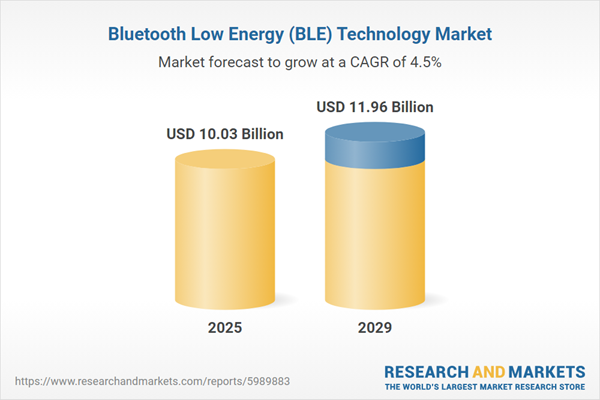

The bluetooth low energy (BLE) technology market size has grown steadily in recent years. It will grow from $9.58 billion in 2024 to $10.03 billion in 2025 at a compound annual growth rate (CAGR) of 4.8%. The growth in the historic period can be attributed to Increased demand for connected devices, increased demand for IoT devices, rose adoption of wearable technology, expanded applications in healthcare and fitness, grew need for low-power wireless connectivity.

The bluetooth low energy (BLE) technology market size is expected to see steady growth in the next few years. It will grow to $11.96 billion in 2029 at a compound annual growth rate (CAGR) of 4.5%. The growth in the forecast period can be attributed to integration with smart home devices, development of Bluetooth mesh technology, demand for location-based services, and demand for asset tracking. Major trends in the forecast period include adoption in IoT devices, integration into automotive systems, integration with 5G technology, expansion into smart home technology, and advancements in Bluetooth low energy SoC technology.

The growing adoption of smart home devices and IoT is expected to drive the expansion of the Bluetooth Low Energy (BLE) technology market. Smart home IoT (Internet of Things) devices include a range of household appliances, systems, and gadgets designed to be interconnected and controlled remotely or automatically via the internet or a local network. The increasing demand for convenience, enhanced security, energy efficiency, and remote control of home functions is fueling the adoption of smart home devices and IoT. BLE technology in smart home devices and IoT enables low-power, cost-effective wireless communication for efficient device connectivity and control. For instance, according to Ericsson, a Sweden-based network and telecommunications company, the number of IoT-connected devices is projected to rise from 13.2 billion in 2022 to 34.7 billion by 2028, with 28.7 billion of these devices connecting via local short-range LPWANs and 6 billion through wide-area networks, including private cellular networks. Consequently, the rising adoption of smart home devices and IoT will drive the growth of the BLE technology market.

Major companies in the BLE technology market are focusing on advanced wireless sensor technology, such as System-on-Chip (SoC), to enhance connectivity, reduce power consumption, and enable innovative applications in IoT, healthcare, and wearable devices. BLE SoCs integrate a microcontroller, radio, and BLE protocol stack into a single chip, providing efficient, low-power wireless communication for various applications. For instance, in June 2022, Renesas Electronics Corporation, a Japan-based semiconductor manufacturer, launched the SmartBond DA1470x Family, the world's most advanced Bluetooth Low Energy (LE) SoC. This SoC integrates power management, hardware voice activity detection, GPU, and Bluetooth LE connectivity into one chip, making it ideal for wearables, consumer medical devices, and home appliances. High integration results in cost savings on the BoM, enabling affordable solutions while reducing PCB component count for compact designs and space optimization. The new product family features a compact form factor and integrates applications and 2D graphics processors, a voice activity detector, and power management, making it suitable for small IoT product designs.

In March 2022, Sonova Holding AG, a Switzerland-based medical equipment manufacturer, acquired Sennheiser's Consumer Division for approximately $243 million. This acquisition is intended to expand Sonova's product portfolio and strengthen its market presence, particularly in the rapidly growing segments of true wireless headsets and speech-enhanced hearables. Sennheiser, a Germany-based audio equipment manufacturer, produces high-fidelity products such as headphones, professional audio solutions, and stereo Bluetooth earbuds featuring Bluetooth Low Energy (BLE) technology.

Major companies operating in the bluetooth low energy (BLE) technology market are Amazon Inc., Apple Inc., Samsung Electronics Co. Ltd., Microsoft Corporation, Huawei Technologies Co. Ltd., Sony Group Corporation, Intel Corporation, Qualcomm Incorporated, Xiaomi Corporation, Broadcom Inc., Texas Instruments Incorporated, Koninklijke Philips N.V., STMicroelectronics N.V., NXP Semiconductors N.V., Microchip Technology Incorporated, Logitech International S.A, Garmin Ltd., Cypress Semiconductor Corporation, Razer Inc., Jabra, Quectel Wireless Solutions Co. Ltd., Fitbit Inc., Nordic Semiconductor ASA, Sierra Wireless Inc., Sennheiser electronic GmbH & Co. KG, Telit Communications PLC.

North America was the largest region in the bluetooth low energy (BLE) technology market in 2024.Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the bluetooth low energy (BLE) technology market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the bluetooth low energy (BLE) technology market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Bluetooth Low Energy (BLE) is a wireless personal area network technology designed to significantly reduce power consumption and cost while maintaining a communication range similar to that of classic Bluetooth. The primary purpose of BLE technology is to enable devices to function with very low power requirements, allowing them to operate for extended periods on small batteries or even coin cell batteries.

The main types of offerings for Bluetooth Low Energy (BLE) technology include modules and chipsets. A module in BLE technology is a pre-packaged unit containing essential components such as the BLE chipset, antenna, and other necessary circuitry, designed for easy integration into electronic devices without requiring extensive technical expertise. The modes are categorized into single mode, dual mode, and classic, serving end users in sectors such as healthcare, sports and fitness, home appliances, automotive, consumer electronics, industrial automation, wearable electronics, and gaming.

The bluetooth low energy (BLE) technology market research report is one of a series of new reports that provides bluetooth low energy (BLE) technology market statistics, including bluetooth low energy (BLE) technology industry global market size, regional shares, competitors with an bluetooth low energy (BLE) technology market share, detailed bluetooth low energy (BLE) technology market segments, market trends and opportunities, and any further data you may need to thrive in the bluetooth low energy (BLE) technology industry. This bluetooth low energy (BLE) technology market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The bluetooth low energy (BLE) technology market consists of revenues earned by entities by providing services such as application development and integration, consulting and training, and system integration and support. The market value includes the value of related goods sold by the service provider or included within the service offering. The bluetooth low energy (BLE) technology market also includes smart home devices, BLE protocol stacks, sensors, beacons, applications, and firmware. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Bluetooth Low Energy (BLE) Technology Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on bluetooth low energy (ble) technology market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for bluetooth low energy (ble) technology ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The bluetooth low energy (ble) technology market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Offering: Module; Chipset2) By Mode: Single Mode; Dual Mode; Classic

3) By End User: Healthcare; Sports and Fitness; Home Appliances; Automotive; Consumer Electronics; Industrial Automation; Wearable Electronics; Gaming

Subsegments:

1) By Module: Single-Mode BLE Module; Dual-Mode BLE Module; Multi-Mode BLE Module; System-in-Package (SiP) Modules2) By Chipset: BLE Transceiver Chipsets; BLE SoC (System on Chip) Chipsets; BLE Processor Chipsets; BLE Application-Specific Integrated Circuits (ASICs)

Key Companies Mentioned: Amazon Inc.; Apple Inc.; Samsung Electronics Co. Ltd.; Microsoft Corporation; Huawei Technologies Co. Ltd.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Bluetooth Low Energy (BLE) Technology market report include:- Amazon Inc.

- Apple Inc.

- Samsung Electronics Co. Ltd.

- Microsoft Corporation

- Huawei Technologies Co. Ltd.

- Sony Group Corporation

- Intel Corporation

- Qualcomm Incorporated

- Xiaomi Corporation

- Broadcom Inc.

- Texas Instruments Incorporated

- Koninklijke Philips N.V.

- STMicroelectronics N.V.

- NXP Semiconductors N.V.

- Microchip Technology Incorporated

- Logitech International S.A

- Garmin Ltd.

- Cypress Semiconductor Corporation

- Razer Inc.

- Jabra

- Quectel Wireless Solutions Co. Ltd.

- Fitbit Inc.

- Nordic Semiconductor ASA

- Sierra Wireless Inc.

- Sennheiser electronic GmbH & Co. KG

- Telit Communications PLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 10.03 Billion |

| Forecasted Market Value ( USD | $ 11.96 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |