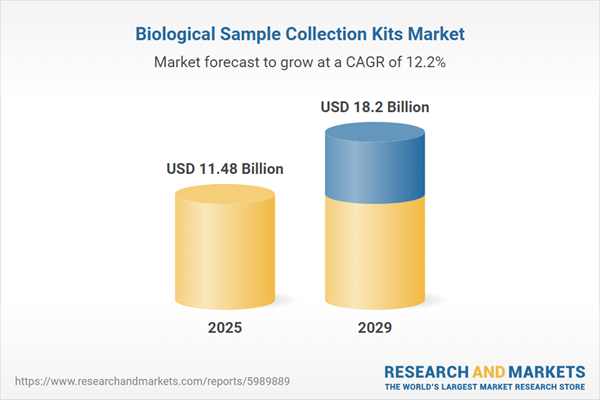

The biological sample collection kits market size has grown rapidly in recent years. It will grow from $10.2 billion in 2024 to $11.48 billion in 2025 at a compound annual growth rate (CAGR) of 12.5%. The growth in the historic period can be attributed to increased awareness of disease screening, rise in home healthcare, growing geriatric population, increased focus on preventive medicine, and expansion of infectious disease testing.

The biological sample collection kits market size is expected to see rapid growth in the next few years. It will grow to $18.2 billion in 2029 at a compound annual growth rate (CAGR) of 12.2%. The growth in the forecast period can be attributed to increasing preference for point-of-care testing, rising incidence of chronic diseases, rising demand for remote patient monitoring, growing emphasis on preventive healthcare, and rising awareness about infectious diseases. Major trends in personalized medicine, and remote patient monitoring.

The increasing prevalence of infectious diseases is expected to drive the growth of the biological sample collection kits market. Infectious diseases, caused by pathogens such as bacteria, viruses, fungi, or parasites, are transmissible between individuals. The rise in these diseases can be attributed to factors like greater global travel, urbanization, antimicrobial resistance, environmental changes, and inadequate healthcare infrastructure. Biological sample collection kits play a critical role in managing infectious diseases by allowing safe and efficient specimen collection for diagnostic, monitoring, and research purposes. For example, in March 2024, the Centers for Disease Control and Prevention (CDC), a U.S.-based national public health agency, reported a 16% increase in tuberculosis cases in the U.S. from 2022 to 2023, totaling 9,615 cases. The incidence rate rose from 2.5 to 2.9 per 100,000 people. Of these, 76% of cases occurred in non-U.S.-born individuals, marking an 18% increase, while U.S.-born cases rose by 9%. Significant increases were observed among Hispanic (23%) and Black (28%) groups among non-U.S.-born individuals, highlighting demographic shifts in TB incidence. As a result, the growing number of infectious diseases is fueling the expansion of the biological sample collection kits market.

Key players in the biological sample collection kits market are focusing on the development of innovative products, such as personalized diagnostic test kits, to cater to customers' evolving needs with advanced functionalities. Personalized diagnostic test kits are designed to detect specific biomarkers or genetic information tailored to an individual's unique health profile, enabling customized medical diagnoses. For instance, Cue Health, a US-based diagnostic test service provider, introduced at-home diagnostic test kits in March 2023. These kits contain all necessary supplies for safe, easy, and private sample collection. After the sample is processed by an independent, CLIA-certified laboratory, the customer receives clear and understandable results securely through the Cue Health App, along with relevant information about their condition or concern.

In May 2022, Babson Diagnostics Inc., a US-based healthcare company, expanded its strategic partnership with Becton, Dickinson, and Company to improve diagnostic blood collection in novel care settings. This expanded collaboration builds upon their previous efforts to develop a capillary blood collection and testing system tailored for retail environments, ensuring laboratory-quality results with small-volume capillary blood samples. Becton Dickinson and Company, a US-based medical technology company, manufactures various medical devices, including biological sample collection kits.

Major companies operating in the biological sample collection kits market are Roche Holding AG, Thermo Fisher Scientific Inc., Abbott Laboratories, 3M Company, Danaher Corporation, Medline Industries Inc., Siemens Healthineers, Becton, Dickinson and Company, Quest Diagnostics, Avantor Inc., Hologic Inc., Formlabs Inc., Hardy Diagnostics Co, Puritan Medical Products Inc., Copan Diagnostics Inc., HiMedia Laboratories Pvt. Ltd., Omega Laboratories Ltd, VIRCELL S.L., Titan Biotech Ltd., BTNX Inc., Mantacc, FL Medical S.R.L.

North America was the largest region in the biological sample collection kits market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the biological sample collection kits market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the biological sample collection kits market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Biological sample collection kits are essential tools crafted for the safe and efficient gathering, preservation, and transportation of biological specimens such as blood, saliva, urine, or tissue. These kits typically comprise sterile containers, swabs, and preservatives, ensuring the samples' integrity for diagnostic or research purposes.

The primary types of biological sample collection kits include swabs, viral transport media, blood collection kits, and others. Swabs serve as instruments for gathering samples from different body sites for medical testing, commonly featuring a soft tip affixed to a stick. These kits find applications in diagnostics and research and are utilized by various end users such as hospitals, clinics, home testing facilities, diagnostics centers, and more.

The biological sample collection kits research report is one of a series of new reports that provides biological sample collection kits market statistics, including the biological sample collection kits industry's global market size, regional shares, competitors with a biological sample collection kits market share, detailed biological sample collection kits market segments, market trends and opportunities, and any further data you may need to thrive in the biological sample collection kits industry. This biological sample collection kits market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The biological sample collection kits market consists of sales of blood collection tubes, saliva collection devices, urine collection containers, swabs for microbial sampling, and tissue biopsy kits. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Biological Sample Collection Kits Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on biological sample collection kits market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for biological sample collection kits ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The biological sample collection kits market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Swabs; Viral Transport Media; Blood Collection Kits; Other Products2) By Application: Diagnostics; Research

3) By End-Use: Hospitals and Clinics; Homecare; Diagnostics Centers; Other End-Uses

Subsegments:

1) By Swabs: Nasopharyngeal Swabs; Oropharyngeal Swabs; Flocked Swabs; Polyester Swabs2) By Viral Transport Media (VTM): Liquid VTM; Dry VTM

3) By Blood Collection Kits: Venous Blood Collection Kits; Capillary Blood Collection Kits; Fingerstick Blood Collection Kits

4) By Other Products: Urine Collection Kits; Saliva Collection Kits; Sputum Collection Kits; Stool Collection Kits; DNA or RNA Collection Kits

Key Companies Mentioned: Roche Holding AG; Thermo Fisher Scientific Inc.; Abbott Laboratories; 3M Company; Danaher Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Biological Sample Collection Kits market report include:- Roche Holding AG

- Thermo Fisher Scientific Inc.

- Abbott Laboratories

- 3M Company

- Danaher Corporation

- Medline Industries Inc.

- Siemens Healthineers

- Becton, Dickinson and Company

- Quest Diagnostics

- Avantor Inc.

- Hologic Inc.

- Formlabs Inc.

- Hardy Diagnostics Co

- Puritan Medical Products Inc.

- Copan Diagnostics Inc.

- HiMedia Laboratories Pvt. Ltd.

- Omega Laboratories Ltd

- VIRCELL S.L.

- Titan Biotech Ltd.

- BTNX Inc.

- Mantacc

- FL Medical S.R.L.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 11.48 Billion |

| Forecasted Market Value ( USD | $ 18.2 Billion |

| Compound Annual Growth Rate | 12.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |