. Ltd., KMC Systems, Savyon Diagnostics Ltd., Prestige Diagnostics U.K. Ltd., Cenogenic Corporation, Avioq Inc.

North America was the largest region in the diagnostic contract manufacturing market in 2024. The regions covered in the diagnostic contract manufacturing market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the diagnostic contract manufacturing market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Diagnostic contract manufacturing pertains to the practice of diagnostic companies outsourcing manufacturing processes and services to specialized contract manufacturing organizations (CMOs) or contract development and manufacturing organizations (CDMOs). This strategic move aims to streamline production, ensure compliance with quality standards, and improve cost efficiency for diagnostic companies.

The primary categories of services within diagnostic contract manufacturing encompass device development and manufacturing services, quality management services, packaging and assembly services, among others. Device development and manufacturing services encompass the design, development, and production of medical devices, including in vitro diagnostic devices and diagnostic imaging devices. These services find application in various sectors such as in-vitro diagnostic devices, diagnostic imaging devices, among others, and are utilized by end users such as medical device companies, pharmaceutical and biopharmaceutical companies, among others.

The diagnostic contract manufacturing market research report is one of a series of new reports that provides diagnostic contract manufacturing market statistics, including diagnostic contract manufacturing industry global market size, regional shares, competitors with an diagnostic contract manufacturing market share, detailed diagnostic contract manufacturing market segments, market trends and opportunities, and any further data you may need to thrive in the diagnostic contract manufacturing industry. This diagnostic contract manufacturing market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The diagnostic contract manufacturing market includes revenues earned by entities through supply chain management, regulatory support, post-market surveillance, logistics, and distribution. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Diagnostic Contract Manufacturing Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on diagnostic contract manufacturing market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for diagnostic contract manufacturing ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The diagnostic contract manufacturing market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Service: Device Development and Manufacturing Services; Quality Management Services; Packaging and Assembly Services; Other Services2) By Application: in Vitro Diagnostic Devices; Diagnostic Imaging Devices; Other Applications

3) By End User: Medical Device Companies; Pharmaceutical and Biopharmaceutical Companies; Other End Users

Subsegments:

1) By Device Development and Manufacturing Services: Product Design and Prototyping; Regulatory Affairs and Compliance; Manufacturing and Assembly; Testing and Validation2) By Quality Management Services: Quality Control and Assurance; Auditing and Inspection Services; Risk Management; Compliance and Certification Support

3) By Packaging and Assembly Services: Primary Packaging; Secondary Packaging; Sterilization Services; Custom Packaging Solutions

4) By Other Services: Supply Chain Management; Inventory Management; Logistics and Distribution; Aftermarket Services

Key Companies Mentioned: Thermo Fisher Scientific Inc.; Abbott Laboratories; Jabil Inc.; Flex Ltd.; Becton Dickinson and Company (BD)

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Diagnostic Contract Manufacturing market report include:- Thermo Fisher Scientific Inc.

- Abbott Laboratories

- Jabil Inc.

- Flex Ltd.

- Becton Dickinson and Company (BD)

- TE Connectivity Ltd.

- Sekisui Diagnostics LLC

- Sanmina Corporation

- Celestica Inc.

- Nipro Medical Corporation

- Philips-Medisize Corporation

- Plexus Corp

- West Pharmaceutical Services Inc.

- Benchmark Electronics Inc.

- Bio-Rad Laboratories

- QIAGEN N.V.

- Kimball Electronics Inc.

- Integer Holdings Corporation

- Bio-Techne Corporation

- Nolato AB

- Nova Biomedical Corporation

- Meridian Bioscience Inc.

- Fujirebio Inc.

- Biokit S.A.

- Invetech Pty. Ltd.

- KMC Systems

- Savyon Diagnostics Ltd.

- Prestige Diagnostics U.K. Ltd.

- Cenogenic Corporation

- Avioq Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 35.91 Billion |

| Forecasted Market Value ( USD | $ 61.46 Billion |

| Compound Annual Growth Rate | 14.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |