This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

Innovations such as blockchain for secure transactions, artificial intelligence for predictive analytics, and automation in warehousing are shaping the future of logistics. Additionally, the growing focus on sustainability is driving changes in how goods are transported, with more emphasis on reducing carbon footprints and adopting eco-friendly practices. The foundation of freight forwarding is the practical and economical transportation of goods preserved in good condition during the route. To accomplish this, freight forwarders become experts in managing the logistics necessary to guarantee that goods reach on time.

In today's markets, having the right tools at disposal is crucial for successful trading and transportation. Many businesses are globalizing their supply chains to take advantage of cost efficiencies and access new markets. This globalization often involves complex logistics and regulatory compliance, which freight forwarders are well-positioned to manage. As supply chains become more intricate, the need for professional freight forwarding services continues to grow.

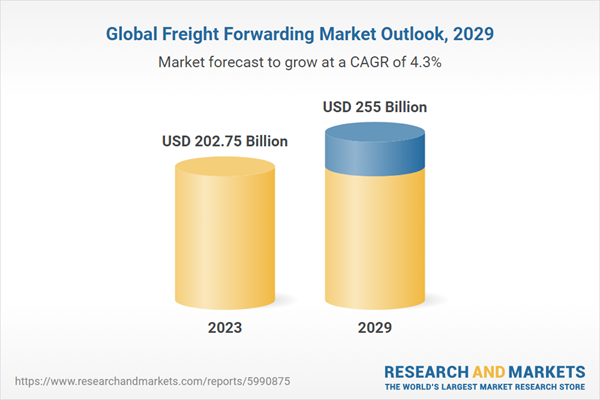

According to the research report, “Global Freight forwarding Market Outlook, 2029” the market is anticipated to cross USD 255 Billion by 2029, increasing from USD 202.75 Billion in 2023. The market is expected to grow with 4.30% CAGR by 2024-29. The rapid rise of e-commerce has significantly impacted the freight forwarding industry. Online shopping has expanded the market reach for retailers and manufacturers, leading to a surge in parcel shipments and demand for reliable and scalable logistics solutions. Freight forwarders play a crucial role in managing the complex logistics associated with global e-commerce, including warehousing, distribution, and last-mile delivery.

Businesses are increasingly focusing on optimizing their supply chains to reduce costs and improve efficiency. Freight forwarders are essential in this process, offering expertise in route planning, cargo consolidation, and inventory management. As companies seek to enhance their supply chain strategies, they turn to freight forwarders to provide integrated and cost-effective logistics solutions. Significant investments in transportation infrastructure, such as ports, highways, and rail networks, are facilitating the movement of goods across regions.

Enhanced infrastructure supports faster and more reliable transportation, which, in turn, drives the demand for freight forwarding services to manage the increased volume of shipments and navigate complex logistics. The expansion of the middle class in emerging economies is driving increased consumer spending and demand for goods. As more people in these regions gain purchasing power, there is a corresponding rise in imports and exports. Freight forwarders are needed to handle the growing volume of trade and manage logistics in these burgeoning markets.

Market Drivers

- E-commerce Expansion: The explosive growth of e-commerce is a major driver of the global freight forwarding market. As online shopping becomes increasingly prevalent, both consumers and businesses are demanding more efficient and reliable logistics solutions. This surge in e-commerce has led to an increase in parcel shipments, with a growing need for robust logistics networks capable of handling a higher volume of small and medium-sized packages. Freight forwarders are at the forefront of managing this increased demand, offering solutions that include real-time tracking, automated sorting, and optimized last-mile delivery. As online retailers expand their reach into international markets, the complexity of cross-border shipping necessitates expert freight forwarding services to handle customs clearance, documentation, and the smooth transportation of goods across borders.

- Technological Advancements: Technological innovations are transforming the freight forwarding industry by enhancing operational efficiency and transparency. Technologies such as artificial intelligence (AI), blockchain, and the Internet of Things (IoT) are revolutionizing logistics management. Real-time tracking systems, powered by these technologies, provide visibility throughout the supply chain, allowing stakeholders to monitor shipments and respond quickly to any issues. AI and data analytics are being used to optimize route planning, predict demand, and streamline decision-making processes. Additionally, blockchain technology offers potential for greater security and transparency in transaction records, reducing fraud and improving trust in the logistics process. These technological advancements enable freight forwarders to offer more efficient, cost-effective, and reliable services, driving market growth.

Market Challenges

- Regulatory Compliance and Customs Complexity: Navigating the complex landscape of international regulations and customs requirements presents a significant challenge for freight forwarders. Each country has its own set of rules regarding imports, exports, tariffs, and trade agreements, which can be both intricate and frequently changing. Ensuring compliance with these diverse regulations requires continuous monitoring and adaptation. The customs clearance process, involving the preparation of accurate documentation and adherence to varying standards, can be time-consuming and prone to errors, potentially causing delays and additional costs. Recent geopolitical events, such as Brexit and trade wars, have added layers of complexity, making it essential for freight forwarders to stay informed and agile in managing regulatory changes and trade policies.

- Supply Chain Disruptions and Risk Management: Supply chain disruptions pose a substantial challenge in the freight forwarding industry, affecting the smooth movement of goods across the globe. Natural disasters such as hurricanes, earthquakes, and floods can disrupt transportation networks and cause significant delays. Geopolitical instability, including conflicts and trade restrictions, further complicates logistics by impacting shipping routes and increasing uncertainty. The COVID-19 pandemic underscored the vulnerabilities in global supply chains, highlighting the need for robust risk management strategies. Freight forwarders must develop contingency plans and adaptive strategies to mitigate the impact of such disruptions, ensuring continuity of service and resilience in their operations.

Market Trends

- Sustainability and Green Logistics: Sustainability has become a prominent trend in the freight forwarding industry, driven by growing environmental concerns and regulatory pressures. Companies are increasingly seeking logistics solutions that minimize their carbon footprint and promote eco-friendly practices. This shift towards green logistics includes efforts to reduce emissions through optimized route planning, the use of energy-efficient vehicles, and the adoption of alternative fuels. Sustainable packaging practices are also gaining traction, with an emphasis on reducing waste and environmental impact. Regulatory bodies are implementing stricter environmental standards, pushing freight forwarders to adopt sustainable practices and align with global initiatives aimed at reducing the carbon footprint of logistics operations.

- Digitalization and Automation: Digitalization and automation are reshaping the freight forwarding industry by enhancing operational efficiency and reducing manual labor. The integration of digital platforms has streamlined processes such as booking, tracking, and communication, providing greater transparency and convenience for both service providers and clients. In warehouses, automation technologies are increasingly used for sorting, handling, and inventory management, leading to improved accuracy and reduced operational costs. AI and machine learning are also being leveraged to predict demand, optimize supply chain operations, and support data-driven decision-making. These advancements in digitalization and automation are driving the evolution of the freight forwarding market, enabling more agile and efficient logistics solutions to meet the demands of a dynamic global trade environment.

The industrial and manufacturing sector drives the freight forwarding market significantly because it requires sophisticated logistics networks to manage the intricate flow of raw materials, intermediate products, and final goods throughout the supply chain. This sector's reliance on global supply chains for sourcing raw materials and distributing finished products necessitates extensive transportation and warehousing solutions. The scale and complexity of industrial operations often involve handling bulky shipments, managing just-in-time inventories, and coordinating multi-modal transportation across diverse regions.

Freight forwarders play a crucial role in streamlining these processes by offering tailored solutions that address specific needs such as heavy cargo handling, customs compliance, and efficient route planning. Additionally, the need for just-in-time delivery and precision in managing supply chain logistics puts significant pressure on freight forwarding services to deliver reliability and efficiency. As manufacturing continues to expand and integrate globally, the demand for comprehensive and reliable freight forwarding solutions grows, reinforcing the sector's leadership in driving market growth.

The transportation and warehousing sector is leading the freight forwarding market due to its essential role in ensuring the seamless movement, storage, and management of goods across global supply chains.

The transportation and warehousing sector plays a pivotal role in the freight forwarding market because it directly influences the efficiency and effectiveness of logistics operations. Transportation is fundamental for moving goods from manufacturers to distributors and ultimately to end consumers, encompassing various modes such as road, rail, air, and sea. Effective transportation management ensures timely deliveries, optimizes routes, and reduces costs, which are critical for maintaining supply chain fluidity. Warehousing, on the other hand, provides crucial storage solutions that support inventory management, order fulfillment, and distribution.

As supply chains become more complex and globalized, the need for integrated transportation and warehousing solutions has intensified. This sector facilitates just-in-time inventory systems, accommodates fluctuations in demand, and supports the efficient handling of both large-scale and small parcel shipments. The interplay between transportation and warehousing enhances the overall logistics ecosystem by providing flexibility, scalability, and reliability. Freight forwarders leverage these capabilities to offer comprehensive services that address the diverse needs of businesses, from managing bulk cargo to handling expedited shipments. As such, the transportation and warehousing sector remains at the forefront of the freight forwarding market, driving growth and innovation in logistics solutions.

Ocean freight forwarding is leading the freight forwarding market due to its unparalleled capacity for handling large volumes of goods and its cost-effectiveness in global trade, particularly for bulk and non-urgent shipments.

Ocean freight forwarding dominates the freight forwarding market primarily because it offers the most efficient and economical solution for transporting large quantities of goods over long distances. As the backbone of international trade, ocean freight enables the movement of vast volumes of cargo across continents, leveraging the extensive network of global shipping routes and ports. This mode of transportation is especially advantageous for bulk goods, raw materials, and manufactured products, where economies of scale make ocean shipping more cost-effective compared to other modes like air freight.

Containerization, a key innovation in ocean freight, has further enhanced its efficiency by standardizing cargo handling and reducing costs associated with loading, unloading, and warehousing. Ocean freight forwarding also provides flexibility in terms of shipping schedules and routes, accommodating the diverse needs of global businesses. While it may involve longer transit times compared to air freight, the cost savings and capacity offered by ocean freight make it the preferred choice for many companies engaged in international trade. This widespread use and reliance on ocean freight underscore its leading role in the freight forwarding market, driving the movement of goods and supporting the global supply chain infrastructure.

B2B (business-to-business) transactions are leading the freight forwarding market due to the high volume of goods and complex logistics requirements involved in the commercial supply chains of businesses operating on a global scale.

B2B transactions dominate the freight forwarding market because they involve the movement of substantial quantities of goods and require sophisticated logistics solutions to manage the intricate supply chains that businesses depend on. Unlike B2C (business-to-consumer) transactions, which typically involve smaller shipments and more frequent, smaller deliveries to individual consumers, B2B logistics encompasses large-scale shipments and bulk transportation. Businesses often engage in cross-border trade with multiple partners, requiring freight forwarders to provide comprehensive services such as customs brokerage, warehousing, and multi-modal transportation solutions.

These commercial transactions involve complex coordination and management of inventory, production schedules, and distribution networks. Freight forwarders play a critical role in optimizing these processes by offering tailored solutions that address specific needs such as handling large volumes of cargo, navigating international regulations, and ensuring timely delivery. The scale and complexity of B2B transactions necessitate reliable and efficient freight forwarding services, which drive market growth and innovation. As global trade continues to expand and businesses seek to optimize their supply chains, the B2B segment remains at the forefront of the freight forwarding market, underpinning the movement of goods and supporting the interconnected global economy.

The Asia-Pacific region is leading the freight forwarding market due to its status as the world's largest manufacturing hub and its strategic position as a key node in global trade routes, which drives immense demand for logistics and transportation services.

The Asia-Pacific region stands at the forefront of the freight forwarding market because it serves as the epicenter of global manufacturing and trade. This region encompasses some of the world's largest economies, including China, Japan, and India, which are pivotal in producing a vast array of goods, from electronics and automotive parts to textiles and consumer products. As the primary manufacturing hub, Asia-Pacific generates a high volume of exports that require complex logistics and transportation solutions to reach international markets.

The region’s strategic location along major maritime trade routes, such as the South China Sea and the Strait of Malacca, further enhances its role in global trade. Major ports in countries like China, Singapore, and South Korea act as critical gateways for shipping goods to and from other regions, facilitating efficient and extensive trade networks. Additionally, the rapid economic growth and increasing consumer demand in the Asia-Pacific region contribute to heightened logistics activities, necessitating advanced freight forwarding services to manage the flow of goods. The combination of substantial production capacity, strategic geographic positioning, and dynamic economic growth positions Asia-Pacific as a leader in the freight forwarding market, driving the demand for innovative logistics solutions and shaping the global supply chain landscape.

- In August 2023, OnBoard Logistics, a company headquartered in the U.S., collaborated with the logistics platform, Raft. By leveraging Raft's technology, OnBoard Logistics implemented a fully automated warehouse pre-check process. This innovative approach optimizes the receipt & processing of cargo prior to its physical arrival, mitigating potential errors and bolstering operational streamlining & cost savings.

- In May 2023, Nippon Express, a Tokyo-based logistics services company, signed a deal to purchase Austrian logistics firm, Cargo-Partner for USD 1.5 billion. This move, a part of the company’s growth strategy, aligns with Nippon Express's ambition to evolve into a worldwide mega-freight forwarder.

- June 2023: Kuehne+Nagel, a global logistics company, marked an agreement to acquire Morgan Cargo, a leading South African, United Kingdom, and Kenyan freight forwarder specializing in transporting and handling perishable goods. The acquisition strengthens the company's perishables logistics service offering while enhancing connectivity for customers to and from South Africa, the United Kingdom, and Kenya, which includes state-of-the-art cold chain facilities.

- April 2023: DHL Global Forwarding signed an MoU with Turkish Cargo to extend its operations to SMARTIST, a cargo facility for Turkish Cargo at the Istanbul airport. This agreement enhances the company's operation efficiencies and further boosts Istanbul's ability to emerge as a global logistics hub.

Considered in this report

- Historic year: 2018

- Base year: 2023

- Estimated year: 2024

- Forecast year: 2029

Aspects covered in this report

- Freight Forwarding market Outlook with its value and forecast along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By End-User

- Industrial & Manufacturing

- Retail and E-commerce

- Automotive

- Consumer Goods

- Healthcare

- Others

By Service Type

- Transportation and Warehousing

- Packaging

- Documentation

- Value-added Services

By Transport Mode

- Ocean Freight forwarding

- Air Freight forwarding

- Road Freight forwarding

- Rail Freight forwarding

By Customer Type

- B2B

- B2C

The approach of the report:

This report consists of a combined approach of primary and secondary research. Initially, secondary research was used to get an understanding of the market and list the companies that are present in it. The secondary research consists of third-party sources such as press releases, annual reports of companies, and government-generated reports and databases. After gathering the data from secondary sources, primary research was conducted by conducting telephone interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. Post this; we have started making primary calls to consumers by equally segmenting them in regional aspects, tier aspects, age group, and gender. Once we have primary data with us, we can start verifying the details obtained from secondary sources.Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations, and organizations related to the Freight Forwarding industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing and presentations, it will also increase competitive knowledge about the industry.This product will be delivered within 2 business days.

Table of Contents

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | July 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 202.75 Billion |

| Forecasted Market Value ( USD | $ 255 Billion |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Global |