Diabetes complications, such as neuropathy, poor circulation, and ulcers, can be managed with the use of medical compression socks, which improve blood flow and decrease pressure on affected areas, prompting healthcare providers to recommend them to patients with diabetes. North American medical compression socks market is driven by improved online accessibility and a diverse range of products available through e-commerce platforms. This enhanced online presence ensures consumers can easily find products that meet their needs and budgets, driving the demand. In addition, technological advancements in materials, design, and manufacturing processes result in high-quality compression socks offering better comfort, breathability, moisture management, and custom fit options. These innovations increase the appeal of medical compression socks to consumers looking for effective health management solutions.

North America Medical Compression Socks Market Report Highlights

- The athletes/sports people segment dominated the market share by the target group of 33.96% due to compression socks boosting performance by enhancing blood circulation, minimizing muscle tiredness, and providing focused support for muscles and joints. They help in quicker recovery after workouts by reducing muscle discomfort and swelling

- The travelers segment is expected to grow significantly over the forecast period. Travelers prefer compression socks that mitigate risks and hold up well against regular wear and laundering, maintaining their efficacy. They are user-friendly and simple to slide on and off to meet the convenience needs of travelers while on the move

- In February 2024, Italian socks knitting machine builder Busi Giovanni exhibited at Exintex, the International Textile Exhibition in Mexico at Puebla's fairgrounds, from 27 February to 1 March 2024. They showcased their range of machines, including those capable of producing medical compression socks

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned

- Julius Zorn, Inc.

- Essity

- SIGVARIS GROUP

- Medi

- Goodhew, LLC

- Cardinal Health

- Medline

- Mölnlycke Health Care AB

- CHARMKING

- Thuasne

- COMRAD

- Enovis (DJO, LLC)

- 3M

- beltwell.com

- Surgical Appliance Industries (SAIBrands)

- Ames Walker

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 110 |

| Published | July 2024 |

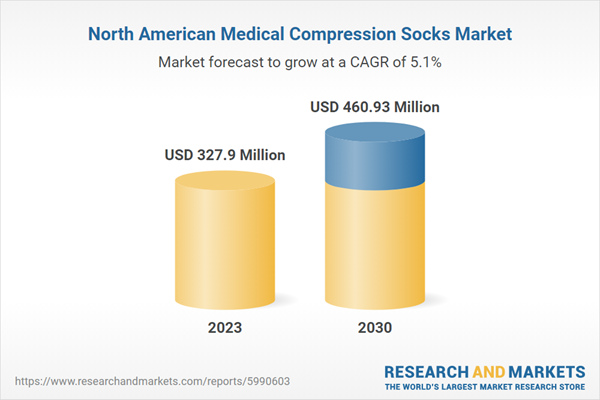

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 327.9 Million |

| Forecasted Market Value ( USD | $ 460.93 Million |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | North America |

| No. of Companies Mentioned | 16 |